Oleochemicals Market Report Scope & Overview:

The Oleochemicals Market Size was valued at USD 24.0 billion in 2023, and is expected to reach USD 43.3 billion by 2032, and grow at a CAGR of 6.8% over the forecast period 2024-2032.

Get E-PDF Sample Report on Oleochemicals Market - Request Sample Report

The oleochemicals market analysis is a part of the global chemicals industry, demarcated by-products stemming from natural fats and oils. This market is recording rapid growth because of a mixture of technological, consumer-spending behavior, and regulatory changes. Since oleochemicals are derived from renewable sources of vegetable oils and animal fats, they find favor due to environmental reasons over traditional petrochemical products. This movement is evidence of the greater trend for concern toward sustainability and environmental awareness on behalf of consumers and enterprises alike.

For instance, the U.S. oleochemicals industry includes its entry into aggressive growth, driven by growing domestic production and new, innovative applications zeroing in on the use of advancements in production technologies for higher efficiency and more sustainable operation. Regulation and consumer demand are focusing the drive on these bio-based products as part of a global movement to lessen the impact on the environment and increase renewable resources. Growth in the oleochemicals industry in India has generally been fast, with the recent steep increase in imports indicative of increased demand and growth in the industry. This is in line with an augmenting domestic production, supported by the import of high-quality raw materials into the country.

Growing demand for green and eco-friendly products is another major driver of the oleochemicals market. The increasing adoption of oleochemical-based ingredients in industries, such as personal care, automotive, and pharmaceuticals has been noticed because these are of natural origin and biodegradable. For instance, in personal care, fatty acids, and esters have wide applications in skincare and hygiene products. Within the automotive sector, the increasing application of oleochemical-based bio-lubricants and additives is based upon enhanced performance properties and reduced impact on the environment, thus fostering the industry's shift toward greener technologies.

The second major driver of market growth at the same time is technological advancements and changes in regulatory laws. With innovations, such as more efficient processing and enzyme catalysts, production is becoming easier and the product range is wider from oleochemicals. Improved transesterification technology has, for instance, provided superior-quality biodiesel and surfactants. Besides, strict regulations in every country to increase the use of renewable resources while drastically reducing harmful chemicals further support the market demand for oleochemicals. Hinging on a technological innovation trend and facing a more positive regulatory environment, the market of oleochemicals, currently well positioned, will continue to grow in conjunction with a strong message of sustainability.

Oleochemicals Market Dynamics:

Drivers:

-

Growing Demand for Biodegradable Products Hinder Market Expansion

The increasing demand for biodegradable products is one of the strongest critical drivers in the oleochemicals market, which is dictated by a wider socio-economic shift towards sustainability and the environment. As oleochemicals are made from sources such as vegetable oils and animal fats and are naturally degradable, they gathered great interest with growing consumer, industrial, and environmental need for solutions that are friendly to the biosphere. For instance, in personal care, the trend is moving toward biodegradable surfactants and emulsifiers based on oleochemical feedstocks. Ingredients such as these found in shampoos, soaps, and lotions would deliver active performance but easily break down within an environment to reduce long-term pollution.

Similarly, biodegradable lubes and additives find applications throughout the automotive industries, decomposing naturally to reduce harm that could be caused by the accumulations of harmful residues. The demand for such biodegradable products also comes from the packaging sector itself, as companies seek ways of replacing traditional plastics. The sector is developing biodegradable packaging materials that use oleochemicals, polymers, and coatings to solve all problems brought by plastic waste and issue a circular economy. This trend is further reinforced by regulatory frameworks and consumer preference, which has quickly shifted to sustainable practices, thus driving the oleochemicals market in response to the heightened need for products that are friendly to the environment.

-

Growing Demand for Oleochemicals from Various End-Use Industry to Augment Market Expansion

One major driving force behind the growth of the oleochemicals market is certainly the rapidly increasing demand for the versatile compound in most end-use industries, due to functional benefits and environmental advantages in a wide variety of applications. This implies that, in the personal care industry, oleochemicals, majorly fatty acids, esters, and surfactants, have increased their role in the formulation of skincare products, shampoos, and soaps. They correspond in value to being of renewable origin and biodegradable, matching consumer preference for non-toxic and eco-friendly personal care products. Another major end-use sector is the automotive industry, where oleochemicals find an application in the formulation of bio-based lubricants and additives. With lesser dependence on fossil fuel products, such formulated products have improved engine performance and reduced carbon footprint.

Hydraulic fluids and engine oils, when formulated from bio-based oleochemical sources, can deliver improved lubricating performance with lesser environmental impacts. In the pharmaceutical industry, oleochemicals are also put into service in the preparation of excipients, carriers, and drug delivery systems, among other medicinal uses associated with their bio-compatibility and lower toxicity. Growing interest in sustainable packaging solutions has also driven research into the production of oleochemical-based polymers and coatings that would provide biodegradable and eco-friendly alternatives to traditional plastics. The unusually wide application spectrum underlines the increased integration of oleochemicals in a diversity of industries by virtue of functionality, sustainability, and compliance with consumer and regulatory demands for greener and more responsible products.

