RF Tunable Filter Market Size & Industry Analysis:

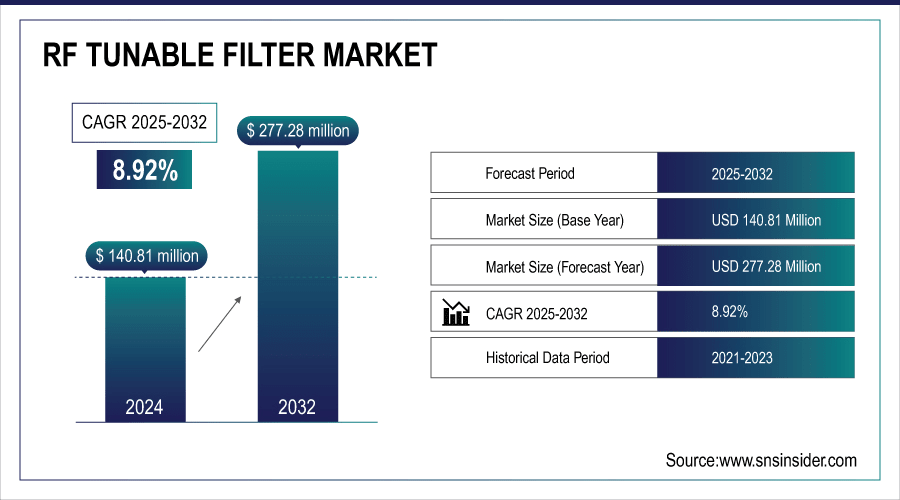

The RF Tunable Filter Market Size was valued at USD 140.81 million in 2024 and is expected to reach USD 277.28 million by 2032 and grow at a CAGR of 8.92% over the forecast period 2025-2032.

To Get more information on RF Tunable Filter Market - Request Free Sample Report

Rising demand for advanced wireless communicational devices and quicker deployment of 5G networks are propelling demand for RF tunable filters in aerospace, defense, and telecom. R&D investments by governments and industry are pushing the envelope for filter performance, frequency agility, and signal integrity; enabling dynamic management of changing connectivity needs; and reducing time to market.

In May 2024, Netcom launched its TunePro 2W range of tunable RF filters, with frequencies up to 3 GHz and power handling up to 2 watts. The filters are intended for use in applications where space is limited and are appropriate for software-defined radios, co-site mitigation, unmanned vehicles, radar, and satellite communications.

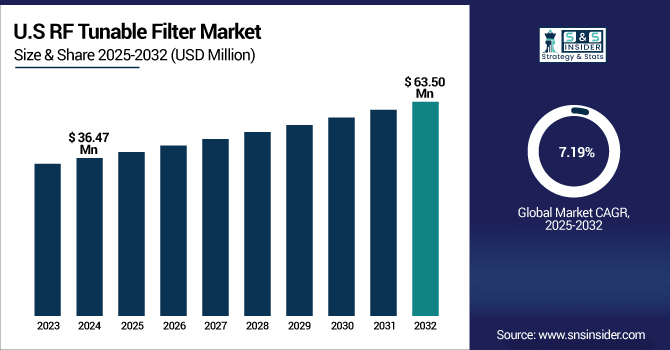

The U.S. RF Tunable Filter Market size was USD 36.47 million in 2024 and is expected to reach USD 63.50 million by 2032, growing at a CAGR of 7.19% over the forecast period of 2025–2032.

US RF Tunable Filter Market Expansion at Rapid Pace – 5G Infrastructure, Defense, Aerospace and Propagation Growth are Some of the Contributing Drivers Major applications of radio frequency could be classified into software defined radios, radar systems, satellite communications and unmanned vehicles, and its healthy growth is driven by constant technological advancements, miniaturization of radio frequency components, and the rising demand for optimizing usage of spectrum.

Akoustis Technologies, Inc. (AKTS) showcased its XBAW RF filter technology at CES 2024, at the same time, providing an update on its pipeline of high-frequency filters for Wi-Fi, 5G infrastructure, automotive, and defense applications. Akoustis additionally announced their new small form factor, high power handling, Wi-Fi, automotive and access point RF filter A10324 at 24 GHz BAW.

RF Tunable Filter Market Dynamics

Key Drivers:

-

Rising Adoption of 5G Infrastructure and Wireless Communication Networks Accelerates the Demand for RF Tunable Filters.

