Paper-Thin Displays (PTDs) Market Size & Trends:

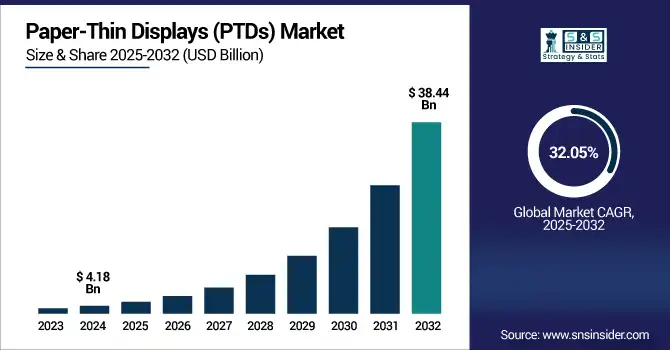

The Paper-Thin Displays (PTDs) Market size was valued at USD 4.18 billion in 2024 and is expected to reach USD 38.44 billion by 2032, growing at a CAGR of 32.05% over the forecast period of 2025-2032.

To Get more information on Paper-Thin Displays (PTDs) Market - Request Free Sample Report

Paper-Thin Displays (PTDs) Market Trends are leading innovation in foldable and rollable smartphones, smart wearables, and automotive infotainment dashboards. Sustainable, lightweight materials and transparent e‑paper solutions boost adoption across consumer electronics.

Paper-Thin Displays (PTDs) market growth is attributed to rapidly developing innovations particularly in OLED and e‑paper that allow for extremely lightweight, bendable, energy-conserving monitors. The growing consumer demand for slim and compact electronics such as foldable phones, tablets, wearables, and IoT devices is propelling adoption. Complemented by ongoing design trends, such as automotive infotainment and smart packaging, and healthcare applications, and sustainable trends, these drivers will accelerate PTD penetration across multiple industries for new use cases. in thin, lightweight and durable displays.

Global shipments of wearables, such as smartwatches and smart rings increased steadily in 2024, with smart rings alone growing over 30% year-over-year.

The U.S Paper-Thin Displays (PTDs) Market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 11.56 billion by 2032, growing at a CAGR of 31.62% over the forecast period of 2025-2032. The U.S. Paper-Thin Displays (PTDs) Market Growth fueled by rapid advancements in flexible OLED &E-PAPER technologies, increasing integration in wearables, smart packaging, automotive infotainment and energy-efficient digital signage.

Paper-Thin Displays (PTDs) Market Dynamics:

Drivers:

-

OLED and E-Paper Advancements Accelerate Adoption of Paper-Thin Displays Across Consumer Automotive and Healthcare Sectors

Rising developments in the OLED (organic light-emitting diode) and e-paper technologies to facilitate ultra-light, bendable, & energy-efficient display solutions is the leading driving factor for the global Paper-Thin Displays (PTDs) market. The increasing need for the compact and thin form factor in consumer electronics including foldable smartphones, smartwatches, tablets, and e-readers is accelerating the adoption of PTDs. These displays are also being used in various industries, such as automotive and healthcare for next-gen infotainment systems, wearable health monitors, and digital dashboards.

Flexible and foldable OLED panels achieved 24 million shipments in 2024, with another projection of 38 million units in 2025, marking a 27% rise in foldable OLED adoption.

Restraints:

-

Environmental Sensitivity and Display Limitations Restrain Broader Adoption of Paper-Thin Displays in Demanding Applications

The global Paper-Thin Displays (PTDs) market has few restraints and limited durability in extreme environmental conditions is one of the crucial restraints for global Paper-Thin Displays (PTDs) market. These conditions are effective in result of high humidity, high UV light, or mechanical stress, which this condition could degrade PTDs especially if the PTDs based on organic and flexible materials. This limits their use in outdoor and industrial situations, where performance must be uncompromised. Also, the difficulties in hardware to achieve a high-resolution and colors make it difficult for e-paper displays to be used in media-rich applications.

Opportunities:

-

Emerging Applications and Innovations Driving Widespread Adoption of Paper-Thin Displays Across Multiple Growing Sectors

Expansion of Paper-Thin Displays (PTDs) deployment in nascent applications, such as intelligent packaging, light-guiding transparent retail signage, and future resolvable IoT interfaces reviews the opportunities. Logistics, retail, and education are on the rise due to the rising focus on sustainability and low power consumption of e-paper displays. In addition, innovative materials science coupled with developing printed electronics will allow the mass production of cost-effective PTD in a variety of sectors.

