Mining Lubricants Market Size & Overview

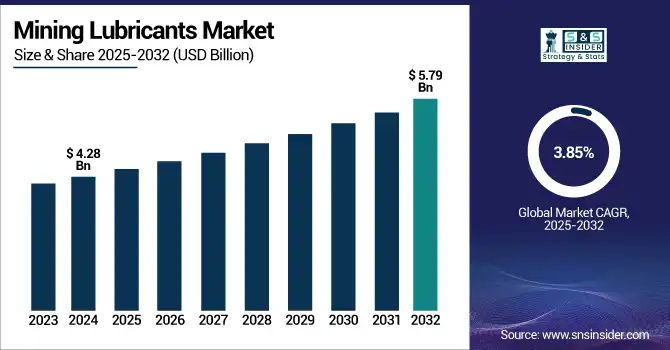

The Mining Lubricants Market size was USD 4.28 billion in 2024 and is expected to reach USD 5.79 billion by 2032, growing at a CAGR of 3.85% over the forecast period of 2025-2032.

To Get more information on Mining Lubricants Market - Request Free Sample Report

The mining lubricants market analysis highlights that the growing demand for metals and minerals is a key factor propelling market growth. This is due to the rapid industrialization, urbanization, and further transition to clean energy technologies, which help increase its demand in the market. Moreover, electric motor vehicles, windmills, and solar radiation panels have an exponentially rising need for readily accessible materials, such as copper, lithium, titanium, and rare earth elements. They are key in large mining projects because they help you reduce wear, maintain the interval time, and increase the life of the machines. Additionally, developments in commodity prices and new exploration activity in both developed and emerging markets are still driving mining output and, consequently, long-term lubricant consumption across the industry.

The U.S. Geological Survey’s Mineral Commodity Summaries 2025 references the scale of mining, which results in many lubrication-related trends, noting that the total value of nonfuel mineral production in the United States was USD 106 billion in 2024.

The U.S recoverable copper mine production was estimated at 1.1 million metric tons, a USD 10.0 billion figure, demonstrating the continued appetite for base metals utilized in critical renewable energy and electric vehicle applications. This indicates that burgeoning exploration and extraction activities driven by the global transition towards infrastructure development and clean-energy technologies are fueling the mining lubricants market growth.

Mining Lubricants Market Dynamics

Drivers

-

Increasing use of high-performance mining equipment drives the market growth.

Growing adoption of high-performance, high-tech equipment to increase productivity, reduce downtime, and enhance safety in surface and underground operations is reshaping the mining landscape. Heavy-duty mining equipment, including hydraulic excavators, articulated dump trucks, and automated drilling rigs, is operated in an extremely high-load environment with numerous impacting physical conditions such as dust, vibration, and wide temperature ranges. Such intensive conditions require high-quality lubricants that provide maximum wear protection, thermal stability, and prolonged lubrication ability.

The U.S. Geological Survey (USGS) has stated that the USD 1 billion increase in total U.S. mineral production to USD 106 billion in 2024 signifies a continued capital investment in mining operations. This increase further demonstrates the continued need for reliable and efficient mining equipment and the lubricants required to keep these powerful machines running.

Restrain

-

Growing shift toward electric mining equipment may hamper the market growth.

The mining industry has been making the slow transition to electric-powered machines, where it has been long determined as the only feasible solution to lower carbon emissions from the operations, to increase energy efficiency, and to meet the global sustainability goals. With electric mining equipment, including battery-electric loaders, haul trucks, and drills having lower operating costs, noise reduction, and improved underground air quality, it is considered the future of mining projects across the globe. But there is one impact of this transition that is important: lower reliance on conventional lubricant. Compared to diesel-powered machinery, electric equipment has minimal moving parts and mechanical systems that require routine lubrication.

Opportunities

-

Expansion of automation and smart mining technologies creates the opportunities in the market.

The increasing use of automation and smart technologies in mining operations is a key opportunity for the mining lubricants market. The advent of advanced technologies like Internet of Things (IoT), artificial intelligence (AI), and autonomous equipment in surface and underground mining activities is increasingly being expanded to enhance the safety, productivity, and operational efficiency. These automatic and sensor-driven systems are designed to very tight performance envelopes, and the lubricants used need to be highly specialized for them to be a performing entity under combined loads, temperatures, and operating conditions. Smart mining machinery demands lubricants that allow for longer service intervals and, at the same time, facilitate real-time monitoring of machinery health, which can minimize downtime and maintenance costs, which drive the mining lubricants market trends.