Higher bandwidths and multiple frequency bands for 5G infrastructure, the need for agile, dynamic, and high-performance filtering solutions have become a necessity. Such RF tunable filters can be switched to different frequencies, performing well in terms of providing optimally-tuned performance while minimizing interference effects in complex communication systems. Because of fast 5G blanket technology in urban and rural areas, and also a rapid growth in IoT devices, the demand for high-speed communication that is seamless has led to better filtering techniques.

Ranatec introduced the RI 282 mobile filter, a digitally tunable bandpass filter with operation from 600 to 6000 MHz. This product improves RF performance and reflects Ranatec's leadership in advanced RF technologies.

Restrain:

-

Limited Availability of Advanced Materials for High-Performance RF Tunable Filters Hampers Market Expansion.

High-performance materials such as MEMS capacitors, varactor diodes and substrate materials are essential to achieve the desired characteristics for RF applications. These materials, however, generally are only found at specialized suppliers, leading to supply chain issues and increased material costs. The need for innovative materials such as PCBs for high frequency and high speed is also a consumer, but they are not yet ripe enough to catch up with the requirements, and we still have to wait before introducing new generation of filters here, too. This limitation significantly restricts the broad utilization of RF tunable filters in the consumer electronics industry, where availability and cost-effectiveness of the material are of critical concern.

Opportunities:

-

Growing Investment in Automotive and Aerospace Sectors Presents Lucrative Opportunities for RF Tunable Filter Applications.

RF tunable filters are becoming vital to provide high-performance communication and signal purity to meet the growing demand for connected cars, autonomous driving, and satellite communications. These tunable filters can eliminate interference in mission-critical systems and improve signal quality when space and weight are limiting factors, such as in automobile sensors and aerospace communications. As technological advancements continue to progress the domains, there will be widespread opportunities for RF tunable filters to support the growing requirements for reliable and credible communication technologies.

Menlo Micro developed a miniaturized high-power tunable filter using MEMS switches and lumped element components, tuning frequency ranges from 225 to 512 MHz with a power handling of 60 W and insertion loss less than 1.5 dB.

Challenges:

-

Technological Advancements and Need for Continuous Innovation Challenge Manufacturers in Keeping Up with Market Demands for RF Tunable Filters.

RF tunable filter market is the rapidly changing technological landscape which demands constant innovation. New demands for performance, reliability and low interference must be satisfied with the rise of communication technologies like 5G and Wi-Fi 6, and RF tunable filters must evolve to meet demands. There’s pressure on producers to innovate not only to create filters that are more effective and have the ability to cope with power, but also smaller and cheaper. This requires regular outlays for research and development, which can be prohibitively expensive for companies with small budgets to remain competitive.

RF Tunable Filter Market Segment Analysis:

By Type

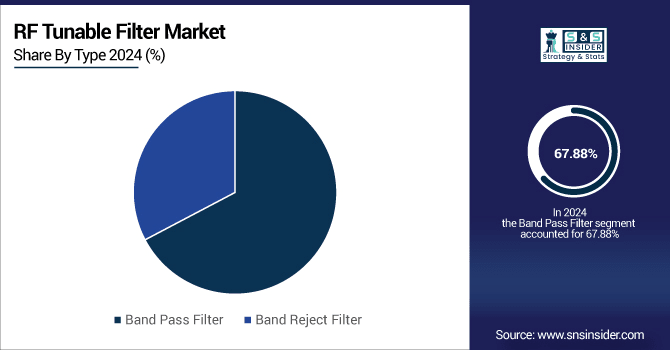

The Band Pass Filter (BPF) segment dominated the RF tunable filter market with a 67.88% share in 2024. BPFs are mainly used in filtering out unwanted frequencies while allowing the frequencies of bands to pass through them, which makes them prominent in applications like 5G communication, satellite systems, and radar technology. Which is why players like Qorvo, and also Broadcom, are leading the pack with technology such as new Qorvo 5G BPF solutions for high-power apps.

The Band Reject Filter (BRF) segment is anticipated to grow at the fastest CAGR of 10.08% during the forecast period (2025 - 2032) BRFs that are developed to suppress a specific frequency range are increasingly needed for wireless communication, medical devices, and military technologies. This growth is fueled by new product introductions; for example, Smiths Interconnect's BRFs (Broadband RF Products) that are miniaturized without compromising high power; what we are seeing in size is decreasing, while power handling capabilities are increasing.