As of June 2025, China’s postal system is aiming for 1 billion recyclable e‑paper packaging sheets in use, each supporting up to 100,000 refreshes, saving over 10 tonnes of paper annually at outlets.

Challenges:

-

Challenges Hindering Seamless Integration and Scalable Adoption of Paper-Thin Displays in Modern Electronics

Integration of PTDs into current electronic systems, such as oscillators and logic gates presents some challenges in terms of matching traditional circuitry with Paper-Thin Displays (PTDs) and are particularly challenging when attaching to existing connectors. Scalability of manufacturing ultra-thin and flexible displays is still difficult, especially regarding the uniformity of materials and devices over large areas. Additionally, emerging materials face regulatory and recycling challenges that also limit more widespread usage.

Paper-Thin Displays (PTDs) Market Segmentation Overview:

By Technology

OLED held the Paper-Thin Displays (PTDs) market share of 46.4% in 2024 and is projected to experience the highest CAGR over 2025-2032. OLED's unmatched flexibility, ultra-thin form factor, and low power consumption make it the ideal choice for foldable smartphones, tablets, and the next wave of wearables, ensuring its dominance. The technology helps to provide high-contrast images with deep blacks and wide viewing angles, which in turn drives demand in consumer electronics. In addition, OLED displays are further gaining in adoption across a breadth of end-products including vehicle infotainment systems and high-end medicals owing to their optical performance.

By Application

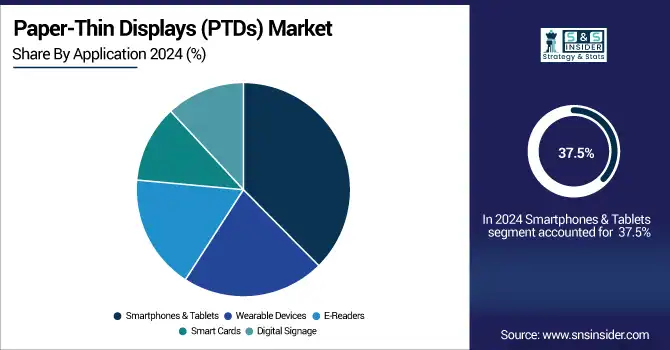

The Paper-Thin Displays (PTDs) market share by product in 2024 is dominated by Smartphones & Tablets with 37.5% due to the increasing adoption of foldable and ultra-slim devices. Flexible OLED and e-paper technologies, which promise to make devices remarkably portable, boost display durability, and conserve power are also being integrated in today’s leading smartphones. Rising consumer demand for sleek and thin gadgets with a high screen-to-body ratio is resulting in higher integration of PTD into flagship models.

The Wearable Devices are anticipated to grow at the highest CAGR during the forecast period of 2025–2032, attributed to the growing health awareness and increasing continuous monitoring needs. PTDs are being adopted by smartwatches, fitness bands, and medical wearables due to their flexible, light-weight structure and battery-saving properties.

By Material

Plastic Substrates accounted about 43.5% of the market share in 2024 and most likely to witness the fastest CAGR from 2025 to 2032. Apart from being light-weight, they have properties of great flexibility and ease of manufacturing at low costs which is why they have taken over most of the domain of use in foldable smartphones, wearables, and e-paper. Thin, flexible and shatter-proof plastic substrates give manufacturers the opportunity to create mechanically strained displays, a perfect match for next-generation CE. Furthermore, it enables large-scale production of Paper-Thin Displays (PTDs) due to their compatibility with roll-to-roll fabrication processes.

By End-Use Industry

Consumer electronics maintained its position at the top with 51.5% share of the global Paper-Thin Displays (PTDs) market in 2024 due to the substantial adoption in foldable smartphones, tablets, smartwatches, e-readers, and other small-sized digital products. Consumer's demands for light weight, minimum energy consumption and flexible display solutions is making it more toward sleek and sophisticated shape with good visual features.

The automotive segment is estimated to register the highest CAGR over 2025-2032 due to the increasing deployment of sophisticated infotainment systems, digital dashboards, and head-up displays. Flexible and curved PTDs offer automakers the ability to boost the aesthetic, functionality, and safety of in-vehicle displays, paving the way for next-generation cockpit designs.