-

Easy availability of raw materials for the production of oleochemicals

-

Growing demand for green chemicals

Restraints:

-

Voltaic Organic Compound Generation during Pre-treatment of Glycerin Hamper Market Expansion

The generation of volatile organic compounds during the pre-treatment of glycerin has become a major restraint to the oleochemicals market growth. It reflects such issues as environmental and safety concerns. Glycerin, being one of the by-products coming from biodiesel production, can be pre-treated for impurities and used in oleochemical applications. For instance, the emission of various volatile organic compound types is possible in such processes, which eventually contribute to air pollution and health problems for workers.

One excellent example would be the heating and chemical reactions involved in the purification of glycerin, which may form byproducts as acetaldehyde and formaldehyde, some notorious compounds. These include some VOCs whose emission control is extremely needed for environmental protection by sophisticated ventilation and other controls on emissions to meet regulatory requirements. As such, the management of VOC emissions does add in complexity and costs to the production process, which could further impede the growth and profitability of the oleochemicals market.

Opportunities:

-

Stringent regulation imposed by the government on using petroleum-based products

Challenges

-

Fluctuating raw material prices of oleochemicals

Oleochemicals Market Segmentation Analysis:

By Product

In 2023, Fatty acid methyl esters dominated the oleochemicals market. The segment has held the largest oleochemicals market share of about 35% as FAME finds broad usage in several sectors, particularly led by their use in biofuel production and industrial processes. The product of transesterification of fatty acids is FAMEs and is, consequently, the basis for biodiesel production, which is increasingly being used as a renewable source of energy to become independent from fossil fuels and, subsequently, reduce GHG emissions.

One example includes biodiesel containing FAMEs, whose production is being fostered while many countries, either individually or through regional political integration, pursue their goals for renewable energies in fighting climate change. These excellent characteristics, such as good biodegradability and low toxicity, help in the application of FAMEs in surfactants, lubricants, and personal care products. This broad field of application will maintain FAMEs at the forefront of the market, with an estimate of values sharing the overall oleochemicals market. While the exact market share may vary, FAMEs' position is always very strong among other sectors, due to their versatile nature and relevance in global sustainability oleochemical market trends.

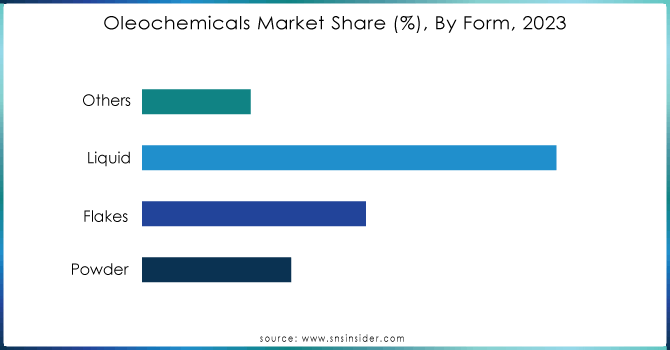

By Form

The liquid form segment dominated the oleochemicals market in 2023, gaining a revenue share of 65%. This can be attributed to the versatility and wide applicability of liquid oleochemicals in the form of fatty acids, glycerol, surfactants, and so on. Liquid oleochemicals find usage in various industries owing to their easy handling, mixing, and applicability properties compared to other forms. They can be found in personal care products, industrial lubricants, and as intermediates during chemical synthesis. For example, liquid fatty acids find wide application in the manufacture of soaps and detergents because they mix well with other ingredients to enhance performance and stability.

Likewise, liquid glycerol is used in many pharmaceutical and cosmetic applications since it is moisturizing and easily mixed with other ingredients. Being in this liquid form also makes its use easier in biodiesel production, since it is a necessary feedstock for the transesterification process. Control factors in this respect, liquid oleochemicals hold quite a big market share, and estimates say they might even command a strong share of the overall market, as a result of their critical role in many applications and the ease of integration in many production processes.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

Personal care and cosmetics generated the largest revenue share, approximately 30%, in the oleochemical market. It could be driven by the fact that ingredients derived from oleochemicals drive major contributions to personal care and cosmetics applications. Starting from fatty acids to esters and surfactants, oleochemicals find application across a host of personal care formulations. For instance, fatty acids are used in soaps and cleansers since they clean but do not irritate human skin. On the other hand, esters produced from these oleochemicals have wide application in moisturizers and lotions due to their emollience that hydrates and thus softens the skin.

Most importantly, in shampoos, conditioners, and hair care products, oleochemical-based surfactants will continue to be in a leading position, as they have good lathering properties and cleansing ability for hair. Another reason of importance is the growing demand for natural, biodegradable, and sustainable ingredients in personal care and cosmetics that boosts oleochemical dominance in this sector. With consumers remaining oriented toward eco-friendly and skin-friendly products, oleochemical-derived ingredients are bound to further their lead.

