Smart Textiles Market Report Scope & Overview:

Get more Information on Smart Textiles Market - Request Sample Report

The Smart Textiles Market Size was valued at USD 3.6 billion in 2023 and is expected to reach USD 26.1 billion by 2032 and grow at a CAGR of 25.0% over the forecast period 2024-2032.

The smart textiles market is experiencing remarkable growth, driven by innovations that integrate electronic components into fabrics, enabling them to perform functions like sensing, energy harvesting, and temperature regulation. As the demand for wearable technology and performance-enhancing fabrics increases, key industries such as healthcare, sports, military, and fashion are benefitting from these advancements. Companies have been focusing on improving the practicality and scalability of smart textiles, with some developing materials that can monitor health parameters, such as heart rate and movement, in real-time. These textiles can provide actionable data that is critical for improving health outcomes and optimizing athletic performance. Moreover, there is a significant push toward integrating energy-harvesting technologies, allowing textiles to power embedded devices, contributing to this market's sustainability aspect. This has spurred interest among various sectors aiming to reduce dependency on traditional power sources.

Several companies have made notable strides in the smart textiles sector in recent developments. In July 2022, MIT researchers developed a textile that can sense movement, which could significantly enhance health monitoring systems by providing more accurate readings for medical purposes, including diagnostics and rehabilitation. This technology could become essential in monitoring patients remotely or tracking the health of elderly individuals. In April 2024, advancements in e-textile production were reported by companies like TextileInside, which discussed innovations in integrating electronic circuits into fabrics, helping streamline manufacturing processes and reducing costs. Additionally, in April 2024, another breakthrough was made in smart textile production by introducing a unique solution to overcome existing production challenges. This technology promises to increase efficiency and improve the scalability of smart textile manufacturing. Meanwhile, in India, there has been a concerted effort to adopt smart textiles within the fashion and health sectors. In April 2023, Apparel Resources reported that, despite challenges, the country is working towards incorporating these textiles into mainstream fashion, healthcare, and fitness industries. The efforts are supported by government-backed initiatives, such as the approval of four startups in the technical textiles sector in August 2024, as highlighted by Pragativadi. These companies and initiatives are helping to propel the smart textiles market by fostering innovation, improving manufacturing capabilities, and addressing scalability concerns.

Smart Textiles Market Dynamics:

Drivers:

-

Growing demand for wearable technology across healthcare, sports, and fitness industries fuels the adoption of smart textiles.

Wearable technology continues to gain momentum, especially in healthcare, sports, and fitness sectors, where smart textiles are used to enhance monitoring and improve performance. These textiles allow for real-time data collection, such as heart rate, body temperature, and movement patterns, which can provide actionable insights for users. In healthcare, they are particularly valuable for remote patient monitoring, offering continuous tracking of vital signs without the need for invasive procedures. For athletes and fitness enthusiasts, smart textiles help optimize training by providing detailed feedback on physical performance. The integration of these technologies into garments increases convenience and accuracy, making them an attractive option for both personal use and medical applications. As health and wellness continue to be a priority globally, this demand for wearable technology will significantly contribute to the smart textiles market growth.

-

Increasing emphasis on energy-efficient textiles and sustainability drives smart textiles market expansion.

-

Advancements in flexible electronics and textile integration technologies enable the development of smart fabrics with enhanced functionalities.

-

Growing consumer interest in health and fitness monitoring drives innovation in smart textiles.

Restraint:

-

High production costs and complex manufacturing processes limit the widespread adoption of smart textiles.

The development and production of smart textiles involve sophisticated technologies and materials, leading to high costs. The integration of electronics, sensors, and other functionalities into fabrics requires specialized manufacturing processes that are not only expensive but also require substantial investment in research and development. For small to medium-sized enterprises (SMEs) and startups, these high costs can be a significant barrier to entry. Moreover, scaling up production to meet demand while maintaining product quality and reliability presents additional challenges. Although prices are expected to decrease with advancements in technology and economies of scale, the high production costs currently limit the widespread adoption of smart textiles, particularly in cost-sensitive industries.

Opportunity:

-

Expansion of smart textiles in the automotive industry presents new revenue opportunities.

-

Development of smart textiles for healthcare applications unlocks a new frontier for the industry.

The healthcare industry offers one of the most promising opportunities for smart textiles, particularly in areas such as remote patient monitoring and personalized medicine. Smart textiles can monitor vital signs such as heart rate, body temperature, and blood pressure, providing continuous, real-time data to healthcare professionals. These textiles can be used in clothing, bedding, or accessories, enabling patients to remain comfortable while their health is closely monitored. As the healthcare industry continues to seek more efficient, non-invasive monitoring solutions, the demand for smart textiles in healthcare is expected to rise, presenting significant growth prospects for the market.

