Palladium Market Report Scope & Overview:

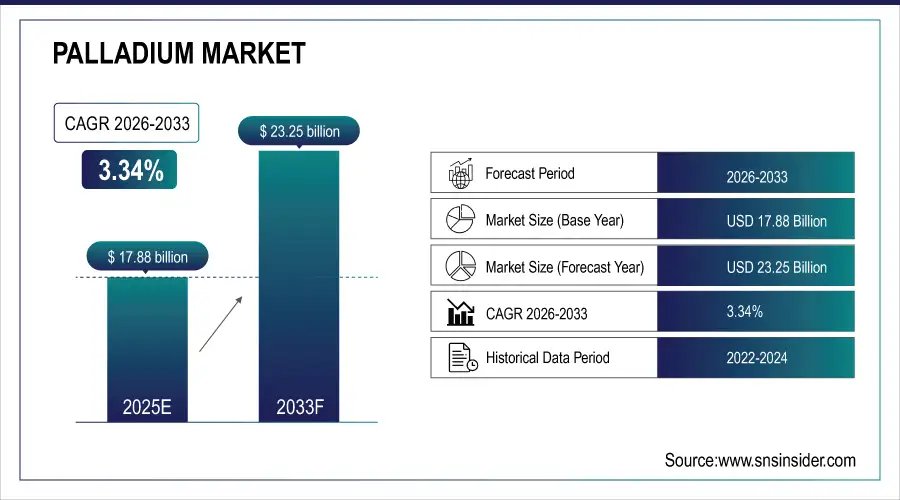

The Palladium Market size was valued at USD 17.88 Billion in 2025 and is expected to reach USD 23.25 Billion by 2033, growing at a CAGR of 3.34% over the forecast period 2026–2033.

The Palladium Market is experiencing strong growth, fueled by the automotive industry's shift toward cleaner exhaust technologies and the rising development of hydrogen-powered systems. Increasing demand for sustainable manufacturing and the metal’s superior catalytic properties are boosting its integration across industries. Moreover, surging investments in recycling and secondary refining technologies ensure long-term supply stability. Palladium’s high conductivity, chemical inertness, and corrosion resistance are further increasing its importance in energy transition, electronics manufacturing, and green technology development.

Palladium Market Size and Forecast

-

Market Size in 2025: USD 17.88 Billion

-

Market Size by 2033: USD 23.25 Billion

-

CAGR: 3.34% from 2025 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Palladium Market - Request Free Sample Report

Key Palladium Market Trends

-

Rising adoption of palladium in automotive catalytic converters due to tightening emission regulations.

-

Expanding use of palladium alloys in electronics and dentistry for high durability and conductivity.

-

Increasing recycling initiatives to counter limited ore supply and support sustainability.

-

Growing investments in hydrogen economy applications, including fuel cells.

-

Technological advances in extraction and refining improving production efficiency.

-

Market volatility driven by fluctuating mining output and geopolitical supply constraints.

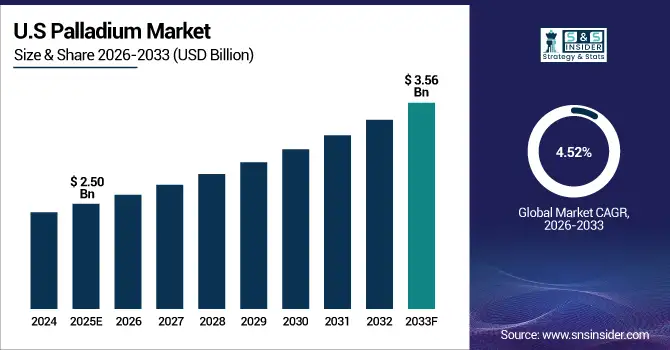

U.S. Palladium Market Insights:

The U.S. Palladium Market size was USD 2.50 billion in 2025 and is expected to reach USD 3.56 billion by 2033, growing at a CAGR of 4.52% over the forecast period of 2025–2033. According to a study, rising demand for emission-compliant vehicles and advanced electronics has significantly accelerated domestic consumption. This cause, increasing environmental regulation enforcement, effects greater investment in automotive catalysts and hydrogen-based systems. Market consolidation among refiners and recyclers ensures improved supply reliability and circular economy integration.

