Nicotine Replacement Therapy Market Report Scope & Overview:

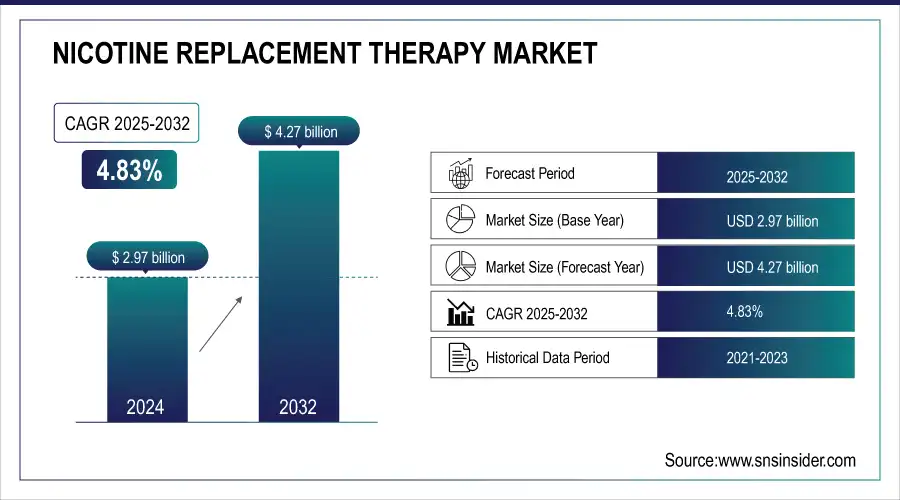

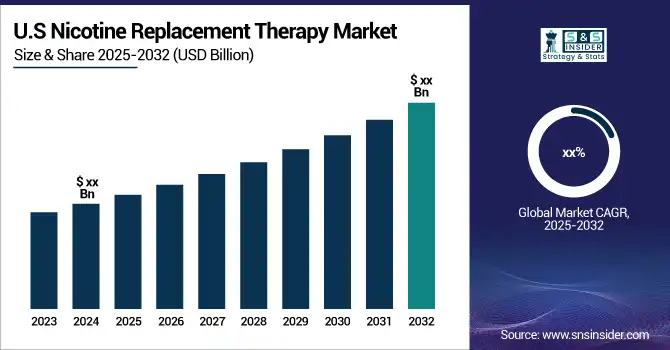

The Nicotine Replacement Therapy Market Size was valued at USD 2.97 Billion in 2024, and is expected to reach USD 4.27 Billion by 2032, and grow at a CAGR of 4.83% in the forecasted period 2025-2032.

Get More Information on Nicotine Replacement Therapy Market - Request Sample Report

The nicotine replacement therapy (NRT) market is propelled by a global push towards reducing tobacco consumption, driven by comprehensive health initiatives and public health policies. The World Health Organization (WHO) reports that tobacco use is a major public health crisis, causing around 8 million deaths each year from smoking-related illnesses. This alarming statistic underscores the urgent need for effective smoking cessation tools. In the United States, the Centers for Disease Control and Prevention (CDC) reveals that more than half of smokers express a strong desire to quit, and approximately 30% are actively seeking assistance through various cessation aids. This heightened awareness about the health risks of smoking and the effectiveness of cessation products is contributing to the growing demand for NRT solutions.

Nicotine Replacement Therapy Market Size and Forecast:

-

Market Size in 2024: USD 2.97 Billion

-

Market Size by 2032: USD 4.27 Billion

-

CAGR: 4.83% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Trends of the Nicotine Replacement Therapy Market:

-

Growing adoption of digital health tools and remote support through apps, telehealth, and wearables to improve quit rates.

-

Regulatory and public health measures such as higher tobacco taxes and anti-smoking campaigns driving demand for NRT.

-

Rising shift toward over-the-counter (OTC) products like gums, patches, and lozenges for easier access.

-

Product innovation with new delivery methods such as oral strips, nicotine pouches, and dissolvable tablets.

-

Expansion in emerging markets supported by rising smoking rates, better healthcare infrastructure, and awareness campaigns.

