Pelargonic Acid Market Report Scope & Overview:

The Pelargonic Acid market size was valued at USD 189.55 million in 2023 and is expected to reach USD 345.14 million by 2032, growing at a CAGR of 6.89% over the forecast period of 2024-2032. The pelargonic acid market report covers production capacity and utilization by region, with a focus on application sectors like agrochemicals and personal care. The report also examines feedstock prices and raw material costs across major regions, along with the impact of regional regulations on market dynamics. Environmental metrics, including emissions and sustainability practices, are analyzed to gauge the industry's eco-footprint. Additionally, it delves into R&D investments and innovations in bio-based production methods, as well as the adoption rates of Pelargonic Acid-based products across different regions, providing a detailed picture of the market’s growth drivers.

Get E-PDF Sample Report on Pelargonic Acid Market - Request Sample Report

Drivers

Growing demand for bio-based herbicides drives the market growth.

The rapid global demand for bio-based herbicides is playing an influential role in the growth of the Pelargonic Acid Market, as an increasing portion of agriculture industries turn to green herbicides in place of traditional synthetic herbicides. As soil degradation becomes increasingly prominent, alongside pollution and health issues from herbicides based on chemicals to humans and the environment, farmers are transitioning towards sustainable solutions for weed control. Pelargonic acid is a biodegradable, low-toxic, and effective non-selective herbicide that has gained popularity due to its naturally derived origins. Moreover, the need to limit the use of synthetic herbicides such as glyphosate and paraquat due to government regulations in several countries has provided an impetus to thyme-based herbicides. Further propelling the market growth are policies that support organic farming and regenerative agriculture, allowing pelargonic acid to solidify its position as the backbone of sustainable agriculture.

Restraint

High production costs associated with pelargonic acid may hamper the market growth.

The market growth is hindered by the high production costs of pelargonic acid as the processes for extraction and purification require high-end technologies and raw materials, further increasing costs. Bio-based feedstock dependence makes their manufacturing costs higher than synthetic ones. Furthermore, both the intricacy of the production process and the stringent quality control measures contribute to expenses on the field level. The currently high costs of pelargonic acid as a natural herbicide and industrial chemical compared to conventional alternatives, nevertheless, restricts its widespread use, especially in price-sensitive markets. Though growing demand for sustainable and bio-based solutions is paving the way for market expansion, the cost barrier is less accomplished sustenance, restraining its penetration in developing economies as affordability is a significant constraint.

Opportunities

Increasing adoption of organic farming practices create an opportunity for the market.

Organic farming practices are being increasingly adopted by farmers in many countries around the globe, offering a great opportunity to the pelargonic acid market because the farmers and agricultural industry at large are willing to switch to natural-based solutions instead of synthetic chemicals. As consumers shift towards organic, premium, and chemical-free food, governments across the world are promoting organic farming by providing subsidies and incentives while also implementing strict regulations against synthetic pesticides and herbicides. As a bio-based, biodegradable, and non-restricted herbicide, pelargonic acid is suitable for use in certified organic crops as a weed control option that complies with organic farming principles. Moreover, the rising awareness associated with soil health, preservation of biodiversity, and sustainable agriculture are further catalyzing the bio-herbicides market, thereby accelerating pelargonic acid growth that caters to the expanding organic farming industry.

Challenges

Regulations and standards imposed by regulatory bodies may challenge market growth.

The growth of the pelargonic acid market is challenged by regulations and standards set by regulatory bodies. The breadth and depth of different regulatory frameworks around the world can be both deep and complex, requiring companies to allocate substantial resources to their compliance efforts. For example, pelargonic acid-based herbicides are proving favorably approved, but different standards operate in different nations, requiring a thorough understanding and compliance. The increase in complexity can result in delays in approvals of products and higher market-entry costs. A further increase in operational costs can be due to the strict guidelines of environmental and safety regulations that may require alterations in production processes. Hence, such regulatory challenges create entry and extension barriers in the market, especially for small-scale players, creating an overall challenge in the pelargonic acid market growth.

Market segmentation

By Grade

The synthetic segment held the largest market share, around 68%in 2023. Synthetic production methods allow for more control of purity and yield and provide homogenous product quality, which is important for industrial applications. It is also a shorter extraction time, and pelargonic acid synthetic production costs less money than natural extraction so it also more economical in large-scale production. Since the raw materials for synthetic production are available, there are fewer uncertainties regarding the supply chain. Due to these benefits, the synthetic segment of the pelargonic acid market has been dominating. The synthetic production process ensures a consistent and scalable supply, which is crucial for these applications. This reliability in meeting industrial demands has been a significant factor in the synthetic segment's market leadership.

