Teleradiology Services Market Size & Overview:

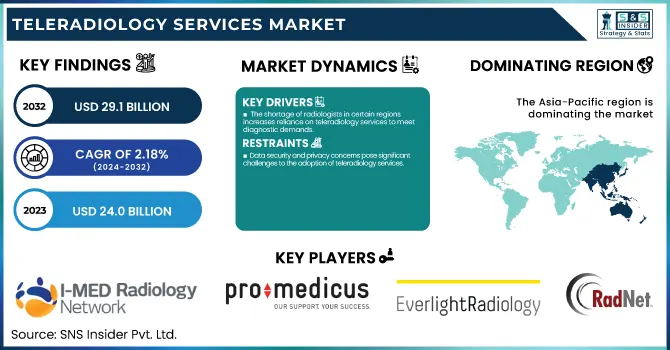

The Teleradiology Services Market size was valued at USD 24.0 billion in 2023 and is projected to reach USD 29.1 billion by 2032, growing at a CAGR of 2.18% over the forecast period 2024-2032.

To Get more information on Teleradiology Services Market - Request Free Sample Report

Teleradiology Services Market research offers a comprehensive analysis of the current market scenario as well as emerging market trends. It can show market growth projections and revenue forecasts. It explores the incidence and prevalence rates of imaging-based diagnoses and how these correlate to the growing need for teleradiology. It also examines adoption rates by region. The report also examines radiologists' workload and reporting turnaround times, with a focus on how AI could improve efficiency. A nuanced breakdown showcases reimbursement trends by government, insurers, and private providers in this community, as well as healthcare spending. The report notes the increasing adoption of AI and cloud-based solutions, which drive automation and scalability in teleradiology services. This information offers a broad perspective on how the market will develop in the time to come. The global teleradiology services market is undergoing great growth due to the rising occurrences of chronic conditions, an aging population, and a shortage of radiologists worldwide.

Teleradiology Services Market Dynamics

Drivers

-

The shortage of radiologists in certain regions increases reliance on teleradiology services to meet diagnostic demands.

The increasing shortage of radiologists worldwide has been a major factor driving the growth of teleradiology services. Globally, in 2023, the number of radiologists there are approximately 345475, with an average of 45 radiologists per million people. This distribution is not evenly spread, with high-income countries having approximately 97.9 radiologists per million inhabitants and low-income countries having less than 2 radiologists per million population. The shortage has led to one radiologist potentially interpreting the results of up to 100 diagnostic scans in a single day, prolonging the time for diagnosis and treatment. Healthcare providers are now adopting teleradiology solutions. To take the example of how I-MED Radiology Network in Australia set up a pilot program connecting MRI devices in remote areas to central “cockpit” locations run by expert technicians. As a result, more than 1,000 remote MRI scans were completed, and regional community members gained access to timely diagnostics.

Implementing AI in teleradiology platforms will help improve the accuracy and efficiency of diagnosis. AI algorithms can help with the basic assessment of medical images, allowing radiologists to pay more attention to complex cases and shortening turnaround times. Especially in regions where radiologists are scant, this technology is a blessing, providing timely and accurate diagnosis even amidst personnel shortages. In summary, the global shortage of radiologists, characterized by uneven distribution and high workloads, is a critical factor driving the growth of teleradiology services. Utilizing remote imaging technologies and incorporating AI integration, healthcare systems are working to lessen the impact of an ongoing shortage of radiologists, which would further protect patients globally and provide access to critical diagnostic services.

Restraints:

-

Data security and privacy concerns pose significant challenges to the adoption of teleradiology services.

Widespread implementation of teleradiology services has been hampered considerably by data security and privacy. The healthcare industry is a lucrative target for cyberattacks due to patient health records reportedly selling for up to $1,000 each on the dark web, enabling identity theft and medical fraud. In 2024, a significant breach occurred when a non-password-protected database belonging to Confidant Health exposed 5.3 terabytes of sensitive data, including therapy session recordings and diagnostic results. Such events undermine patient trust and expose weaknesses in telehealth platforms.

Furthermore, healthcare entities tend to struggle with establishing strong cybersecurity practices. A 2024 survey found that approximately 40% of healthcare entities did not use mobile encryption, and 31% of healthcare entities didn't have a mobile device policy almost 71% of healthcare entities encrypt their patient data. These flaws in security systems render teleradiology services vulnerable to unauthorized data access as well as data leakage. Moreover, these concerns are aggravated by the manner of using unsecured communication lines. NHS doctors, however, are known to use popular apps like WhatsApp to discuss private patient information because their official system is so labor-intensive, which poses serious privacy and security concerns. These practices emphasize the critical need for secure, compliant means of communication within healthcare organizations.

