Optical Emission Spectroscopy Market Size:

The Optical Emission Spectroscopy Market was valued at USD 732.90 million in 2023 and is expected to reach USD 1261.76 million by 2032, growing at a CAGR of 6.26% from 2024-2032.

To Get more information on Optical Emission Spectroscopy Market - Request Free Sample Report

The Optical Emission Spectroscopy (OES) Market report provides insights into adoption trends and industry utilization of OES, with the key areas covered being metallurgy, mining, and aerospace. It presents regional OES usage trends, with dominant and growing markets highlighted. The report also provides projections of OES equipment volume with a prospective perspective for technology adoption. Further, it presents spending trends within government, industrial, and private sectors, with the trends in investments highlighted. A distinctive aspect is an analysis of regulatory and compliance trends, reviewing changing standards that dictate OES adoption, and providing an in-depth knowledge of compliance requirements applicable to specific industries.

Optical Emission Spectroscopy Market Dynamics

Drivers

-

Rising Demand for Quality Control and Material Testing in Manufacturing Industries propelling the Optical Emission Spectroscopy Market.

The growing demand for rigorous quality control and material analysis in industries like metallurgy, automotive, and aerospace is a key driver of the Optical Emission Spectroscopy (OES) market. OES is extensively applied to determine the chemical composition of metals and alloys to meet safety and performance requirements. The automotive industry, for example, is seeing rapid expansion in electric vehicle (EV) manufacturing, where high-precision material analysis is needed to maximize battery performance and lightweight parts. Some recent breakthroughs include the introduction by Thermo Fisher Scientific of a semi-quantitative analysis tool for ICP-OES in April 2024, further increasing the capacity to analyze unknown samples effectively. Moreover, increasing needs for sophisticated material testing in foundries and factories are fueling the implementation of OES technology.

-

Technological Advancements in Optical Emission Spectroscopy driving the market growth.

Optical Emission Spectroscopy advancements, including better detector sensitivity, automation, and artificial intelligence (AI)-)-enabled data analysis, are driving market expansion. Next-generation OES systems currently utilize solid-state detectors (SSD) and hybrid detection technologies to improve accuracy and speed. The availability of cloud-based spectroscopy solutions permits real-time sharing of data and remote diagnostics, cutting downtime and enhancing efficiency. For example, in 2023, Hitachi High-Tech introduced a next-generation OES system with improved argon-purge optics for better detection limits in the analysis of ultra-low carbon steel. Furthermore, the growing usage of Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) for environmental monitoring and pharmaceutical applications is propelling market growth. The increasing use of AI-driven analytical software in spectroscopy is likely to further automate workflows and enhance precision, driving growth in the OES market.

Restraint

-

High Initial Investment and Maintenance Costs Restraining the Optical Emission Spectroscopy Market.

One of the biggest constraints in the Optical Emission Spectroscopy (OES) industry is the heavy initial investment and regular maintenance charges involved in such sophisticated analytical systems. OES systems, especially Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) systems, demand high capital outlay for procurement, installation, and calibration. Moreover, operational expenses, such as the requirement for high-purity argon gas, maintenance, and periodic software updates, contribute to the cost, particularly for small and medium-sized businesses. The complexity of operating systems also requires expert employees, further adding training and labor costs. Regardless of declining costs due to technological improvements over time, affordability is an important issue. Budget-constrained firms can use other, less expensive analytical methods like X-ray fluorescence (XRF) spectroscopy to limit the more extensive application of OES across price-sensitive industries.

Opportunities

-

With growing global environmental regulations and a greater emphasis on green industrial practices, the Optical Emission Spectroscopy (OES) market holds opportunities in environmental monitoring.

Governments and regulatory agencies like the Environmental Protection Agency (EPA) and the European Environment Agency (EEA) are implementing strict emission control policies, which are propelling demand for accurate metal and pollutant analysis in air, water, and soil. OES, especially ICP-OES, is extensively employed for trace detection of heavy metals in industrial effluents, potable water, and crop samples. Increased pollution concerns, combined with advances in automation and real-time monitoring, have motivated industries to make investments in OES technology. The introduction of portable and field-deployable OES instruments is further expanding market penetration, generating new revenues for manufacturers supplying the environmental testing market.

