Micromachining Market Report Scope & Overview:

To Get More Information on Micromachining Market - Request Sample Report

The Micromachining Market size was valued at USD 3.17 Billion in 2023 and is now anticipated to grow USD 5.63 Billion by 2032, displaying a compound annual growth rate (CAGR) of 6.59% during the forecast Period 2024-2032.

The micromachining market is a rapidly growing sector driven by advancements in precision manufacturing technologies. It involves the use of highly focused tools and techniques to achieve micro-level precision in material removal for creating intricate patterns, features, and components at the micron scale. This market is pivotal in industries such as electronics, automotive, aerospace, and medical devices, where miniaturization is critical. Micromachining technologies include laser micromachining, electrical discharge machining (EDM), ultrasonic micromachining, and abrasive jet machining, each offering unique benefits in terms of precision, speed, and material compatibility. Laser micromachining, for instance, is widely used for its ability to cut, drill, and engrave micro features on materials like metals, ceramics, and plastics. EDM is known for its accuracy in shaping complex geometries in hard materials.

In aerospace, micromachining plays a critical role in creating lightweight yet highly durable components that ensure the optimal performance and safety of aircraft. This industry alone accounts for approximately 15-20% of the micromachining market. Additionally, the automotive industry, which is increasingly adopting lightweight materials and complex designs, contributes to the growth of the micromachining market, especially in creating precision components for electric vehicles (EVs) and autonomous driving technologies. Furthermore, automation and AI integration into micromachining processes are improving efficiency and operational precision. AI-driven automation systems are anticipated to enhance productivity and reduce human error, making micromachining techniques more accessible and scalable for various applications. These advancements are expected to push the industry toward broader adoption, reinforcing the market's trajectory toward continued growth.

| Feature | Description | Commercial Products |

|---|---|---|

| High Precision Manufacturing | Utilizes advanced laser, electrical, or ultrasonic machining for high precision in micro-scale manufacturing, essential for electronics, medical, and automotive industries. | LPKF Laser & Electronics Laser Micromachining, IPG Photonics Micromachining |

| Material Versatility | Capable of working with a wide range of materials, including metals, ceramics, polymers, and composites, for versatile application needs. | Oxford Lasers Micromachining, GF Machining Solutions LASER P Series |

| Minimal Thermal Impact | Ensures minimal thermal damage to materials by using controlled laser pulses, protecting the integrity of sensitive components. | Coherent StarCut Tube, 3D-Micromac Laser Micromachining |

| Submicron Accuracy | Achieves submicron precision, allowing the production of intricate components for industries requiring high accuracy, such as aerospace and healthcare. | IPG Photonics Ultrafast Micromachining, Microlution ML-5 |

| Reduced Material Waste | Minimizes waste by precisely targeting material removal, making it an environmentally friendly option for manufacturing. | Synova Laser MicroJet, LASEA Ultra-Precision Micromachining |

| High-Speed Processing | Offers rapid processing speeds to increase throughput, essential for industries with high production demands like consumer electronics and automotive sectors. | Panasonic Laser Micromachining Systems, ESI Model 5330 |

| Advanced Automation Capability | Compatible with automated systems, enabling efficient, scalable production for complex and repetitive micro-manufacturing tasks. | GF Machining Solutions Microlution, Fanuc Robodrill Micro-machining |

| Cost-Effective Microfabrication | Provides a cost-effective alternative to traditional manufacturing for creating small and complex parts, especially in high-value sectors like medical devices. | Amada Miyachi Micromachining Systems, Oxford Lasers ML Series |

MARKET DYNAMICS

DRIVERS

- The growing need for highly precise components in industries like aerospace, automotive, and electronics is driving the increased demand for micromachining technologies.

The increasing demand for precision manufacturing is a key driver of growth in the micromachining market. Industries such as aerospace, automotive, and electronics are at the forefront of this trend, as they require highly accurate and intricate components for their advanced systems. In aerospace, for example, micromachining is crucial for producing small, lightweight, and precise parts, such as turbine blades, engine components, and structural elements, where even minute variations can impact performance and safety. Similarly, in the automotive sector, the push towards lightweight, fuel-efficient vehicles has led to the demand for small, complex components that require micromachining processes like laser cutting and micro milling for precision.

The electronics industry, particularly in the production of components for smartphones, wearables, and other devices, also heavily relies on micromachining. The increasing miniaturization of electronic products, combined with the need for high performance and durability, has led to the demand for tiny, highly intricate components like microprocessors, connectors, and sensors, which are best produced using micromachining techniques. These processes allow manufacturers to achieve extremely tight tolerances and high-quality surface finishes, making them indispensable for industries where precision is paramount. As technology continues to evolve and industries push the boundaries of miniaturization and performance, the need for precision manufacturing through micromachining will only grow, driving further market expansion. This trend is reshaping manufacturing processes and creating opportunities for micromachining technologies to address the challenges of increasingly sophisticated industrial applications.

