Behavioral Health Software Market Report Scope & Overview:

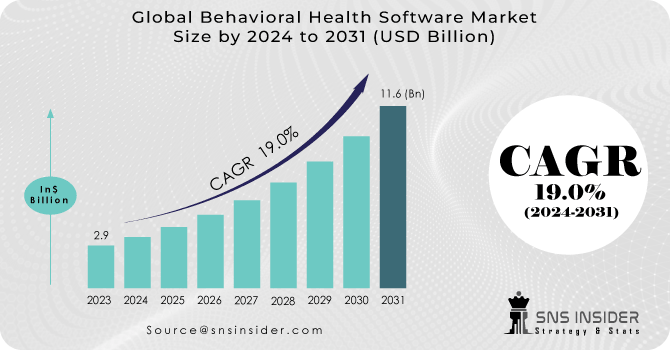

The Behavioral Health Software Market Size was valued at USD 2.9 billion in 2023 and is expected to reach USD 11.6 billion by 2031, and grow at a CAGR of 19.0% over the forecast period 2024-2031.

The rising prevalence of mental disorders in the young and the old. Patients are seeking treatment due to the rising issue of stress, anxiety, and depression. Therefore, to ensure that patients are mentally stable, healthcare facilities adopt a variety of software. According to the World Health Organization, depression is the most-prevalent mental disorder and one of the main causes of disability worldwide. According to it, depression affects an estimated 280 million individuals worldwide currently. In addition, market participants are focusing on new product and service launches as well as partnerships in order to expand the overall market.

Get more information on Behavioral Health Software Market - Request Sample Report

MARKET DYNAMICS

DRIVERS

-

Government initiatives to encourage behavioral health organisations to embrace electronic health records

-

Positive behavioural health policies are being implemented in the United States.

-

Increased use of behavioural healthcare software

The main factors contributing to the high cost of treatment are the need for and the creation of excessive paperwork, which results in the loss of productivity among healthcare professionals and the poor management of the revenue cycle by behavioural health organisations. Attention to and adoption of behavioural health software as a means of reducing medication errors and paperwork, increasing productivity, ensuring quick access to patient data, improving the efficiency of the process and reducing healthcare costs has increased as a result of the need to address these issues. The adoption of behavioural health software has been driven by these benefits, in particular amongst large hospitals and community healthcare facilities.

RESTRAINTS

-

There is a shortage of healthcare IT professionals in the field.

-

Data privacy concern

The privacy of data is a major concern for providers when it comes to behavioral health. Behavioral health providers are constrained from sharing information regarding patients with mental illness or substance abuse with individuals not involved in the patient's treatment. However, the patient's data can be accessed by any healthcare professional who is not involved in the case, thanks to the integration of data and the development of IT tools.

OPPORTUNITIES

-

Subscription models are becoming more and more popular

-

Telehealth as a means of delivering medical care

-

The health of team members is increasingly taken into account by emerging countries

In developing markets like Asia Pacific, Latin America, and the Middle East and Africa, players in the behavioral health software market stand to benefit significantly from growth opportunities, particularly those unable to adhere to US Federal Government standards. Government efforts to establish standards, regulations, and infrastructure will incentivize healthcare providers to embrace EMR and EHR technology in Australia.

CHALLENGES

-

Financial Constraints

The greatest challenge for healthcare organisations, in particular emerging economies, is to overcome finance constraints. However, the extent of data that is retained has shown to be very important and IT infrastructure as a key element for healthcare institutions began to evolve. At present, software solutions for behavioral health are relatively costly. Sometimes the cost of maintenance and software updates for these systems may be in excess of what is actually charged. Support and maintenance services are an ongoing expenditure, which may account for almost 30.0% of the overall cost of ownership by means of software updates according to changing user requirements. Therefore, when they are focusing on the implementation of electronic health records and modernisation of RCM systems, behavioural healthcare organisations face a challenge in justifying expenditure at first glance.