Challenges

-

One of the biggest challenges in the Optical Emission Spectroscopy (OES) market is the complexity of standardization and calibration across industries and applications.

OES analyzers need highly accurate calibration standards to provide proper elemental analysis, which can depend on the sample matrix, sample type, and the presence of interfering elements. In applications such as metallurgy, mining, and environmental testing, minute deviations from calibration cause results to vary, affecting quality control and compliance with regulations. Various manufacturers employ proprietary software and calibration practices, so cross-platform standardization is problematic. Continuous recalibration resulting from instrument drift or varying operating conditions further complicates repetitive analysis. These challenges can be overcome through enhanced automation in calibration processes, standardization of industry standards, and software-driven analytical corrections to improve reproducibility and usability.

Optical Emission Spectroscopy Market Segmentation Analysis

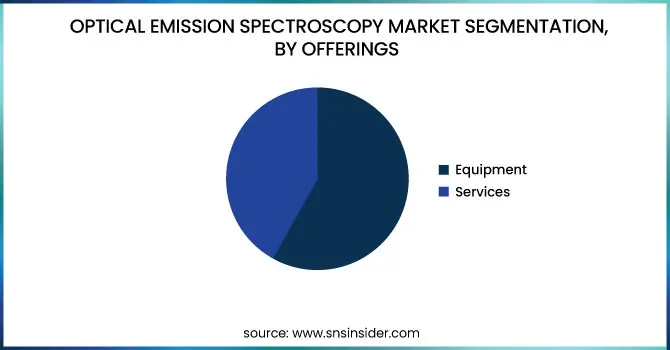

By Offerings

The equipment division dominated the Optical Emission Spectroscopy (OES) market in 2023 with a 62.31% market share, following the widespread uptake of high-technology spectrometers across the metallurgy, mining, automobile, and aircraft industries. Improving focus on material quality checking, meeting regulatory requirements for stringency, and greater dependency on accuracy analytical instrumentation have boosted high-performance OES equipment demand such as Arc/Spark OES and Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) systems. The leading players like Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer are continuously launching innovative, high-throughput OES solutions to increase efficiency and precision in elemental analysis. In addition, as processes across industries are increasingly automated, demand for benchtop and portable spectrometers has increased, supporting the segment's market leadership.

The services segment is experiencing the fastest growth during the forecast period as the demand for instrument calibration, maintenance, and software updates grows to improve the performance and lifespan of OES equipment. With OES systems becoming increasingly sophisticated and integrated with digital technologies, industries need specialized support services such as training, data analysis consulting, and remote monitoring to maximize instrument performance. Furthermore, the increasing trend of outsourcing analytical services to third-party contract research organizations (CROs) and third-party laboratories is driving the demand for specialized OES-related services. Increasing regulatory compliance demands and requirements for high-accuracy material testing are compelling companies to invest in post-sales support and service contracts, which is propelling the growth of the services segment in the Optical Emission Spectroscopy market.

By Form Factor

The benchtop segment dominated the Optical Emission Spectroscopy (OES) market with a 70.14% market share in 2023 because of its higher accuracy, stability, and broad applications in industries like metallurgy, mining, aerospace, and automobile. Benchtop OES systems provide precise elemental analysis and are the most sought-after by laboratories and manufacturing plants that need reliable material testing and quality assurance. These instruments come with sophisticated technologies, including Photomultiplier Tubes (PMT) and Solid-State Detectors (SSD), which improve their analytical capabilities for trace element detection. They are also used in high-volume sample testing industries based on the toughness and versatility of benchtop OES to test a variety of metal and non-metal samples. With top players like Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer regularly developing benchtop models, this segment continued to be the most preferred option in 2023.

