Paralleling Switchgear (PSG) Market Size & Growth Trends:

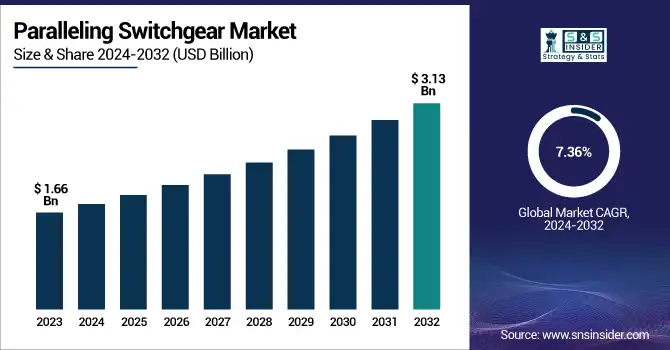

The Paralleling Switchgear Market Size was valued at USD 1.78 Billion in 2024 and is expected to reach USD 3.14 Billion by 2032 and grow at a CAGR of 7.36% over the forecast period 2024-2032.

To Get more information on Paralleling Switchgear Market - Request Free Sample Report

Features in Operational & Technical improvements are about load balancing, fault tolerance, and efficient power distribution. Smart controllers, remote monitoring, & the ability to integrate with renewable energy sources for the most efficient usage Technological & Innovation development. Infrastructure & Deployment trends lean towards modularity and scalability, facilitating deployment in commercial, industrial, and data center settings. Performance & Reliability is also improved through better design, stronger circuit protection, and modern diagnostics, driving high-quality power supply for critical operations. Together, these factors are fostering the growth and adoption of the market in industries.

Paralleling Switchgear Market Dynamics

Key Drivers:

-

Driving Growth Through Reliable Power Supply Renewable Energy Integration and Infrastructure Expansion

A key factor fueling growth is the growing need for continuous and reliable power supply across the industrial vertical including sectors like utilities, healthcare, data centers, and manufacturing. As businesses continue to depend on critical systems, advanced power management solutions are becoming investment priorities for assured continuity. Furthermore, there is an increasing use of renewable energy, such as solar and wind energy, which is driving the use of paralleling switchgear to stabilize the grid by managing peaks and troughs of production. An increase in Infrastructure projects, majorly in developing economies, is yet another driver for the market to grow, due to the need for good power distribution systems for such projects.

Restrain:

-

Overcoming Cost Challenges and Technical Complexities in Paralleling Switchgear for Reliable Operations

High installation and maintenance costs are the biggest challenge. Switchgear systems with parallel arrangements forecast the complexity of components and develop advancements in control mechanisms and changes of configurations, increasing costs as a result. This makes it difficult, especially for small and medium-sized enterprises (SMEs) that deal on a low budget. Furthermore, the integration of multiple power sources can be complicated; if not done properly, the system will fail to synchronize. This requires technical know-how and precise integration of the systems. If they set up and maintain it poorly though, then there is a high risk of system failure, resulting in downtime that can be very costly to the business.

Opportunity:

-

Smart Technology and Sustainable Solutions Driving Growth in Paralleling Switchgear Market Innovation

Smart technology adoption such as IoT-integrated monitoring systems based on Cloud technology is opening new growth opportunities there. Such innovations allow for additional data analysis in real-time, predictive maintenance, and greater efficiency of the system, making these options very attractive for end-users. Moreover, rising efforts towards energy conservation and sustainable power solutions will create new opportunities for manufacturers to manufacture greener switchgear. Further widening industrial automation trends and escalating demand for backup power solutions in mission-critical industries will open tremendous prospects for market growth in the forthcoming years.

Challenges:

-

Raw Material Costs Cybersecurity Risks and Interoperability Challenges Hindering Paralleling Switchgear Market Growth

The second biggest challenge is raw material price variation and increase which in turn affect the cost of production and profitability of the manufacturers. Pivotal materials including copper, aluminum, and steel are exposed to pricing vagaries that render cost management a painful exercise. Regions and industries are using different versions of the standards, leading to compatibility problems that keep products ("interoperability") from being widely adopted. Increasing emphasis on decentralized generation (smaller localized power systems instead of switching whole buildings to centralized switchgear solutions) adds to this difficulty. Moreover, the potential threats associated with new-age digitalized switchgear systems against cyber-attacks can create hesitancy for some industries from adopting advanced solutions, leading to barriers in market growth.

