Palm Methyl Ester Derivatives Market Report Scope & Overview

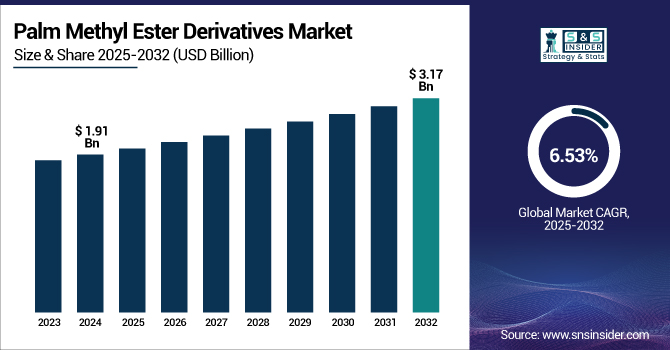

The Palm Methyl Ester Derivatives Market size was valued at USD 1.91 billion in 2024 and is expected to reach USD 3.17 billion by 2032, growing at a CAGR of 6.53% over the forecast period of 2025-2032.

To Get more information on Palm Methyl Ester Derivatives Market - Request Free Sample Report

Expansion of detergent and cleaning products drives the market growth. This is because of the increasing international demand for sustainable and bio-based cleaning products. With an increase in concern among consumers regarding the environment, we see a trend towards biodegradable, non-toxic, and renewable resource-based products, properties inherently present in palm methyl ester derivatives.

In August 2023, Vantage Specialty Ingredients made a strategic investment in Peter Cremer, North America, for palm methyl ester derivatives. This collaboration focuses on leveraging the oleochemical expertise of both companies to target growth opportunities in the biodiesel and personal care sectors, especially in emerging markets.

Moreover, due to various governments worldwide implementing stricter policies on environmental issues, as well as the promotion of green raw materials, palm methyl esters represent an interesting choice for manufacturers who would like to reduce their carbon footprint. The increasing demand for sustainable cleaning products and the rising demand for effective but gentle cleaning solutions are fueling the adoption of palm methyl ester derivatives, which are driving the palm methyl ester derivatives market growth.

Market Dynamics

Drivers

-

Rising Demand for Bio-Based Surfactants in Personal Care Products to Drive Market Growth

Due to the growing awareness of environmental protection, consumers prefer natural and sustainably sourced ingredients in personal care products such as shampoos, body washes, and facial cleansers. Mild, readily biodegradable, and lower environmental impact surfactants, often palm methyl esters, are being derived from bio-based sources versus petrochemical-based synthetics and developed as alternatives to more traditional synthetic surfactants. These surfactants provide rich and effective foaming and cleaning properties as compared to conventional surfactants with less harshness to the skin, making them suitable for sensitive skin systems. The company focused on launching new bio-based palm ester derivatives surfactants in the market.

For instance, the launch of Plantapon Soy by BASF in March 2022 represents a real stride for sustainable personal care ingredients.

This natural origin bio-based anionic surfactant is COSMOS approved, 100% natural origin, non-GMO soy protein (biodegradable), coconut oil-based, ISO 16128 compliant, and vegan. It is considered mild with evidence of eye irritation and patch tests, which helps make it suitable for sensitive skin formulations.

Restrain

-

Fluctuating Palm Oil Prices May Hamper the Market Growth

Palm oil price volatility impacts palm oil prices, significantly restraining the palm methyl ester derivatives (PMED) market assessment. Palm oil is the main raw material in the production of palm methyl esters, and its price is affected by many things, including weather events, geopolitical tensions, and changes in global demand. For instance, negative climatic conditions like droughts or floods in major palm oil-producing nations such as Indonesia and Malaysia can lower harvest yields, reducing palm oil supply and raising prices. Other contributing factors include trade restrictions and export policies, and global market dynamics, particularly changes in the prices of fuel.