By Product

The Arc/Spark Optical Emission Spectroscopy segment dominated the market in 2023 with a 64.15% market share because of its extensive use in metallurgy, foundries, and manufacturing sectors for accurate metal analysis. The technology is extremely efficient in identifying the composition of solid metal samples and hence is the first choice for quality control in steel production, aluminum processing, and automotive industries. Arc/Spark OES provides fast, precise, and reproducible results, with adherence to industry standards for material inspection. Further, high-energy discharge technology evolution and automation have enhanced the efficiency of Arc/Spark OES devices, increasing their demand as well. With prominent companies such as Hitachi High-Tech Analytical Science, Bruker Corporation, and SPECTRO Analytical Instruments developing improved Arc/Spark OES, the segment dominated the market even in 2023.

By Detector

The Solid state detector (SSD) segment dominated the Optical Emission Spectroscopy (OES) Market with a 45.62% market share in 2023 because of its higher sensitivity, speed, and longevity over conventional photomultiplier tube (PMT) detectors. SSDs provide better resolution and quicker signal processing, which makes them suitable for applications that demand accurate elemental analysis, including metallurgy, mining, and environmental testing. In addition, SSD technology is smaller, more energy efficient, and less expensive, which has contributed to its broad application in contemporary OES instruments. Accelerating the growing need for real-time and high-throughput analysis in research labs and industrial quality control further pushed the use of SSDs. Recent developments of CMOS and CCD-based solid-state detectors have improved detection precision and dynamic range, further enhancing the utility of SSDs as the next-generation OES system choice.

By Application

The Chemical Composition Analysis segment dominated the market with 43.06% market share in 2023 because of its importance in material authentication, identification of alloys, and analysis of elements in various industries. OES is greatly depended upon by industries including metallurgy, aerospace, automotive, and manufacturing for accurate chemical characterization of raw materials as well as finished products to certify that they meet the requirements of regulatory norms and quality standards. The increasing need for high-purity metals, advanced alloys, and composite materials has further accelerated the demand for strong chemical composition analysis. Furthermore, improvements in Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) and Arc/Spark OES have improved accuracy, speed, and sensitivity, making them unavoidable for laboratories and industrial use. With more stringent material safety regulations and rising quality control requirements, this segment remained the market leader in 2023.

By End Use

The Metallurgy and Foundries segment dominated the market with a 27.41% market share in 2023 because of the widespread application of OES in metal production, processing, and quality assurance. OES is a critical technology in the metallurgy sector for the analysis of the chemical composition of metals and alloys to comply with industry standards and material specifications. As the requirement for high-strength metals accelerates in building, automotive, aviation, and heavy machinery applications, producers come to depend upon OES in detecting trace contaminants, managing contaminants, and providing product uniformity. In addition, more demanding government regulations towards metal purity as well as assurance of quality necessitated extensive applications of OES in foundries. The capability of Arc/Spark OES and ICP-OES to offer fast, precise, and economical elemental analysis has further reinforced the market dominance of the segment.

Optical Emission Spectroscopy Market Regional Insights

North America dominated the Optical Emission Spectroscopy (OES) market with a 43.24% market share in 2023, owing to the established industrial base, strict regulatory requirements, and high usage of sophisticated analytical technologies. The region has a strong base of leading market players, such as Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer, driving innovation and ongoing development of OES solutions. Moreover, stringent environmental regulations imposed by organizations like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) require accurate metal analysis in metallurgy, automotive, and oil & gas industries. The region's investment in research and development, combined with its leadership in quality control and material testing applications, has further entrenched its supremacy. Additionally, U.S. and Canadian aerospace and defense industries greatly depend on OES for component testing and failure analysis, supporting North America's dominance in the industry.

Asia Pacific is witnessing the fastest growth in the Optical Emission Spectroscopy (OES) market with a 7.35% CAGR throughout the forecast period due to Manufacturing and infrastructure, and growing demand for quality control in major industries. China, India, Japan, and South Korea are increasing their metallurgy, automotive, and semiconductor sectors, which are fueling the demand for sophisticated material analysis methods like OES. The booming mining and metal production industry in China and Australia has also boosted the use of OES for ore and alloy analysis. Also, rising environmental issues and tighter regulatory norms in countries such as China and India on emissions as well as wastewater treatment are driving the adoption of OES solutions in environmental testing. With technological shifts, high foreign investments, and a transition towards automation, Asia Pacific is expected to dominate the market growth throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Optical Emission Spectroscopy Market