Paralleling Switchgear (PSG) Market Segments Analysis

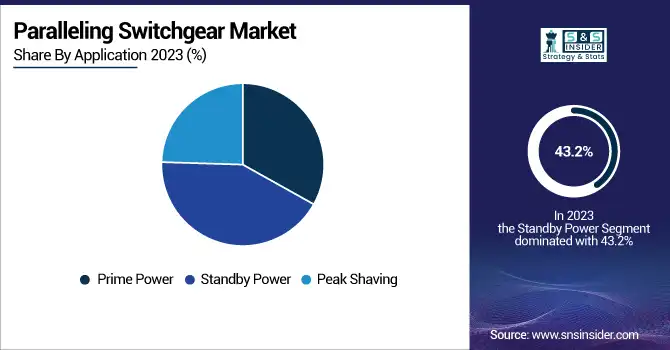

By Application

Standby power segment held the major share of the paralleling switchgear market in 2023 followed by 43.2% of the total paralleling switchgear market share. The growing demand for backup power solutions in important industries such as healthcare, data centers, and commercial infrastructure continues to be driving this dominance. Industries that need constant power supply require standby power systems because they enable normal operation during grid failures.

The peak shaving segment is set to grow at the highest CAGR from 2024-2032. The growth can be attributed to the growing concern about energy costs and the increasing penetration of peak shaving solutions for load management. The demand-side flexibility of industrial customers, who can curtail electricity consumption during peak periods, enables them to reduce utility costs substantially while also strengthening the stability of the power system. This trend is only expected to accelerate as companies continue to recognize the importance of an energy optimization strategy.

By Type

The open transition system segment accounted for the maximum market share in the year 2023 and is likely to continue its trend due to its simple and well effective design, cost-effectiveness and simple installation Open transition systems separate the load from the power source during the transfer process for a short moment making them suitable for non-critical applications where a power interruption of a few seconds is acceptable. These systems have gained acceptance in industries where power continuity is not very essential, thus acquiring significant market share.

From 2024 to 2032, the closed transition system segment is anticipated to have the highest CAGR. This growth would be fueled by the increasing need for seamless power transfers in key verticals like hospitals, data centers, and financial institutions. Whereas closed transition systems are suitable for US-based power switching with zero power loss, which reduces the number of operational interruptions and increases system reliability, gradually overtaking open transition systems in mission-critical environments.

By Voltage

In 2023, the low voltage segment held the largest share of the paralleling switchgear market, as these are widely used for commercial buildings, data centers, and industrial facilities with lower power needs. Low voltage systems are preferred, as they can be produced at a lower cost, are easy to install, and are appropriate for applications under 1,000 volts. This segment has held the largest market share owing to its adoption across the sectors such as healthcare, retail, and manufacturing.

The medium voltage segment to witness the highest CAGR through 2024-2032. This increase is attributed to the increasing requirement for effective power distribution solutions from the major industry, utilities, and structure applications. Medium voltage systems present improved power management capabilities, boost safety features, and are ideal for running high voltage level applications, they are a must for the expansion of any industrial and commercial setups.

By End Use

In 2023, the commercial & industrial segment dominated the paralleling switchgear market, owing to the growing demand for reliable power solutions in industries such as manufacturing, healthcare, and data centers. Paralleling switchgear systems is crucial for providing backup power, load management, and system efficiency for mission-critical industries that depend on continuous power for operations. This segment was further enabled by rapid industrial infrastructure developments and a burgeoning commercial target base.

The utilities & power generator segment is anticipated to witness the fastest CAGR between 2024 and 2032. The growing demand for grid stability, renewable energy penetration, and high investment in power generation infrastructure drive this growth. Advanced switchgear solutions are being adopted by utilities to optimize distributed energy resources, resulting in constant power supply and improved relay system reliability.

