Polyacrylamide Market Report Scope & Overview:

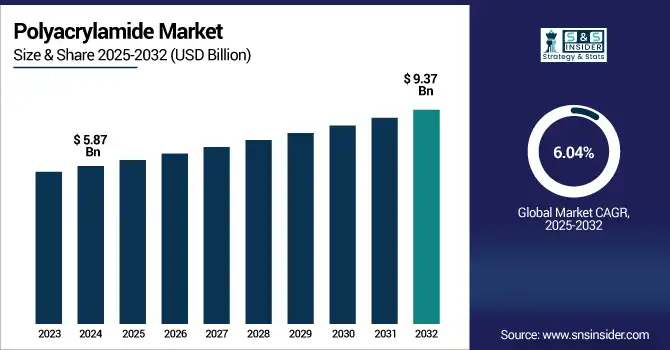

The Polyacrylamide Market size was valued at USD 5.87 billion in 2024 and is expected to reach USD 9.37 billion by 2032, growing at a CAGR of 6.04% over the forecast period of 2025-2032.

To Get more information on Polyacrylamide Market - Request Free Sample Report

Polyacrylamide market analysis indicates that growth in mining is driving the market because polyacrylamide is an important polymer used in mineral processing. This is widely used for solid-liquid separation, sedimentation, and tailings treatment, critical to operating mines in an efficient and environmentally sound manner. The demand for water and waste management is growing as global mineral and metals demand grows in response to infrastructure, renewable energy, and industrial and manufacturing activities. Polyacrylamide is one of the most widely used chemicals in the industry, and it has proven its efficiency for water consumption and recovery. The increasing dependence on polyacrylamide in the mining process is a key influencer driving polyacrylamide market growth.

According to the U.S. Environmental Protection Agency, publicly-owned treatment works (POTWs) in the United States treat an estimated 32 billion gallons of municipal wastewater per day and provide water treatment chemicals. Considering industrial and mining-related water treatment, it is estimated that approximately 40 billion gallons of wastewater are treated every day, highlighting the importance of flocculants such as polyacrylamide in these processes.

Polyacrylamide Market Dynamics:

Drivers

-

Increasing Use in the Pulp & Paper Industry Drive the Market Growth

In the paper-making industries, polyacrylamide (PAM for short) is readily used for paper retention aid, drainage aid, and flocculant. It also aids in improving the quality of paper by increasing the retention of fiber, decreasing the drainage time on the paper machine, and providing uniform sheet formation. Increasing usage of packaging materials, tissue papers, and specialty papers across the globe is led by a boom in e-commerce, hygiene awareness, and food packaging among other end-use sectors, has been creating demand for functional additives such as polyacrylamide over the years.

In Feb 2022, Kemira announced its major step toward sustainability by launching full-scale commercial production bio‑polyacrylamide.

Restrain

-

High Production and Handling Costs May Hamper the Market Growth

The factor that hinders the growth of the polyacrylamide industry is high production cost and handling cost, which may limit the entrance of new players and small-scale manufacturers. Often used in the initial polyacrylamide production process, these specialized raw materials are toxic and hazardous, and, therefore, require strict safety protocols. Moreover, controlled environments, sophisticated machinery, and accurate temperature and pH monitoring during production processes all require pumping up the operational costs. In addition to this, polacrylamide itself in liquid or emulsion forms needs to be stored and transported in a way that guarantees containment; otherwise, polacrylamides may be destabilized, therefore lowering the quality of the product.

Opportunities

-

Technological Advancements in Polymer Chemistry Creates an Opportunity in the Market

The advancements in technology related to polymer chemistry are creating immense opportunities in the polyacrylamide market due to the ability to manufacture more efficient, specialized, and sustainable polymer variants. The efficacy of polyacrylamide has been improved by introducing it to various innovations like copolymerization techniques, nano-structuring, and smart polymers that modify its solubility, thermal stability, and targeted reactivity. Such developments enable the polymer to be customized for diverse applications, including but not limited to water treatment, enhanced oil recovery, biomedical applications, and electronics. For example, new high-molecular-weight, shear-stable formulations are working really well in the most abrasive industrial applications, which drives the polyacrylamide market trends.