Paper-Thin Displays (PTDs) Market Regional Analysis:

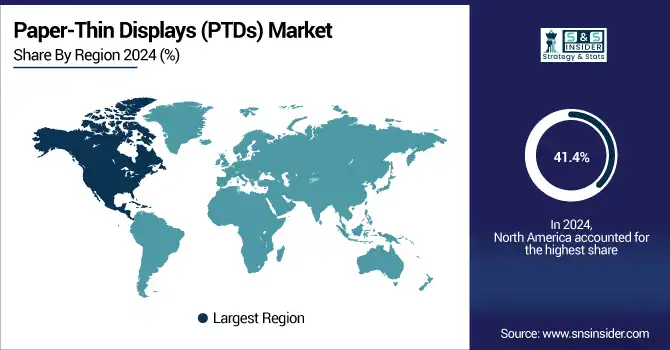

The Paper-Thin Displays (PTDs) market was led by North America in 2024 with a commanding 41.4% share attributed to well-recognized technological innovation, early adoption of advanced consumer electronic products and a well-established electronics manufacturing ecosystem. There is a greater proliferation of flexible OLED and e-paper displays in applications from foldable smartphones and wearables to automotive infotainment and smart packaging around the region. This increasing R&D investment proves to be a driving force for the market, whereas, strategic partnerships between tech firms and display OEMs provide a positive push to the market growth.

The U.S. accounted for the largest share of the North American PTDs market on account of the quick uptake of next generation electronics and also the existing robust R&D infrastructure along with the presence of display technology developers and end-user industries in the country.

Asia Pacific will hold the fastest CAGR of 32.8% over 2025-2032, driven by growing consumer electronics production, improving disposable income, and increasing demand for foldable devices and wearables. The presence of key display panel manufacturers and OEMs in the region leads to rapid development of OLED and e-paper displays. Government backing for flexible electronics, increasing automotive production, and smart city programs are further bolstering PTD use in various sectors.

The Asia Pacific PTDs market was led by China owing to massive manufacturing base, significant investment in OLED and flexible display technologies, and massive adoption from electronics, automotive, and smart packaging end-users in the market.

The Paper-Thin Displays (PTDs) market in Europe is gaining momentum, fueled by high adoption of energy-efficient and sustainable display technologies in the consumer electronics, automotive, and retail industries. The strong R&D ecosystems and innovation hubs in the region support growth opportunities in flexible OLED and e-paper technologies. Increased emphasis on digital transformation particularly in areas such as education and logistics is also driving PTD integration. In line with this, the rising adoption of smart packaging and clear signage highlights the potential applications of paper-thin displays.

Market growth is expected to take off much more slowly in emerging economy markets, such as in Latin America and the Middle East & Africa (MEA), where the gradual introduction of higher-level consumer electronics and digital signage will provide a fertile breeding ground for growth. Market potential is supported by expanding telecom infrastructure and urbanization and a growing interest in smart retail and education systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Paper-Thin Displays (PTDs) Companies are:

The Paper-Thin Displays (PTDs) companies are Samsung Display, LG Display, E Ink Holdings, BOE Technology, Japan Display, Visionox, AU Optronics, Royole, TCL CSOT, Sharp, FlexEnable, Plastic Logic, OLEDWorks, UDC, Innolux, Konica Minolta, C3Nano, Cambrios, NextFlex, and Pervasive Displays.

Recent Developments:

-

In June 2025, Samsung has launched a 32-inch Color E-Paper display offering ultra-low power digital signage with QHD resolution and vivid color imaging.

-

In July 2024, LG Display unveiled flexible, distortion-free automotive OLED technology optimized for in-cabin use, including larger curved and rollable screens, showcased at Display Week and aimed at software-defined vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.18 Billion |

| Market Size by 2032 | USD 38.44 Billion |

| CAGR | CAGR of 32.05 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (OLED, E-Paper, LCD and Quantum Dot), • By Application (Smartphones & Tablets, Wearable Devices, E-Readers, Smart Cards and Digital Signage) • By Material (Plastic Substrates, Glass Substrates, Metal Foil and Organic Materials) • By End Use Industry (Consumer Electronics, Automotive, Healthcare, Retail and Education) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsung Display, LG Display, E Ink Holdings, BOE Technology, Japan Display, Visionox, AU Optronics, Royole, TCL CSOT, Sharp, FlexEnable, Plastic Logic, OLEDWorks, UDC, Innolux, Konica Minolta, C3Nano, Cambrios, NextFlex, and Pervasive Displays. |