| Company/Project | Investment/Funding | Purpose |

|---|---|---|

| Myant (Canada) | $80 million Series D (May 2024) | Expansion of health-focused smart textiles and wearable technology. |

| Wearable X (USA) | $10 million Series A (March 2024) | Development of smart apparel integrating biometric sensors for fitness and health. |

| Hexoskin (Canada) | $20 million Series B (July 2023) | Advancement of wearable health monitoring systems with integrated textiles. |

| Bioserenity (France) | $12 million Series A (September 2023) | Funding for textile-based health-monitoring garments for chronic disease management. |

| Sewn (USA) | $15 million Seed Funding (October 2024) | Support for production of wearable smart textiles for fashion and fitness sectors. |

In recent years, significant investments have been flowing into the smart textiles market, supporting the growth and development of innovative wearable technologies. For instance, Myant (Canada) secured $80 million in Series D funding in May 2024 to expand its health-focused smart textiles and wearable solutions. Wearable X (USA) raised $10 million in Series A funding in March 2024 to enhance its smart apparel that integrates biometric sensors for fitness and health tracking. Similarly, Hexoskin (Canada) received $20 million in Series B funding in July 2023 to advance wearable health monitoring systems. In Europe, Bioserenity (France) obtained $12 million in Series A funding in September 2023 to develop textile-based health monitoring garments for chronic disease management. Additionally, Sewn (USA) secured $15 million in seed funding in October 2024 to support the production of smart textiles for the fashion and fitness industries. These investments underscore the growing interest and potential in the smart textiles sector, which is poised for continued innovation and market expansion.

Smart Textiles Market Segments

By Type

In 2023, the active/ultra-smart textiles segment dominated the smart textiles market, holding approximately 60% of the market share. This segment is favored for its advanced functionalities such as sensing, energy harvesting, and real-time monitoring, which are key for applications in healthcare, sports, and fitness. For example, active textiles like those used in smart clothing for health monitoring, which track heart rate, body temperature, and movement, have seen substantial adoption. The increasing integration of sensors and electronics into fabrics that actively respond to environmental or physiological changes has contributed to the dominance of this segment.

By Function

The sensing function segment dominated the smart textiles market in 2023, capturing approximately 35% of the market share. Sensing textiles are crucial for applications such as health monitoring, where they track vital signs like heart rate and body temperature in real-time. Examples of sensing textiles include shirts that can monitor respiratory rates or socks that track step count and foot pressure, widely used in healthcare and sports industries. This technology is growing rapidly due to its ability to provide detailed and actionable data, particularly in personal healthcare management and sports performance analysis.

By Material Type

In 2023, conductive polymers emerged as the dominant material type in the smart textiles market, accounting for approximately 40% of the market share. These polymers, which conduct electricity, are widely used in the development of smart textiles, enabling the integration of sensors and other electronic components into fabrics without compromising flexibility or comfort. Conductive polymers are essential in creating garments that can monitor health, regulate temperature, or interact with devices, and are preferred for their lightweight, flexible, and cost-effective properties, making them a popular choice for wearable technology.

By End-Use Industry

The healthcare segment dominated the smart textiles market in 2023, with an estimated market share of around 30%. Smart textiles in healthcare are used for continuous monitoring of vital signs, such as heart rate, blood pressure, and body temperature, through wearable garments like shirts, socks, and patches. These textiles provide non-invasive, real-time data, allowing for more efficient patient management and remote monitoring. With the increasing demand for telemedicine and chronic disease management, healthcare applications have seen substantial adoption, driving the growth of smart textiles in this sector.

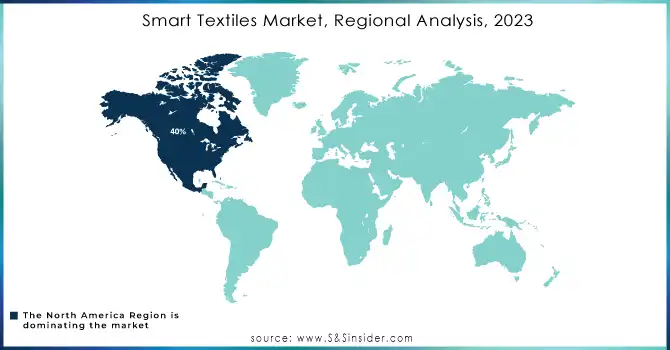

Smart Textiles Market Regional Analysis

In 2023, North America dominated the smart textiles market, accounting for approximately 40% of the market share. This region's leadership can be attributed to the strong presence of key players in the industry, significant investments in research and development, and the increasing adoption of smart textiles across various sectors, including healthcare, military, and sports. The United States, in particular, has been a major contributor to this dominance, where companies like Gentherm and Textronics are at the forefront of developing wearable technology embedded in textiles for monitoring health, temperature regulation, and enhancing performance in both military and sports applications. The U.S. government’s ongoing support for innovative technologies through funding for research and development in the textile sector has also fostered a conducive environment for the growth of smart textiles. Additionally, the robust healthcare infrastructure and the increasing demand for wearable health monitoring devices have propelled the market forward, with products like smart garments designed for continuous heart rate monitoring and fall detection becoming increasingly popular. The dominance of North America in the smart textiles market is supported by advanced manufacturing capabilities, high consumer awareness, and widespread commercialization of smart textile innovations.

