OTR Tires Market Size:

Get More Information on OTR Tires Market- Request Sample Report

The OTR Tires Market size was valued at USD 10.72 billion in 2023, and is expected to reach USD 18.11 billion by 2032, and grow at a CAGR of 5.48% over the forecast period of 2024-2032.

The growing construction and mining industries are important, with a projected 15% rise in equipment needs anticipated in emerging economies. This leads to a significant rise in the need for tires designed specifically to endure the tough conditions present in these sectors. The increase in the global population has led to a higher demand for food production, causing a 40% rise in the utilization of heavy machinery on farms. This rise demands dependable OTR tires that can withstand tough agricultural environments. As per industry experts, remanufacturing old tires can greatly extend their lifespan, providing the opportunity to save as much as 70% in comparison to buying new tires. The focus on retreading shows a growing trend towards more cost-effective choices in the OTR tire sector.

SNS Insider predicts a strong 6.7% increase in construction spending in the United States in 2024, which could lead to higher demand for off-the-road (OTR) tires. On the other hand, changes in worldwide commodity prices have a substantial effect on the level of demand. An increase of 12% in rubber prices in Q2 2024 could encourage consumers to postpone replacing tires, affecting immediate demand. Government regulations also have a part to play. Strict regulations on emissions for off-road vehicles are driving manufacturers to develop fuel-efficient off-the-road tires. It is projected that by 2027, this shift will make up more than 30% of the automotive off-the-road tire market, influenced by regulations such as the EU's Stage EV emission standards. In conclusion, extreme weather events have the potential to interrupt the demand for OTR tires. For instance, an increase in floods and hurricanes may cause a temporary rise in the need for new tires for emergency vehicles and equipment used for disaster relief.

Market Dynamics

Drivers:

-

OTR tires are used on tractors, harvesters, and sprayers in the agricultural industry. Advancements in technology in agriculture, such as precision farming and self-driving equipment, continue to increase the need for OTR tires in the sector.

-

OTR tires are essential in various infrastructure projects such as roads, bridges, and buildings. Government funding for infrastructure development presents substantial growth potential for the OTR tire market.

-

Advancements could reduce downtime for equipment operators and improve productivity levels.

Enhancements in materials and construction methods have resulted in a notable 30% boost in tire lifespan, greatly cutting down on the time spent on repairs and replacements. Furthermore, advanced tread patterns with increased depth and self-cleaning capabilities have improved traction on various terrains by 25%, reducing slipping and increasing efficiency. Moreover, improvements in compounds with low rolling resistance have led to fuel efficiency increases of up to 10%, resulting in significant savings for operators. In addition to these fundamental enhancements, there is great potential for further innovative technologies in the future. Exciting advancements in self-repairing features and built-in tire monitoring technologies will continue to transform the OTR tire industry.

Restrains:

-

The OTR tire industry constantly struggle with maintaining durability for challenging off-road environments while also prioritizing fuel efficiency for budget-conscious operators.

-

The fast progress in autonomous vehicles in construction and mining poses a challenge for the OTR tire industry, prompting the need to adjust to potential changes in usage patterns.

-

Changes in the prices of raw materials, specifically rubber, lead to uncertain cost challenges for manufacturers of OTR tires.

Rubber, which is the main ingredient, goes through major changes because of factors such as weather affecting its growth in Southeast Asia, the leading region for production, and varying demand from the automotive industry. In North America, profit margins for OTR tire companies were squeezed as prices increased by an average of 9.39% in Q1 2024. Forecasting production costs and setting stable prices becomes challenging due to this volatility. Nevertheless, the sector is taking comfort in progress. The creation of High Flexural Strength (HFS) compounds is decreasing the dependence on natural rubber by integrating recycled materials such as tire crumb, reducing the dependency on unstable natural resources.

Market Segmentation:

By Vehicle Type

Construction & Industrial Equipment has a significant market share of about 40%, mainly because loaders, dozers, and forklifts are in high demand in these industries. Mining is a close second at approximately 35%, since large haul trucks need unique OTR tires for heavy loads and tough conditions. About 20% of agricultural vehicles consist of tractors that require tires capable of navigating different terrains and weather conditions. The remaining 5% is represented by the segment known as "Others," which includes ATVs and specialty vehicles.

Progress is constantly transforming the off-the-road tire industry. Solid tires, which are especially favoured in the mining industry for their ability to resist punctures, are now being enhanced to provide better shock absorption, resulting in a more comfortable ride. Researchers are investigating biodegradable materials for a more sustainable future, as well as improving retreading technologies to prolong tire lifespan and decrease waste.