Opportunity

-

Increasing Popularity of Palm Oil Certifications Creates Opportunities for Market Growth

The demand for sustainably harvested feedstocks is rising, particularly in the personal care, detergent, and biofuels sectors. The RSPO certification guarantees that palm oil is sustainable agriculture or produced with respect to environmental & social issues related to palm oil production, which raises the issues of deforestation, habitat destruction, and human rights. Such a certification gives an audit trail of accountability and transparency to in-house manufacturers to create a distinction for their products in a highly competitive market. Therefore, manufacturers of palm methyl ester derivatives who can provide RSPO-certified products may find themselves in higher demand, particularly as enterprises and consumers become increasingly aware of sustainable principles.

BASF has met its 2021 goal of sourcing 100% RSPO-certified palm (kernel) oil, purchasing 242,946 metric tons of certified palm kernel oil the total procurement volume for that year. This promise has also been integrated into the sustainability targets of BASF and contributes to the saving of more than 330,000 metric tons of CO₂ emissions in comparison to conventional sourcing.

Additionally, the company achieved 96% traceability of its global palm oil footprint to the oil mill level. This certification helped the company to build its goodwill in the market.

Segmentation Analysis

By Product

The Laurate segment held the largest palm methyl ester derivatives market share, around 31%, in 2024. It can be used in a wide range of applications, including personal care, cosmetics, and detergents. Laurates like lauric acid and its derivatives are popular due to their superior surfactant properties, making laurates suitable for cleaning, shampoo, body wash, and other end-use applications in personal care. This is what makes these derivatives such a great formulation in personal care, as they have brilliant cleansing and oil removing abilities, while being mild for sensitive skin.

Oleate held a significant market share and was the fastest-growing segment in the forecast period. Oleates are often added to skin creams, lotions, shampoos, and soaps as a natural emollient to help the skin become more hydrated and feel smoother and softer, which makes them a popular additive in many personal care products. This aligns with the market share of oleates, as there is an increasing demand for natural and bio-based products among consumers who want sustainable and eco-friendly products.

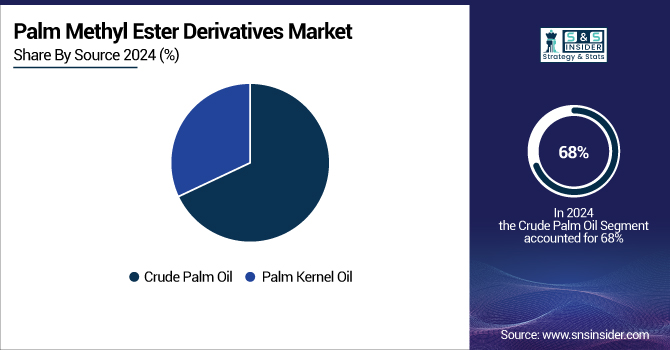

By Source

The Crude Palm Oil segment held the largest market share, around 68%, in 2024. CPO serves as the main feedstock for the production of palm methyl esters, which are further utilized for production in personal care, detergents, biofuel, and industrial applications. The oil palm is widely cultivated in many parts of the world, most dominantly in Indonesia and Malaysia, which guarantees a stable and large-scale production of crude palm oil, thus it easily found and economical for producers.

Palm Kernel Oil held a significant market share and was the fastest-growing segment in the forecast period. It is widely found in personal care products such as shampoos, soaps, and lotions due to their emulsifying and moisturizing nature. As consumers have become increasingly aware of the environmental impact of the products they use, PKO has been even more preferred for its biodegradability properties, as many companies now target more sustainable and eco-friendly ingredients.

By End-Use

The soaps & detergents segment held the largest market share, around 34%, in 2024. It is due to their biodegradability and lower toxicity than many synthetic alternatives, these esters are especially well-suited for the ever-expanding market for environmentally-friendly and sustainable cleaning products. Moreover, the increasing trend for environmentally friendly consumer products has been a key enabler of palm oil-based ingredients, as palm oil is both cheap and accessible; thus, soaps and detergents manufacturers prefer palm oil-based ingredients.

The lubricants & additives segment held a significant market share. It is due to high lubricating properties, high biodegradability, and low toxicity, palm methyl esters are used in bio-lubricant and additives production, which can be obtained specifically from palm kernel oil. These properties render these fluids appropriate for automotive, industrial, and marine lubricants and for use as hydraulic fluids, cutting oils, and grease formulations.