Moreover, in 2023, Asia Pacific is expected to emerge as the fastest-growing region in the smart textiles market at a CAGR of 18% from 2024-2032. This growth is driven by a surge in investments in the textile sector, advancements in wearable technologies, and the increasing demand for smart textiles across industries such as healthcare, sports, and fashion. Countries like China, India, and Japan are leading the charge in this region. In China, the government’s support for the development of technical textiles and the increasing focus on health and fitness are fueling demand for wearable smart garments. For instance, Chinese manufacturers are increasingly producing smart fabrics integrated with sensors for health monitoring and fitness tracking, which is enhancing the country's position as a leader in manufacturing and innovation. India is also witnessing rapid growth in smart textiles, particularly in the healthcare and fashion sectors, as both local startups and large enterprises like Reliance Industries are venturing into wearable tech to cater to the increasing consumer demand for health-tracking solutions and stylish, functional garments. Meanwhile, Japan is focusing on the development of high-tech smart textiles, particularly in sports, automotive, and military applications. As the demand for innovative and high-performance textiles rises, the Asia Pacific region is set to experience continued growth in smart textiles adoption, supported by a booming middle-class population, advancements in textile production, and increasing healthcare awareness.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Smart Textiles Market

-

Adidas AG (Climacool Apparel, Smart Running Shoes)

-

AiQ Smart Clothing (BioMan T-Shirt, Health Monitoring Jacket)

-

Clothing Plus Ltd (Heart Rate Monitoring Textile, Fitness Monitoring Wearables)

-

DuPont De Nemours Inc. (Nomex Fabrics, Kevlar Fiber-based Smart Textiles)

-

Gentherm Incorporated (Climate-Controlled Seats, Thermoelectric Heating and Cooling Textiles)

-

Google (Jacquard Smart Jacket, Interactive Touch Panels for Apparel)

-

Hexoskin (Carre Technologies) (Smart Shirts, Hexoskin Smart Monitoring Apparel)

-

Intelligent Clothing Ltd (Health Monitoring Wearables, Temperature-Adaptive Clothing)

-

Interactive Wear AG (Wearable Heating Systems, Smart Light Integration Textiles)

-

Koninklijke Ten Cate (Protective Clothing Fabrics, Geotextiles)

-

Loomia Technologies Inc. (Loomia Electronic Layer, Smart Temperature-Control Textiles)

-

Ohmatex A/S (Textile-Integrated Electronics, Sensor-Embedded Wearables)

-

Outlast Technologies (Temperature-Regulating Fabrics, Phase-Change Material Textiles)

-

Schoeller Textiles AG (c_change Membrane, Coldblack UV-Protection Fabrics)

-

Sensoria Inc. (Smart Socks, Heart Rate Monitoring Bras)

-

Textronics Inc. (Textile Sensors, Fitness Monitoring Wearables)

-

Texas Instruments Incorporated (Wearable Sensor Modules, Energy Harvesting Smart Textiles)

-

Toray Industries Inc. (Luminescent Fibers, Smart Sports Apparel)

-

Vista Medical Ltd. (Pressure Mapping Fabrics, Smart Therapeutic Cushions)

-

Vivonoetics Inc. (Wearable Respiratory Monitoring Systems, Smart BioHarness)

Recent Developments

-

November 2024: Myant acquired Swiss smart textile companies Sensora and Clothing+ to expand its healthcare and sportswear capabilities. This acquisition strengthens Myant’s position in the wearable technology market by integrating advanced health-monitoring features into its smart textile products.

-

April 2024: Virtual Skin Contact pioneered in smart textiles. Researchers introduced a virtual skin contact technology in smart textiles, enhancing wearer comfort and functionality. This innovation allows textiles to adapt to body changes, enabling real-time health tracking and sensory feedback without bulky sensors, revolutionizing wearable technology.

-

September 2023: Egypt announced plans for a $60 million smart textile mill focused on producing advanced fabrics with embedded health monitoring and environmental sensors. The new facility aims to modernize Egypt's textile industry and position the country as a leader in the growing smart textiles market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.6 Billion |

| Market Size by 2032 | US$ 26.1 Billion |

| CAGR | CAGR of 25.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Active/ultra-smart textiles, Passive smart textile) • By Function (Energy Harvesting, Sensing, Thermo Electricity, Luminescence & Aesthetics, Others) • By Material Type (Conductive Polymers, Metallic Yarn, Optical Fibers, Carbon Nanotubes, Others) • By End-use Industry (Military & Defense, Sports & Fitness, Automotive, Healthcare, Fashion & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koninklijke ten cat, Google, Schoeller Textiles, Textronics, Dupont De Nemours, Texas Instruments, Gentherm, Sensoria, Adidas, Ohmatex and other key players |

| Key Drivers | • Advancements in flexible electronics and textile integration technologies enable the development of smart fabrics with enhanced functionalities. • Growing consumer interest in health and fitness monitoring drives innovation in smart textiles |

| RESTRAINTS | • High production costs and complex manufacturing processes limit the widespread adoption of smart textiles |