By Mechanism

Mechanical Tuning held approximately 58.36% revenue share of RF tunable filter market in 2024. This solution is founded on a physical mechanism of tuning, e.g., modifying components in order to adjust the frequency response. Mechanical tunable filters have extensive application in high-power applications like radar systems, satellite communications, and military electronics, demanding high performance, low insertion loss, and wide coverage of frequency ranges.Market need has led companies like Pole/Zero Corporation to push the limits of mechanical tuning technology into smaller, more powerful filters.

The electronic tuning segment is predicted to register the fastest CAGR of 10.17% in the global automotive software market during the forecast period of 2025 to 2032. Instead, different types of electronic devices, such as varactor diodes and FETs, were utilized to change the filter frequency. They are mostly preferred due to high-speed tuning, small size, and easy integration into the next-generation wireless and communication systems. Pioneering companies like Analog Devices, MtronPTI and others are innovating in this area, expanding capabilities for systems across a diverse range of applications.

By Component

The Surface Acoustic Wave (SAW) filter segment dominated the RF tunable filter market as of 2024, the registered revenue of which was 36.40%. In comparison, SAW filters offer a low price, compact size, as well as superior shielding performance at 2-3GHz frequency, making it a vital part of smartphones, tablets and 5G devices. SAW filter technology has, for example, been a core driver for a number of companies including Murata Manufacturing and Qorvo.

Nisshinbo Micro Devices released two types (NSNJ2023, NSNJ2024) of high-performance dual SAW filters in June 2024 that are used for multi-band communication systems to improve the performance of a wireless communication system.

Digital Tunable capacitors market is anticipated to grow at the fastest rate in RF tunable filter market with a CAGR of 10.11% during the forecast period of 2025 to 2032. A fast, accurate electronic tuning capability is essential for use in applications such as 5G, IoT and satellite communications, which is what DTCs enable. Analog Devices and MtronPTI lead this technology.

In September 2021, for example, an agreement was signed between MtronPTI and Digi-Key Electronics for the global distribution of the company's crystal resonators, filters, and oscillators, which will see electronically tunable filters made available to more customers than ever before, driving future market expansion as a result.

By System

The Radar System segment dominated in the RF Tunable Filter Market in 2024 with revenue share of 32.75% , owing to the increasingly high demand for sophisticated radar systems in aerospace and defense industries, where radio frequency (RF) tunable filters play an essential role in enhancing the clarity of a signal and reducing interference. Companies like Analog Devices and Qorvo have pioneered new low-loss high-performance tunable filters specifically for radar, thereby solidifying the segment's market-leading position.

The Pocket and Handheld Radio segment is fastest growing at a CAGR of 10.01% during the forecast period 2025-2032. Increased demand from military communication services and emergency services are driving the growth to be used in portable communication devices, which require seamless and free communication. There are two types of tunable RF filters available in the market: low RF filter (tunable, small) low-cost tunable filter (high-power and multi-pole) which increase the performance of handheld radios, which is driving high growth in this segment in firms such as Netcom and Smiths Interconnect.

By Application

In 2024, the Aerospace and Defense segment is the largest market share of 29.41% of revenue in the RF tunable filter industry. This makes sense, given the importance of safe, interference-free communications for defense applications like radar, satcom and electronic warfare. Some other important companies include Analog Devices and Qorvo, who have defined a lot of the RF tunable filter technologies for defense, enabling capabilities based on C4ISTAR systems and SATCOM on the move solutions.

The Smart Cities segment is projected to have the fastest CAGR of 10.48% over the period 2025-2032. With a tendency towards the ubiquitous installation of IoT devices in urban infrastructure and the increase of 5G network installations, the need for constant and effective frequency management and interference mitigation adds to this growth. Corrective measures are required in the form of RF tunable filters in order to provide stable communication as these applications fall under the periphery of smart cities including traffic management, public safety and environmental monitoring.

