Neuroendoscopy Market Report Scope And Overview:

Get More Information on Neuroendoscopy Market - Request Sample Report

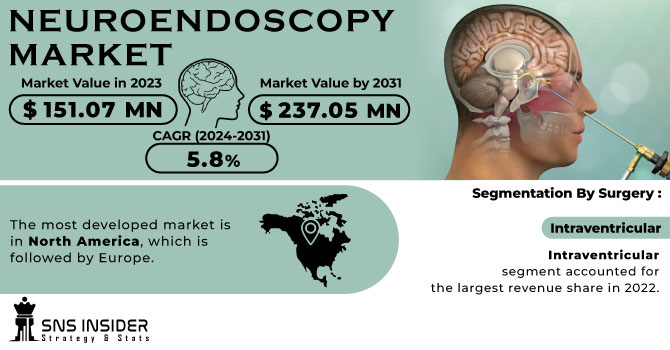

The Neuroendoscopy Market Size was valued at USD 202.40 Million in 2023 and is expected to reach USD 329.94 Million by 2032, growing at a CAGR of 5.58% over the forecast period of 2024-2032.

The neuroendoscopy market is undergoing a transformative phase, fueled by innovation and clinical demand for less invasive procedures. Our report explores the reimbursement landscape for neuroendoscopy procedures, shedding light on how policy and coverage impact global adoption. It delves into the innovation pipeline of key companies, spotlighting emerging technologies redefining neurosurgical standards. Insights from surgeons and neurologists bring real-world context to product performance and evolving clinical needs. Addressing sustainability, the report examines the carbon footprint of the manufacturing process, revealing industry efforts toward greener production. It also presents a detailed reusability economics and ROI analysis, offering healthcare providers a financial perspective on reusable systems. These elements together craft a compelling narrative of market progress and future potential.

The US Neuroendoscopy Market Size was valued at USD 63.94 Million in 2023 with a market share of around 78% and growing at a significant CAGR over the forecast period of 2024-2032.

The US neuroendoscopy market is experiencing steady growth, driven by rising cases of brain tumors, hydrocephalus, and minimally invasive surgical preferences. The increasing availability of advanced neuroendoscopic systems from U.S.-based companies like Medtronic and Stryker, paired with strong clinical research support from organizations such as the American Association of Neurological Surgeons (AANS), is accelerating adoption. Favorable reimbursement structures under Medicare and private insurers also boost procedural volume. Additionally, growing investments in neurosurgical training programs and R&D funding from institutions like the National Institutes of Health (NIH) are fostering innovation, further reinforcing the U.S. as a key leader in the neuroendoscopy landscape.

Market Dynamics

Drivers

-

Expanding Clinical Evidence Supporting Superior Outcomes of Neuroendoscopy over Conventional Neurosurgical Techniques Accelerates Market Adoption

The neuroendoscopy market is increasingly gaining traction due to the growing body of clinical evidence supporting its efficacy over traditional neurosurgical techniques. Numerous peer-reviewed studies and outcomes published by neurosurgical institutions in the United States and Europe demonstrate that neuroendoscopy offers reduced surgical trauma, quicker recovery, and lower postoperative complications. Hospitals and academic centers are actively incorporating this evidence into their treatment guidelines, particularly for conditions such as intraventricular tumors, colloid cysts, and hydrocephalus. These benefits are significantly shifting the preference of both surgeons and patients toward minimally invasive approaches. The American Association of Neurological Surgeons (AANS) and the Congress of Neurological Surgeons (CNS) have published white papers and hosted sessions showcasing successful case studies, which further reinforce confidence in neuroendoscopic interventions. This expanding clinical validation not only helps in driving physician awareness but also enhances trust among healthcare payers and regulatory authorities, ultimately accelerating the market penetration of neuroendoscopic systems globally.

Restraints

-

High Initial Investment and Maintenance Costs of Neuroendoscopy Equipment Limit Adoption in Resource-Constrained Healthcare Facilities

Despite the clinical advantages of neuroendoscopy, the high initial cost associated with acquiring advanced neuroendoscopic systems poses a major restraint to market growth, particularly in developing regions. These systems often require integrated imaging, navigation tools, and disposable components, adding to the total cost of ownership. Furthermore, the cost of routine maintenance, equipment upgrades, and training staff adds financial pressure on healthcare facilities with limited budgets. Many smaller hospitals and diagnostic centers in low- and middle-income countries find it challenging to justify such capital investments, especially when traditional surgical methods are still viable. This cost barrier restricts widespread adoption, creating a disparity in access to advanced neurosurgical care. Although leasing models and refurbished equipment are being introduced to bridge this gap, affordability remains a significant concern that impedes the market expansion of neuroendoscopy, especially in cost-sensitive environments.