For instance, In June 2024, SNF Holding Company invested USD 18 million to expand its polyacrylamide manufacturing plant in Lara, Australia. It expanded our ability to provide advanced flocculants and coagulants to the mining, oil & gas, and agricultural sectors allowing us to produce higher-performing, specialty polymers customized to changing industrial demands.

Polyacrylamide Market Segmentation Analysis:

By Product

Anionic held the largest polyacrylamide market share, around 49%, in 2024. It is due to be used in wastewater treatment, mining, and individual paper. This polyacrylamide type is useful, particularly as a flocculant and coagulant for separating suspended solids from municipal and industrial effluent streams in liquid-solid separation processes. This has led it to gain preference in water treatment facilities worldwide because of the superior electrochemical behavior of this material, which helps in improving the overall performance in dewatering sludge, clarification of water, or improving the process efficiency. Anionic polyacrylamide is utilized for the settlement and recycling of process water in the mining industry and used in paper production to aid in retention and drainage.

Cationic held a significant polyacrylamide market share. It is due to its importance in playing a crucial role in sludge dewatering, wastewater treatment, and industrial processing applications. Cationic polyacrylamides are more effective in treating organic-rich wastewater resulting from food processing, textile manufacturing, and municipal sewage plants, unlike the anionic types. They neutralize negatively charged particles, resulting in better floc formation, which enhances solid-liquid separation and reduces sludge volume. It reduces the cost of disposal and improves recycling of water, thus making cationic polyacrylamide an ideal solution for sustainability and regulatory compliance-focused sectors.

By Application

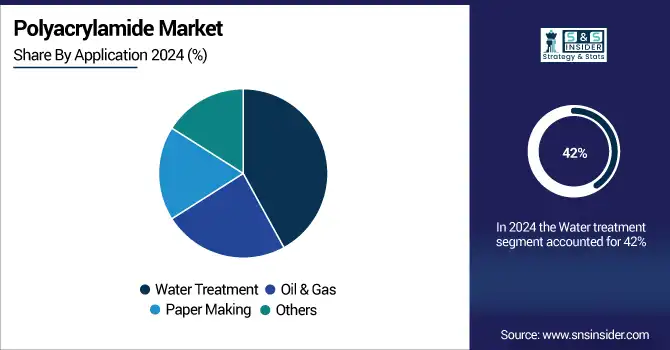

Water treatment segment held the largest market share, around 42%, in 2024. It is driven, among others, by the increased global emphasis on sustainable water management and the rise in public and private investment money targeted at wastewater recycling initiatives at the municipal, industrial, and commercial scale. Polyacrylamide is a commonly used flocculant and coagulant in water treatment to aggregate suspended particles, promote sedimentation, and enhance treated water quality. Due to increasing urbanization and rapid industrialization in emerging economies, governments and industries around the world are investing considerably to retrofit water infrastructure and meet growing environmental regulations.

Oil & Gas holds a significant market share in the polyacrylamide market. It is due to is used for enhanced oil recovery and in drilling and fracturing operations. The partially hydrolyzed polyacrylamide variant is injected into oilfields to enhance the viscosity of the solution and improve sweep efficiency, thereby increasing the amount of crude oil that can be extracted from mature wells. Polyacrylamide allows the displacement of the oil and the improvement of recovery processes by reducing water mobility, which also makes the extraction process more cost-effective. The chemical is also used in drilling fluids and wellbore stabilization to thicken the fluid and reduce fluid loss.

Polyacrylamide Market Regional Outlook:

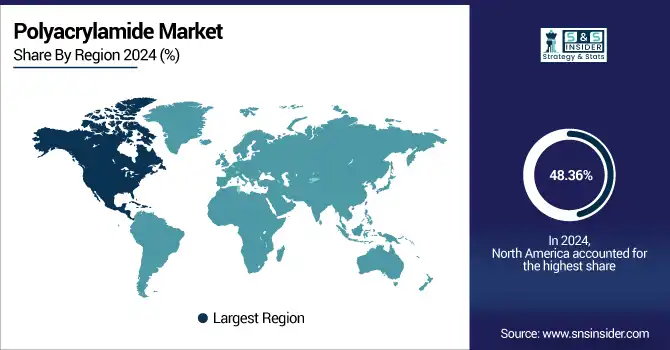

North America polyacrylamide market held the largest market share, around 48.36%, in 2024. It is due to a high industrial base, developed water treatment infrastructure, and a substantial oil & gas business. Polyacrylamide is commonly utilized in municipal and industrial water treatment systems to facilitate flocculation, sludge dewatering, and the improvement of water quality at a large-scale level in both the U.S. and Canada. Moreover, polyacrylamide uptake is largely driven by the oil & gas sector in the region, especially for shale exploration and enhanced oil recovery (EOR). Key players in the market like SNF and BASF have invested heavily in production units around North America to ensure a steady supply of high-grade polymers.

