NGS based RNA Sequencing Market Report Scope & Overview:

Get More Information on NGS based RNA Sequencing Market - Request Sample Report

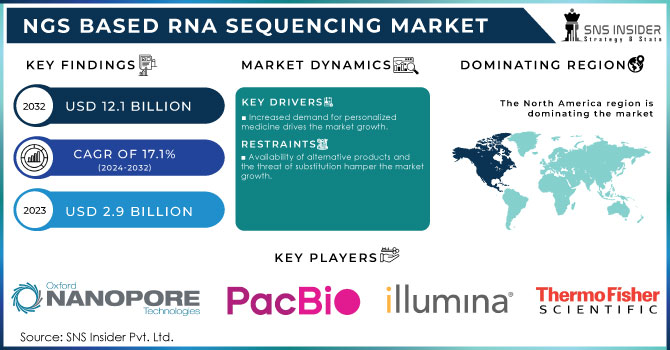

The NGS based RNA Sequencing Market Size was valued at USD 2.9 Billion in 2023 and is expected to reach USD 12.1 Billion by 2032 and grow at a CAGR of 17.1% over the forecast period 2024-2032.

The increasing reliance on NGS based RNA sequencing for precision medicine has turned the tide in understanding the diagnostics and treatment of diseases, especially cancer. RNA sequencing gives a much more inclusive perspective on gene expression profiles, which provides researchers and clinicians with the ability to detect rare mutations, to see where alternative splicing occurs or new RNA isoforms. This intelligence is crucial in oncology, and where tumor molecular signature can differ largely from one patient to another. RNA sequencing enables identification of distinct genetic alterations that drive an individual cancer which promotes the development of personalized treatment patterns based on the unique genetic architecture of the tumor.

In 2023, Illumina launched its NovaSeq X series, a next-generation sequencer designed to deliver ultra-high-throughput RNA sequencing with greater speed and accuracy. This innovation is expected to advance personalized medicine by offering faster and more cost-effective solutions for comprehensive RNA analysis, especially in cancer genomics.

The application of RNA sequencing in drug discovery to define new drug targets and biomarkers is on the rise within pharmaceutical companies, greatly improving their development processes. RNA sequencing is the technique for one to analyze gene expression at the level of an entire transcriptome, enabling them to identify disease and cell type-associated pathways and molecular alterations which can be therapeutically exploited. It is of particular importance for creating RNA drugs including mRNA vaccines and the newly re-introduced gene-silencing therapeutics or RNA interference therapies that have been in the news a lot. With the continued success of RNA-based therapies, RNA sequencing in pinpointing direct therapeutic targets is expected to rise, significantly ameliorating personalized medicine and drug discovery.

In 2023, Moderna announced the expansion of its mRNA therapeutics pipeline by incorporating RNA sequencing technologies to better understand patient responses and optimize its drug candidates. This integration aims to identify specific biomarkers associated with therapeutic efficacy and safety, enhancing the drug development process.

NGS based RNA Sequencing Market Dynamics

Drivers

-

Increased demand for personalized medicine drives the market growth.

The increased demand for personalized medicine has also contributed significantly to the growth of NGS-based RNA sequencing market, as healthcare is progressively transitioning toward more personalized modes of treatment. Precision medicine uses genetic and genomic data to individualize treatment options by matching treatments to unique patient characteristics, optimizing efficacy while minimizing side effects. Major players at the RNA sequencing end are taking various steps to address this demand. Illumina released its NovaSeq 6000 earlier this year, for example, a device that allows researchers to perform high-throughput RNA sequencing for large-scale genomics studies focused on mapping genomes and developing individual patient treatments. The Ion Proton System was developed to accelerate sequencing workflows, and enable support of personalized medicine initiatives by Thermo Fisher Scientific in 2022.

These findings point to an increasing appreciation for the role of RNA sequencing in elucidating idiosyncratic responses to therapies, informing refinement of personalized therapeutic approaches. This, in combination with government support funding genomic studies and industry leaders who are pioneering their own ideas will continue to drive the growth of personalized medicine, and differentiate it as a pillar in modern health care.

Restrain

-

Availability of alternative products and the threat of substitution hamper the market growth.