-

Increasing reliance on online and e-commerce channels for convenient and discreet product purchases.

|

Country

|

Total Smokers 2024

|

| Nauru | 48.30% |

| Myanmar | 44.40% |

| Kiribati | 39.70% |

| Papua New Guinea | 39.60% |

| Bulgaria | 39.50% |

| Serbia | 39.50% |

| Timor Leste | 38.70% |

| Indonesia | 38.20% |

| Croatia | 37% |

| Solomon Islands | 36.90% |

-

Notes: High Smoking Prevalence: Nauru has the highest smoking rate among the listed countries, with 48.30% of the population being smokers. Myanmar, Kiribati, and Papua New Guinea also have relatively high smoking rates, ranging from 38.20% to 44.40%.

-

Regional Variations: The countries listed exhibit a range of smoking rates, suggesting that there are regional variations in smoking prevalence. For example, countries in Oceania (Nauru, Kiribati, Papua New Guinea, Solomon Islands) generally have higher smoking rates compared to those in Europe (Bulgaria, Serbia, Croatia).

-

Potential Factors Influencing Smoking Rates: Several factors can influence smoking rates in different countries, including cultural norms, socioeconomic conditions, tobacco control policies, and public health initiatives.

Governments worldwide are playing a crucial role in this shift by investing in public health campaigns designed to promote smoking cessation and reduce tobacco use. These campaigns often include educational programs, smoking cessation support services, and subsidies for NRT products, making them more affordable and accessible. Furthermore, stricter anti-smoking regulations, such as smoke-free laws in public places and higher tobacco taxes, are reinforcing efforts to discourage smoking and encourage the use of NRT products. The global regulatory environment is also becoming increasingly supportive of smoking cessation efforts. For example, the implementation of standardized packaging for tobacco products and plain packaging laws are being adopted in various countries to reduce the appeal of smoking and increase the visibility of health warnings. These measures, combined with government-sponsored cessation programs and incentives, are expected to drive further growth in the NRT market, highlighting the importance of these products in global tobacco control strategies.

Nicotine Replacement Therapy Market Driver:

-

Rising Anti-Smoking Campaigns and Regulatory Support Worldwide Boost Nicotine Replacement Therapy Market Growth, Highlighted by FDA Guidance

The growing number of anti-smoking initiatives, combined with strict government regulations, is driving the expansion of the nicotine replacement therapy (NRT) market. As global awareness of smoking-related health risks rises, regulatory authorities and healthcare organizations continue to promote smoking cessation programs. For example, in March 2024, the U.S. FDA updated guidance to simplify the approval of over-the-counter NRT products, making them more accessible to the public. This regulatory push not only encourages smokers to adopt therapies such as patches, gums, and lozenges but also motivates pharmaceutical companies to expand product innovation. These cause-and-effect dynamics strongly contribute to NRT market growth.

A smoker in the U.S. is now able to easily purchase FDA-approved OTC nicotine pouches at pharmacies without prescription barriers. This increased accessibility has resulted in higher adoption rates, reinforcing the role of regulatory changes as a significant driver of the NRT market.

Nicotine Replacement Therapy Market Restraints:

-

High Costs of Nicotine Replacement Therapy Products Restrict Market Growth by Limiting Access to Low-Income Populations Globally

Despite the growing awareness of health risks associated with smoking, the high costs of nicotine replacement therapy products remain a significant barrier to adoption. Many NRT solutions, including patches, nasal sprays, and lozenges, are priced at levels that may not be affordable for low- and middle-income consumers. This creates an inequality in access, as wealthier populations are more able to benefit from these cessation products, while price-sensitive segments continue to rely on traditional smoking habits. The lack of insurance coverage for NRT in certain regions further compounds this issue, reducing overall treatment uptake and slowing market growth.

In several developing countries, the price of a monthly supply of NRT patches can exceed average weekly wages, making these products inaccessible. As a result, smokers often continue with cheaper tobacco alternatives, highlighting how cost remains a direct restraint in the global NRT market.

Nicotine Replacement Therapy Market Opportunities:

-

Expansion of Innovative Nicotine Delivery Systems Creates Opportunities for NRT Market Growth, with Philip Morris Launching New Nicotine Pouches

The rising popularity of novel nicotine delivery systems, such as oral strips, pouches, and dissolvable tablets, is creating major opportunities in the NRT market. These new products provide discreet, convenient, and faster-acting alternatives compared to traditional gums and patches, thereby appealing to younger demographics seeking flexibility in smoking cessation solutions. In June 2023, Philip Morris launched a new range of nicotine pouches targeting European markets, reflecting a strong focus on innovation to capture consumer interest. This trend shows a clear cause-and-effect relationship where innovation drives adoption, enabling companies to expand their market reach and cater to evolving customer preferences.

