Packaging Machinery Market Report Scope & Overview:

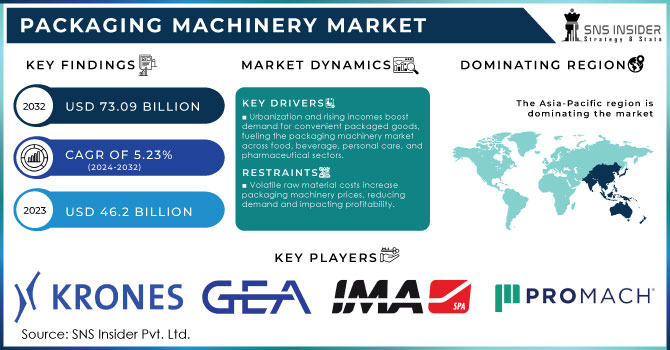

The Packaging Machinery Market size was valued at USD 46.2 Billion in 2023 and is expected to reach USD 73.09 Billion by 2032, propelling at a CAGR of 5.23% during the forecast period of 2024-2032.

Get More Information on Packaging Machinery Market - Request Sample Report

The Packaging Machinery market analysis highlights the increasing need for faster production, improved accuracy, and meeting consumer demand for packaged goods through automation. Processed food and beverages offer advantages in terms of convenience, simplicity, and saving time. These features of packaged food and drinks are what drive consumers to purchase these products. The increasing number of millennials and Gen-Z in consumer demographics is expected to increase the demand for convenient products. In addition, progress in technology and creativity is driving the expansion.

Technology advancements, such as automation, robots, and other devices are expanding the reach of products across various industries. Food was the leading customer sector in Europe 2023, accounting for 30.9% of the total turnover at €2.856 billion, with an export intensity of 74.5%. The second most important sector is beverages, accounting for 26.2% of the overall revenues. 83.3% of sales in this sector are allocated for foreign markets. The main packaging machine group continued to lead with 52.4% of revenue, while the end-of-line, labelling, and ancillary equipment sector followed with 27.2%, and the remaining 20.4% was attributed to secondary packaging.

By 2030, the U.S. packaging machinery market is estimated to undergo significant improvements, as more than 60% of machines will be automated and equipped with the Internet of Things. This figure is expected to promote efficiency and reduction of labor costs in the segment. The market is projected to expand at a rate of 7% annually in relation to machinery aimed for the needs of biodegradable and recyclable materials, which indicates a strong packaging machinery market trends toward sustainability, and more and more participants engage in using eco-friendly packaging for their goods. Besides, it is expected that within a shorter period to 2027, there will be a 15% share in sales related to customized and flexible solutions.

Packaging Machinery Market Dynamics:

Drivers:

-

Urbanization and Rising Incomes Boost Demand for Convenient Packaged Goods, Fueling the Packaging Machinery Market Across Different Sectors

The increasing demand for convenience and packaged products globally is greatly impacted by the quick urbanization and growth in incomes. With the increase in urban population, there is a growing need for fast, simple meals, and products that can be consumed on the move, indicating a trend toward convenience-focused lifestyles, further propelling the packaging machinery market growth. This pattern is especially noticeable in the use of pre-prepared meals, drinks, grooming products, and medicines, as customers look for items that easily integrate into their hectic schedules. The increasing need for packaged goods has a direct influence on the packaging machinery sector, which is essential for the successful and productive manufacturing process of these products.

Packaging machinery needs to adjust to changing industry requirements by offering solutions that improve speed, efficiency, and product quality. Due to this, manufacturers and suppliers of packaging machinery are facing an increase in demand, driven by the requirement to keep up with the growing market for convenient and packaged goods. This growing need for advanced packaging solutions highlights the vital importance of packaging machinery in satisfying contemporary consumer demands and aiding the overall packaged goods sector.

-

Sustainability Prioritizes Eco-friendly Materials and Waste Reduction, Boosting Demand for Packaging Machinery Aligned with these Goals

Focus on sustainable and environmentally friendly packaging is key in current environmental initiatives, emphasizing the utilization of recyclable and biodegradable materials to decrease ecological footprints and cut down on waste. This method is guided by the rising expectations from consumers and regulations for more environmentally-friendly practices, and a greater recognition of environmental concerns.

Businesses are embracing sustainable practices to comply with global environmental objectives, causing an increased need for packaging machinery that can handle these materials. One example is the growing demand for machinery that can process biodegradable films, compostable containers, and recycled materials. This change not only reduces carbon emissions but also improves brand image and meets environmental guidelines. Consequently, there is a notable increase in demand for advanced, environmentally-friendly packaging options and the equipment that goes with them, in line with the overall shift toward environmental consciousness and efficient use of resources, further aiding the packaging machinery market expansion.

Restraints:

-

Volatile Raw Material Costs Increase Packaging Machinery Prices, Reducing Demand and Impacting Profitability

Fluctuations in prices of raw materials including steel, aluminum, and plastics have a significant effect on the manufacturing industry, particularly in packaging machinery, hampering the growth of the packaging machinery market. When the prices of these essential materials vary unexpectedly, manufacturing costs for equipment increase, potentially causing disruptions in manufacturers' overall cost framework. When production costs rise, companies must choose between absorbing them or passing them on to customers as higher prices.