Opportunities:

-

Integration of artificial intelligence (AI) into teleradiology platforms offers potential for enhanced diagnostic accuracy and efficiency.

Artificial intelligence (AI) is a promising algorithm in teleradiology designed to improve diagnostic accuracy and efficiency. They have shown significant improvements in healthcare delivery in the last implementations. In Australia, South Australian Medical Imaging (SAMI) has implemented AI technology in several hospitals to help diagnose chest X-rays. This system focuses on areas of potential interest on images, making diagnoses suggestions for which the radiologist is asked to consider and confirm, thus improving diagnostic accuracy and clinician confidence. Likewise, New York's Northwell Health uses an AI tool called iNav to screen MRI and CT scans for early signs of pancreatic cancer. That frontline strategy cut the time it takes to start treatment in half, allowing for timely patient care. AI-based solutions implemented in Indian hospitals so far have improved diagnostic accuracy by 40 percent.

AI-enhanced natural language processing has streamlined report generation by 35%, while Google's health AI has increased efficiency by 30% and more. Aidoc’s FDA- and CE-approved AI algorithms are integrated into over 900 hospitals and imaging centers, such as Yale New Haven Hospital and Cedars-Sinai Medical Center. These algorithms provide accurate detection of diseases, including strokes and pulmonary embolisms, aiding in the diagnostic workflow. The Mayo Clinic's implementation of a comprehensive computer vision system has resulted in a 34% reduction in diagnostic errors and a 28% improvement in early disease detection rates, processing over 20,000 images daily. These examples illustrate how AI can revolutionize teleradiology by enhancing diagnostic accuracy, minimizing errors, and optimizing workflows to ultimately improve patient outcomes.

Challenges:

-

Navigating complex regulatory frameworks and licensing requirements across different regions can hinder the seamless implementation of teleradiology services.

Navigating complex regulatory frameworks and licensing requirements poses significant challenges to the seamless implementation of teleradiology services. The shortage is chronic in India, where just one radiologist is available for every 100,000 patients, well below international standards. This shortfall highlights the urgent need for teleradiology to fill this service gap. Nevertheless, ever-evolving regulatory landscapes hinder the integration of teleradiology into healthcare systems. They must be strictly compliant with data privacy laws while maintaining high-security standards, as medical records are sensitive information. Moreover, technical difficulties, including data transfer and image quality problems, can obstruct remote diagnosis efficiently. These challenges, driven by the external forces of infrastructure and connectivity policy, must be met by the collaborative effort of regulators, Internet and health providers, and technology vendors to align regulation, optimize infrastructure, and define protocols. Such collaborative efforts are essential to fully realize the potential of teleradiology in addressing the pressing shortage of radiologists and improving patient outcomes.

Teleradiology Services Market Segmentation Analysis

By Modality

In 2023, the mammography segment accounted for the highest revenue share in the teleradiology services market. These may include the rising prevalence of breast cancer and government programs encouraging breast cancer screening. Breast cancer became the most frequently diagnosed cancer worldwide in 2021, responsible for 12% of all new cancer cases across the world, according to the World Health Organization. Dramatically increased demand for mammography services. Also, mammography is largely used in government-supported screening programs, which is further fueling segment growth. For example, the U.S. Centers for Disease Control and Prevention (CDC) notes that the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) has offered breast cancer screening to more than 6 million women since 1991. Similarly, the UK's National Health Service (NHS) Breast Screening Programme invites all women aged 50 to 70 for screening every three years, with plans to extend the age range to 47-73.

There is a shortage of on-site commercial teleradiologists with expertise in mammography interpretation, which has further boosted the use of teleradiology services in this segment. NIMRT enables faster, more kinds, and more experienced reading of mammograms, especially in rural or under-resourced areas. This has facilitated increased access to quality breast cancer screening and diagnosis, propelling the segment's leadership in the breast cancer screening market.

