Focused Ion Beam Market Size & Trends:

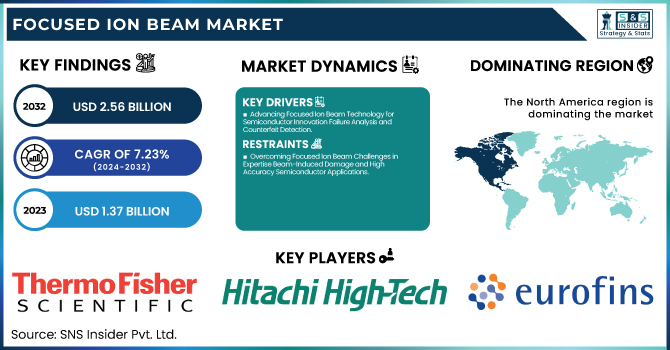

The Focused Ion Beam Market was valued at USD 1.37 billion in 2023 and is expected to reach USD 2.56 billion by 2032, growing at a CAGR of 7.23% over the forecast period 2024-2032. With advanced semiconductor fabrication and failure analysis aiding the market for Focused Ion Beam (FIB), fab capacity utilization is on the rise. Increased R&D investments are improving system accuracy, miniaturization, and material characterization capabilities. FIB systems are transforming with AI and automation, leading to enhanced operational efficiencies, defect detection, and autonomous milling. New applications such as 3D nanofabrication, biomaterials research, and quantum computing are broadening the range of the market. These technological advancements are putting the FIB technology in a position as one of the most important tools for the development of new materials and devices.

To Get more information on Focused Ion Beam Market - Request Free Sample Report

The US-focused Ion Beam market is seeing significant growth supported by the growth of the semiconductor and electronics sectors. Focused Ion Beam (FIB) systems are frequently used for applications including failure analysis, nanofabrication, and device modification. With semiconductor devices getting denser every year, it has become indispensable to have the best analytical tools available and FIB provides such tools for material characterization and defect analysis.

The U.S. Focused Ion Beam Market is estimated to be USD 0.36 Billion in 2023 and is projected to grow at a CAGR of 7.06%. The U.S. Focused Ion Beam (FIB) market is growing due to the rising need for circuit editing, defect analysis, and high-resolution imaging in semiconductor fabrication. Increased usage in aerospace, defense, and biomedical research, along with advancements in multi-beam and plasma FIB technologies, further drive adoption across various high-tech industries.

Focused Ion Beam Market Dynamics

Key Drivers:

-

Advancing Focused Ion Beam Technology for Semiconductor Innovation Failure Analysis and Counterfeit Detection

The changes in semiconductor market trends and higher demand for failure analysis, circuit modification, and nanofabrication in the semiconductor and electronics industry are driving the growth of the Focused Ion Beam (FIB) market. With the scaling of semiconductor nodes and the increasing complexity of integrated circuits, focused-ion-beam (FIB) technology has matured to become an important method to achieve accurate material extraction, defect study, and sample preparation for transmission electron microscopy (TEM). Moreover, the rising penetration of 5G, artificial intelligence, and Internet of Things (IoT) devices is also driving the demand for advanced semiconductor testing and fabrication processes. In addition, the growing issue of counterfeit electronics in defense & aerospace, and automotive sectors is creating strong demand for FIB, as it is used for counterfeit detection and forensic studies. Furthermore, with the development of plasma FIBs, large-area material removal has become a technology of choice for high-throughput applications.

Restrain:

-

Overcoming Focused Ion Beam Challenges in Expertise Beam-Induced Damage and High-Accuracy Semiconductor Applications

The technical complexity and operational expertise required for the use of Focused Ion Beam (FIB) will remain one of the major challenges in the FIB market. Highly skilled technicians are required to operate and interpret results from complex ion milling, deposition, and imaging processes that form part of FIB systems. This hampers widespread adoption due to an acute shortage of trained personnel (more so in emerging markets). In addition, beam-induced damage and sample modification are major issues in many applications, especially for high-accuracy applications like semiconductor failure analysis and nanofabrication. However, a technological challenge is to ensure minimal material damage while keeping the resolution.

