Bionic Ear Market Report Scope & Overview:

Get more information on Bionic Ear Market - Request Sample Report

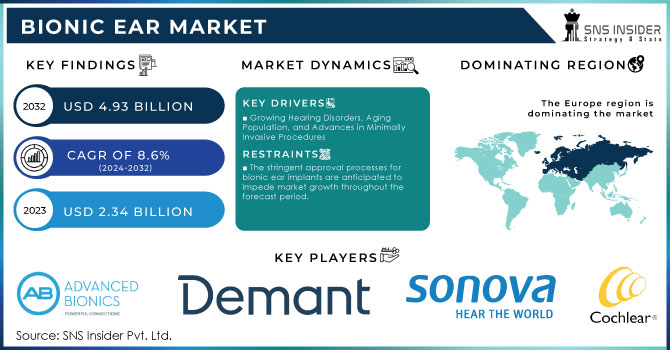

The Bionic Ear Market Size was valued at USD 2.34 billion in 2023 and is expected to reach USD 4.93 billion by 2032 and grow at a CAGR of 8.6% over the forecast period 2024-2032.

The bionic ear market is gaining enormous attention due to various factors such as the geriatric population, increasingly afflicted with hearing loss and the benefits of being at the cutting edge of technology. According to the World Health Organization (WHO), it is estimated that by 2050, 2.5 billion people will be suffering from some form of hearing impairment, out of which at least 700 million will need rehabilitation related to this type of hearing loss. However, another aspect is that nearly 1 billion of the world's young people are at permanent, preventable risk of hearing loss from unhealthy listening habits, such as high-volume music and prolonged exposure to loud noises.

Recent advances in bionic ear technology have greatly improved the user experience and effectiveness of devices such as a cochlear implant and an auditory brainstem implant. For example, most modern cochlear implants can directly connect to wireless devices enabling audio streaming from smartphones televisions, and other external devices without the use of wires. This allows the users to enjoy much broader experiences of sound and therefore improves their quality of life.

Besides all the wireless attributes, bionic ears have been miniaturized, reduced in size, and have become powerful. Directional microphones, artificial intelligence, and hybrid technologies enhance the quality of sound and user interaction. These advancements and increased awareness of treatment options for hearing loss are very strongly driving the bionic ear market. The other driving forces for the increased demand for bionic ears are rising healthcare access and favorable reimbursement policies, especially in key markets like the United States and Europe. The leading trend of tackling hearing loss, mainly through demographic changes and improvements in technology, will also help sustain market growth. Advanced sound quality and connectivity features are also crucial for the broader usage of bionic ear implants.

With the population aging and cases of hearing loss continually rising, the bionic ear market is full of promise for continued growth, and this opportunity can be taken to reach people who have mild to profound hearing loss. With technology becoming better in this regard as well as a better understanding of how and why to treat hearing loss, the future for the bionic ear market holds much promise by providing innovative means through which afflicted individuals can more effectively communicate and improve their overall well-being.

Table of Regulatory Approvals for Bionic Ear Devices:

|

Device Name |

Regulatory Body |

Approval Date |

Key Regulatory Notes |

|---|---|---|---|

|

Phonak Naída Link |

FDA (USA) |

January 31, 2018 |

Compatible with smartphones |

|

Cochlear Nucleus Profile |

FDA (USA) |

August 25, 2021 |

Enhanced design for improved comfort |

|

MED-EL Bionics 6 |

CE Mark (EU) |

May 15, 2022 |

New generation with wireless features |

|

Advanced Bionics Sky |

FDA (USA) |

October 15, 2022 |

Customizable with advanced sound features |

|

Oticon More |

TGA (Australia) |

February 1, 2023 |

Incorporates AI for improved sound clarity |

|

Phonak Paradise |

FDA (USA) |

July 30, 2023 |

Features integrated Bluetooth technology |

Table of Major Players in the Bionic Ear Market:

|

Company Name |

Key Products/Technologies |

Market Focus |

Headquarters Location |

|---|---|---|---|

|

Cochlear Limited |

Nucleus series, Baha system |

Cochlear implants and solutions |

Australia |

|

MED-EL |

Cochlear implants, Hearing aids |

Innovative hearing solutions |

Austria |

|

Advanced Bionics |

HiRes series cochlear implants |

Advanced cochlear solutions |

USA |

|

Oticon |

Oticon Medical (BAHA) |

Bone conduction hearing devices |

Denmark |

|

Sonova Holding AG |

Phonak, Unitron, and other brands |

Comprehensive hearing solutions |

Switzerland |

Bionic Ear Market Dynamics

Drivers

-

Growing Hearing Disorders, Aging Population, and Advances in Minimally Invasive Procedures

Several key factors are driving the market for a bionic ear of significant importance, particularly the growing prevalence of hearing disorders and an increasing geriatric population. Notably, as reported in the WHO report, over 360 million people globally suffer from hearing loss, which is a significant disability worldwide. This problem worsens with age, the Royal National Institute for Deaf People communicates that 70% of people more than 70 years of age and 42% above the age of 50 suffer from hearing disorders. In addition, growing health care expenditure, entertainment spaces where prolonged exposure to sound takes place, and novel bionic ear devices in the process of being launched into the market are factors contributing to the growth of the market. The other major factor is the rise in demand for minimally invasive surgical procedures. The adoption levels of such procedures have increased tremendously due to the encouragement provided by factors of technological advancement in this field as well as favorable insurance policies that enhance easy access to these procedures.

Increased R&D expenditure in the next-generation sound processor is also positively impacting the market landscape. Increased commitment to innovation along with the rise in awareness among parents and improved infrastructures for hearing disorder diagnosis in the neonates leaves scope for significant growth in the bionic ear market. In effect, a larger pool of patients, advanced technology, and high demand are emerging as key thrust areas for effective solutions in hearing loss.

