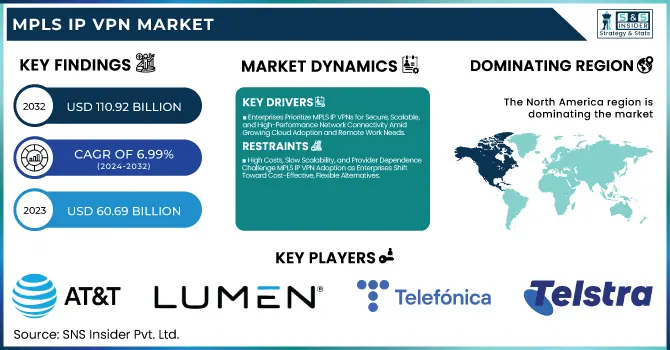

MPLS IP VPN Market Report Scope & Overview:

The MPLS IP VPN Market was valued at USD 60.69 billion in 2023 and is expected to reach USD 110.92 billion by 2032, growing at a CAGR of 6.99% from 2024-2032. This report includes valuable insights into adoption rates, customer base, pricing movements, technology trends, and security. The growing need for secure high-performance networking solutions in industries is fueling growth. Besides, the requirement of cost-efficient, scalable, and dependable communication networks by businesses is also driving the market growth. Technological advancements, especially in cloud computing and network automation, are likely to further drive the adoption of MPLS IP VPN solutions, making them essential to today's enterprise networks.

To Get more information on MPLS IP VPN Market - Request Free Sample Report

MPLS IP VPN Market Dynamics

Drivers

-

Enterprises Prioritize MPLS IP VPNs for Secure, Scalable, and High-Performance Network Connectivity Amid Growing Cloud Adoption and Remote Work Needs.

The growing adoption of cloud applications, remote employees, and data-intensive operations is compelling organizations to implement highly scalable and secure network infrastructures. Conventional internet-based VPNs hardly satisfy the high security and performance demands of today's enterprises. MPLS IP VPNs offer a dedicated, secure network with improved security features that guarantee data integrity and protection against cyberattacks. Furthermore, these networks provide inherent scalability, enabling enterprises to add operations without degrading performance. The capacity for low latency, high-speed connections, and higher Quality of Service (QoS) makes MPLS IP VPNs the first option for businesses requiring reliability and performance in their network infrastructure.

Restraints

-

High Costs, Slow Scalability, and Provider Dependence Challenge MPLS IP VPN Adoption as Enterprises Shift Toward Cost-Effective, Flexible Alternatives.

The high capital investment needed for MPLS network deployment, infrastructure, and maintenance is a key challenge, especially for small and medium-sized businesses. High operating expenses make it challenging for companies to commit to long-term MPLS, especially when cost-saving options such as SD-WAN are becoming increasingly popular. Slow provisioning and intricate configurations also restrict the capacity of companies to scale rapidly in response to shifting demands. Reliance on service providers also limits flexibility, resulting in vendor lock-in and possible service restrictions. With internet-based VPN solutions getting progressively more secure and performing at high levels, most businesses are reevaluating MPLS IP VPNs, moving towards more flexible and economical network solutions that serve their digital transformation efforts well.

Opportunities

-

Hybrid and Multi-Cloud Adoption Boosts Demand for MPLS IP VPNs as Enterprises Seek Secure, High-Performance, and Reliable Network Connectivity.

Enterprises are increasingly embracing hybrid and multi-cloud infrastructures to support flexibility, scalability, and efficiency of operations. With multiple cloud platforms being integrated into business environments, the requirement for high-performance, secure network connectivity has become imperative to support seamless data sharing and application performance. Internet-based connections traditionally suffer from reliability and security issues, prompting MPLS IP VPNs as the preferred option for enterprises that require dedicated, low-latency, and secure networking solutions. The capability of MPLS to deliver consistent performance, improved traffic management, and end-to-end encryption makes it a key element of cloud strategies today. With digital transformation driving industries faster than ever before, organizations are now more and more using MPLS IP VPNs to optimize cloud connectivity and remain competitive.

Challenges

-

SD-WAN Adoption Surges as Enterprises Seek Cost-Effective, Flexible, and Cloud-Optimized Networking Solutions, Reducing Reliance on Traditional MPLS IP VPNs.