Opportunity:

-

Expanding Focused Ion Beam Applications in Nanotechnology Biomedical Research Quantum Computing and AI-Powered Automation

There are ample opportunities for growth within nanotechnology biomedical research and material science applications. The emergence of FIB in quantum computing, MEMS/NEMS fabrication, and battery will expose new fields of market growth. In addition, there is a growing demand for personalized multiscale structures being used in biotechnology and drug delivery systems. AI-Powered Solutions Market Scope: FIB systems are seeing high precision and efficiency with the introduction of automation based on AI technologies, which are estimated to drive the expedited adoption of these technologies across a variety of growing industries, opening up novel avenues for growth over the forecast years.

Challenges:

-

Addressing Focused Ion Beam Limitations in Processing Speed Large-Area Applications and Competing Nanotechnologies

One of the most significant constraints is the unfavorable slow processing speed for large-area applications. While Ga+ Liquid Metal FIB systems can accomplish microstructure modifications in close to optimal timescales, they are not as effective in large-volume material removal, suggesting they may be growing outside their area of applicability for industry-relevant rapid prototyping. Moreover, although Plasma FIB (PFIB) has shown better throughput, the integration of PFIB seems to be a challenge for the industry. Meanwhile, the development of other nanometer imaging and preparing innovations like electron shaft lithography (EBL) and helium ion microscopy (HIM) presents an aggressive danger, placing the brakes on FIB embracing certain applications. Automation and hybrid FIB technologies will be essential to tackling these challenges and supporting the ongoing growth of the market.

Focused Ion Beam Industry Segments Analysis

By Type

Ga+ Liquid Metal was the leading FIB in the market, accounting for 76.5% of the market share in 2023. The reason behind this dominance is its advantages of high precision, stability, and high acceptance in semiconductor failure analysis, circuit editing, and nanofabrication. Because of their high depth of focus and thin ion beams, Ga+ FIB systems are suitable for numerous high-resolution imaging, milling, and deposition applications in research and industry. This market position is established due to their ability to produce focused ion beams to remove and modify materials to exacting specifications.

Gas Field Ion Sources (GFIS) are expected to witness the highest CAGR from 2024-2032. They have gained traction due to their high resolution, high surface sensitivity, and low-sample damage compared to Ga+ FIB. Applications of Gas Field technology are paving the way to revolutionizing nanotechnology, defect analysis, and other cutting-edge research projects that have ultimate demand in ultra-high precision. Rising investments in advanced semiconductor devices and miniaturized components will also propel the growth of the Gas Field FIB market.

By Application

In 2023, Failure Analysis accounted for the largest share of the FIB market with 37.4% market share. It is this dominance that continues to be fostered in its importance due to FIB usage in the semiconductor and electronics industries for defect detection, fault isolation, and material characterization. As semiconductor devices shrink and evolve into higher technology nodes, failure analysis through FIB will continue to be a vital component for quality assurance, reliability, or product optimization. Such high precision FIB failure analysis technique now has been super-enforced due to the complexity of integrated circuits (ICs) and MEMS/NEMS devices.

The nanofabrication segment is expected to grow at the highest CAGR during 2024–2032 due to its increasing applications in quantum computing, photonics, and biomedical research. FIB-based nanofabrication, which relies on the precise modification and nano-patterning of materials, is an essential step toward the realization of next-generation chips, sensors, and nanostructured materials. The increase in nanotechnology-based innovations will expedite the adoption of FIB in advanced material research and manufacturing.