Impact of Russia-Ukraine War

The increased demand for behavioral and mental health services, partly due to the heightened stress and anxiety caused by geopolitical instability. Initiatives by governments to promote the adoption of electronic health records in behavioral healthcare organisations as well as positive reforms within the field of mental health care have stimulated this demand. In addition to the adoption of telehealth services as a means of providing advanced care services, these initiatives have led to the expansion of therapy centres and an increased focus on subscription models. Moreover, positive change in the field of mental health is hindered by substantial obstacles. Gaps in scientific and clinical knowledge, stigma associated with behavioral health, ineffectual care systems, and siloed healthcare data management pose challenges to the effective diagnosis, treatment, and management of behavioral health conditions. However, significant changes in the global behavioural health landscape are likely to be driven by disruption factors like culture and behaviour change, advances in science and technology, improved access to care as well as better data sharing and interoperability.

Impact of Economic Slowdown

Budgetary restrictions and a decrease in spending on health care have been caused by the slowdown triggered by factors such as the COVID 19 epidemic and geopolitical tensions, which has affected many sectors. As a result, healthcare providers, including those in the mental health sector, have become more cautious in their investments in software solutions. Due to budgetary constraints, healthcare organisations may delay or reduce their planned adoption and upgrading of behavioural health software. This slowdown in purchasing decisions may have an impact on the growth and expansion strategies of software suppliers, which would lead to a drop in demand. In addition, some healthcare providers have been putting priority on basic services and cost savings measures over investment in new technologies to dampen demand for behavioural health software as a result of the recession.

Market Segmentation

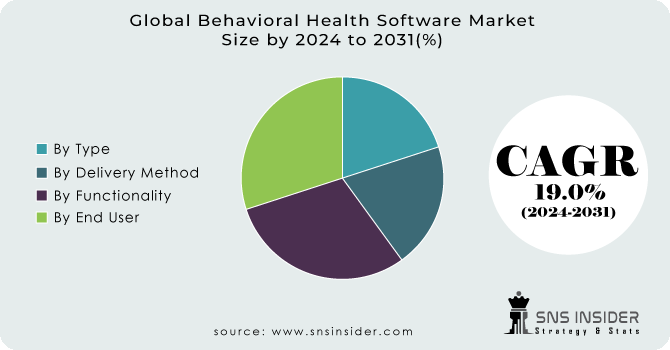

By Functionality

-

Clinical Functionality

-

Electronic Health Records (EHRs)

-

Clinical Decision Support (CDS)

-

Telehealth

-

Others

-

-

Administrative Functionality

-

Patient/Client Scheduling

-

Workforce Management

-

Others

-

-

Financial Functionality

-

Revenue Cycle Management

-

Managed Care

-

Others

-

In 2023, the clinical functionality segment accounted for a large share due to an increasing number of government initiatives aimed at boosting adoption of electronic health records. The electronic health records, which are provided to these entities on a common platform in order to enhance interoperability, enable them to maintain large quantities of healthcare data for several institutions while providing real time information about patients. In addition, as a result of their active filtering and presentation of knowledge and person specific information at the appropriate time in order to improve health and treatment effectiveness, it is becoming increasingly common for clinicians, staff, patients or others involved in the psychosomatic healthcare value chain to adopt medical decision support schemes.

By Delivery Method

-

Subscription Model

-

Ownership Model

In 2023, the subscription model segment accounted for the largest market share owing to the high demand from smaller and moderate sized mental health providers. Financial constraints that prevent them from buying full software ownership and paying a large amount of money are the main reason. A subscription model is a software licensing model where users are required to pay periodic fees, typically every month or annually, for access to fully enabled features of the application. This model is relatively affordable and can be chosen either by the user or according to their wishes, provided that they comply with their requirements. Market growth has been positively affected by these factors.