The Indian government is giving a boost to propagate automation and smart technologies in the mining sector by investing in these technologies itself. The Ministry of Mines, for example, has earmarked nearly USD 50 million in funding for research institutes to develop more efficient extraction and beneficiation technologies for critical minerals such as lithium and rare earth elements. It is aimed at decreasing India's import dependence and boosting domestic mining capabilities

Mining Lubricants Market Segmentation Analysis

By Product

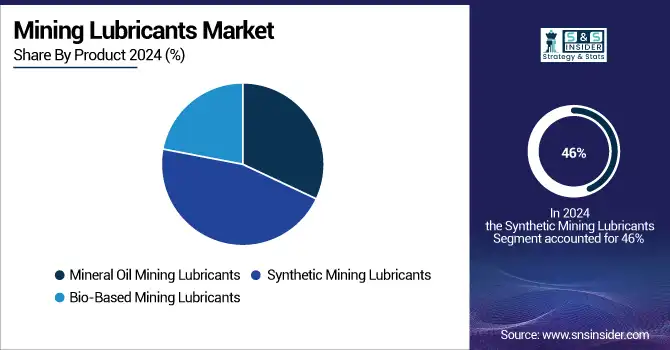

Synthetic mining lubricants held the largest mining lubricants market share, around 46%, in 2024. It is mainly attributed to its performance superiority in extreme operating conditions commonly present in mining applications. Synthetic alternatives provide unparalleled thermal stability, oxidation resistance, and load-carrying ability compared to traditional mineral-based lubricants, which is precisely why they are preferred for use in high-pressure, high-temperature applications. Such attributes aid in enhancing the equipment's lifespan, preventing frequent maintenance, and overall efficient operation, all of which are crucial in reducing downtime and ensuring continued productivity during the function of mining operations.

Mineral oil mining lubricants held a significant mining lubricants market share owing to their cost effectiveness and easy availability. These lubricants are widely employed in a variety of mining equipment where extreme performance characteristics are considered less critical. This lower initial cost compared to synthetic alternatives makes them an attractive choice for mining operations, particularly in developing areas where budget constraints are more pronounced. In addition, mineral oil lubricants also have a rich history in the industry and a reliable performance in regular applications like gearboxes, engines, and hydraulic systems.

By Application

Iron ore mining held the largest market share, around 32%, in 2024. It is due to the massive scale, along with the high levels of intensity required to extract as well as process iron ore at the mining site. Iron ore is also one of the most mined commodities in the world and is a key raw material used by the global steel industry, so it is produced extensively in regions like Australia, Brazil, China, and India. Because of the heavy loads and harsh environmental conditions associated with the equipment used in iron ore mining, this area needs high-performance lubricants to provide durability, efficiency, and no downtime.

Coal mining holds a significant market share in the mining lubricants market. It is due to the massive and intensive operations for extracting and processing coal and higher supplemental factors in countries such as China, India, the United States, and Australia. In several areas, the energy sector still heavily relies on coal for power generation and industrial applications, thus maintaining the high demand for its extraction. Draglines, loaders, drills, conveyor belts, and other heavy machinery used in coal mining typically work under very high loads and difficult conditions, making their lubrication frequent, fail-safe, and reliable to avoid wear and downtime, and to enable continuous operation.