Palladium Market Drivers:

-

Rising Demand for Automotive Catalysts and Clean Energy Technologies Strengthens Palladium Market Growth

The drive for sustainable transport and emission control standards is significantly increasing palladium utilization in catalytic converters and fuel cells. This cause, stringent vehicular emission norms across the U.S., Europe, and Asia, effects soaring palladium demand for exhaust gas treatment. Moreover, expanding adoption of electric and hybrid vehicles requires advanced palladium-coated components to improve energy efficiency and reduce toxicity. Technological advancements in autocatalyst design and recycling expansion are stabilizing long-term usage patterns. The alignment between clean energy goals and palladium’s catalytic efficiency ensures strong, sustained market development.

In July 2025, Norilsk Nickel optimized its palladium refining process for autocatalyst applications, achieving a 12% increase in metal recovery efficiency and meeting tighter Euro 7 emission standards.

Palladium Market Restraints

-

Supply Constraints and Price Volatility Challenge Market Stability

Limited mining sources and concentrated supply from a few countries pose ongoing risks to market equilibrium. This cause, dependency on Russia and South Africa for over 70% of global palladium output, effects vulnerability to geopolitical and operational disruptions. Price volatility affects downstream industries like automotive and electronics, raising production costs and deterring long-term contracts. Furthermore, fluctuating labor conditions and mine maintenance delays add to market uncertainty. The restraint also pushes manufacturers to seek alternative materials, including platinum or recycled palladium, to reduce risk exposure.

In late 2024, labor strikes in South Africa led to over a 9% decline in monthly palladium supply, causing temporary price spikes and reduced availability for industrial users.

Palladium Market Opportunities

-

Growing Role of Palladium in the Hydrogen Economy Creates Future Growth Prospects

Emerging hydrogen-based technologies are reshaping global demand patterns for palladium due to its superior catalytic and hydrogen absorption properties. This cause, rising focus on green hydrogen production, effects increased palladium demand in fuel cells and electrolyzers. The incorporation of palladium membranes in hydrogen purification and storage systems enhances operational efficiency and purity levels. Ongoing R&D on nano-palladium catalysts also opens avenues for lower-cost, high-performance solutions. As net-zero policies expand worldwide, palladium-based innovation will offer immense growth potential for industrial and energy applications.

In January 2025, Anglo American Platinum announced collaboration with the U.K. Hydrogen Taskforce to develop palladium membranes for scalable hydrogen purification systems, aiming to enhance fuel cell adoption across transport and power sectors.

Palladium Market Segment Analysis:

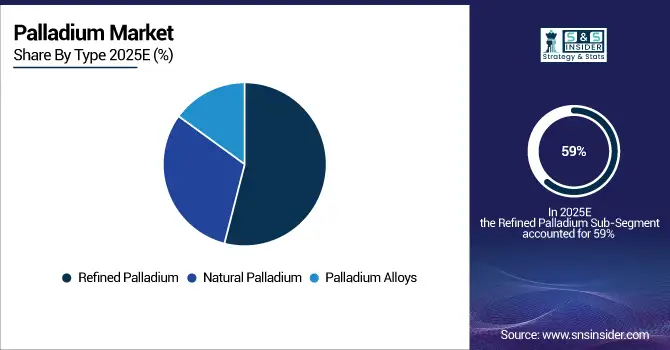

By Type, Refined Palladium Leads Market While Palladium Alloys Register Fastest Growth

The Refined Palladium segment dominates with a 59% revenue share in 2025E, supported by strong automotive and jewelry applications demanding high-purity metal. This cause, efficiency needs in catalytic converters and emission systems, effects growing investments in refining operations. Continuous developments in ore processing and recycling technologies further enhance refined palladium supply stability.

The Palladium Alloys segment, growing at the largest CAGR of 7.13%, benefits from increasing use in electronic components and dental materials. This cause, alloy strengthening and improved conductivity needs, effects expansion in high-durability connector and sensor production within electronics industries.

By Application, Automotive Leads Market While Electronics Registers Fastest Growth

The Automotive segment dominates with a 48% share in 2025E due to its primary use in vehicle catalytic converters. This cause, rising implementation of emission reduction mechanisms, effects expanded palladium demand from automakers meeting regulatory compliance. Refinery output adjustments ensure steady supply for green vehicle production.

The Electronics segment grows fastest at a 6.11% CAGR driven by increased miniaturization and sensor integration. This cause, ongoing semiconductor and circuit developments, effects more demand for palladium-coated contacts, plating materials, and connectors across advanced electronic devices.