By Vertical

In 2023, Electronics & Semiconductor held a market share of 51.4%, and it is anticipated to expand at an impressive CAGR from 2024 to 2032. As the complexity of integrated circuits (ICs), advanced packaging technologies, and nanodevices continue to grow, so does the need for Focused Ion Beam (FIB) systems in this market. FIB serves as an important technique in failure analysis, circuit editing, and material characterization, establishing reliability and performance for semiconductor devices. While FIBs are already prevalent in semiconductor manufacturers seeking to miniaturize and analyze defects, the rapid growth of advanced technologies such as AI, 5G, and IoT has inspired significant investment into this field. Presently, the ability of fabless semiconductor companies to outsource the integrated photonic chip industry is allowing the electronics & semiconductor industry to emerge as a vital growth driver in the global FIB-SEM market as the demand for applications in nanofabrication and modifications of devices are increasing due to the presence of quantum computing.

Focused Ion Beam Market Regional Outlook

In 2023, North America held a market share of 33.7% and accounted for the largest market share for Focused Ion Beam (FIB) systems due to the high concentration of key semiconductor companies, research institutes, and nanotechnology centers in this region. With FIB applications in failure analysis, circuit modification, and material research, Thermo Fisher Scientific, Intel, and IBM, among others are active users in the region. NASA and top universities also use FIB for space-related nanofabrication and material science advancement. North America accounts for the higher market share due to the growth in the aerospace and defense sector where FIB is used for counterfeit retrieval and microelectronics analysis.

The fastest growth from 2024 to 2032 is expected to be in Asia Pacific, due to rapid developments in semiconductor production, consumer electronics, and nanotechnology studies. Semiconductor behemoths like TSMC, Samsung, and SMIC which reside in China, Japan, South Korea, and Taiwan are heavily investing in next-generation chip innovation and failure analysis. Continued growth in AI, 5G, and electric vehicle (EV) technologies is also increasing demand for circuit editing and nanofabrication-based FIBs. Furthermore, regional adoption is also projected to be boosted by Chinese and Indian government initiatives to bolster domestic semiconductor production.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Focused Ion Beam Market are:

-

Thermo Fisher Scientific Inc. (Helios G4 FIB-SEM)

-

ZEISS International (Crossbeam FIB-SEM)

-

Hitachi High-Tech Corporation (NX9000 FIB-SEM)

-

JEOL Ltd. (JIB-4700F Multi Beam System)

-

TESCAN ORSAY HOLDING, a.s. (S9000G FIB-SEM)

-

Raith GmbH (IONline FIB)

-

A&D Company, Limited (AD-9901 FIB System)

-

Veeco Instruments Inc. (Nexus IBE)

-

Eurofins Scientific (FIB Services)

-

Delong Instruments a.s. (LVEM5 Electron Microscope)

-

Fibics Incorporated (FIBICS FIB Solutions)

-

Zyvex Labs LLC (Zyvex LithoEtch)

-

Ionoptika Ltd. (J105 FIB-TOF)

-

Nanosurf AG (FlexAFM with FIB)

-

Oxford Instruments plc (OmniProbe 400)

Recent Trends

-

In October 2024, ZEISS launches Crossbeam 550 Samplefab FIB-SEM, an automated system for high-precision TEM sample preparation, enabling hands-free lamella production with over 90% automation yield.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.37 Billion |

| Market Size by 2032 | USD 2.56 Billion |

| CAGR | CAGR of 7.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ga+ Liquid Metal, Gas Field, Plasma) • By Application (Failure Analysis, Nanofabrication, Device Modification, Circuit Edit, Counterfeit Detection) • By Vertical (Electronics & Semiconductor, Industrial Science, Bioscience, Material Science) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., ZEISS International, Hitachi High-Tech Corporation, JEOL Ltd., TESCAN ORSAY HOLDING a.s., Raith GmbH, A&D Company Limited, Veeco Instruments Inc., Eurofins Scientific, Delong Instruments a.s., Fibics Incorporated, Zyvex Labs LLC, Ionoptika Ltd., Nanosurf AG, Oxford Instruments plc. |