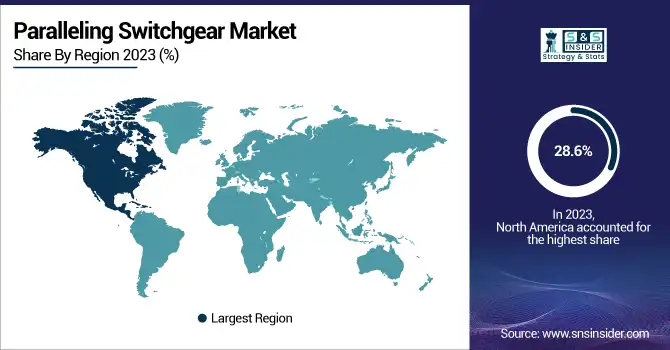

Paralleling Switchgear Market Regional Analysis

North America was the largest segment of the paralleling switchgear market in 2023, holding 28.6% of the market share. The region accounted for the largest share owing to the presence of well-established industrial infrastructure, growing need for uninterrupted power supply, and high adoption of backup power products. The presence of various key industries represented by data centers, healthcare, and manufacturing has driven the need for advanced power management systems set to help shape the future of this market. Data center hubs in the United States especially operated by some of the largest cloud providers such as Amazon Web Services (AWS), Microsoft, and Google, depend on large amounts of paralleling switchgear as well to continue operations during a power outage. Moreover, the growing age of power grid infrastructure in North America has also contributed to the rising adoption of modern switchgear systems for enhancing power reliability.

Due to the rapid urbanization and industrialization in this region combined with the demand for additional energy, the Asia Pacific region is anticipated to experience the fastest CAGR from 2024–2032 of over 10% during this period. China, India, Japan, etc. have begun to invest heavily in infrastructure and generation projects. For example, India has been advancing its smart grid systems and large-scale industrialization which has fuelled demand for efficient distribution of power generation. Driven by greater complexity in power requirements, China's growing manufacturing sector and renewable energy projects also need advanced switchgear systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Paralleling Switchgear Market are:

-

Schneider Electric (Paralleling Switchgear Systems)

-

Cummins Inc. (PowerCommand® Paralleling Systems)

-

Caterpillar (Cat® Electric Power Switchgear)

-

General Electric Company (Entellisys* Low-Voltage Switchgear)

-

Regal Rexnord Corporation (Paralleling Switchgear Solutions)

-

Siemens (SIMOPRIME Medium-Voltage Switchgear)

-

Mitsubishi Electric (Diamond® Paralleling Switchgear)

-

ABB (UniGear Digital Switchgear)

-

Eaton (ArcGard Metal-Enclosed Switchgear)

-

Pioneer Power Solutions (Paralleling Switchgear)

-

INDUSTRIAL ELECTRIC MFG (Custom Paralleling Switchgear)

-

EMI (Paralleling Switchgear Systems)

-

Kohler Co. (Decision-Maker® Paralleling System)

-

Nixon Power Services (Paralleling Switchgear Solutions)

-

ASCO Power Technologies (Paralleling Switchgear)

Recent Trends

-

In October 2024, Schneider Electric unveils its next-gen Ringmaster AirSeT switchgear, an SF6-free solution designed for sustainable and efficient medium voltage applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.78 Billion |

| Market Size by 2032 | USD 3.14 Billion |

| CAGR | CAGR of 7.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Prime Power, Standby Power, Peak Shaving) • By Type (Open Transition System, Closed Transition System) • By Voltage (Low Voltage, Medium Voltage) • By End Use (Commercial & Industrial, Utilities & Power Generator, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Cummins Inc., Caterpillar, General Electric Company, Regal Rexnord Corporation, Siemens, Mitsubishi Electric, ABB, Eaton, Pioneer Power Solutions, INDUSTRIAL ELECTRIC MFG, EMI, Kohler Co., Nixon Power Services, ASCO Power Technologies. |