Opportunities

-

Increasing Emphasis on Green Operating Rooms Encourages Sustainable Design Innovations in Neuroendoscopy Devices

An emerging opportunity within the neuroendoscopy market lies in the growing global movement toward environmentally sustainable healthcare practices. Hospitals are increasingly prioritizing "green" operating rooms that minimize environmental impact through the use of energy-efficient equipment, waste reduction strategies, and reusable surgical instruments. This trend opens the door for manufacturers to design eco-friendly neuroendoscopy systems with recyclable materials, energy-saving components, and minimal packaging. Companies that align their product development with these sustainability goals can gain a competitive edge, especially in regions where environmental compliance is tied to public funding or hospital ratings. U.S.-based organizations such as Practice Greenhealth and the Health Care Without Harm initiative are actively encouraging hospitals to adopt sustainable medical technologies. As this movement gains traction, it creates a promising opportunity for neuroendoscopy device manufacturers to differentiate themselves through green innovation, potentially capturing new customer segments and supporting long-term brand loyalty.

Challenge

-

Shortage of Neuroendoscopy-Certified Professionals Hinders Widespread Implementation Across Diverse Healthcare Settings

A pressing challenge facing the neuroendoscopy market is the shortage of professionals who are adequately trained and certified in performing endoscopic neurosurgical procedures. Despite the rise in specialized training programs, the global supply of neuroendoscopy-capable surgeons has not kept pace with demand. In rural and underserved areas, this skills gap is even more pronounced. As neuroendoscopy is a highly specialized domain, the learning curve is steep, requiring not only technical knowledge but also extensive hands-on experience. Hospitals are often reluctant to invest in advanced neuroendoscopy systems unless they have qualified personnel to operate them, leading to underutilization of existing infrastructure. Furthermore, the lack of standardized credentialing across countries and even within states creates inconsistencies in the quality of care. This scarcity of trained professionals continues to act as a bottleneck, limiting the scalability and penetration of neuroendoscopy procedures globally.

Segmental Analysis

By Device type

Rigid neuroendoscopes dominated the neuroendoscopy market in 2023 with an estimated market share of 66%. Rigid neuroendoscopes maintained their leadership due to superior visualization, precise navigation, and their established role in critical brain procedures, particularly for intraventricular surgeries. These devices offer enhanced image resolution and durability, making them highly suitable for complex neuro-oncological and hydrocephalus-related procedures. According to the American Association of Neurological Surgeons (AANS), rigid neuroendoscopes are predominantly used in procedures such as endoscopic third ventriculostomy (ETV), which is widely practiced in both pediatric and adult neurosurgery. Furthermore, major hospitals and neurosurgical centers in the United States, Germany, and Japan have standardized rigid endoscopes due to their compatibility with high-definition camera systems and surgical instruments. Government initiatives such as the U.S. FDA’s streamlined approval processes have accelerated market adoption of advanced rigid endoscopes from manufacturers like KARL STORZ and B. Braun, reinforcing their dominance globally.

By Usability

Reusable neuroendoscopes dominated the neuroendoscopy market in 2023, accounting for approximately 70.5% of the total market share. Reusable neuroendoscopes have established dominance in the market as they offer significant long-term cost advantages and align with hospital efforts toward sustainability and efficiency. These scopes are preferred in high-volume neurosurgical departments where multiple procedures are conducted daily, making one-time use devices economically impractical. According to the Association for the Advancement of Medical Instrumentation (AAMI), updated reprocessing standards and automated cleaning systems have made reusable neuroendoscopes safe and compliant with infection control practices. Additionally, large academic medical centers and government hospitals in countries like the United States, France, and South Korea invest in reusable systems to reduce medical waste and ensure consistent quality in repeated procedures. Hospitals participating in the U.S. Centers for Medicare & Medicaid Services (CMS) value-based care models also opt for reusable devices to maintain budgetary efficiency while delivering advanced care, thereby further encouraging widespread adoption.