By Component Type

-

Support Services

-

Software

By End User

-

Payers

-

Providers

-

Patients

In 2023, the patients segment accounted for the biggest share owing to a high number of patients who use behavioral health software at home care facilities and hospitals. Patients are people who have a behavioural or mental illness and are being treated by mental health professionals. For the purposes of self-care, patients can use behavioural health software. Growth in this segment is also expected to be stimulated by increasing awareness of mental health issues.

Need any customization research on Behavioral Health Software Market - Enquiry Now

Regional Analysis

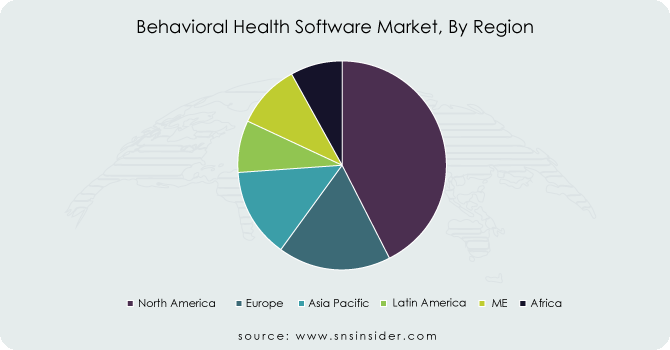

North America accounted for around 42.5% of the behavioural health software market's revenue in 2023, and it is anticipated to remain at a high level over the coming years. The increase in the number of people requiring these services for the freedom from mental illness, the increase in government funding for the provision of these services, and the implementation of various reforms in the field of mental health have contributed to the large market share of the United States in the region. Moreover, the region is a promising market due to easy availability of reimbursement for telepsychiatry services and increasing awareness of mental health software.

Asia Pacific is projected to grow at a faster CAGR than other regions over the forecast period due to the population of older people in China, Japan and India continues to increase due to their increased use of smartphones and internet access. The market has a huge growth potential, thanks to the vast number of mobile phone users in China and India. In addition, the growing literacy rate in regions is responsible for increased adoption of technology-based solutions such as telemedicine, ePrescriber, telepsychiatry and psychiatric software.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Some of the major key players are as follows: AdvancedMD, Credible Behavioral Health, Valant, Kareo, Hol musk, Core Solutions, Inc., Epic systems, Netsmart Technologies, Well I gent, Inc., Medi tab, Medi ware, Allscripts, Cerner Corporation, Quali facts Systems, Inc. and Other Players

Epic systems-Company Financial Analysis

Recent Developments:

-

In April 2022, A new suite of behavioural health technology, built on the company's electronic medical record EHR and practice management system, has been announced by NextGen Healthcare, a cloud-based healthcare technology provider. By collecting multispeciality information from across Community health services on a single platform, the new suite highlights the organisation's commitment to promoting overall health and reducing inequalities of care.

-

In December 2022, Valant, a United States-based provider of cloud-based Electronic Health Records (EHR) for behavioral health practices, introduced a novel tool for managing prospective patients. In order to improve the patient experience, the efficiency of the intake process, and the satisfaction of the physician, this tool will help to match new patients with the most appropriate behavioral healthcare provider.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.9 Billion |

| Market Size by 2031 | US$ 11.6 Billion |

| CAGR | CAGR of 19.0 % From 2024 to 2031 |

| Base Year | 2022 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Functionality (Clinical Functionality, Administrative Functionality, Financial Functionality) • By Delivery Method (Subscription Model, Ownership Model) • By Software Type (Standalone, Integrated) • By End User (Payers, Providers, Patients) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hol musk, Core Solutions, Inc., Epic systems, Netsmart Technologies, Well I gent, Inc., Medi tab, Medi ware, Allscripts, Cerner Corporation, Quali facts Systems, Inc. |

| DRIVERS | • Adoption of behavioral health software is on the rise. • Funding from the government • Government initiatives to encourage behavioral health organisations to embrace electronic health records |

| RESTRAINTS | • Concerns about data security • Professionals in the field of health care information technology (HCIT) are in short supply. |