Mining Lubricants Market Regional Outlook

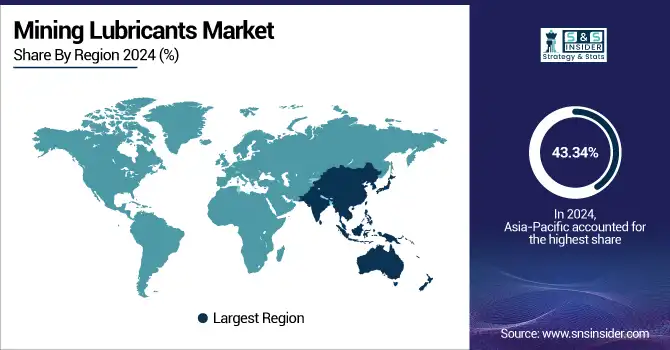

Asia-Pacific held the largest market share, around 43.34%, in 2024. It is owing to the abundance of mineral reserves, coupled with extensive industrialization and huge investments in infrastructure development. China, India, and Australia are the largest producers of coal, iron ore, and other major minerals in the world, contributing to large mining grease activities, which create the need for high-performance lubricants. Furthermore, the growing mining equipment lubricants, and energy sectors in the region will also drive the demand for continuous mineral extraction, which, in turn, is likely to propel the mining lubricants consumption.

For example, in April 2025, China reported 389.31 million metric tons of coal, a 3.8% growth year over year, as coal production during the first four months of the year totaled 1.58 billion tons. Additionally, Indonesia has now become the epicentre of the global nickel market, holding a commanding majority of the nickel that the world needs for electric vehicle batteries and electronics.

North America mining lubricants market held a significant market share and is the fastest-growing segment during the forecast period. It is owing to the established mining framework, extensive metal production, operational performance, and lasting equipment in the region. As a major source of copper, gold, coal, and rare earth elements, the United States and Canada produce key materials essential to industries from construction to electronics and renewable energy. Mining in the region is highly mechanized and employs advanced machinery and apparatus, which require specialized lubricants to ensure optimal performance under extreme conditions. Moreover, high regulatory requirements regarding safety and the environment promote the use of high-performance, generally synthetic or bio-based types of lubricants.

U.S Mining Lubricants market size was USD 747 million in 2024 and is expected to reach USD 1129 million by 2032 and grow at a CAGR of 5.30% over the forecast period of 2025-2032. It is due to the massive capability of the latest category machines and their maintenance. The U.S. is one of the mining lubricants companies in the world, with certain minerals such as coal, copper, gold, and industrial sand, and has a large fleet of heavy-duty mining equipment that requires regular and premium lubrication. There is also a high focus on operational efficiency, safety, and compliance with stringent environmental regulations that fuel the demand for high-quality lubricants such as synthetic and biodegradable ones.

In May 2024, ExxonMobil merged with Pioneer Natural Resources, forming an unconventional oil giant in the Permian Basin. The acquisition markedly increases ExxonMobil's production location, which in turn may drive demand for mining lubricants during extraction and processing.

Europe held a significant market share over the forecast period. It is owing to the presence of a developed mining sector, established technological infrastructure, and a well-developed environmental regulatory structure, according to which the demand for high-performance and eco-friendly lubricants is driven. It hosts significant mining for the coal, iron ore, copper, and industrial metals required by the nation's manufacturing and automotive sectors. As European mining enterprises look to align machinery with efficiency standards and reduce downtime, more and more mining companies are introducing high-performance lubrication solutions that not only enhance the efficiency of machinery but also comply with strict sustainability standards.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

ExxonMobil Corporation, Shell plc, Chevron Corporation, TotalEnergies SE, BP plc, Fuchs Petrolub SE, Petro-Canada Lubricants Inc., Quaker Houghton, Kluber Lubrication, Sinopec Lubricant Company, and Others.

Recent Development:

-

In 2024, Idemitsu Kosan planned to expand the production capacity of lubricants by 50% by 2025 to respond to increasing demand for mining lubricants.

-

In 2023, ExxonMobil announced the investment of USD 1 billion in its lubricant manufacturing facility in Singapore to cater to the increasing demand for mining lubricants in the Asia-Pacific region.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.28 Billion |

| Market Size by 2032 | USD 5.79 Billion |

| CAGR | CAGR of 3.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Mineral Oil Mining Lubricants, Synthetic Mining Lubricants, Bio-Based Mining Lubricants) •By Application (Coal Mining, Iron Ore Mining, Bauxite Mining, Rare Earth Mineral, Precious Metal Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Shell plc, Chevron Corporation, TotalEnergies SE, BP plc, Fuchs Petrolub SE, Petro-Canada Lubricants Inc., Quaker Houghton, Kluber Lubrication, Sinopec Lubricant Company. |