By Application

Intraventricular neuroendoscopy dominated the neuroendoscopy market in 2023 with a market share of 52.8%. Intraventricular procedures lead due to their efficacy in treating common neurological conditions such as hydrocephalus, colloid cysts, and intraventricular tumors. These procedures are minimally invasive and particularly beneficial for pediatric patients, who make up a significant proportion of hydrocephalus cases globally. As per the National Institute of Neurological Disorders and Stroke (NINDS), hydrocephalus affects an estimated 1 to 2 in every 1,000 births, making intraventricular endoscopy crucial in early intervention. Neuroendoscopic third ventriculostomy (ETV) has increasingly replaced shunt placements due to fewer complications and reduced long-term dependency. Moreover, international guidelines from organizations like the World Federation of Neurosurgical Societies (WFNS) highlight the preference for endoscopic techniques in ventricular access, which has encouraged health systems in both developed and emerging countries to adopt this method, sustaining its dominance.

By End-use

Hospitals accounted for the largest share in the neuroendoscopy market in 2023, contributing approximately 65.4% of the total revenue. Hospitals dominate the neuroendoscopy landscape due to their comprehensive surgical capabilities, advanced operating room technologies, and concentration of highly trained neurosurgeons. Most neuroendoscopic procedures, particularly those requiring general anesthesia and advanced post-operative monitoring, are conducted in tertiary care hospitals. In the United States, institutions like Johns Hopkins Hospital and Cleveland Clinic have dedicated neuroendoscopy programs that attract global patient inflow. Moreover, the availability of government and private insurance reimbursements for neurosurgical procedures further supports hospital-based services. Policies from the U.S. Department of Health and Human Services (HHS) that promote technology integration into patient care have also led hospitals to invest heavily in neuroendoscopic equipment. Additionally, public hospitals across Europe and Asia are expanding neurosurgical infrastructure, reaffirming the hospital segment’s leading position in the market.

Regional Analysis

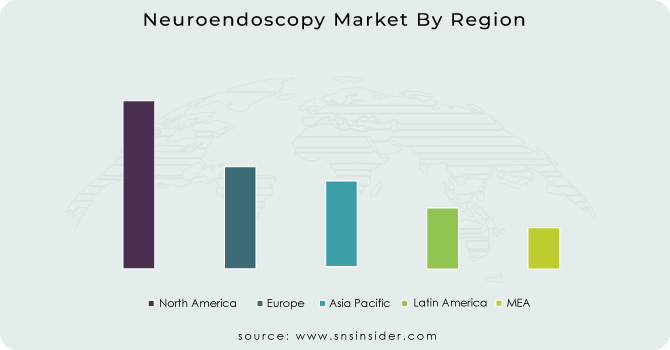

North America dominated the neuroendoscopy market in 2023 with a market share of 40.5%. North America’s leadership in the neuroendoscopy market is attributed to its well-developed healthcare infrastructure, high healthcare expenditure, early adoption of advanced medical technologies, and strong presence of global neuroendoscopy device manufacturers. The United States, contributing the majority of the regional share, is home to major players such as Medtronic, Stryker, and KARL STORZ, which continually invest in R&D and product innovation. Moreover, according to the National Center for Health Statistics (NCHS), the prevalence of brain tumors and neurological conditions that require neuroendoscopic intervention has seen a steady increase, prompting demand for minimally invasive surgical solutions. Canada, while smaller in population, has a growing base of specialized neurosurgical centers, particularly in Toronto and Vancouver, supported by public healthcare funding for advanced procedures. Mexico is also emerging, with private hospitals increasingly equipping operating theaters with neuroendoscopy systems. Additionally, robust reimbursement policies under Medicare and private insurers in the U.S. ensure accessibility to neuroendoscopic procedures, further fueling regional dominance. Academic institutions such as the University of California, San Francisco (UCSF) have also been at the forefront of clinical trials and surgical advancements, reinforcing North America's global lead in neuroendoscopy.