Oleochemicals Market Regional Outlook:

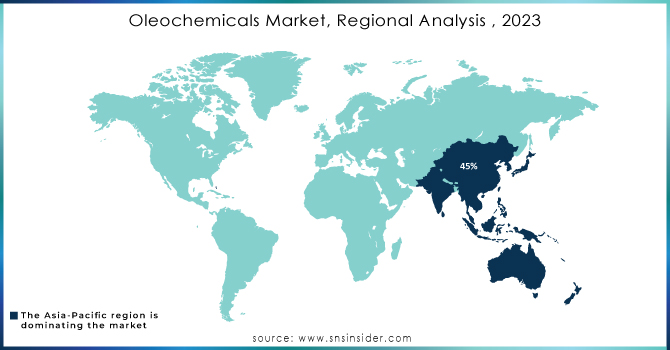

In 2023, the Asia Pacific region dominated the oleochemicals market by capturing almost 45% of the global market share. Coupled with this, its domination is supported by robust production capabilities and enormous consumption against the backdrop of rapid industrial growth. Countries, such as Malaysia and Indonesia are large producers of oleochemicals, with rich palm oil resources that supply a big feedstock for oleochemicals. For instance, Malaysia, is well positioned as the number one exporter of palm-based oleochemicals in use within personal care products, biodiesel, and industrial lubricants. Such well-developed infrastructure, supporting regulatory framework, and serious investments in sustainable technologies producing this very oleochemical all prove the leading status of this region.

Another major force pushing the increased demand for oleochemicals in the Asia Pacific region is the growth in the personal care and consumer goods industries that consume a great deal of oleochemical derivatives. Other factors still at work, driving the consumption rates of oleochemicals, include a growing middle class, rising urbanization, and increased consumer awareness about eco-friendly products. Asia Pacific has established itself as the uncontested leader in the global market for oleochemicals, which is just the excellent combination of production capacity, consumption demand, and strategic investments.

Moreover, in 2023, North America held the regional oleochemicals market share of about 20% and had the fastest growth. The growth is being fanned by investment in bio-based chemicals and new technologies for production. Interests in sustainability with associated regulations drive the demand. Growing demand from industries, such as personal care, automotive, and pharmaceuticals for renewable and eco-friendly oleochemical-based products pushes growth in North America.

For instance, the fast-moving personal-care and automotive industries in this region demand bio-based surfactants and lubricants that help achieve targets on sustainability and incentives available under several regulations. Furthermore, adoption for oleochemical-based products in the U.S. and Canada for a wide array of applications, from personal care products to biodegradable packaging solutions, is gaining speed.

Key Players:

The major Oleochemical Companies are Vantage Specialty Chemicals, Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., Kao Chemicals Global, Ecogreen Oleochemicals, Corbion, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, KLK OLEO, Evyap Sabun Yag Gliserin San ve Tic A.S., JNJ Oleochemicals Incorporated, Sakamoto Yakuhin kogyo Co., Ltd., Stephan Company, Pepmaco Manufacturing Corporation, Philippine International Dev., Inc. (Phidco, Inc.), and other key players mentioned in the final report.

Recent Developments:

-

May 2024: Corbion entered a partnership agreement with IMCD, a distribution partner and formulating company of specialty chemicals and ingredients, for the inclusion of various Corbion products for the food & beverage sector in Thailand.

-

April 2024: Vantage Specialty Chemicals increases the capacity of METAUPON* NMT (N-Methyl Taurine) in Leuna. The expansion is to capture consumer demand for personal care, industrial, and household applications.

-

January 2024: Godrej Industries signed an MoU with the Gujarat government to invest USD 71.8 mn in the next four years to enhance oleochemicals production capacity. The impetus behind such expansion is to meet the growing demand for the same from the personal care, pharmaceuticals, and food industries.

-

April 2023: Emery Oleochemicals, one of the leading global producers of natural-based specialty chemicals, announced the launch of its newest product, INFIGREEN 420R. This recycled content polyester polyol was engineered from post-industrial waste.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 24.0 Billion |

| Market Size by 2032 | US$ 43.3 Billion |

| CAGR | CAGR of 6.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Specialty Esters, Fatty Acid Methyl Esters, Glycerol Esters, Alkoxylates, Fatty Amines, Others) •By Form (Powder, Flakes, Liquid, Others) •By Application (Personal Care & Cosmetic, Consumer Goods, Food Processing, Textiles, Paints & Inks, Industrial, Healthcare & Pharmaceuticals, Polymer & Plastic Additives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vantage Specialty Chemicals, Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., Kao Chemicals Global, Ecogreen Oleochemicals, Corbion, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, KLK OLEO, Evyap Sabun Yag Gliserin San ve Tic A.S., JNJ Oleochemicals Incorporated, Sakamoto Yakuhin kogyo Co., Ltd., Stephan Company, Pepmaco Manufacturing Corporation, Philippine International Dev., Inc. (Phidco, Inc.), and other key players |

| Key Drivers | •Rising demand for biodegradable products •Increasing demand for oleochemicals from various end-use industry •Easily available raw material for the production of oleochemicals •Rising demand for green chemicals |

| Restraints | •Voltaic Organic Compound generation during pre-treatment of glycerin |