Restraints

-

The stringent approval processes for bionic ear implants are anticipated to impede market growth throughout the forecast period.

-

Elevated costs associated with medical procedures and devices are likely to pose a challenge to market expansion.

Bionic Ear Market - Key Segmentation

By Type

During 2023, the cochlear implants segment dominated the market overall with the highest share of 74.4% in revenues. This can be attributed to the successive increase in cochlear implantation surgeries and its increased market penetration. The tremendous advancement in the technology of cochlear implants has helped thousands of people worldwide recover their ability to hear, thereby helping to improve significantly the quality of their lives. For instance, in January 2022, the FDA approved Cochlear Limited's Cochlear Nucleus Implants. These devices are specifically intended for subjects suffering from single-sided deafness and unilateral hearing loss (UHL/SSD).

The second area, the auditory brainstem implant (ABI), is also on the growth trajectory due to the growing number of cases of neurofibromatosis type 2 (NF2). In recent years, significant advancements have occurred in both hardware and electrode configurations for ABI. Although this device was first developed with the intent to help NF2 patients, new research now shows that the technology can indeed restore the hearing of children and non-tumor-bearing subjects, thereby increasing further the areas of application and accordingly the market reach of this technology.

By End Use

Hospitals accounted to be the largest contributor in the market during 2023 with a 56.2% share and are further projected to gain the highest growth in the forecasting period. The significant share of this segment is mainly due to favorable health reimbursement policies and a high number of surgeries conducted in hospitals. Moreover, the availability of specialists who can perform intricate procedures like cochlear, BAHA and auditory brainstem implantation also favors the growth of this segment.

The clinics segment is poised to record the second-highest growth rate during the next forecast period. During the last few years, clinics have emerged as one of the other locations where cochlear implantation procedures to restore auditory functions for patients suffering from advanced sensorineural hearing loss (SNHL) are currently being offered. Improving incidence rates of hearing loss coupled with a growing number of well-equipped ENT clinics is driving this segment.

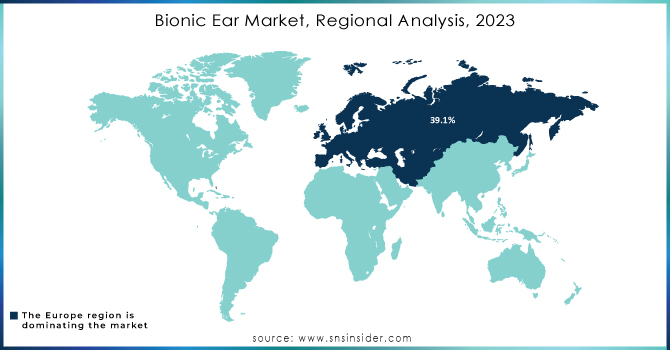

Bionic Ear Market Regional Analysis

Europe dominated the 2023 market share in bionic ears at 39.1%. This growth is because of the high prevalence of hearing loss in general, and particularly among the elderly in this region. Increased use of bionic ear technology by adults and children has also added to market growth due to advancements in the technology of bionic ear. The greater awareness of available remedies for hearing loss also helps contribute to a positive market outlook in Europe.

Another region expected to foresee considerable growth soon is the Asia Pacific region. The region has a huge and rapidly increasing population, which would be expected to fuel the prevalence of hearing loss. Increasing disposable income and healthcare expenditure also play a big role in propelling the overall market growth in this region. Nevertheless, the growth prospects in the region will be a little constrained by limited healthcare infrastructure in most countries and the high cost involved in bionic ear solutions. Such an increase in demand for hearing loss treatments would unlock greater potential in the Asia Pacific bionic ear market.

Overall, Europe led in the market, with its growth poised to come from the Asia Pacific region based on demographic and economic factors.

Need Any Customization Research On Bionic Ear Market - Inquiry Now

Key Manufacturers of Cochlear Implants and Bionic Ear Devices

-

Sonova

-

Demant A/S

-

GAES

-

MED-EL

-

WS Audiology

-

Oticon

-

Hangzhou Nurotron

-

Zhejiang Nurotron Biotechnology Co. Ltd.

Companies Offering Related Technologies and Solutions

-

Amplifon

-

Listent Medical

-

Medtronic PLC

-

Ekso Bionics

-

Ossur

-

Terumo Corporation

-

William Demant Holdings

-

Edward Lifesciences Corporation

Recent Developments

In May 2024, Atrium Health Wake Forest Baptist became the first health system in the Carolinas to implement a robotic-assisted cochlear implant system, marking a significant advancement in the bionic ear market.

In Sept 2023, Cochlear Limited made significant strides in integrating state-of-the-art cochlear implant technology. This advancement has empowered individuals with hearing loss to engage more fully with society, greatly improving their quality of life and productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.34 Billion |

| Market Size by 2032 | USD 4.93 Billion |

| CAGR | CAGR of 8.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cochlear Implant, Auditory Brainstem Implants, BAHA/BAHS) • By End Use (Hospitals, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cochlear Ltd., Sonova, Demant A/S, GAES, Advanced Bionics, MED-EL, WS Audiology, Oticon, Hangzhou Nurotron, Zhejiang Nurotron Biotechnology Co. Ltd. |

| Key Drivers | • Growing Hearing Disorders, Aging Population, and Advances in Minimally Invasive Procedures |

| Restraints | • The stringent approval processes for bionic ear implants are anticipated to impede market growth throughout the forecast period. • Elevated costs associated with medical procedures and devices are likely to pose a challenge to market expansion. |