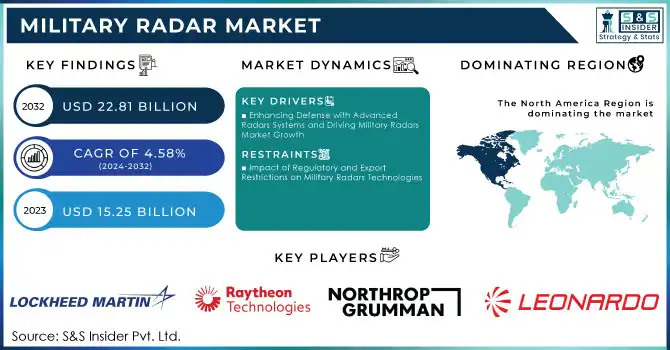

Military Radar Market Size:

Get more information on Military Radar Market - Request Sample Report

The Military Radar Market Size was valued at USD 15.25 Billion in 2023, expected to reach USD 22.81 Billion by 2032, growing at a CAGR of 4.58% over the forecast period 2024-2032.

The Military radar market is experiencing substantial growth, driven by global defense modernization efforts. Countries are investing heavily in upgrading their radar systems, essential for enhancing surveillance, target acquisition, and overall military capabilities. Significant investments include the U.S. F-15K fighter jets undergoing a USD 6 billion upgrade, and Poland's USD 7.3 billion project to modernize its F-16 fleet to the Viper configuration with advanced AN/APG-83 AESA radar. Similarly, Norway and Canada are advancing their radar capabilities, including the development of new missile-tracking systems. These upgrades highlight the rising demand for sophisticated radar technologies, as nations prioritize defense modernization.

For example, Greece is investing in modernizing its F-16 fleet with advanced radar and avionics, including the AN/APG-83 AESA radar, through a comprehensive program to extend its operational life. The program aligns with the country's focus on strengthening defense in the Eastern Mediterranean. Additionally, Greece is acquiring advanced fighter jets like the F-35A and Dassault Rafale to complement its upgraded fleet, signaling a broader strategy to enhance military readiness.

Military Radar Market Dynamics

Drivers

-

Enhancing Defense with Advanced Radars Systems and Driving Military Radars Market Growth

The growing need for advanced radar systems in defense modernization programs is a key driver of the Military Radars Market. Countries are increasingly prioritizing upgrades to enhance the effectiveness of their defense systems. For instance, the U.S. Air Force is undertaking the largest modification in the history of its B-52 bombers, incorporating new radar and engine technologies to improve surveillance and target acquisition. Similarly, the Army's air and missile defense programs, such as the LTAMDS radar, are being expedited to ensure faster and more accurate threat detection. Additionally, Canada’s investment in over-the-horizon radar as part of NORAD modernization and the development of next-gen radar like Lockheed Martin’s Sentinel A4 for the U.S. Army are further driving market demand. These advancements in radar technologies, designed to detect diverse and emerging threats, play a crucial role in enhancing military capabilities and readiness globally, making radar systems essential for modern defense strategies. The demand for such technologies is set to rise as defense agencies worldwide strive to stay ahead of evolving threats, boosting the military radars market growth potential.

Restraints

-

Impact of Regulatory and Export Restrictions on Military Radars Technologies

Regulatory and export restrictions present significant obstacles for the military radars market, particularly concerning advanced radar technologies such as high-resolution radar satellites. Stringent controls, including the U.S. Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), govern the export of military electronics and space-based radar systems. These regulations can delay international deployment by slowing approval processes, thus complicating global trade. Recent revisions to export rules, such as those published in the Federal Register (Oct 2024), have further tightened controls over military-grade electronics, restricting access to emerging markets. As nations modernize their defense systems, including radar capabilities, the prolonged approval timelines hinder the rapid adoption of new technologies. This regulatory burden affects manufacturers, especially those producing radar systems for surveillance, missile defense, and reconnaissance. Consequently, these controls limit expansion into high-growth regions, thus stifling global market opportunities. As export regulations continue to evolve, they will remain a key restraint shaping the military radars market dynamics.

