Waterborne Coatings Market Analysis & Overview:

The Waterborne Coatings Market Size was USD 72.3 billion in 2023 and is expected to reach USD 119.6 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

Get more information on Waterborne Coatings Market - Request Sample Report

Increasing construction activities due to rapid urbanization and infrastructure development in developing countries are contributing a lot to the demand for waterborne coatings in architectural and decorative applications. With growing residential, commercial, and industrial populations in urban areas, demand for eco-friendly durable coatings is expected to drive the global coating market. Water-based paint and water-based paint will produce low VOC emissions and suit your interior and exterior surfaces, so the use of waterborne coatings is preferred for coatings, as they perform better. Furthermore, government initiatives supporting sustainable construction practices and green building certifications are also driving demand for these coatings. In particular, their ease of use, rapid drying speeds, and visually attractive choices make waterborne coatings the ideal solution to satisfy the wide range of requirements in modern infrastructure projects, ensuring they will continue as a mainstay of the construction industry.

Governments globally have set stringent regulations to limit Volatile Organic Compound (VOC) emissions. For example, the U.S. Environmental Protection Agency (EPA) regulates coatings under its National Emission Standards for Hazardous Air Pollutants (NESHAP). VOC levels in coatings must comply with limits to reduce air quality impacts.

Industrial applications of waterborne coatings are increasing, due to their excellent properties including excellent adhesion and corrosion resistance, as well as easy application. These coatings work especially well to protect equipment and machinery against extreme environmental conditions like moisture, chemicals, and temperature fluctuations. Their low VOC emissions make them sustainable options in compliance with the strictest international environmental regulations. In addition, the combined advantages when dry alongside compatibility to many substrates, provide waterborne coatings with utility in industrial manufacturing and maintenance. Such coatings are increasingly being embraced by the automotive, aerospace, and heavy equipment industries to ensure longevity and compliance with environmental specifications. For waterborne coatings, both performance benefits and environmental considerations are leading to this evolution in industrial coatings.

In August 2023, PPG collaborated with one of China’s largest automakers to create an innovative waterborne coating for automotive parts. This new formulation aims to offer performance comparable to traditional solvent-based coatings while being more environmentally sustainable.

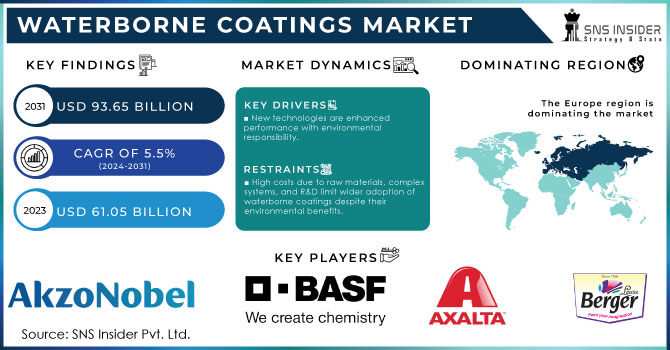

Waterborne Coatings Market Dynamics

Drivers

-

New technologies are enhanced performance with environmental responsibility.

New technologies continue to penetrate the waterborne coatings industry increasing performance and performance while meeting environmentally responsible requirements. These innovations aim to enhance the durability, adhesion, and resistance of coatings while minimizing harmful emissions. Using advanced resins and polymers, such as acrylics and polyurethanes, have had an impact in improving the coatings' performance, making them dirt-resistant in industrial and architectural applications. And with this we minimize VOC emissions, which are a fundamental issue in regulatory framework like those applied in U.S. and EU. In efforts to further reduce material use and waste, manufacturers are also focusing on technologies such as nano-coatings that provide higher performance at less thickness. Additionally, the industry focus on waterborne solutions coupled with adoption in eco-sensitive segments, wherein waterborne coatings are positioned as substitutes to solvent-based ones, has further boosted growth. They are pushing the market growth with high capital performance features combined with a lower environmental footprint, responding to consumer and regulatory needs.

Restraint

-

High costs due to raw materials, complex systems, and R&D limit wider adoption of waterborne coatings hamper the market growth.

Waterborne coatings are unable to address the high prices of raw materials, intricate production systems, and extensive research and development (R&D) costs, these are tougher barriers to the use of waterborne coatings and restrict the market growth. Ingredients for waterborne coatings, like resins and polymers, may be higher in price compared to standard solvent-based components, thus increasing production prices. Additionally, the new formulations must comply with both performance criteria and environmental legislation which demands significant investment in R&D when developing them, thus, such technology is expensive for smaller manufacturers or new entrants. Moreover, the specialized equipment and infrastructure required to generate and utilize waterborne coatings add to these significant expenses.

Opportunity

These economies are experiencing significant investments in infrastructure development and other long-term projects, fueling a surge in demand for construction materials. The construction spending in emerging markets is projected to grow at a rate exceeding that of North America and Western Europe. This rapid expansion presents a significant opportunity for resin and waterborne coating manufacturers. The Asia Pacific region, particularly China and India, is at the forefront of this growth, with these markets creating substantial demand for these products. This confluence of factors positions emerging economies as a key driver for the future of the waterborne coatings market.