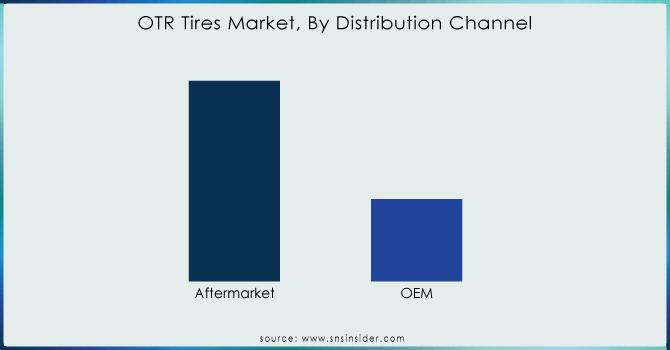

By Distribution Channel

Controlling approximately 70% of the market, the aftermarket sector holds a strong advantage. The reason for OTR tires' dominance is the fact that they have a short lifespan due to the tough conditions they endure. These tires undergo regular testing in mining, agriculture, and construction settings, leading to a high demand for replacements. The OEM industry provides tires already mounted on new heavy equipment and makes up roughly 30% of the market. Experiencing rapid growth alongside increased investments in new machinery for construction, mining, and agriculture, this sector aligns with the production schedules of equipment manufacturers.

Need any customization research on OTR tires market - Enquiry Now

Regional Analysis:

APAC region held the dominant share of 42% in 2023 in OTR tires market. China, a dominant force in the construction and mining industries, accounts for 40% of the demand due to its abundant mineral reserves and the "Made in China 2025" program. India is right behind at 25%, driven by a thriving agricultural industry and increasing infrastructure projects that are boosting the use of OTR tires. Nevertheless, the aftermarket sector is successful alongside the original equipment manufacturer sector with a share of almost 45%, underscoring the important function of post-purchase maintenance in maintaining the large fleet of machinery operational. Innovation is playing a prominent role as well, with developments such as self-repairing tires using sealants to fix punctures automatically, cutting down on downtime and expenses for operators of OTR vehicles.

Government spending on infrastructure projects such as road and building construction has seen a significant increase, with some countries reaching up to 70%. This results in a significant requirement for large equipment, driving the need for OTR tires. Additionally, progress in agriculture in these areas is causing a 60% increase in high-powered tractors, which is also boosting the demand for agricultural OTR tires. It is intriguing that there is an increasing trend towards retreading, where new rubber tread is added to old tires, resulting in potential cost savings of up to 50%. This tendency shows not only economic factors but also an increasing environmental awareness in the sector.

Key Players:

Michelin, Titan International, Apollo Tyres Ltd, Cheng Shin Tire, Bridgestone, Toyo Tire Corp, Goodyear, Continental AG, Pirelli & C S .P.A and others.

Recent Developments:

Michelin: Announced a significant investment of USD 750 million in their Lexington, South Carolina plant to expand radial earthmover tire production, targeting the growing construction equipment market in the Americas. This highlights their focus on radial tires, a trend gaining traction due to superior performance and durability.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.72 billion |

| Market Size by 2032 | US$ 18.11 billion |

| CAGR | CAGR of 5.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle Type (Mining, Agricultural Vehicle, Construction & Industrial Equipment, Others) • by Construction Type (Radial, Bias, Belted Bias) • by Distribution Channel (Aftermarket, OEM) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cheng Shin Tire, Michelin, Titan International, Apollo Tyres Ltd, Continental AG, Bridgestone, Toyo Tire Corp, Goodyear, Pirelli & C S .P.A and others |

| Key Drivers | • OTR tires are used on tractors, harvesters, and sprayers in the agricultural industry. Advancements in technology in agriculture, such as precision farming and self-driving equipment, continue to increase the need for OTR tires in the sector. • OTR tires are essential in various infrastructure projects such as roads, bridges, and buildings. Government funding for infrastructure development presents substantial growth potential for the OTR tire market. |

| RESTRAINTS | • The OTR tire industry constantly struggle with maintaining durability for challenging off-road environments while also prioritizing fuel efficiency for budget-conscious operators. • The fast progress in autonomous vehicles in construction and mining poses a challenge for the OTR tire industry, prompting the need to adjust to potential changes in usage patterns. |