RF Tunable Filter Market Regional Overview:

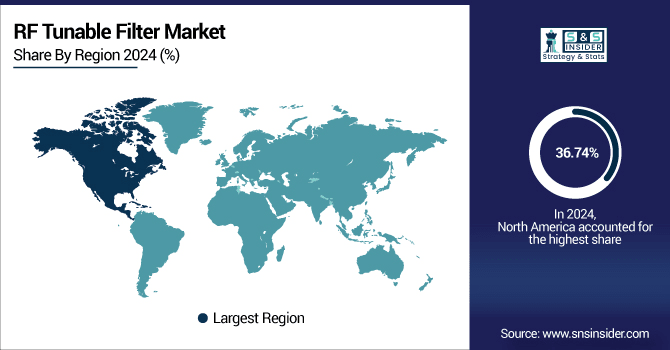

North America dominated the RF tunable filter market in 2024 with a revenue share of 36.74%, due to high demand for RF tunable filter in aerospace and defense and high-end communications. The expansion through innovation was led by the players such as Analog Devices, Dover Corporation and Netcom, Inc. Accordingly, the high-performance filters for military use pioneered by Analog Devices in particular were also boosted by the extent of early 5G uptake and no holds barred R&D spend.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific region is expected to be the fastest CAGR of 9.91% in the RF tunable filter market during the forecast years 2025-2032. This growth is fueled by accelerating innovation in communications technology such as 5G networks and an explosion of IoT devices throughout countries like China, Japan and India. Firms like Murata Manufacturing and Nisshinbo Micro Devices are leading the charge with newer dual SAW filters that address this surging demand. Local emphasis on smart cities and the development of wireless communication infrastructure is helping fuel demand for cost-effective RF tunable filter.

RF Tunable Filter Market in the European region is dominated by Germany owing to its highly developed industrial structure and a strong focus on innovation & industries like automotive, telecommunication, and defense. Leading players such as EPCOS (a TDK Group company) are supporting Germany in the development of novel RF Filter solutions. The presence of advanced 5G infrastructure, radar systems, smart manufacturing, and related high investments in Germany are expected to fuel the demand for tunable filters, reinforcing its lead in the regional market.

The Middle East & Africa RF tunable filter market is developing with the United Arab Emirates and Saudi Arabia leading the way with dallops in 5G, defence and smart city. Latin America is witnessing growth with Brazil and Argentina as the key responsible countries for the deployment of wireless technology and telecom expansion, increasing the demand for tunable filters to improve communication systems and digital infrastructure.

Key Players Listed in the RF Tunable Filter Market are:

Some of the major key players are Santec Corporation, DiCon Fiberoptics Inc., Analog Devices Inc., Kent Optronics Inc., Brimrose Corporation, Netcom Inc., Micron Optics, Pole/Zero Corporation, Coleman Microwave Company, Thorlabs Inc. and others.

Recent Development:

-

Pole/Zero recently announced the IMF Series of digitally tunable bandpass and notch filters, covering 1.5 to 24 GHz, which was first introduced in July 2023. The filters ignore noise, making them suitable for radar, electronic warfare, and SATCOM designs, and capable of supporting faster-than-normal tuning speeds.

-

In November 2023, Brimrose launched the AOTF Tunable Filters, free-space acousto-optic tunable filters. Such filters have a broad range of applications, from spectroscopy to optical sensing.

-

Netcom announced the TunePro 2W family of tunable RF filters, covering a frequency range from DC to 3 GHz and handling up to 2 watts of input power. They are designed for mission-critical communications applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 140.81 Million |

| Market Size by 2032 | USD 277.28 Million |

| CAGR | CAGR of 8.92% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Band Pass Filter, Band Reject Filter) •By Mechanism (Mechanical Tuning, Electronic Tuning, Magnetic Tuning) •By Component (Surface Acoustic Wave (SAW) Filter, Varactor Diode, MEMS Capacitor, Oscillator Filters, Digitally Tunable Capacitor (DTC), Surface Mount Device (SMD) Variant) •By System (Handheld and Pocket Radio, Radar System, RF Amplifier, Software-defined Radio, Mobile Antenna, Avionics Communication System, Test and Measurement Systems) •By Application (Aerospace and Defense, Smart Cities, Transportation, TV White Spaces, Healthcare, Energy and Power, Mining) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Santec Corporation, DiCon Fiberoptics Inc., Analog Devices Inc., Kent Optronics Inc., Brimrose Corporation, Netcom Inc., Micron Optics, Pole/Zero Corporation, Coleman Microwave Company, Thorlabs Inc. |