Waterborne Coatings Market Segmentation Analysis

By Resin Type

The acrylic sub-segment dominated the industry with the highest revenue share of 24% in 2023 by type. Growing demand from infrastructure and automotive industries regarding glossy color retention in outdoor exposure is anticipated to propel the demand for acrylic waterborne coatings. The demand for acrylic resin-based coatings will likely grow substantially over the foreseeable future owing to increasing applications in radiation curing and electrodeposition. Growing demand in the transportation industry for aircraft, autos, ships, railroads, and truck refinishes is expected to drive the demand for Polyurethane (PU) coatings. They are widely used owing to properties, such as abrasion resistance, toughness, and chemical & weather resistance. Stringent government regulations regarding reducing VOC emissions and consistent odors along with shifting consumer preference towards waterborne coatings over their solvent-borne counterparts are expected to remain a major factor driving product demand.

By Application

The architectural sub-segment dominated the waterborne coatings market in 2023, capturing a staggering 20% share. Increase in stringent VOC regulations and a construction boom in developing economies fueled by rising disposable incomes. However, the market landscape extends beyond the walls of buildings. The growing adoption of acrylic-based coatings in industrial applications signifies a promising diversification trend. Furthermore, innovative new offerings like insulation and sound-damping coatings hint at exciting growth prospects across the entire waterborne coatings market, underscoring its potential to cater to a wider range of applications.

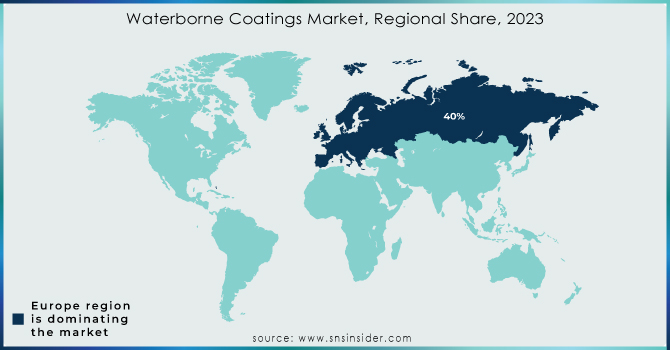

Waterborne Coatings Market Regional Outlook

Europe held the largest market share around 40% in 2023. The region has also been considerably impacted by the EU’s VOC (Volatile Organic Compounds) directives requiring stricter compliance with stringent environmental regulations again, encouraging a move toward more sustainable and eco-friendly solutions, and waterborne over solvent-based coating systems. It tessellates with the state goal of limiting pollution and carbon emissions by promoting the use of more environmentally friendly products.

In addition to this, industry-specific coatings, such as high-performance marine, automotive, industrial machinery, and architecture, drive the demand for such coatings majorly in Europe due to the strong manufacturing base. In addition, major industry participants such as BASF and AkzoNobel are based in Europe, contributing to advancements and investments in waterborne technologies. These players have focused on investing a lot of money into R&D to develop advanced waterborne coatings that not only meet performance and sustainability standards but help the region's dominance in this market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

AkzoNobel NV (Dulux, Sikkens)

-

BASF SE (BASF Waterborne Coatings, MasterProtect)

-

Axalta Coating Systems LLC (Alesta, Imron)

-

Berger Paints India Ltd. (Luxol, Silk Glamor)

-

Kansai Paint Co. (Platinum, Opal)

-

Nippon Paint Holdings Co. Ltd (Supermatex, Weatherbond)

-

PPG Industries Inc. (Pitt-Char, PPG Aquapon)

-

RPM International Inc. (Rust-Oleum, Zinsser)

-

Sherwin-Williams Company (ProMar, Emerald)

-

The Valspar Corp. (Valspar Duramax, Valspar Medallion)

-

Tikkurila Oyj (Temalac, Joker)

-

Henkel AG & Co. KGaA (Loctite, Teroson)

-

Hempel A/S (Hempel Decorative, Hempel Premium)

-

Jotun A/S (Jotun Essence, Jotun Super)

-

Sika AG (Sikafloor, Sikagard)

-

Futura Coatings Ltd. (Futura Eco, Futura Flex)

-

Valspar Corp. (Valspar Wood, Valspar Metal)

-

Bolidt (Bolidt Flooring, Bolidt Protective Coatings)

-

Kraton Polymers (Kraton Polymers - Waterborne, Kraton Polymers - Base)

-

Eastman Chemical Company (Eastman Waterborne Coatings, Eastman Tetrashield)

Recent Development:

-

In May 2023: AkzoNobel NV company's Coatings business is making waves with its new AccelstyleTM line. These coatings, designed for the outside of aluminum beverage cans, are the first to be free of bisphenols, styrene, and PFAS. This eco-friendly launch follows their success with AccelshieldTM 700, the first BPA-free internal coating for can ends, compliant with both US and EU regulations.

-

In May 2024: Axalta, a major coatings company, joined forces with Solera, a leader in vehicle lifecycle management. This partnership integrates Axalta's paint systems with Solera's platform, allowing body shops to estimate their carbon footprint per repair. This considers factors like chosen repair methods, paint application, and drying conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 72.3 billion |

| Market Size by 2032 | US$ 119.6 billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Acrylic, Polyurethane, Epoxy, Alkyd, Polyester, PTFE, PVDC, PVDF, Others), •By Application (Architectural, General Industrial, Automotive OEM, Metal Packaging, Protective Coatings, Automotive Refinish, Industrial Wood, Marine, Coil, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AkzoNobel NV, BASF SE, Axalta Coating Systems LLC, Berger Paints India Ltd., Kansai Paint Co., Nippon Paint Holdings Company Ltd., PPG Industries Inc., RPM International Inc., The Sherwin-Williams Company, The Valspar Corp., Tikkurila Oyj |

| Drivers | •New technologies are enhanced performance with environmental responsibility. |

| Restraints | •High costs due to raw materials, complex systems, and R&D limit wider adoption of waterborne coatings despite their environmental benefits. |