- Advancements in micromachining technologies, like laser micromachining, EDM, and micro milling, have improved precision, efficiency, and accessibility, driving market growth by enabling the production of smaller, intricate components.

Advancements in technology have significantly enhanced the capabilities of micromachining, driving its growth across various industries. Key innovations such as laser micromachining, electrical discharge machining (EDM), and micro milling have revolutionized the ability to produce precise, miniature components with high accuracy. Laser micromachining, for instance, uses focused laser beams to precisely cut or engrave materials, allowing for intricate designs and fine patterns on small parts without the need for physical contact. This minimizes the risk of material damage and offers greater flexibility in handling a variety of materials. EDM, on the other hand, utilizes electrical discharges to remove material from a workpiece, enabling the creation of complex shapes and fine details with excellent precision, particularly in hard materials. Micro milling provides a versatile approach for machining small-scale parts, offering high-speed, high-precision cutting of intricate features on substrates like metals, polymers, and ceramics.

These technological advancements have made micromachining more efficient, cost-effective, and accessible for industries demanding high precision, including electronics, aerospace, automotive, and healthcare. The ability to manufacture smaller, more complex components with higher quality and less material waste has driven the adoption of micromachining techniques. As the demand for miniaturized and highly accurate components continues to rise, innovations in these technologies play a crucial role in meeting industry requirements, thereby stimulating growth in the micromachining market. The integration of automation and advanced control systems also enhances the consistency and scalability of these processes, further contributing to their widespread adoption.

RESTRAIN

-

Micromachining involves intricate, high-precision processes that can be difficult to maintain consistently, leading to increased operational costs due to the need for specialized tooling and regular calibration.

Micromachining is a highly precise manufacturing process that involves creating intricate features and components at a microscopic scale, typically in the range of micrometers. Achieving the required level of precision consistently is one of the most significant challenges in this field. The complexity arises from several factors, starting with the fine tolerances that must be maintained to produce high-quality parts. As materials become increasingly complex, such as in the case of hard metals or composites, the difficulty of maintaining precision grows. These materials often require specialized tools, advanced machining techniques, and specific calibration processes to ensure consistent results.

The process of micromachining itself involves precise control of factors like speed, pressure, and temperature, which further complicates its execution. Even slight variations in these parameters can lead to defects or inaccuracies, potentially impacting the functionality of the end product. Furthermore, micromachining often involves the use of sophisticated technologies like laser cutting, EDM, or micro-milling, each of which requires specialized equipment and skilled operators. These specialized tools and technologies, while capable of delivering extremely fine results, come with high operational costs. Regular calibration and maintenance of the equipment are essential to ensure the continued accuracy and efficiency of the machining process, adding another layer of complexity and expense. As a result, while micromachining offers unmatched precision, it also demands significant investment in both time and resources to overcome its inherent complexities.

KEY SEGMENTATION ANALYSIS

By Type

The Non-Traditional segment dominated the market share over 49% in 2023, largely driven by the widespread adoption of advanced technologies such as Electro Discharge Machining (EDM), Electrochemical Machining (ECM), and laser machining. These technologies offer several advantages, including consistent and precise cutting, the ability to process various materials, and the elimination of post-machining finishing processes. The increased efficiency, accuracy, and versatility provided by these methods make them highly preferred in industries requiring complex, high-precision components. The continuous growth in demand for these technologies has cemented the Non-Traditional type as the dominant category in the market, as they offer a more effective solution for modern manufacturing needs compared to traditional methods.

By Process

The Subtractive process segment dominated the market share over 42% in 2023, driven by its cost-efficiency, time savings, and widespread adoption in mass production. This method’s versatility in handling various materials, including hard metals, wood, and thermoplastics, has significantly contributed to the growth of this segment. Furthermore, recent advancements in tool designs have enhanced the process's flexibility, allowing a single machine to perform multiple operations. This innovation has provided significant space-saving benefits for end-use companies, further optimizing their production facilities.

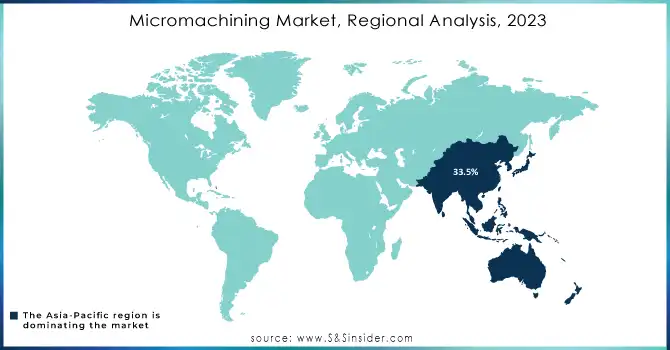

KEY REGIONAL ANALYSIS

The Asia-Pacific region currently leads the market, accounting for 33.5% in 2023. This dominance is driven by the region’s increasing demand for electronics and semiconductors, which are essential for high-precision manufacturing and the creation of miniaturized components. The ability to fabricate small, intricate structures supports the region's expanding industrial sector. As industrialization accelerates and emerging economies within the region grow, the demand for advanced manufacturing technologies continues to surge.