Enterprises are increasingly adopting SD-WAN as a more agile and cost-saving option compared to MPLS IP VPNs. SD-WAN solutions offer cloud-native architecture, improved traffic management, and easy integration with multi-cloud environments, making them a business favorite when it comes to digital transformation. In contrast to MPLS, which is based on fixed infrastructure and dedicated circuits, SD-WAN utilizes multiple transport mechanisms, lowering costs while enhancing network agility. This transition is compelling businesses to rethink long-term MPLS investments, especially as SD-WAN solutions are continually improving with enhanced security features and smart routing capabilities. With more organizations placing emphasis on cloud connectivity and operational efficiency, the competitive environment for MPLS IP VPNs is increasingly becoming tougher.

MPLS IP VPN Market Segment Analysis

By Service

Layer 3 segment led the MPLS IP VPN Market with the largest revenue share of around 62% in 2023 because it can offer highly secure, scalable, and efficient routing solutions for enterprise networks. Layer 3 MPLS is favored by companies for its enhanced traffic engineering, easy integration with multi-site networks, and excellent Quality of Service (QoS) features. Its support for IP-based routing and multiple protocols makes it best suited for large enterprises, financial institutions, and service providers with high-performance connectivity and security needs.

Layer 2 segment is expected to expand at the fastest CAGR of approximately 8.16% during 2024-2032 due to growing demand for low-latency and high-speed connectivity solutions. Layer 2 MPLS adopted by enterprises offers easy network management, lower overhead, and improved control over Ethernet-based communications. The growth of cloud computing, data center interconnect, and IoT solutions is driving the requirement for Layer 2 VPNs since they provide direct point-to-point as well as multipoint connectivity with less complexity in routing.

By Industry

IT & Telecom segment led the MPLS IP VPN Market with the largest revenue share of around 28% in 2023 owing to its imperative requirement for secure, high-performance, and scalable network infrastructure. Telecom companies and IT service providers use MPLS IP VPNs to provide high-quality data transmission, low-latency connectivity, and secure services for cloud apps and enterprise services. The growing requirement for bandwidth-heavy applications, VoIP, and data center interconnectivity further reinforces MPLS as the go-to solution for IT & Telecom players.

Education segment is expected to grow at the fastest CAGR of around 9.51% during the forecast period from 2024-2032 due to the accelerating digital transformation of educational organizations and growing e-learning platform adoption. Educational institutions, universities, and online educators need secure, dependable connectivity to support virtual classrooms, cloud learning management systems, and research collaborations. MPLS IP VPNs provide high-speed, low-latency connections for guaranteed access to learning resources without disruption. The increasing focus on distant learning and intelligent campus infrastructure further propels the growth of this segment.

By Application

Audio Conferencing segment led the MPLS IP VPN Market with the largest revenue share of approximately 33% in 2023 owing to its widespread enterprise use for uninterrupted and low-cost communication. Companies depend on audio conferencing for remote collaboration, team meetings, and customer interactions, leveraging MPLS's secure, low-latency connectivity. Demand for quality voice calling, especially from industries such as IT, banking, and medical, has boosted the dominance of the segment due to MPLS providing better call stability and few interruptions than classical internet-based applications.

Video Conferencing segment will grow at the fastest CAGR of roughly 8.35% from 2024-2032, driven by the growing uptake of remote offices, virtual conferencing, and hybrid office formats. Businesses, educational institutions, and healthcare organizations are placing emphasis on high-definition, real-time communications, necessitating high-bandwidth and stable network solutions. MPLS IP VPNs provide low-latency and secure video communication, providing end-to-end smooth conferencing experience. The increased demand for cloud-based collaboration tools and virtual training also fuels the segment's rapid growth.

