Patch-Based Wound Healing Products Market Size Analysis:

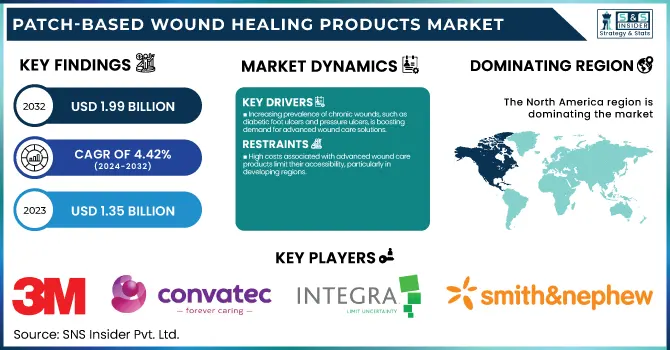

The Patch-Based Wound Healing Products Market Size was valued at USD 1.35 billion in 2023 and is expected to reach USD 1.99 billion by 2032, growing at a CAGR of 4.42% over the forecast period 2024-2032.

To Get more information on Patch-Based Wound Healing Products Market - Request Free Sample Report

Patch-Based Wound Healing Products Market Report includes key statistics and trends in 2023 to evaluate recent activities and determine the prevalence and incidence of chronic and acute wounds worldwide and by major regions. It examines trends in prescription and utilization, emphasizing variations in adoption across different regions. The report analyzes production and consumption volumes, delivering estimates of the market expansion. It also explores the allocation of health spending, including spending by the public sector, private insurers, and out-of-pocket. Explore leading industrial prospects in the current trends and innovations of material technologies with standalone products like hydrocolloid, foam, and antimicrobial patches, along with trends in the regulatory landscape that include novel FDA approvals and CE certifications. Stakeholders use these insights to better understand market dynamics, emerging innovations, and compliance requirements unique to the wound care market, influencing strategic decision-making.

The growing health needs, especially in the case of chronic diseases such as diabetes, are one of the major factors driving the growth of the patch-based wound healing products market. The U.S. Department of Health and Human Services has implemented extensive research on advanced wound care technologies. In 2023, the U.S. held a significant share of 46% of the North American region, contributing substantially to North America's dominance. Moreover, the National Institutes of Health (NIH) stated that about 6.5 million patients in the U.S. experience chronic wounds every year which will require better wound care facilities.

Patch-Based Wound Healing Products Market Dynamics

Drivers:

-

Increasing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is boosting demand for advanced wound care solutions.

Chronic wounds like diabetic foot ulcers (DFUs) and pressure ulcers are increasingly driving the need for advanced wound care such as patch-based wound healing products. An estimated 6.5 million U.S. citizens suffer from chronic wounds resulting in large healthcare costs. The most concerning complication is the diabetic foot ulcer which occurs in 19% to 34% of individuals with diabetes in their lifetime according to studies. This complication reduces the quality of life and has a high incidence of infections and amputations.

Venous leg ulcers, accounting for 70% to 90% of lower leg ulcers, are another prevalent chronic wound type. In the US, it affects around 600,000 people each year, causing the loss of 2 million working days per year. Venous leg ulcers and their treatment are expensive, with estimates of treatment costs reaching $2.5 to $3.5 billion per year. In India, a few studies were either conducted among hospital-attended patients or community-based, where the community-based study was done from June 2022 to December 2023, which estimated an overall prevalence of chronic wounds to be 1.89 per 1,000 population. Within this cohort, diabetic foot ulcers and neglected traumatic wounds were the predominant etiologies, each comprising 36.7% of cases. These statistics highlight the increasing global burden of chronic wounds and the dire need for effective wound care solutions. These specialized, targeted treatment products on a patch-based product help speed up healing for scar-free healing while also preventing further complications which is currently a rising healthcare challenge.

Restraints:

-

High costs associated with advanced wound care products limit their accessibility, particularly in developing regions.

Advanced wound care products have substantial costs which act as barriers to their adoption, especially across emerging economies. As an example, an NPWT pump typically costs $90 in the USA while traditional wound dressings cost $3. The high cost of these advanced products remains a barrier, and despite studies reporting the overall cost per person of treatment is higher with traditional dressings ($350) compared to NPWT ($200), it can discourage adoption. This gap is even wider in developing countries, which rely heavily on out-of-pocket healthcare spending, restricting access to complex therapies. Also, chronic wounds remain a significant challenge for more than 40 million patients worldwide, leading to an estimated annual economic burden of over $15 billion. Over 4 million patients are reported to suffer from chronic wounds in Europe alone every year, taking up 25%–50% of acute hospital beds in use and costing wage-national healthcare budgets at least 4%. The lack of adequate reimbursement policies in these regions further discourages the use of advanced wound care products, leading to a preference for traditional methods despite their longer healing times and potential complications.