In 2022, SNF USD 300 million investment by SNF has been made to upgrade capacity at its U.S facility in Plaquemine, Louisiana. Working on 3 projects by adding powder-grade polyacrylamide of 30,000MT/year and acrylamide monomer of 100,000MT/year to the production capacity

The U.S. polyacrylamide market size was USD 2.10 billion in 2024 and is expected to reach USD 3.40 billion by 2032 and grow at a CAGR of 6.18% over the forecast period of 2025-2032. It is mainly especially on account of its well-established industrial sphere and high demand from key end-use industries including wastewater treatment, oil & gas and paper manufacturing sectors. The country possesses one of the most developed and extensive municipal and industrial water treatment systems in which polyacrylamide is a critical chemical utilized for flocculation, sludge dewatering, and solids separation. In addition, polyacrylamide is widely used in shale exploration and enhanced oil recovery (EOR) industries in the U.S., owing to its significant role in enhancing concentrate extraction and minimizing water demand from the latter, which will further accelerate market demand.

Asia Pacific polyacrylamide market held a significant market share and is the fastest-growing segment in the forecast period. It is due to the fastest industrialization, urbanization, and population growth in major economies such as China, India, Japan, South Korea, etc. There is a rising demand for wastewater treatment in these countries due to growing environmental awareness, increasing water scarcity, and stringent water quality regulations enforced by the governments. Most polyacrylamide used in the region is in municipal and industrial water treatment plants. Furthermore, Asia Pacific is home to the widest array of mining, paper, agriculture, and oil & gas industries, which are identified as major end-use applications for polyacrylamide. Low-cost manufacturing and abundance of raw materials, coupled with increasing foreign investments towards the development of industrial infrastructure, have further stimulated the regional consumption.

Europe held a significant market share in the forecast period. It is owing to its strict environmental policies, efficient wastewater management systems, and robust industrial infrastructure. Free of harmful substances, polyacrylamide champion of efficient treatment chemicals, is centered under such benchmark frameworks, which impose high requirements on water purification, industrial effluents, and sludge. Germany, France, and the U.K. have advanced water recycling infrastructure and are heavily investing in sustainable practices, which will undoubtedly bolster polyacrylamide demand. Furthermore, the region is also heavily indulged in pulp & paper, oil & gas, and chemical manufacturing, and these activities require polyacrylamide in order to increase the functioning of these processes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major polyacrylamides companies are SNF Group, Kemira, BASF SE, Solenis, Ashland, Black Rose Industries Ltd., Anhui Tianrun Chemicals Co., Ltd., Shandong Shuiheng Chemical Co., Ltd., Xitao Polymer Co., Ltd., and ZL EOR Chemicals Ltd.

Recent Development:

-

In March 2025, Kemira and International Flavors & Fragrances announced a €130 million joint venture named Alphabio in Kotka, Finland, to produce 44,000MT/year of renewable, biobased polymers, including polyacrylamides for global industrial and personal care markets.

-

In 2023, Mitsubishi Chemical introduced an APAM line, specifically designed for oil & gas wastewater systems, that is stable to 120°C.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.87 Billion |

| Market Size by 2032 | USD 9.37 Billion |

| CAGR | CAGR of 6.04% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By By Product (Anionic, Cationic, and Non-ionic) • By Application (Water Treatment, Oil & Gas, Paper Making, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SNF Group, Kemira, BASF SE, Solenis, Ashland, Black Rose Industries Ltd., Anhui Tianrun Chemicals Co., Ltd., Shandong Shuiheng Chemical Co., Ltd., Xitao Polymer Co., Ltd., ZL EOR Chemicals Ltd. |