On the other hand, Asia Pacific emerged as the fastest growing region in the neuroendoscopy market during the forecast period with a substantial growth rate. Asia Pacific is projected to experience the highest growth in the neuroendoscopy market due to expanding healthcare infrastructure, a rising number of neurosurgical procedures, and increasing government focus on modernizing public hospitals. Countries like China, India, and Japan are key contributors. In China, the government’s “Healthy China 2030” initiative is investing heavily in surgical innovations, including neurosurgery, while promoting minimally invasive technologies to enhance patient outcomes. Similarly, India’s Ayushman Bharat scheme is broadening access to complex neurosurgical procedures in public and private sectors, where neuroendoscopy is gaining ground for treating hydrocephalus and tumors. Japan leads in neurosurgical innovation and is home to advanced academic hospitals like the University of Tokyo Hospital, which regularly conduct neuroendoscopic surgeries with cutting-edge systems. South Korea, known for its healthcare technology exports, is expanding minimally invasive procedures to attract medical tourism. These advancements, combined with increased government health spending and surgeon training programs, are accelerating the region’s adoption of neuroendoscopy, thereby making Asia Pacific the fastest growing region through 2032.

Do You Need any Customization Research on Neuroendoscopy Market - Enquire Now

Key Players

-

Ackermann Instrumente GmbH (Neuroendoscopy Sheaths, Working Element for Neuroendoscopy)

-

Adeor Medical AG (Ultrasonic Aspirator, Velocity Neuroendoscopy System)

-

B. Braun Melsungen AG (Lotta Neuroendoscope, Aesculap MINOP System)

-

Carl Zeiss Meditec AG (Zeiss Group) (Kinevo 900, TIVATO 700)

-

Clarus Medical (NeuroNavigator, MiniScope Neuroendoscope)

-

Joimax (EndoLIF Lumbar System, MultiZYTE Neuro)

-

Karl Storz SE & Co. KG (Lotta System, MINOP InVent Neuroendoscope)

-

Machida Endoscope Co. Ltd (Flexible Neuroendoscope Model NSI-F4, Rigid Neuroendoscope Model NSI-R4)

-

Medtronic (StealthStation System, Midas Rex MR8 High-Speed Drill)

-

Olympus Corporation (Visera 4K UHD System, ENDOEYE Flex 3D)

-

Richard Wolf GmbH (LOTTA HD Neuroendoscope, Endocam Logic 4K)

-

Schindler Endoskopie Technologie GmbH (Rigid Neuroendoscopes, Pediatric Neuroendoscopy Sheaths)

-

Söring GmbH (Ultrasonic Surgical System, Sonoca 300)

-

Stryker (1688 AIM 4K Platform, PneumoClear Insufflator)

-

Tonglu Wanhe Medical Instrument Co. Ltd (Neuroendoscopy Rigid Scope, Neuroendoscopy Sheath System)

-

Visionsense (a Medtronic brand) (VS3D Visualization System, Visionsense 3D Camera)

-

Rudolf Medical GmbH + Co. KG (Rigid Neuroendoscope, Endoscopic Suction and Irrigation System)

-

NeuroVista Corporation (Neurostimulator System, Implantable Seizure Advisory Device)

-

Aesculap (a division of B. Braun) (MINOP Explorer, MINOP Straight Forward Telescope)

-

XION GmbH (EndoCompact Neuro, Matrix Spectar Camera System)

Recent Developments

-

September 2024: Clearmind Biomedical received FDA clearance for its Neuroblade neuroendoscopy system, integrating multiple surgical functions into a single device. The first U.S. procedure using it was successfully conducted at Mount Sinai Hospital.

-

November 2023: Amrita Hospital in Kochi inaugurated the Amrita Centre for Neuro Endoscopy (ACNE), Kerala’s first dedicated center for minimally invasive neuroendoscopic surgeries, enhancing skull base and pediatric procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 202.40 Million |

| Market Size by 2032 | USD 329.94 Million |

| CAGR | CAGR of 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Device type (Rigid, Flexible) •By Usability (Reusable, Disposable) •By Application (Intraventricular, Transcranial, Transnasal) •By End-use (Hospitals, Ambulatory surgical centers, Diagnostic centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Karl Storz SE & Co. KG, B. Braun Melsungen AG, Olympus Corporation, Stryker, Medtronic, Adeor Medical AG, Clarus Medical, Machida Endoscope Co. Ltd, Schindler Endoskopie Technologie GmbH, Ackermann Instrumente GmbH and other key players |