Modular Chillers Market Size & Overview:

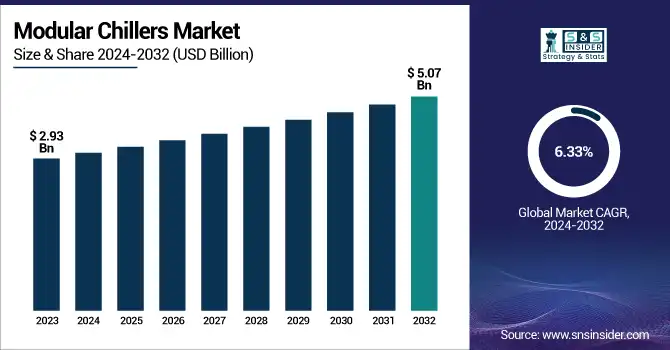

The Modular Chillers Market Size was valued at USD 2.93 Billion in 2023 and is expected to reach USD 5.07 Billion by 2032 and grow at a CAGR of 6.33% over the forecast period 2024-2032.

To Get more information on Modular Chillers Market - Request Free Sample Report

The Modular Chillers Market is witnessing tremendous growth with increasing demand for energy-efficient cooling solutions in commercial, industrial, and residential applications. Modular chillers are scalable, redundant, and easy to maintain, which makes them a popular option for HVAC applications. Some of the major drivers of market growth include stringent environmental regulations, rising adoption of smart cooling technologies, and expanding infrastructure development. The study offers in-depth market trend analysis, competitive scenarios, technology advancements, and investment possibilities.

The U.S. Modular Chillers Market stood at USD 0.35 billion in 2023 and is anticipated to increase to USD 0.63 billion by 2032, growing at a CAGR of 6.78% from 2024 to 2032. The Modular Chillers Market is expanding at a fast pace with increasing demand for energy-efficient and scalable cooling solutions. Commercial, industrial, and residential sectors are embracing modular chillers for their cost-effectiveness and flexibility. Developments in smart cooling technologies and strict environmental regulations are also fueling market growth and innovation.

Modular Chillers Market Dynamics

Key Drivers:

-

Increasing Adoption of Energy-Efficient HVAC Systems Drives Modular Chillers Market Growth

The growing need for energy-efficient HVAC systems due to industries and commercial buildings trying to save on energy usage and operational expenses has increased demand. Modular chillers provide increased efficiency, scalability, and redundancy compared to conventional chillers and thus are a desired option. Stringent energy standards and green building codes from governments across the globe are also hastening market growth. Moreover, technology improvements in intelligent cooling solutions, including IoT-monitored and AI-optimized monitoring, improve system efficiency and decrease maintenance expenses. The increasing trend towards sustainability and carbon footprint mitigation is compelling businesses to invest in modular chillers, leading to their expanding market penetration in all industries.

Restraint:

-

High Initial Investment Costs Limit the Widespread Adoption of Modular Chillers in Cost-Sensitive Markets

Although they have long-term cost-saving advantages, modular chillers involve a high initial investment, which can be a significant deterrent for companies, particularly in price-sensitive markets. Procurement, installation, and integration of modular chillers involve more capital than traditional cooling systems, and hence affordability becomes a major issue. Small and medium-sized enterprises (SMEs) are reluctant to make the transition due to financial constraints and prefer traditional systems with lower capital costs. In addition, the limited awareness of modular chillers' long-term energy and operational advantages is another limiting factor for their acceptance.

Opportunity:

-

Growing Smart Building and Green Infrastructure Development Expands Modular Chillers Market Potential

The emerging trend of smart buildings and green infrastructure is a big opportunity for the modular chillers market. Governments and companies are funding sustainable building solutions that incorporate energy-efficient technologies, such as smart HVAC systems. Modular chillers, through their capability to maximize cooling loads and minimize energy wastage, fit right in with these green solutions. In addition, technological developments in building automation systems (BAS) enable the smooth integration of modular chillers to monitor performance in real-time and for predictive maintenance. Increasing demand for LEED-certified structures and green infrastructure will drive the implementation of modular chillers higher, leading to business growth across the world.

Challenge:

-

Complexity in System Integration and Maintenance Hinders Modular Chillers Market Growth

Modular chillers have benefits such as scalability and energy efficiency, but integrating them with existing HVAC infrastructures can be complicated. Incompatibility issues in systems, different cooling load demands, and technical skills involved in installation and maintenance are obstacles for end-users. Lack of proper training on the part of facility managers and technicians can create inefficiencies that compromise system performance and longevity. Improper balancing of loads and synchronization of control systems can also cause suboptimal energy savings. In order to overcome these obstacles, industry players need to concentrate on delivering holistic training, easy-to-use control systems, and improved after-sales support to ensure smooth adoption and operation of modular chillers in various applications.