Opportunities:

-

Emerging economies like India and China present significant growth potential due to improving healthcare infrastructure and rising healthcare expenditure.

Increasing healthcare expenditure across the globe, along with advancement in healthcare infrastructure are some of the key factors driving the global patch-based wound healing products market. In September 2024, the worldwide pipeline for healthcare construction projects stood at roughly $646.9 billion compared to $636.8 billion in June 2024, demonstrating a strong dedication towards improving healthcare infrastructure. This extension entails the creation of smart hospitals, a sector expected to grow with a significant compound annual growth rate (CAGR). These innovations are anticipated to bring about enhanced patient outcomes and a rising need for cutting-edge wound care solutions such as patch-based products. This spike is a result of incorporating IoT, big data, machine learning, and artificial intelligence into the healthcare systems itself creating better medical procedures and hospitality for the patients. In addition, the growing trend of telemedicine and remote monitoring highlights the importance of advanced wound care products that empower patients to manage effective treatment at home. Since healthcare systems throughout the world are investing in infrastructure and technology to improve patient care and outcomes, these global trends provide significant opportunities for the patch-based wound healing products market.

Challenges:

-

Regulatory challenges and compliance requirements pose significant hurdles for manufacturers entering the patch-based wound healing products market.

Manufacturers of patch-based wound healing products face challenges navigating the regulatory landscape. In the U.S., the FDA requires wound dressings such as Sylke to go through extensive testing to prove safety and effectiveness guidelines. All new product iterations, even the ones derivating from previous ones to target specific surgical needs, must be independently carried through this whole process of approvals. In the European Union, medical devices undergo intensive reviews according to the Medical Device Regulation (MDR) as well. Manufacturers must provide extensive clinical data and maintain robust quality management systems to obtain the CE marking necessary for market entry. These rigorous guidelines are intended to protect patients but can push back time-to-market and increase development costs. In emerging markets, regulatory frameworks might be less established or in a state of flux, making global distribution more challenging for companies. Among others, compliance with a plethora of international standards demands heavy investment in regulatory expertise and resources. Moreover, post-market surveillance obligations require ongoing monitoring and reporting that imposes further operational challenges on manufacturers.

Patch-Based Wound Healing Products Market Segment Analysis

By Formulation

In 2023, collagen held a higher share 34% of the patch-based wound healing products market because of its antimicrobial properties and role in faster healing. It is most commonly used for diabetic foot ulcers and post-operative infections. Expects the need for collagen-based wound care products to increase with the growing prevalence of diabetes, with more than 537 million people suffering from diabetes in the world. The biocompatibility and biodegradability of collagen make it an important component in hydrogels used in wound dressings to promote fibroblast production and healing. The growth of collagen-based products is further encouraged by the initiatives of the government to enhance healthcare infrastructure, and provide access to advanced wound care solutions. Collagen is the leader in the market due to its success in situations like chronic wounds, which are a common complication in diabetes. According to the International Diabetes Federation, the number of individuals suffering from diabetes is expected to reach 643 million by the end of 2030, thus estimated to spike demand for various collagen-based wound healing products. In addition, the growing incidence of surgical procedures and their associated high risk of surgical site infections (SSIs) have increased the need for collagen-based wound care products. It is also driven by the U.S. government, which has been focused on reducing healthcare expenses while providing better patient outcomes with the help of advanced wound care technologies, making collagen-based solutions a suitable choice.

The formulation of collagen patches is anticipated to grow significantly over the forecast period due to their biocompatibility and biodegradability, which stimulate the process of wound healing by promoting the production of fibroblasts while providing a good environment for wound healing. The patches are in high demand due to their antimicrobial properties that increase safety and provide many advantages such as speeding up healing and reducing the possibility of infection.

By Application

The acute wounds segment accounted for the highest market share in 2023, owing to the increasing prevalence of wounds caused by accidents and surgeries that require immediate wound care. Significant growth in this segment is due to the rising requirements for speedy and effective recovery solutions to lessen complications and avoid hospital stays. The growing usage of various technological advancements in wound care products that provide better management of acute wounds has broadened their market scope. These factors, along with government initiatives to improve healthcare infrastructure and curb infection rates, are driving the adoption of advanced wound-healing solutions for acute wounds.

This segment is primarily driven by the high incidence of acute wounds from road accidents. According to the World Health Organization, 93.0% of all traffic deaths worldwide occur in middle- and low-income countries, necessitating the need for rapid wound-healing solutions. Furthermore, an upsurge in the number of surgeries performed around the world is because most surgeries tend to end up finding surgical site infections and hence need proper cure which in turn is expected to fuel the growth in the acute wound care products market.