Regional Analysis

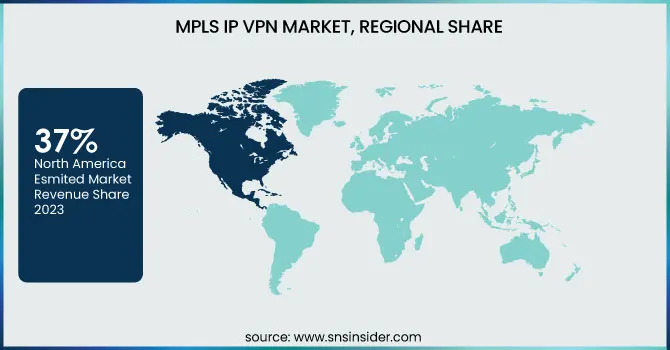

North America dominated the MPLS IP VPN Market with the largest revenue share of approximately 37% in 2023 as a result of the prevalent existence of large companies, sophisticated IT infrastructure, and high demand for secure and resilient network connectivity. The high adoption rate in cloud computing, remote working solutions, and data-intensive applications in BFSI, IT & telecom, and healthcare sectors have contributed towards MPLS deployment. Moreover, the imperative for high-performance enterprise networks and strict cybersecurity regulations have increased North America's dominance in the market.

Asia Pacific is expected to grow at the fastest CAGR of approximately 8.88% during 2024-2032, led by accelerated digital transformation, rising cloud adoption, and growing enterprise networks. The expanding IT & telecom industry in the region, higher demand for hybrid work solutions, and augmented investments in smart infrastructure are fueling the adoption of MPLS. Besides, the growth of multinational companies, increasing internet penetration, and the demand for secure low-latency connectivity are some of the major drivers propelling the market's strong development in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

British Group plc (BT IP VPN, BT Net Protect)

-

Lumen Technologies (Lumen MPLS VPN, Lumen Cloud Connect)

-

Cisco Systems, Inc. (Cisco SD-WAN, Cisco MPLS VPN)

-

GCX (GCX Global MPLS VPN, GCX IP Connect)

-

Reliance Globalcom Services Inc. (Reliance MPLS VPN, Reliance Cloud Connect)

-

Telefonica Group (Telefonica MPLS VPN, Telefonica SD-WAN)

-

Telstra Corporation (Telstra Global MPLS, Telstra VPN Services)

-

T‑Mobile USA, Inc. (T-Mobile MPLS VPN, T-Mobile SD-WAN)

-

Verizon Communications Inc. (Verizon MPLS VPN, Verizon SD-WAN)

-

Orange Business Services (Orange MPLS VPN, Orange SD-WAN)

-

CenturyLink (CenturyLink MPLS VPN, CenturyLink SD-WAN)

-

Sprint Nextel Corporation (Sprint MPLS VPN, Sprint Cloud Connect)

-

Charter Communications (Charter Enterprise VPN, Charter Cloud Solutions)

-

Vodafone (Vodafone MPLS VPN, Vodafone SD-WAN)

-

China Telecom (China Telecom VPN, China Telecom Cloud Connect)

-

China Unicom (China Unicom IP VPN, China Unicom SD-WAN)

-

WINDTRE (WINDTRE VPN, WINDTRE MPLS)

-

Comcast (Comcast Enterprise VPN, Comcast Cloud Solutions)

-

Deutsche Telekom (Deutsche Telekom MPLS VPN, Deutsche Telekom SD-WAN)

Recent Developments:

-

In 2024, AT&T introduced its Network-Based IP Remote Access (ANIRA) service, which integrates MPLS VPN with Internet-based VPN to offer a secure and scalable solution for remote access. This service aims to streamline connectivity for businesses with distributed workforces, enhancing security and performance.

-

In 2025, BT introduced enhanced hybrid network solutions by integrating MPLS with SD-WAN technology, providing businesses with a flexible, high-performance network infrastructure to improve application performance and reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 60.69 Billion |

| Market Size by 2032 | USD 110.92 Billion |

| CAGR | CAGR of 6.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Layer 2, Layer 3) • By Application (Automated Machines, Video Conferencing, Audio Conferencing, Others) • By Industry (BFSI, Healthcare, IT & Telecom, Government, Education, Retail & Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AT&T Inc., British Group plc, Lumen Technologies, Cisco Systems, Inc., GCX, Reliance Globalcom Services Inc., Telefonica Group, Telstra Corporation, T-Mobile USA, Inc., Verizon Communications Inc., Orange Business Services, CenturyLink, Sprint Nextel Corporation, Charter Communications, Vodafone, China Telecom, China Unicom, WINDTRE, Comcast, Deutsche Telekom |