Modular Chillers Market Segments Outlook

By Product

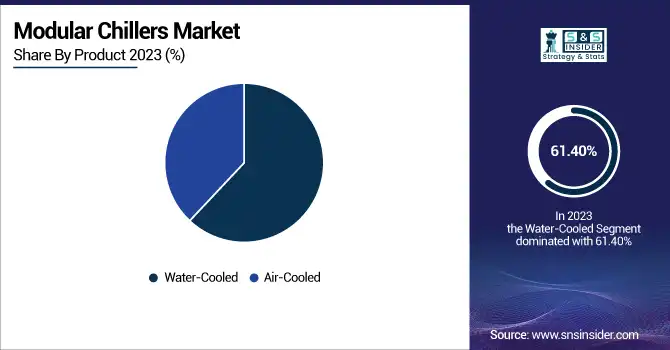

The Water-Cooled modular chillers segment dominated the market with a 61.40% share in revenue terms in 2023, benefiting from high efficiency, better cooling capacity, and extensive use across commercial and industrial sectors. Industry players such as Carrier, Trane, and Daikin have introduced highly advanced water-cooled modular chillers with advanced energy efficiency and intelligent control aspects. For example, Trane's Agility water-cooled chillers concentrate on space-conserving designs and optimized energy efficiency. Growing demand from data centers, healthcare institutions, and commercial buildings drives this segment's dominance. With regulatory pressure and sustainability initiatives favoring energy-efficient cooling, the water-cooled segment continues to be a keystone of the Modular Chillers Market.

The Air-Cooled modular chillers segment is estimated to have the highest CAGR of 6.45% owing to an increase in the demand for economical, flexible, and easy installation cooling solutions. Major industry stakeholders such as Mitsubishi Electric, Johnson Controls, and LG Electronics are innovating on this front. For instance, LG introduced its Inverter Scroll Modular Chiller with superior heat exchange technology for enhanced efficiency as well as minimization of carbon emissions. The segment is supported by growing uptake in small-to-medium commercial establishments, residential complexes, and retrofitting applications where water availability is limited.

By Application

The commercial segment held the largest share of 47.80% in the Modular Chillers Market in 2023, influenced by the growing need for efficient cooling in corporate spaces, data centers, healthcare, and government buildings. Major industry players like Daikin Industries Ltd. and Carrier Global Corporation have been launching innovative modular chiller products to maximize system efficiency and minimize carbon emissions. In 2023, Trane Technologies introduced high-efficiency modular chillers with intelligent controls for energy management in commercial buildings. The fast growth of commercial infrastructure, strict energy policies, and increasing use of smart building technologies continue to drive the dominance of the segment.

Residential application is anticipated to expand at the highest CAGR of 7.44% due to growing urbanization, smart home adoption, and the need for energy-efficient HVAC equipment. Industry leaders such as Mitsubishi Electric Corporation and Johnson Controls have designed modular chillers specific for residential cooling with features like quiet operation and energy efficiency. LG Electronics released an IoT-monitoring-enabled advanced residential modular chiller in 2024. Government policies encouraging energy-efficient homes and the increase in green building certifications also increase demand.

Modular Chillers Market Regional Analysis

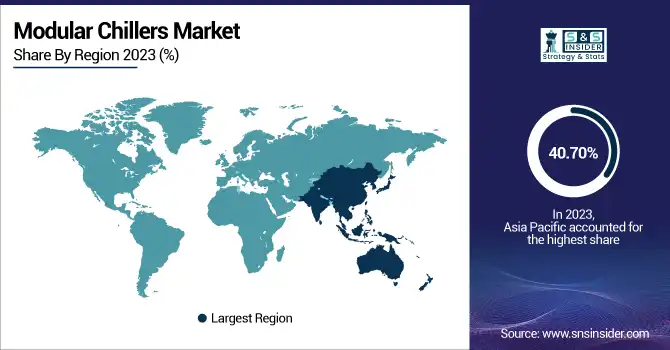

The Asia Pacific region led the Modular Chillers Market with a 40.70% revenue share in 2023 due to fast urbanization, industrial growth, and rising investments in energy-efficient HVAC facilities. India, China, and Japan are observing a growth spurt in commercial developments, such as data centers, office buildings, and healthcare buildings, propelling the demand for modular chillers. Established players such as Daikin, Carrier, and Trane Technologies have introduced smart modular chillers with IoT controls and better energy efficiency to meet increasing demand. The increase in the usage of green building certifications and initiatives by governments towards carbon footprint management further augurs well for regional market growth.