Military Radar Market Segment Analysis

by Platform

In 2023, the ground-based segment of the military radars market dominated, capturing around 48% of the revenue share. This growth is primarily driven by the increasing demand for advanced surveillance, air defense, and missile tracking systems. Ground-based radar platforms offer a strategic advantage in military operations, providing real-time data for decision-making and ensuring enhanced perimeter defense. Their versatility in deployment, combined with technological advancements in radar precision and coverage, solidifies their position as a critical component in modern defense infrastructure. As defense modernization efforts expand globally, the demand for ground-based radar systems continues to rise, sustaining its market leadership.

by Dimension

In 2023, 2D radar systems dominated the military radars market, accounting for approximately 56% of the revenue. This significant share is due to the widespread adoption of 2D radar for various defense applications, including air traffic control, surveillance, and threat detection. 2D radars are favored for their simplicity, reliability, and cost-effectiveness, making them ideal for tactical and operational military needs. They provide precise data on target location and movement, essential for early warning systems and missile defense. As the demand for secure airspace monitoring and ground surveillance grows, 2D radar remains a dominant technology in military radars systems.

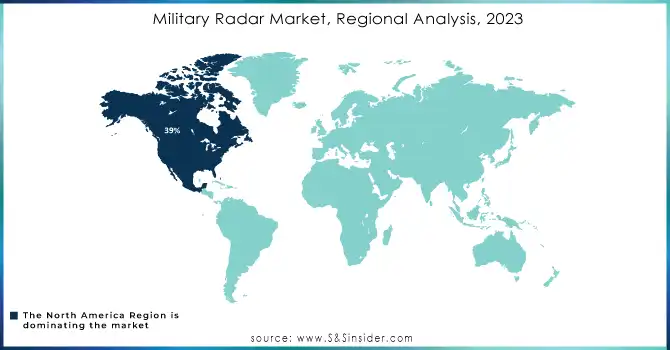

Military Radar Market Regional Overview

In 2023, North America dominated the military radars market, capturing approximately 39% of the total revenue share. This dominance is largely due to the robust defense infrastructure in the United States, which invests heavily in advanced radar technologies for various defense applications, including air surveillance, missile defense, and reconnaissance. Key defense contractors like Raytheon, Lockheed Martin, and Northrop Grumman play a crucial role in developing and deploying innovative radar systems. Furthermore, the U.S. government’s focus on modernizing military assets, including radar systems, ensures continued growth and technological advancements in the region’s defense sector, reinforcing its leadership in the global market.

Asia-Pacific emerged as the fastest-growing region in the military radars market in 2023, driven by increasing defense budgets and the modernization of military forces across countries like China, India, and Japan. The region's expanding focus on enhancing air defense systems and border security is boosting demand for advanced radar technologies. Moreover, significant investments in research and development by regional defense contractors and governments are fueling the growth. The rise of emerging economies with a growing need for defense modernization further contributes to the region's rapid market expansion.

Get a Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Military Radar Market with their product:

-

Lockheed Martin – (AN/TPQ-53 Counterfire Target Acquisition Radar, AN/FPS-132/ARSR-4 Air Surveillance Radar)

-

Raytheon Technologies – (AN/SPY-6 Radar System, AN/TPY-2 Radar System)

-

Northrop Grumman – (Ground/Air Task-Oriented Radar (G/ATOR), AN/TPS-80 Ground Radar)

-

Thales Group – (Ground Master 400, SMART-L MM Radar)

-

Leonardo S.p.A. – (RAT 31 DL, Kronos Family Radar Systems)

-

BAE Systems – (S1850M Surveillance Radar, Artisan 3D Radar)

-

Saab Group – (Giraffe 1X Radar, Erieye Airborne Radar System)

-

Harris Corporation (L3 Harris Technologies) – (AN/ALR-69A Radar Warning Receiver, FPRC Air Surveillance Radar)