Younger consumers in Europe increasingly prefer nicotine pouches due to their portability and lack of smoke or odor. This shift in behavior has boosted sales for companies like Philip Morris, demonstrating how product innovation directly translates into growth opportunities within the NRT market.

Nicotine Replacement Therapy Market Segmentation Analysis:

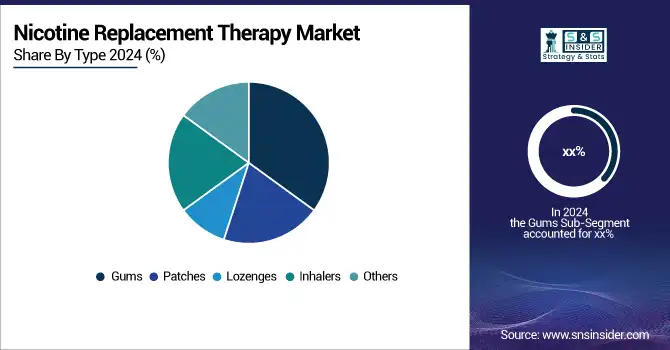

By Type, Nicotine Gums Lead the Market While Patches Emerge as the Fastest-Growing Product Segment in 2024

In 2024, nicotine gums dominate the nicotine replacement therapy (NRT) market, largely due to their ease of use, immediate craving relief, and widespread availability across pharmacies, retail outlets, and online platforms. Gums are often considered the first line of choice for individuals attempting to quit smoking, as they provide both flexibility in dosage and a convenient, discreet option for use in public or work environments. Their affordability and strong consumer awareness have further cemented gums as the leading product type, supported by healthcare professionals frequently recommending them in smoking cessation programs.

Meanwhile, nicotine patches are the fastest-growing segment in 2024, driven by their consistent nicotine delivery system, which reduces withdrawal symptoms effectively over time without requiring repeated usage. Patches are especially popular among individuals seeking a hassle-free, once-a-day solution that fits seamlessly into daily routines. Increased clinical endorsements and innovative product launches offering varied dosage strengths are fueling strong growth momentum in this category.

By Distribution Channel, Hospitals & Retail Pharmacies Dominate While Online Channels Witness Fastest Growth in 2024

In 2024, hospitals & retail pharmacies dominate the nicotine replacement therapy (NRT) market due to their strong consumer trust, wide accessibility, and professional guidance from healthcare providers. Patients prefer purchasing NRT products such as gums, patches, and lozenges from these outlets because of the assurance of authenticity, proper dosage advice, and bundled counseling services that enhance treatment adherence. This channel has established itself as the most reliable and preferred distribution option for smokers seeking structured cessation support.

Online channels are the fastest-growing segment in 2024, driven by the increasing digitalization of healthcare and the rapid adoption of e-commerce platforms. Consumers are attracted to the convenience of home delivery, discreet purchases, and access to a broad range of product options. The growth of online pharmacies, coupled with aggressive digital marketing campaigns by NRT brands, is accelerating online adoption, particularly among younger and tech-savvy demographics.

Nicotine Replacement Therapy Market Regional Analysis:

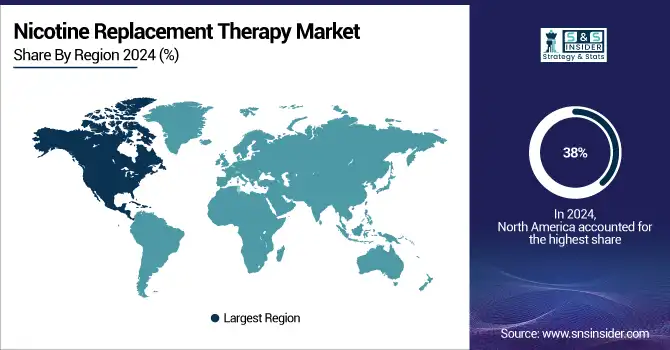

North America Dominates Nicotine Replacement Therapy Market in 2024

In 2024, North America commands an estimated 38% share of the Nicotine Replacement Therapy Market, solidifying its leadership position. The region’s dominance is fueled by high smoking prevalence, strong government-backed anti-tobacco initiatives, and widespread availability of FDA-approved NRT products. A mature healthcare infrastructure, insurance support for cessation treatments, and innovation in gums, patches, and lozenges further strengthen its market standing. With rising awareness of smoking-related health risks and increasing professional guidance from healthcare providers, North America continues to drive adoption and lead large-scale implementation of nicotine replacement therapies.