By Application

The herbicide segment held the largest market share, around 28% in 2023. The growing popularity of biopesticides concerning environmental and human health safety is the main reason to favor the eco-friendly herbicides in agriculture that is due to the growing consumer awareness and demand between farmers regarding the adverse effects associated with chemical pesticides on human health and the environment. Alternatively, pelargonic acid, a naturally occurring compound, is also often used as a non-selective contact herbicide with a wide spectrum of activity against most weeds. Due to its natural origin and low toxicity, it is commonly used in organic farming. The increasing focus on sustainability in agriculture and the trend toward natural herbicidal alternatives have also boosted the adoption of pelargonic acid in herbicide formulations.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Regional Analysis

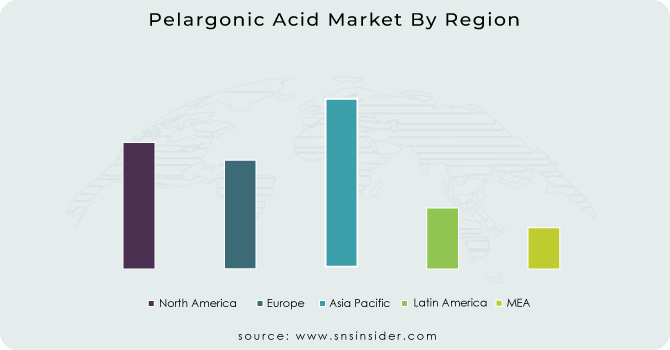

Asia Pacific held the largest market share, around 45.2% in 2023 due to the growing agriculture industry in the region, rising bio-based herbicides demand, and favorable government initiatives for sustainable agriculture. Growing organic farming and chemical-free crop protection solutions across developing nations such as China and India, in addition to growing environmental awareness across developed economic regions such as Germany and Japan, will boost market growth for pelargonic acid-based. Shortly after, the rapid industrialization and urbanization in this region have also drove the demand for pelargonic acid in the use of lubricants, coatings, and personal care products.

North America held a significant share in the forecast period. It is demand for bio-based herbicides is high, as the region is home to strict environmental regulations and a growing rate of sustainable agricultural practice adoption. Pelargonic acid is a popular natural herbicide amongst organic farms in United States and Canada, where organic farming has been booming over the years in commanding prices. In addition, the high consumption of pelargonic acid in the region can be attributed to its thriving industrial sectors such as lubricants, coatings, and personal care, among others. The dominance of North America is also supported by the present of leading market players, advancement of production technologies and continuing R&D activities. Additionally, the regional market growth is mainly fueled by government policies and incentives that promote bio-based chemicals.

Key Players

-

Kunshan Odowell Co., Ltd

-

Central Drug House (P) Ltd.

-

Glentham Life Sciences Limited

-

Emery Oleochemicals

-

Matrica S.p.A

-

Haihang Industry

-

Tokyo Chemical Industry Co., Ltd.

-

Zhengzhou Yibang Industry & Commerce Co., Ltd.

-

OQ Chemicals GmbH

-

Elevance Renewable Sciences

-

Vantage Specialty Chemicals

-

Sigma-Aldrich Corporation

-

Alfa Aesar

-

Penta Manufacturing Company

-

Spectrum Chemical Manufacturing Corp.

-

TCI America

-

Santa Cruz Biotechnology, Inc.

-

Acros Organics

| Report Attributes | Details |

| Market Size in 2023 | US$ 189.55 Mn |

| Market Size by 2032 | US$ 345.14 Mn |

| CAGR | CAGR of 6.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Synthetic Grade and Natural Grade) • By Application (Detergents, Personal Care & Cosmetics, Lacquer & Coatings, Lubricants, Food Additives, Herbicide, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M, The Window Film Company, Eastman Chemical Company, Garware Suncontrol, Avery Dennison Corporation, Saint Gobain, Madico Inc., Solar Screen International SA, XPEL Inc., Purlfrost, Polytronix Inc., Johnson Window Films, Hanita Coatings, V-KOOL, Reflectiv, Global Window Films, Huper |