-

Israel Aerospace Industries (IAI) – (EL/M-2084 Multi-Mission Radar, EL/M-2032 Radar)

-

Damen Shipyards Group – (MR-90, Radar Solutions for Naval Platforms)

-

General Dynamics Mission Systems – (AN/TPS-59(V)3 Radar, Air Defense Radar Systems)

-

Rockwell Collins (Collins Aerospace) – (Multi-Role Radar (MRR), TacNet Radar System)

-

Fujitsu – (Airborne Early Warning and Control Radar Systems)

-

Mitsubishi Electric – (TRAPS Radar System, FPS-5 Air Surveillance Radar)

-

Aireon – (Space-based Automatic Dependent Surveillance-Broadcast (ADS-B) Systems)

-

Harris Corporation (now part of L3 Harris) – (Falcon III Radar Systems, AN/TPS-75 Radar)

-

Indra Sistemas – (Lanza 3D Radar, Smart-S Mk2 Radar)

-

Leonardo UK – (Seaspray 7000E Radar, Ground Master 400)

-

Oerlikon (Part of Rheinmetall) – (Skyguard Radar System, Fire Control Radar Systems)

-

TCAS (Transponder-based Collision Avoidance System) – (Military Radar Collision Avoidance System for Aircraft)

List of companies that supply raw materials for radar systems:

-

DuPont

-

3M

-

Honeywell International

-

CeramTec

-

Corning Inc.

-

Heraeus

-

Samsung SDI

-

Nippon Steel Corporation

-

Materials Solutions Ltd.

-

Dow Inc.

-

Sumitomo Electric Industries

-

AT&T Materials and Technologies

-

Mitsubishi Materials Corporation

-

Kuraray Co. Ltd.

-

Indium Corporation

-

SGL Carbon

-

Teijin Limited

-

Alcoa Corporation

-

UMICORE

-

Applied Materials

Recent Development

-

March 21, 2024 – Raytheon, a business of RTX, was awarded a USD 1.2 billion contract to supply Germany with additional Patriot air and missile defense systems. This expansion includes the latest Patriot Configuration 3+ radars, launchers, and command systems, enhancing Germany's air defense and interoperability with NATO allies.

-

March 15, 2024 – Lockheed Martin extended its collaboration with Navantia, Spain’s national defense and shipbuilding company, for an additional three years. This agreement will focus on advancing opportunities in surface ships and submarines, including the F-110 frigate program and integration of advanced combat systems.

-

March 27, 2024 – South Korea announced a USD 2.9 billion F-15K Performance Improvement Project to upgrade radar systems and enhance mission capabilities. The upgrades will include the AN/APG-82 radar, BAE Systems' AN/ALQ-250 warning system, and a new cockpit display, improving target identification and situational awareness.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.25 Billion |

| Market Size by 2032 | USD 22.81 Billion |

| CAGR | CAGR of 4.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Ground-based, Naval, Airborne, Space) • By Frequency Band (VHF/UHF Band, L Band, S Band, C Band, X Band, Ku/Ka/K Band) • By Dimension (2D Radar, 3D Radar, 4D Radar) • By Application (Air and Missile Defense, Intelligence, Surveillance and Reconnaissance, Navigation and Weapon Guidance, Space Situational Awareness, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lockheed Martin, Raytheon Technologies, Northrop Grumman, Thales Group, Leonardo S.p.A., BAE Systems, Saab Group, Harris Corporation (L3 Harris Technologies), Israel Aerospace Industries (IAI), Damen Shipyards Group, General Dynamics Mission Systems, Rockwell Collins (Collins Aerospace), Fujitsu, Mitsubishi Electric, Aireon, Harris Corporation (now part of L3 Harris), Indra Sistemas, Leonardo UK, Oerlikon (Part of Rheinmetall), and TCAS (Transponder-based Collision Avoidance System) are key players in the military radar market. |

| Key Drivers | • Enhancing Defense with Advanced Radars Systems and Driving Military Radars Market Growth. |

| Restraints | • Impact of Regulatory and Export Restrictions on Military Radars Technologies. |