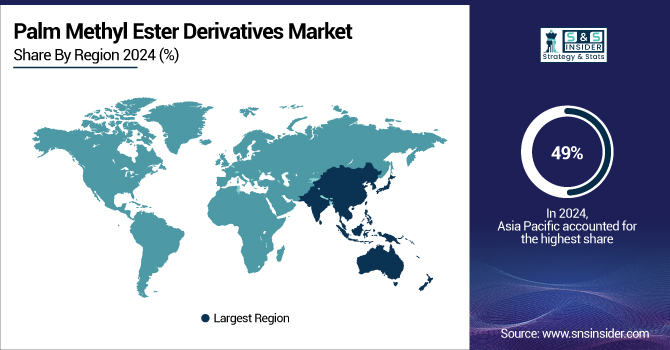

Regional Analysis

Asia Pacific held the largest market share, around 49%, in 2024. The region has the largest production, consumption and processing of palm oil across the globe. Indonesia and Malaysia are the top producers of palm oil in the world, providing a stable and low-cost source of raw materials for PMED manufacturers. A mature supply chain for palm oil, integrated with palm oil mills, allows for rapid conversion of palm oil for local use and into palm oil derivatives. Apart from that, a rapidly expanding consumer base for personal care, detergents, and biofuels, the major end-user segments for palm methyl esters, the Asia Pacific region is also among the top growers of palm methyl esters in the globe.

India is motivated to fast-track biodiesel blending with a special emphasis on the production of palm methyl ester derivatives (PMEDs) based biodiesel as per a policy brief by The Energy and Resources Institute (TERI). The efforts of the country to find feedstocks available domestically, such as palm oil, to improve biodiesel production and decrease dependence on imported fossil fuels. TERI also cites the need for restrained feedstock costs and community engagement to enhance production methods for sustained biodiesel development

North America held a significant market share and growing region in the forecast period. This is owing to increased demand from fatty acid and biodiesel industries, high environmental regulations, and large available biomass feedstock. For example, the biodiesel production industry in the United States is well-developed based on derivatives of palm oil for use as biofuels. The U.S. held the largest market share and CAGR of 7.00% in the forecast period 2025-2032.

Sustainable palm oil production will help alleviate the increasing pressure on U.S. biodiesel production assets in 2022, where U.S. biodiesel production capacity was around 2.1 billion gpy, half of which was based on palm oil-based feedstocks (i.e., palm oil, palm kernel, and waste palm oil). Further, policies in support of domestic initiatives such as the Renewable Fuel Standard (RFS) in the U.S. are creating increasing volumes of renewable fuels in transportation, benefiting bio-based products, including palm methyl esters.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Palm Methyl Ester Derivatives Companies:

KLK OLEO, Wilmar International Limited, IOI Oleochemical, Emery Oleochemicals, Musim Mas Group, P&G Chemicals, Vantage Specialty Chemicals, Pacific Oleochemicals, Carotino Group, and Ecogreen Oleochemicals.

These key players help to understand the palm methyl ester derivatives market share, Palm methyl ester derivatives market analysis, palm methyl ester derivatives market trends, and palm methyl ester derivatives industry trends.

Recent Development:

-

In December 2024, Wilmar International acquired a 31% stake or share in Adani Wilmar for USD 1.44 billion, marking a significant move in the agribusiness sector.

-

In 2024: Chinaplas Emery Oleochemicals showcased its bio-based plasticizers EDENOL 1208, 2178, and 2192, highlighting its commitment to sustainable solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.91 Billion |

| Market Size by 2032 | USD 3.17 Billion |

| CAGR | CAGR of6.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Caprylate, Laurate, Myristate, Palmitate, Stearate, Oleate, Linoleate, Others), • By Source Crude Palm Oil, Palm Kernel Oil) • By End Use (Soaps & Detergents, Personal Care & Cosmetic Products, Food & Beverages, Lubricants & Additives, Solvents, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | KLK OLEO, Wilmar International Limited, IOI Oleochemical, Emery Oleochemicals, Musim Mas Group, P&G Chemicals, Vantage Specialty Chemicals, Pacific Oleochemicals, Carotino Group, and Ecogreen Oleochemicals |