North America, is the fastest-growing region. Its growth can be attributed to significant technological advancements and increased investments in manufacturing capabilities. Both regions are benefitting from evolving market trends, with Asia-Pacific leading in overall market share and North America gaining momentum at a rapid pace. This dynamic is reflective of the global shift toward advanced production technologies, especially in industries requiring high-precision and miniaturization.

Do You Need any Customization Research on Micromachining Market - Inquire Now

Some of the major key players of Micromachining Market

-

Coherent, Inc. (Laser systems, laser micromachining solutions)

-

Georg Fischer Ltd. (Micromachining and precision machining equipment)

-

Makino Milling Machine Co., Ltd. (Precision milling machines, CNC machining centers)

-

Lumentum Holdings Inc. (Laser diodes, fiber lasers, micromachining systems)

-

Mitsubishi Heavy Industries Ltd. (Laser cutting machines, micromachining solutions)

-

DATRON Dynamics Inc. (CNC milling machines, precision micro-milling solutions)

-

Han’s Laser Technology Industry Group Co., Ltd. (Laser marking, engraving, and cutting machines)

-

Electro Scientific Industries, Inc. (Laser micromachining systems for electronics)

-

IPG Photonics Corporation (Fiber lasers, laser sources for micromachining applications)

-

Heraeus Holding GmbH (Precious metals, sensors, micromachining tools)

-

Trumpf GmbH (Laser systems, laser cutting, and micromachining technologies)

-

ROFIN-SINAR Technologies Inc. (Laser-based material processing systems)

-

Jenoptik AG (Laser systems for precision machining, cutting, and welding)

-

KUKA AG (Industrial robots for micromachining applications)

-

Mahr Inc. (Measuring and precision tools, micromachining solutions)

-

Trotec Laser GmbH (Laser cutting and engraving systems)

-

FANUC Corporation (CNC systems, robotic micromachining solutions)

-

SICK AG (Laser scanners, optical micromachining systems)

-

Haas Automation, Inc. (CNC machining centers, micro-milling tools)

-

Kyocera Corporation (Ceramic-based micro-machining tools, cutting tools)

Suppliers providing advanced technologies and solutions that support high-precision, high-quality micromachining applications across a range of industries, including electronics, medical devices, aerospace, automotive, and more. of Micromachining Market:

-

Laserline GmbH

-

Precitec GmbH & Co. KG

-

Epilog Laser

-

Resonetics

-

LightFab GmbH

-

Lasea SA

-

Cynosure

-

Alpine Metal Tech

-

SPECTRA-Physics

-

VSL (Virtual Source Laser)

RECENT DEVELOPMENTS

-

In October 2023: Nano Dimension’s Additive Manufacturing Group broadened its Fabrica Micromachining product range.

-

In June 2023: Coherent Corp. introduced its Matrix nanosecond pulsed UV lasers, offering a highly cost-effective solution for high-contrast marking. These lasers are ideal for marking consumer goods, industrial electronics, home appliances, and packaging materials with precision and clarity, delivering exceptional performance at a reduced cost.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.17 Billion |

| Market Size by 2032 | USD 5.63 Billion |

| CAGR | CAGR of 6.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Traditional, Non-traditional, Hybrid) • By Axis (3-axes, 4-axes, 5-axes, Others) • By Process (Additive, Subtractive, Others) • By Industry (Automotive, Semiconductor & Electronics, Aerospace & Defense, Medical & Aesthetics, Telecommunications, Power & Energy, Plastics & Polymers, Gems & Jewelry, Others (Machine tools & Manufacturing, Watchmaking, Glass)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Coherent, Inc., Georg Fischer Ltd., Makino Milling Machine Co., Ltd., Lumentum Holdings Inc., Mitsubishi Heavy Industries Ltd., DATRON Dynamics Inc., Han’s Laser Technology Industry Group Co., Ltd., Electro Scientific Industries, Inc., IPG Photonics Corporation, Heraeus Holding GmbH, Trumpf GmbH, ROFIN-SINAR Technologies Inc., Jenoptik AG, KUKA AG, Mahr Inc., Trotec Laser GmbH, FANUC Corporation, SICK AG, Haas Automation, Inc., Kyocera Corporation. |

| Key Drivers | • The demand for high-precision miniaturized components across electronics, healthcare, and aerospace is driving the adoption of micromachining to produce intricate, small-scale parts. • Technological advancements in laser and ultrasonic micromachining improve manufacturing precision and speed, driving adoption in industries requiring high accuracy, such as electronics, medical devices, and aerospace. |

| RESTRAINTS | •The advanced technology and specialized equipment required for micromachining systems entail significant upfront investment and ongoing operational costs, making it difficult for small and medium-sized enterprises to adopt. |