By Form, Powder Leads Market While Bars Register Fastest Growth

In 2025E, the powder segment commands a 47% market share, driven by its extensive use in catalyst manufacturing and electronic coatings. Growing automation in catalyst processing ensures consistent palladium consumption across the chemical and automotive industries. The powder form enhances uniformity, reaction efficiency, and performance reliability, making it a preferred choice for advanced catalytic and electronic applications in both industrial and technological processes.

The bars segment records the fastest growth in 2025E, supported by increasing investment and hedging activities in precious metals. As investors seek to diversify their portfolios, palladium bars gain popularity as a stable and high-value asset. Institutional investors are showing stronger interest in palladium bullion holdings, viewing it as both a financial hedge and a strategic component of long-term investment strategies amid market uncertainty.

By End-Use, Automotive Leads Market While Electronics & Electrical Registers Fastest Growth

In 2025E, the automotive segment holds a dominant 49% market share, primarily due to stricter environmental compliance and the global shift toward green mobility. Rising production of electric and hybrid vehicles has increased the need for efficient catalytic systems and advanced sensors, both of which rely heavily on palladium. This growing integration underscores the metal’s vital role in emission control and sustainable automotive innovation.

The Electronics & Electrical segment is projected to grow at the fastest rate in 2025E, fueled by rising demand for compact, durable, and high-performance conductors. Technological advancements in microelectronics and miniaturized components have expanded palladium’s use in plating, capacitors, and circuit connections. Its superior conductivity, corrosion resistance, and reliability make palladium indispensable in modern electronic manufacturing, driving significant growth within this sector.

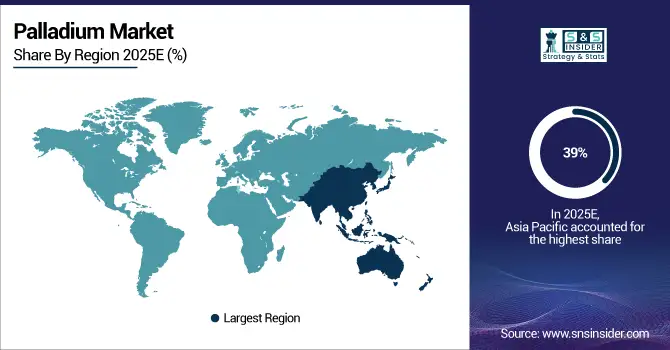

Palladium Market Regional Analysis:

Asia-Pacific Dominates the Palladium Market in 2025E

In 2025E, the Asia-Pacific region holds an estimated 39% share of the global palladium market, driven by rapid industrialization and expanding automotive manufacturing. Countries such as China, Japan, and South Korea lead in demand due to their strong focus on emission control technologies and electric vehicle production. Growing investments in refining capacity, recycling, and clean energy applications are further strengthening the region’s market dominance, making Asia-Pacific a crucial pillar in global palladium trade and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China’s Dominance in the Asia-Pacific Palladium Market, 2025

China stands as the largest consumer and refiner of palladium in the Asia-Pacific region, driven by rapid industrial electrification, stringent emission control standards, and expanding fuel cell programs. The nation’s advanced refining infrastructure and robust manufacturing base underpin its growing demand for palladium in automotive and clean energy applications. Additionally, strong government incentives promoting sustainable industries and technological innovation further reinforce China’s leadership position, solidifying its pivotal role in the regional palladium market for 2025.

North America Registers Fastest Growth in the Palladium Market in 2025E

This cause, clean energy investment surge and advanced vehicle manufacturing, effects accelerated palladium adoption in catalytic and electronic applications. The United States dominates North America due to robust automotive catalyst manufacturing, growing demand for hydrogen fuel solutions, and expanding recycling capacity. Major refiners and technology developers are increasing palladium recovery to strengthen supply chain resilience and meet sustainability mandates.

Europe Palladium Market Insights, 2025

The Europe Palladium Market in 2025 is witnessing steady growth driven by rising demand from the automotive, electronics, and jewelry sectors. Increasing adoption of palladium in catalytic converters for emission control and in hydrogen fuel cell technologies is enhancing market expansion. Sustainable mining practices and recycling initiatives are also influencing supply dynamics. Moreover, technological advancements and industrial innovations are expected to strengthen

-

Germany’s Leadership in Europe’s Palladium Market, 2025

Germany continues to dominate the European palladium market in 2025, fueled by its advanced automotive innovation, strong clean technology research and development, and leadership in recycling efficiency. The nation’s robust industrial infrastructure and commitment to sustainability have positioned it as a key hub for palladium recovery and utilization. Expanding partnerships between refineries and electric vehicle (EV) manufacturers further strengthen Germany’s market position, ensuring a competitive edge in Europe’s evolving green economy.