Patch-Based Wound Healing Products Market Regional Insights

North America held the largest share of the patch-based wound healing products market, at approximately 43% in 2023, supported by the region's advanced healthcare infrastructure and high penetration of advanced wound care technologies. The U.S. accounts for a considerable part of this share owing to favorable reimbursement policies and a large market foothold of invasive wound care product manufacturers. However, the Asia-Pacific region is projected to record the highest CAGR during the forecast period, due to rapid healthcare industry development and a rise in awareness regarding advanced wound care products. The growing prevalence of chronic wounds and trauma injuries will also play a significant role in boosting growth in the Asia-Pacific region, as this region sees expanding healthcare infrastructure. Extensive initiatives by the governments to improve healthcare access, along with increased insurance coverage, is likely to fuel the adoption of patch-based wound healing products in this region. In 2023, a significant share was also attributed to China, owing to its extensive, fast-growing population that has increased the incidence of chronic and acute wounds. China's strong growth in the advanced wound care market can be attributed to significant investment in healthcare infrastructure and a higher adoption rate of advanced technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Patch-Based Wound Healing Products Market Key Players

Key Service Providers/Manufacturers

-

3M (U.S.): Tegaderm Transparent Film Dressing, Cavilon No Sting Barrier Film

-

Convatec Inc. (U.K.): AQUACEL Ag+ Extra Hydrofiber Dressing, DuoDERM Signal Dressing

-

Integra LifeSciences (U.S.): Integra Wound Matrix, Dermal Regeneration Template

-

Smith & Nephew plc (U.K.): ALLEVYN Life Foam Dressing, Opsite Flexifix

-

B. Braun SE (Germany): Askina Foam, Askina DresSil

-

Coloplast Pty Ltd (Australia): Biatain Silicone, Comfeel Plus Transparent

-

Mölnlycke Health Care AB (Sweden): Mepilex Border, Mepitel One

-

Johnson & Johnson Private Limited (India): REACTIC Hydrocolloid Dressing, NU-DERM Alginate Dressing

-

Harro Höfliger Verpackungsmaschinen GmbH (Germany): Specializes in manufacturing machinery for wound care products; specific product names are proprietary to their clients.

-

Sanara MedTech Inc. (U.S.): CellerateRX Surgical Gel, BIAKŌS Antimicrobial Wound Gel

-

Reapplix A/S (U.S.): LeucoPatch

-

Cardinal Health (U.S.): Cardinal Health Silicone Bordered Foam Dressings, Cardinal Health Hydrocolloid Dressings

-

Ostomed (U.K.): Provides specialized wound care solutions; specific product names are proprietary.

-

Kerecis (U.S.): Kerecis Omega3 Wound, Kerecis Omega3 Burn

-

Axio Biosolutions Pvt Ltd (India): Axiostat Hemostatic Dressing, MaxioCel

-

NANOVIBRONIX CORPORATION (U.S.): PainShield MD, WoundShield

-

Human BioSciences (U.S.): Medifil II Collagen Particles, SkinTemp II Collagen Sheets

-

DermaRite Industries, LLC. (U.S.): DermaFilm Transparent Film Dressing, DermaGinate Calcium Alginate Dressing

-

Winner Medical Co., Ltd. (China): Winner Silicone Foam Dressing, Winner Alginate Dressing

-

Huhtamäki Oyj (Finland)

Recent Developments in the Patch-Based Wound Healing Products Market

-

The U.S. Department of Health and Human Services, research has been directed toward the clinical efficacy of hydrogel-based patches to create moist healing conditions and prevent infections.

-

Horizon 2020 initiative by European Commission as an incubator & prescriber of innovation around bioengineered dressings integrating those into public health systems to improve wound care outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.35 Billion |

| Market Size by 2032 | USD 1.99 Billion |

| CAGR | CAGR of 4.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Formulation (Povidone-iodine, Collagen, Silver, Others) • By Application (Acute Wounds, Chronic Wounds) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Convatec Inc., Integra LifeSciences, Smith & Nephew plc, B. Braun SE, Coloplast Pty Ltd, Mölnlycke Health Care AB, Johnson & Johnson Private Limited, Harro Höfliger Verpackungsmaschinen GmbH, Sanara MedTech Inc., Reapplix A/S, Cardinal Health, Ostomed, Kerecis, Axio Biosolutions Pvt Ltd, NANOVIBRONIX CORPORATION, Human BioSciences, DermaRite Industries LLC, Winner Medical Co. Ltd, Huhtamäki Oyj |