Adoption of RNA sequencing is directly proportional to its market value, the reason being high costs related with NGS platforms and services. Advanced sequencing instruments are expensive not only in terms of the initial investment required to purchase them, but also because they are pre-installed with large costs for reagents, consumables and maintenance afterwards a model that is out of reach to many average-sized laboratories or research institutions. Moreover, the costs associated with sequencing experiments (both experimental and analysis) are not trivial and only compound access issues. The high cost of this sequencing approach has a substantial financial burden, which in turn holds back the broad adoption of RNA sequencing in both the research and clinical setting, ultimately impeding personalized medicine and genomic studies.

Opportunities

-

Growing demand for high-performance polymers and specialty chemicals.

Expansion of the NGS-based RNA sequencing market size is due to continual innovations in technology, which assists researchers in conducting large and cost-effective genomic studies. New technologies such as single-cell RNA sequencing now allow gene expression to be studied in individual cells, providing new insights into cellular diversity and disease processes. For example, in 2021, 10x Genomics expanded its portfolio 10x to include the chromium single cell gene expression solution for increased resolution of RNA sequencing in biological research applications Likewise, Illumina found their seats at the head of the NGS technology table with, notably in 2012 when they changed the game by launching the NextSeq 2000 System (2022), allowing RNA sequencing to be faster and more accurate than ever before. This is in addition to the likes of PacBio and their long-read sequencing technologies that cater towards more complex genomic information, making the dissection of difficult transcripts increasingly possible. Not only they perform RNA sequencing faster, but also brings about more accuracy and utility of results in several areas of research as well as non-research settings driving the stimulus for investment and demand within the market.

NGS based RNA Sequencing Market segmentation Overview

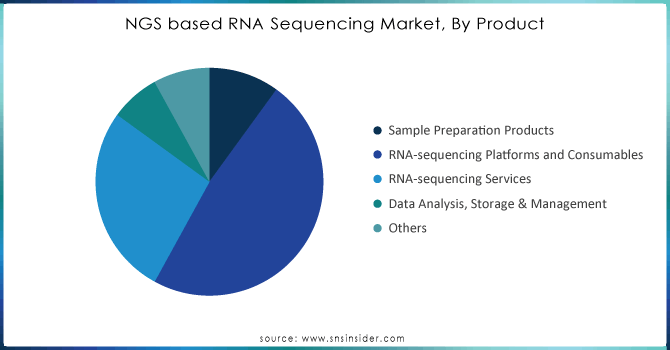

by Product

RNA-sequencing Platforms and Consumables held the largest market share around 48% in 2023. It is leading to the increased adoption of these product solutions in conjunction with the ever-rising demand for high-throughput, accurate and efficient products which is driving their market growth. These platforms provided the technological basis to scale up RNA sequencing, so that one can sequence full transcriptomes, measure gene expression and detect RNA polymorphisms. Robust platforms for genomics, personalized medicine, and disease research must have the ability to handle a vast amount of precise data.

Need any customization research on NGS based RNA Sequencing Market - Enquiry Now

by Technology

The most common of the NGS-based RNA sequencing technologies is Sequencing by Synthesis. SBS has gained a major market share with applications in Illumina, mainly because it provides massive scale and offers tremendous accuracy and cost efficiencies. This consists in the incremental incorporation of nucleotides into a strand of DNA that is being synthesized and with each registered incorporation. This method enables high-throughput sequencing, and is considered suitable for analysing large sets of transcriptions (transcriptomic studies) and gene expression itself. Large-scale, low error rate data production capacity of the technology makes it fit for RNA sequencing in research and clinical application areas such as cancer genomics, rare diseases, drug development etc.

by End-User

On the basis of end-user, research and academia accounted for the largest share in the NGS-based RNA sequencing market due to increasing application of RNA-sequencing in basic research, genomics studies and molecular biology. In 2023, when academic labs, research institutes and universities to study mRNA expression, gene expressions and research biological processes at molecular level this market segment continues to dominate. Along with the precision to harvest vast amount of data, RNA sequencing is now considered to be one of the necessary tools for functional studies on complex diseases (e.g., cancer research), developmental biology, and evolutionary genetics.