Using the latter method could result in lower demand owing to the increased prices might discourage potential purchasers or cause current clients to look for more affordable options. This scenario presents a dual challenge for companies to both retain their market share and manage their profits effectively by striking a balance between increasing expenses and staying competitive with pricing. To cope with these changes, strategic planning and efficiency enhancements are needed to reduce the impact on financial performance.

Packaging Machinery Market Segmentation Outlook:

By Type

The Form-Fill-Seal type is holding the dominant packaging machinery market share of around 35.4%. The dominance is driven by all-in-one operation of formation of the packaging material, filling of the product, and sealing. This type is highly efficient and widely used in the food and beverage sector. This type of machine is used for high-production manufacturing serve, pack, and shipping of edible goods. Thus, saving time and money due to speed and efficiency in sealing and vacuum sealing of products.

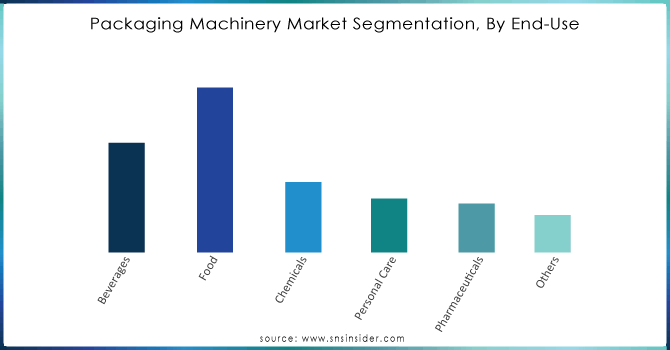

By End-Use

The Food is dominating the packaging machinery market with a share of around 36.2%, and the rising need for packaged food for convenience and the rising consumption of organic food product requiring specialized packaging solution are likely to augment the demand for packaging equipment. In addition to this, automation and industry 4.0 is expected to help in enhancement of productivity and provide safety without and human intervention.

Need any customization research on Packaging Machinery Market - Enquiry Now

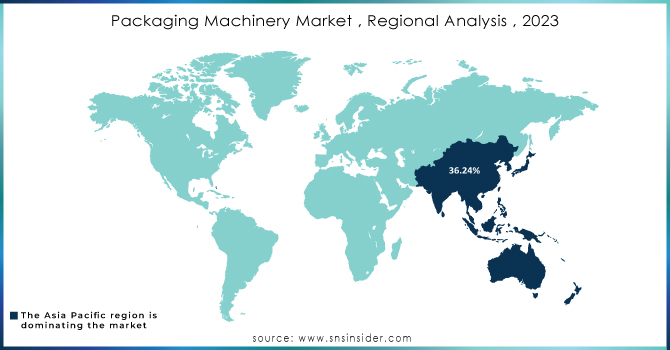

Packaging Machinery Market Regional Analysis:

Asia Pacific is the leading region in the packaging machinery market with a share of about 36.24% of the total market. It was due to rapid growth of population and rising purchasing power of consumers throughout the region creating the demand for packaged goods. Also, the rising e-commerce industry is supporting to grow the market.

North America is experiencing rapid growth due to high demand for automation and technological advancements in sectors including food and beverage, pharmaceuticals, and e-commerce. The growing demand for effective packaging solutions to meet higher consumer expectations and strict regulatory standards has driven the adoption of advanced packaging machinery.

Key Players in Packaging Machinery Market are :

The major key players are Krones AG, GEA Group, M.A. Industria Macchine Automatiche S.p.A., Tetra Laval International S.A., ProMach, Aktiengesellschaf, Syntegon Technology GmbH, Coesia S.p.A., Duravant, Maillis Group and others.

Recent Developments

-

In November 2023, ELITER Packaging Machinery launched GRAN SONATA its newly designed and enhanced automatic cartooning machine, featuring an open profile, multi-axis servo drive system, and stainless-steel construction offering a compact secondary and tertiary packaging automation option that can handle both large-sized cartooning and medium-sized case packing.

-

In May 2023, Barry-Wehmiller unveiled its new facility in Minnesota, US, to develop innovative packaging machinery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 46.2 Billion |

| Market Size by 2032 | US$ 73.09 Billion |

| CAGR | CAGR of 5.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (General Packaging, Modified Atmosphere Packaging, Vacuum Packaging) • By Type (Filling, Labeling, Form-Fill-Seal, Cartooning, Wrapping, Palletizing, Bottling Line, Others) • By End Use (Beverages, Food, Chemicals, Personal Care, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Krones AG, GEA Group, M.A. Industria Macchine Automatiche S.p.A., Tetra Laval International S.A., ProMach, Aktiengesellschaf, Syntegon Technology GmbH, Coesia S.p.A., Duravant |

| Key Drivers | • Urbanization and rising incomes boost demand for convenient packaged goods, fueling the packaging machinery market across food, beverage, personal care, and pharmaceutical sectors. • Sustainability prioritizes eco-friendly materials and waste reduction, boosting demand for packaging machinery aligned with these goals. |

| RESTRAINTS | • Volatile raw material costs increase packaging machinery prices, reducing demand and impacting profitability. |