The Middle East & Africa market is expected to witness the significant CAGR of 5.99% over the forecast period with the increasing infrastructure developments, harsh climatic conditions, and growing emphasis on sustainable cooling systems. Increasing developments of smart cities, commercial buildings, and industrial campuses in the UAE, Saudi Arabia, and South Africa are driving demand for modular chillers. Players such as Johnson Controls and LG Electronics have launched high-efficiency modular chiller models designed for high-temperature regions to provide improved cooling performance. Government-supported energy efficiency programs and increased investments in HVAC systems powered by renewable sources are likely to spur additional regional market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Modular Chillers Market Key Players are:

-

Trane Technologies plc – (Modular Series Chillers, Sintesis Air-Cooled Chillers)

-

GREE ELECTRIC APPLIANCES, INC. – (GMV5 Modular Chiller, Scroll Modular Chiller)

-

Carrier Corporation – (AquaSnap 30MP Modular Chiller, AquaForce 30XV Air-Cooled Chiller)

-

FRIGEL FIRENZE S.p.A. – (Microgel Modular Chiller, Aquagel Chiller System)

-

Midea Group – (MGC-V Modular Air-Cooled Chiller, MWC-W Modular Water-Cooled Chiller)

-

Multistack International Limited – (MagLev Chiller, Air-Cooled Modular Chiller)

-

Daikin Industries, Ltd. – (TZ Modular Chiller, EWAT-B Air-Cooled Scroll Chiller)

-

Johnson Controls – (YVFA Free-Cooling Modular Chiller, YMC Magnetic Bearing Centrifugal Chiller)

-

Haier Group – (MRV Modular Chiller, Modular Scroll Chiller)

-

Mitsubishi Electric Corporation – (E-Series Modular Chiller, City Multi Modular Chiller)

-

McQuay Air-Conditioning Ltd. – (WMC Modular Centrifugal Chiller, Modular Scroll Chiller)

-

Johnson Controls-Hitachi Air Conditioning – (SAMURAI Modular Chiller, Scroll Chiller Series)

-

Ingersoll Rand – (Thermo King Modular Chiller, Air-Cooled Scroll Chiller)

-

Multistack, LLC. – (MS Modular Chiller, MagLev Water-Cooled Chiller)

-

LG Electronics – (Inverter Scroll Modular Chiller, Air-Cooled Modular Chiller)

-

Nanjing TICA Climate Solutions Co., Ltd. – (Modular Air-Cooled Chiller, Variable Speed Water-Cooled Chiller)

-

Gree Electric Appliances, Inc. of Zhuhai – (Modular Scroll Chiller, V6 Air-Cooled Modular Chiller)

Recent Developement

-

January 2024 – Trane Technologies plc introduced the Thermo King Advancer Hybrid Refrigeration System, a state-of-the-art transport refrigeration unit (TRU) designed to enhance energy efficiency, reduce emissions, and support sustainability initiatives.

-

February 2024 –REE ELECTRIC APPLIANCES, INC. launched its New Generation Modular Air-Cooled Chiller, integrating AI-based optimization technology to enhance energy efficiency, operational flexibility, and intelligent cooling performance. This innovation caters to commercial, industrial, and data center applications, addressing the growing demand for sustainable and energy-efficient HVAC systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.93 Billion |

| Market Size by 2032 | USD 5.07 Billion |

| CAGR | CAGR of 6.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product – Water-Cooled (<50kW, 51-100kW, 101-200kW, 201-300kW, >301kW), Air-Cooled (<50kW, 51-100kW, 101-200kW, 201-300kW, >301kW) •By Application – Commercial (Corporate Offices, Data Centers, Public Buildings, Mercantile & Service, Healthcare, Others), Residential, Industrial (Chemical, Food & Beverage, Metal Manufacturing & Machining, Medical & Pharmaceutical, Plastics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trane Technologies plc, GREE ELECTRIC APPLIANCES, INC., Carrier Corporation, FRIGEL FIRENZE S.p.A., Midea Group, Multistack International Limited, Daikin Industries, Ltd., Johnson Controls, Haier Group, Mitsubishi Electric Corporation, McQuay Air-Conditioning Ltd., Johnson Controls-Hitachi Air Conditioning, Ingersoll Rand, Multistack, LLC., LG Electronics, Nanjing TICA Climate Solutions Co., Ltd., Gree Electric Appliances, Inc. of Zhuhai |