-

Thermo Fisher Scientific Inc. (iCAP 7000 Plus Series ICP-OES, ARL iSpark Series Optical Emission Spectrometers)

-

PerkinElmer Inc. (Avio 500 ICP-OES, Optima 8000 ICP-OES)

-

Agilent Technologies Inc. (5100 ICP-OES, 5800 ICP-OES)

-

Horiba Ltd. (Ultima Expert ICP-OES, GD-Profiler 2)

-

Hitachi High-Tech Analytical Science (FM EXPERT Optical Emission Spectrometer, OE750 Optical Emission Spectrometer)

-

Bruker Corporation (Q4 TASMAN Series, Q8 MAGELLAN)

-

SPECTRO Analytical Instruments GmbH (SPECTRO ARCOS ICP-OES, SPECTROLAB S)

-

Shimadzu Corporation (ICPE-9800 Series, ICPE-9000 Series)

-

Analytik Jena AG (PlasmaQuant PQ 9000, PlasmaQuant PQ 9100 Elite)

-

GBC Scientific Equipment (Integra XL ICP-OES, OptiMass 9500)

-

Teledyne Leeman Labs (Prodigy Plus ICP-OES, Prodigy DC Arc)

-

Rigaku Corporation (NEX DE VS, Supermini200)

-

Spectro Scientific (Spectroil M Series, Spectroil Q100)

-

Oxford Instruments plc (Foundry-Master Pro2, PMI-Master Pro2)

-

Malvern Panalytical Ltd. (Zetium, Epsilon 4)

-

Skyray Instrument Inc. (ICP-2060T, ICP-5000)

-

Belec Spektrometrie Opto-Elektronik GmbH (Belec Compact Port HLC, Belec Vario Lab)

-

Luvata Group (OES-5500, OES-6500)

-

Angstrom Advanced Inc. (AA-7000 ICP-OES, AA-5000 ICP-OES)

-

Qualitest International Inc. (Q4 Mobile, Q6 Mobile)

Suppliers (These suppliers provide essential components, consumables, and raw materials required for Optical Emission Spectroscopy (OES) instruments and operations.)

-

Avantor, Inc.

-

Merck KGaA

-

Sigma-Aldrich Corporation

-

Thermo Fisher Scientific Inc.

-

PerkinElmer Inc.

-

Agilent Technologies Inc.

-

Bruker Corporation

-

Shimadzu Corporation

-

Hitachi High-Tech Analytical Science

-

HORIBA, Ltd.

Recent Development in Optical Emission Spectroscopy Industry

-

In April 2024, Thermo Fisher Scientific launched a new semi-quantitative analysis instrument for inductively coupled plasma-optical emission spectroscopy (ICP-OES). The new solution is meant to improve the identification of unknown samples by making the analytical process easier. Through this innovation, Thermo Fisher seeks to enhance efficiency in elemental analysis and help achieve a cleaner and safer environment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 732.90 million |

| Market Size by 2032 | US$ 1261.76 million |

| CAGR | CAGR of 6.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings (Equipment, Services) • By Form Factor (Benchtop, Portable) • By Product (Arc/Spark OES, ICP-OES [Inductively Coupled Plasma]) • By Detector (Photomultiplier Tube [PMT], Solid State Detector [SSD], Hybrid) • By Application (Chemical Composition Analysis, Material Testing and Quality Control, Environmental Testing, Research and Development) • By End Use (Metallurgy and Foundries, Mining and Exploration, Automotive, Aerospace and Defense, Oil and Gas, Food and Beverages, Metals and Heavy Machinery, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies Inc., Horiba Ltd., Hitachi High-Tech Analytical Science, Bruker Corporation, SPECTRO Analytical Instruments GmbH, Shimadzu Corporation, Analytik Jena AG, GBC Scientific Equipment, Teledyne Leeman Labs, Rigaku Corporation, Spectro Scientific, Oxford Instruments plc, Malvern Panalytical Ltd., Skyray Instrument Inc., Belec Spektrometrie Opto-Elektronik GmbH, Luvata Group, Angstrom Advanced Inc., Qualitest International Inc., and other players. |