Offshore-Wind Energy Market Report Scope & Overview:

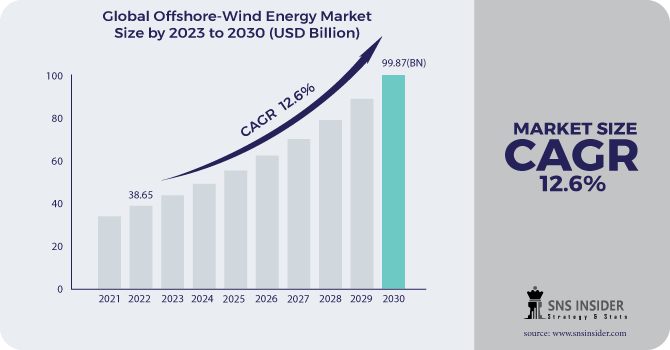

The Offshore-Wind Energy Market size was valued at USD 43.59 billion in 2023 and is expected to grow to USD 113.57 billion by 2031 and grow at a CAGR of 12.71% over the forecast period of 2024-2031.

Offshore wind energy is a form of renewable and clean energy obtained by harnessing the force of the wind at the sea, where the wind is steadier and reaches at a higher speed than on land due to the absence of barriers. Offshore wind energy produces low greenhouse gas emissions (the main cause of global warming). Offshore wind energy does not consume water and provide a domestic source of electricity but offshore wind energy affects the birds and marine life.

To Get More Information on Offshore-Wind Energy Market - Request Sample Report

Wind can produce twice the power on the sea than on the dry land because it blows more at the seaside. The transformed electricity is then supplied to the onshore electricity network. Offshore wind farms are more efficient than onshore wind farms. The more wind speed yields more amount of energy and a steadier wind supply yields a more reliable source of energy. The offshore wind energy is produced far away from the residential area which reduces the impact on the local environment. Being a clean and green form of energy, it reduces the cost of electricity.

When the wind blows on the blades of the turbine at the seaside then the turbines get rotated. Due to rotation electricity gets generated. This electricity generation is based on the electromagnetic principle, where magnets are rotated inside a coil of conductive wire. Then this electricity is sent through the cables and is used by homes and businesses.

Impact of COVID-19

The productivity of offshore wind energy was impacted severely during the COVID-19 pandemic. Despite investment in the global offshore wind energy market quadrupling in the first half of 2020, the rapid spread of the virus has disrupted the foundation of wind turbine manufacturing, the operation of the supply chain, blade production, and wind installations.

The pandemic has caused delays in the construction of wind farms, resulting in a decrease in the number of turbines installed. This has led to a reduction in the amount of energy generated by offshore wind farms, which has had a negative impact on the industry., However, the offshore wind energy market has shown resilience in the face of the pandemic. Companies have adapted to the new challenges posed by the virus, implemented new safety measures, and found innovative ways to continue operations.

Market Dynamics

Drivers

-

Increasing environmental concerns regarding greenhouse gas emissions

-

Rising awareness regarding the harmful effects of fossil fuels on the environment

-

Rising adoption of green energy consumption

-

Continuously increasing investments in the renewable energy sources

Increasing demand for renewable energy sources drives the market for offshore-wind energy which helps to reduce carbon emissions and protects the environment from the harmful effects of fossil fuels. Moreover, Various rules and regulations imposed by the government to promote green energy also boost the offshore-wind energy market significantly.

Restrain

-

High initial investment to build infrastructure

In order to initiate an offshore wind energy project, a significant initial investment is necessary. This financial requirement may impede the expansion of the offshore wind energy market.

Opportunities

-

Increasing government initiatives to curb the carbon footprint

Challenges

-

Increasing logistic issues due to the current economic recession

Impact of Russia-Ukraine War:

The Russia-Ukraine war has impacted the offshore-wind energy market severely. The instability in the region has caused a decrease in investment and slowed the development of offshore wind projects. The offshore wind energy market has been growing rapidly in recent years, with many countries investing heavily in renewable energy sources. However, the Russia-Ukraine conflict has created uncertainty and instability in the region, making it difficult for companies to invest in offshore wind projects. The conflict has also led to a decrease in the availability of skilled labor and materials needed for offshore wind projects. This has resulted in delays and increased costs for companies looking to develop offshore wind farms in the region.

Impact of Recession:

The energy market has experienced a significant decline due to the continuously growing market instability, such as a recession. The downturn in the global economy has led to a decrease in demand for renewable energy sources, including offshore wind energy. This has resulted in a slowdown in the growth of the offshore wind energy market. In addition, technological advancements have made offshore wind energy more cost-effective and efficient. This has helped to make offshore wind energy more competitive with traditional energy sources, even in the midst of an economic downturn. Moreover, for long-term purposes, the government is considering sustainable energy production to reduce energy costs.

Key Market Segmentation

By Components:

-

Turbines

-

Electrical infrastructure

-

Substructures

By Location:

-

Shallow Water

-

Transitional Water

-

Deep Water

By Depth:

-

0 to ≤ 30 m

-

30 to ≤ 50 m

-

50 m

By Capacity:

-

Up to 3MW

-

3MW to 5MW

-

Above 5M

.png)

Do You Need any Customization Research on Offshore-Wind Energy Market - Enquire Now

Regional Analysis

Europe dominated the offshore wind energy market in 2021 and is expected to show the highest growth in the market during the forecast period. This growth is mainly attributed to the increasing investment by the government in renewable energy projects along with favorable government policies. The presence of various key players in Europe further drives the market’s growth. Moreover, European Whistleblowing Institute supports the research and development activities for offshore wind energy projects to promote the use of green energy. Nowadays countries in Europe are shifting their focus on upgrading their electrical infrastructure which drives the market for offshore wind energy significantly.

The Asia-Pacific region is also anticipated to show visible growth during the forecast period due to the adoption of renewable energy in the countries like China, India, and Japan. The increasing government regulations regarding the prevention of carbon emissions help to boost the offshore wind energy market during the forecast period.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Siemens Wind Power, Vestas Wind Systems A/S, Goldwind Science and Technology Co. Ltd., Gamesa Corporacion Technologica SA, GE Wind Energy, Sinovel Wind Group Co. Ltd., Dong Energy A/S, Suzlon Group, Nordex SE, China Ming Yang Wind Power Group Limited, and other key players mentioned in the final report.

Siemens Wind Power-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2023 | US$ 43.59 Bn |

| Market Size by 2031 | US$ 113.57 Bn |

| CAGR | CAGR of 12.71 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Turbines, Electrical infrastructure, Substructure) • By Location (Shallow Water, Transitional Water, Deep Water) • By Depth (0 to ≤ 30 m, 30 to ≤ 50 m, 50 m), By Capacity (Up to 3MW, 3MW to 5MW, Above 5MW) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Siemens Wind Power, Vestas Wind Systems A/S, Goldwind Science and Technology Co. Ltd., Gamesa Corporacion Technologica SA, GE Wind Energy, Sinovel Wind Group Co. Ltd., Dong Energy A/S, Suzlon Group, Nordex SE, and China Ming Yang Wind Power Group Limited |

| Key Drivers | • Increasing environmental concerns regarding greenhouse gas emissions • Rising awareness regarding the harmful effects of fossil fuels on the environment • Rising adoption of green energy consumption |

| Market Opportunities | • Increasing government initiatives to curb the carbon footprint |