Need any customization research on Nicotine Replacement Therapy Market - Enquiry Now

-

United States Leads North America’s Nicotine Replacement Therapy Market

The United States dominates due to its extensive smoking cessation ecosystem, government programs, and insurance-backed support for NRT products. Availability of a wide range of gums, patches, and lozenges, coupled with strong pharmacy networks and professional counseling, drives higher adoption rates. Additionally, innovations in product formulations, flavors, and digital health integration enhance consumer preference. The U.S. benefits from high public awareness campaigns, regulatory support, and partnerships between NRT manufacturers and healthcare providers, positioning it as the primary revenue contributor in North America in 2024.

Asia Pacific is the Fastest-Growing Region in Nicotine Replacement Therapy Market in 2024

The Asia Pacific NRT Market is projected to grow at a robust CAGR of 9.5% from 2025 to 2032. This growth is fueled by increasing smoking populations, rising health awareness, and government anti-tobacco initiatives. Expanding middle-class populations, improved accessibility through pharmacies and online channels, and rising disposable incomes further accelerate adoption. Countries like China, India, and Japan are actively integrating NRT solutions into healthcare systems, making the region a hub for fast-growing nicotine replacement therapy demand.

-

China Leads Asia Pacific’s Nicotine Replacement Therapy Market

China dominates due to its massive smoking population, government anti-smoking policies, and growing public health awareness. Availability of diverse NRT products across pharmacies and e-commerce platforms increases accessibility. Partnerships with international NRT manufacturers and localized product offerings make treatments affordable and appealing. Rising urbanization, enhanced healthcare infrastructure, and targeted awareness campaigns support adoption across different demographics. These factors collectively ensure China’s leadership in Asia Pacific’s NRT market in 2024.

Europe Nicotine Replacement Therapy Market Insights, 2024

Europe shows steady growth in 2024, driven by stringent tobacco control policies, reimbursement support, and growing consumer awareness of smoking cessation. Countries across Western Europe implement strict anti-smoking regulations, public health campaigns, and accessible NRT distribution networks to accelerate adoption.

-

United Kingdom Leads Europe’s Nicotine Replacement Therapy Market

The United Kingdom dominates due to its government-backed stop-smoking services and widespread availability of affordable NRT products through the NHS and pharmacies. High public awareness, regulatory support, and digital health integrations further strengthen adoption, making the U.K. the primary contributor to Europe’s market in 2024.

Middle East & Africa and Latin America Nicotine Replacement Therapy Market Insights, 2024

The NRT market in the Middle East & Africa and Latin America is witnessing steady growth in 2024, fueled by rising health awareness, urbanization, and increasing access to international NRT brands. In the Middle East, initiatives in Saudi Arabia and the UAE encourage adoption, while in Latin America, Brazil and Mexico lead due to rising demand for smoking cessation products. Improved pharmacy networks, e-commerce platforms, and health campaigns further drive market growth across both regions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 2.97 Billion |

| Market Size by 2032 | US$ 4.27 Billion |

| CAGR | CAGR of 4.83% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Gums, Patches, Lozenges, Inhalers, and Others) •By Distribution Channel (Hospital & Retail Pharmacies, Retail Stores, and Online Channels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Johnson & Johnson, Haleon, Perrigo Company plc, GlaxoSmithKline plc, Pfizer, Inc., Cipla Ltd., Glenmark Pharmaceuticals Ltd., Fertin Pharma, Rubicon Research Pvt Ltd., Sparsh Pharma, Pierre Fabre Group, Imperial Brands plc, British American Tobacco plc, Philip Morris International, Inc., JT International SA, JUUL Labs, Inc., Alchem International Pvt. Ltd., SAABI NZ PTY Limited, PL Developments, Nicotine Solutions, and other players |