By Type

The onshore segment accounted for the largest revenue share of 49% in the teleradiology services market in 2023. Reasons attributable to the dominance of the onshore segment include regulatory compliance, data security, and preference for local expertise. The teleradiology market landscape is influenced by the type of regulation that the government places on it. As an example, here are stringent standards for patient data protection in the United States set by the Health Insurance Portability and Accountability Act (HIPAA). Onshore teleradiology providers are generally in a better position to meet these regulations, and as such, they have a competitive advantage. In 2021, there were 714 healthcare data breaches affecting 500 or more people, according to a report from the U.S. Department of Health and Human Services, indicating that data security is crucial to healthcare services. Onshore services are preferable also due to medical liability and malpractice concerns. On-shore radiology services are also more likely to provide radiologists licensed in the jurisdiction in which a healthcare provider operates, a fact that is often preferred by physicians paying for these services. This preference is mirrored in state-level regulations. For example, the Texas Medical Board requires out-of-state telemedicine providers to obtain a Texas medical license to provide telemedicine in the state.

However, the offshore segment is gaining traction due to cost advantages and the ability to provide 24/7 coverage. According to the U.S. Bureau of Labor Statistics, radiologists earned a median annual salary of $301,720 in 2022, which makes offshore options appealing to healthcare providers who want to bring down costs. With developing countries building up their healthcare infrastructure and training systems, the quality divide between onshore and offshore will continue to narrow, leading to rapid growth in the offshore segment.

Teleradiology Services Market Regional Insights

Asia-Pacific held the majority of the market with a 39% share. Several factors, like better healthcare infrastructure, rising healthcare expenditure, and government efforts to encourage vendors to use digital health solutions for their business operations, are driving this growth at a rapid pace. For Example, China’s 14th Five-Year Plan (2021–2025) focuses on building “Internet + Healthcare” services, such as teleradiology. Launched in 2020, the National Digital Health Mission of the Government of India aims to create a comprehensive digital health ecosystem, which is anticipated to drive the adoption of teleradiology in the country. The rapid growth of the region can be attributed to its large population base as well as the increasing prevalence of chronic diseases and rising healthcare awareness. Approximately 37% of the global burden of cancer is found in the 26 member states of the World Health Organization’s Western Pacific Region, including many Asian countries. The region suffers a high disease burden, and in many Asian countries, there is a shortage of radiologists, further contributing to the demand for teleradiology services in the region.

The North American region is expected to have a considerable compound annual growth rate during the forecast period. This predominance is primarily owing to the advanced healthcare infrastructure, high penetration of digital health technologies, and favourable reimbursement policies in the region. Increasing telehealth coverage, including teleradiology, by the U.S. Centers for Medicare & Medicaid Services (CMS) has also contributed to substantial market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Teleradiology Services Market

Key Service Providers/Manufacturers

-

I-MED Radiology Network

-

Pro Medicus

-

Everlight Radiology

-

RadNet

-

INFINITT Healthcare

-

Teladoc Health

-

Virtual Radiologic

-

Medica Group Plc.

-

Telemedicine Clinic

-

USARAD Holdings, Inc.

-

TeleDiagnosys Services Pvt Ltd.

-

ONRAD, Inc.

-

StatRad LLC

-

Aris Radiology

-

NightShift Radiology

-

Philips Healthcare

-

GE Healthcare

-

Siemens Healthineers

-

Agfa HealthCare

Recent Developments

-

In November 2024, GE Healthcare signed a cooperation agreement with the Indian government to set up teleradiology centers in rural India. It addresses the needs of underserved regions by expanding access to healthcare services and meeting the demand for diagnostic imaging through a shortage of radiologists.

-

In March 2024, Siemens Healthineers unveiled its cloud-based teleradiology solution, which enables seamless collaboration between radiologists across different healthcare facilities. The solution incorporates advanced cybersecurity features to ensure compliance with data protection regulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.0 Billion |

| Market Size by 2032 | USD 29.1 Billion |

| CAGR | CAGR of 2.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Inhouse, Onshore, Offshore) • By Modality (CT-Scans, Ultrasound, X-Rays, MRI, Mammography, PET-CT) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | I-MED Radiology Network, Pro Medicus, Everlight Radiology, RadNet, INFINITT Healthcare, Teladoc Health, Teleradiology Solutions, Virtual Radiologic, Medica Group Plc., Telemedicine Clinic, USARAD Holdings, Inc., TeleDiagnosys Services Pvt Ltd., ONRAD, Inc., StatRad LLC, Aris Radiology, NightShift Radiology, Philips Healthcare, GE Healthcare, Siemens Healthineers, Agfa HealthCare |