Middle East & Africa and Latin America, 2025

The Palladium Market in these regions shows stable growth led by investments in mining and refining capacity. South Africa leads MEA as one of the world’s largest producers of palladium, supporting global supply stability. In Latin America, Brazil shows rising adoption in automotive catalytic systems, driven by emission standard upgrades and growing industrial mobility.

Competitive Landscape for the Palladium Market

Norilsk Nickel

Norilsk Nickel, based in Russia, is the largest global palladium producer, contributing substantially to global supply. The company operates extensive mining, refining, and recycling facilities across Siberia. Its role in the Palladium Market is vital as it ensures consistent global availability, supporting automotive, electronics, and industrial applications.

-

In July 2025, Norilsk Nickel expanded its Norilsk and Kola refining capacities, enhancing annual palladium output by 8% and improving processing sustainability standards.

Sibanye Stillwater

Sibanye Stillwater, headquartered in South Africa, is a leading producer of platinum-group metals with integrated mining and recycling operations in the U.S. and Africa. The company supplies refined palladium primarily for automotive and clean energy sectors. Its strategic recycling initiatives strengthen palladium circular economy frameworks.

-

In March 2025, Sibanye Stillwater commissioned an advanced automated palladium recycling unit in Montana, increasing recovery efficiency by 15%.

Anglo American Platinum

Anglo American Platinum, a South Africa-based leader, operates world-class palladium mines and refineries. The company emphasizes sustainable extraction and clean energy metal supply. Its contributions to fuel cell and hydrogen applications underline palladium’s green economy potential.

-

In January 2025, Anglo American Platinum launched a hydrogen catalyst innovation hub to develop advanced palladium-based components for zero-emission vehicles and industrial systems.

Impala Platinum Holdings Limited (Implats)

Impala Platinum Holdings Limited, or Implats, is a prominent South African palladium and platinum producer with diverse mining operations. Its vertically integrated model ensures full-cycle production from extraction to refining. The company’s focus on refining innovation and workforce safety supports consistent, responsible palladium supply globally.

-

In June 2025, Implats completed a smelter modernization project in Rustenburg, cutting emissions by 18% while boosting palladium purity output for international catalyst manufacturers.

Palladium Market Key Players:

-

Norilsk Nickel

-

Sibanye Stillwater

-

Anglo American Platinum

-

Impala Platinum Holdings Limited (Implats)

-

Johnson Matthey

-

Vale S.A.

-

Glencore plc

-

Jinchuan Group Co., Ltd.

-

Sumitomo Metal Mining Co., Ltd.

-

First Quantum Minerals Ltd.

-

Chalice Mining Ltd.

-

Platinum Group Metals Ltd.

-

Southern Palladium Limited

-

Otto Chemie Pvt. Ltd.

-

Vineeth Precious Catalysts Pvt. Ltd.

-

Alfa Aesar

-

China North Industries Corp (NORINCO)

-

Manilal Maganlal & Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 17.88 Billion |

| Market Size by 2032 | US$ 23.25 Billion |

| CAGR | CAGR of 3.34 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural Palladium, Refined Palladium, Palladium Alloys) • By Application (Automotive, Electronics, Jewelry, Chemical Industry, Dental) • By End-Use Industry (Automotive, Electronics & Electrical, Jewelry, Chemical, Others) • By Form (Powder, Granules, Bars, Pellets, Foils) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Norilsk Nickel (Nornickel), Sibanye Stillwater, Anglo American Platinum, Impala Platinum Holdings Limited (Implats), Johnson Matthey, Heraeus, Vale S.A., Glencore plc, Jinchuan Group Co., Ltd., Sumitomo Metal Mining Co., Ltd., Umicore SA, First Quantum Minerals Ltd., Chalice Mining Ltd., Platinum Group Metals Ltd., Southern Palladium Limited, Otto Chemie Pvt. Ltd., Vineeth Precious Catalysts Pvt. Ltd., Alfa Aesar, China North Industries Corp (NORINCO), Manilal Maganlal & Company. |