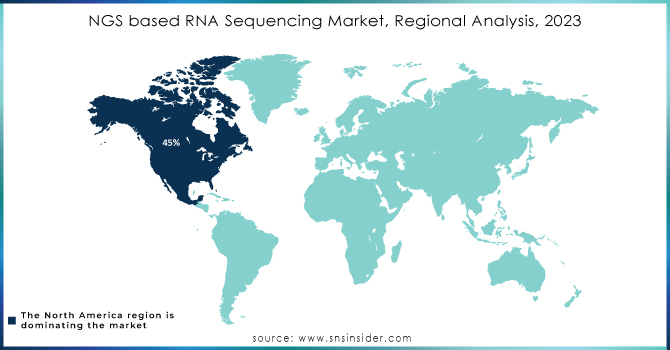

NGS based RNA Sequencing Market Regional Analysis

North America held the highest revenue share of about 45% in 2023. Geographically, North America is a key market for NGS-based RNA sequencing as the region possesses great infrastructure for genomics research, well-established healthcare systems and strong government support in terms of funding to research & innovation. It is particularly strong in the United States, fueled by big investments from both government bodies and private players. To give an example, the National Institutes of Health (NIH) is still a major source of funds for genomic research: in 2023 more than USD 42 billion was devoted for medical research and a great portion of these funds are doing to RNA sequencing projects aiming at shedding light on intricate diseases such as cancer or neurological disorders.

For example, non-profit and government entities like the NIH have implemented initiatives such as the All of Us Research Program that focuses on precision medicine and utilizes RNA sequencing to examine genetic data from over a million participants. Similarly, the Cancer Moonshot Initiative is--aimed at speeding up cancer research and has put a lot of cash into RNA sequencing technologies to detect gene expression patterns associated with various cancers.

Key Players

-

Illumina, Inc. (TruSeq RNA Library Prep Kit)

-

Thermo Fisher Scientific (Ion Torrent RNA Sequencing)

-

Pacific Biosciences (PacBio Sequel System)

-

Qiagen N.V. (QIAseq RNA Library Kit)

-

Oxford Nanopore Technologies (MinION RNA Sequencing)

-

Agilent Technologies (SureSelect RNA Sequencing)

-

Roche Sequencing Solutions (KAPA RNA HyperPrep Kit)

-

PerkinElmer (NEXTFLEX Rapid Directional RNA-Seq Kit)

-

BGI Genomics (DNBSEQ RNA Sequencing)

-

Eurofins Genomics (NGS RNA Sequencing Services)

-

Bio-Rad Laboratories (ddSEQ Single-Cell RNA Sequencing)

-

Takara Bio USA (SMARTer Stranded RNA-Seq Kit)

-

Nugen Technologies (Ovation RNA-Seq System)

-

CD Genomics (RNA Sequencing Service)

-

Macrogen, Inc. (NGS RNA Sequencing Service)

-

Novogene Corporation (RNA-Seq Service)

-

Strand Life Sciences (RNA-Seq Solutions)

-

BaseClear (RNA Sequencing Service)

-

Zymo Research (Zymo-Seq RNA Library Kit)

Recent Development:

-

In 2024, PacBio expanded its HiFi RNA sequencing capabilities with updates to its Sequel IIe System, now offering enhanced throughput and longer reads. This upgrade is aimed at researchers needing high-fidelity transcriptome data for complex biological studies, such as cancer research and the understanding of gene regulation.

-

In 2023, Thermo Fisher introduced the Ion Chef System, an automated platform designed to streamline library preparation for RNA sequencing. This automation reduces hands-on time and variability in the workflow.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.9 Billion |

| Market Size by 2032 | US$ 12.1 USD Billion |

| CAGR | CAGR of 17.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product & Services (Sample Preparation, Platforms & Consumables, Services, Data Analysis) • by Technology (Sequencing by Synthesis, Ion Semiconductor Sequencing, Single-molecule Real-time Sequencing, Nanopore Sequencing) • by Application (Expression Profiling Analysis, Small RNA-sequencing, Variant Calling and Transcriptome Assembly, De Novo Transcriptome Epigenetics) • by End User (Research and Academia, Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | llumina, Inc., Thermo Fisher Scientific, Pacific Biosciences, Qiagen N.V., Oxford Nanopore Technologies, Agilent Technologies, Roche Sequencing Solutions, PerkinElmer, BGI Genomics, Eurofins Genomics, Bio-Rad Laboratories, Takara Bio USA, Nugen Technologies, CD Genomics, Genewiz, Macrogen, Inc., Novogene Corporation, Strand Life Sciences, BaseClear, Zymo Research, and other players. |

| Key Drivers | • Increased demand for personalized medicine drives the market growth. |

| Market Opportunities | • Growing demand for high-performance polymers and specialty chemicals |