Advanced Lead Acid Battery Market Report Scope & Overview:

Get More Information on Advanced Lead Acid Battery Market - Request Sample Report

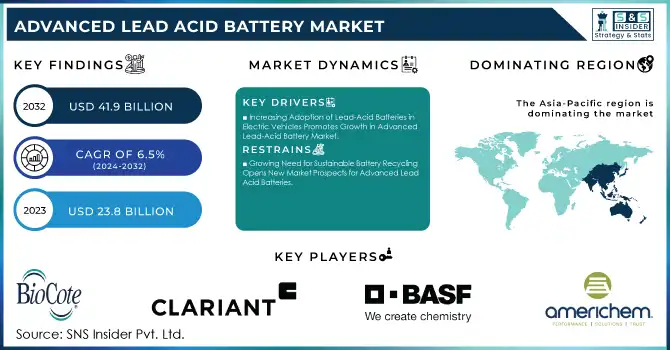

The Advanced Lead Acid Battery Market Size was valued at USD 23.8 billion in 2023 and is expected to reach USD 41.9 billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

The Advanced Lead Acid Battery Market has witnessed a surge in innovation, driven by the increasing demand for more efficient, durable, and cost-effective energy storage solutions. One of the key factors influencing this market is the automotive sector, where advancements in battery technology are being rapidly adopted. The recent developments in the sector are pushing the boundaries of lead-acid batteries, focusing on improving performance and lifecycle. Companies are focusing on enhancing the capabilities of these batteries for diverse applications, such as electric vehicles (EVs) and renewable energy storage systems. The dynamic market forces include the need for sustainable energy solutions, lower operating costs, and extended battery life. Additionally, government initiatives and regulatory pressures to reduce carbon footprints are significantly influencing the development and adoption of advanced lead-acid batteries in various industries.

In July 2024, Exide announced its plans to launch a new advanced SLI (starting, lighting, and ignition) AGM (absorbed glass mat) battery tailored for the automotive sector. This innovation focuses on providing superior performance, longer service life, and a higher charge acceptance rate compared to conventional lead-acid batteries. The technology promises improved energy efficiency, which is becoming increasingly important in automotive applications, particularly in start-stop systems and hybrid vehicles. The AGM battery's robust design ensures reliability, making it a suitable choice for a wide range of automotive applications. In December 2024, Ameren Missouri, a major electric utility, made significant strides in its clean energy transition by advancing stationary lead battery technology. This initiative is part of the company’s commitment to integrating renewable energy solutions into the grid. The advanced lead batteries are being deployed for grid storage, where they offer a cost-effective alternative to traditional lithium-ion batteries. This development is particularly noteworthy as it demonstrates the scalability and long-term potential of advanced lead batteries in stationary energy storage, contributing to more resilient and sustainable energy systems. These advancements highlight the growing role of advanced lead-acid battery technology in both the automotive and energy sectors.

Advanced Lead Acid Battery Market Dynamics:

Drivers:

-

Increasing Adoption of Lead-Acid Batteries in Electric Vehicles Promotes Growth in Advanced Lead-Acid Battery Market

The growing demand for electric vehicles (EVs) is one of the significant drivers fueling the expansion of the advanced lead-acid battery market. As automakers strive to develop cost-effective solutions for energy storage, lead-acid batteries are seen as a viable option for entry-level electric vehicles and hybrid vehicles. These batteries offer the advantage of low cost and reliability, crucial for the widespread adoption of EVs. Additionally, technological advancements in lead-acid battery chemistry are enhancing their performance and lifespan, making them even more attractive for EV manufacturers looking for affordable energy storage systems. As governments worldwide continue to introduce stricter emission regulations, manufacturers are increasingly turning to advanced lead-acid batteries for their ability to support eco-friendly initiatives without significant cost increases. This growing trend of electric vehicle adoption, alongside the push for greener technologies, is poised to further drive the market for advanced lead-acid batteries.

-

Rise in Renewable Energy Projects Drives Demand for Advanced Lead-Acid Batteries in Energy Storage Applications

-

Government Regulations and Policies Supporting Adoption of Advanced Lead-Acid Batteries Fuel Market Growth

Government policies and regulations encouraging the use of renewable energy sources and energy-efficient storage systems are key factors propelling the growth of the advanced lead-acid battery market. Many countries have implemented stringent environmental standards that push industries toward adopting cleaner, more efficient energy solutions. These regulations create a favorable environment for the development and deployment of advanced lead-acid batteries, particularly in sectors like automotive and energy storage. Furthermore, governments offer incentives and subsidies for the integration of energy storage systems, which include lead-acid batteries, into grid infrastructure and renewable energy projects. Such initiatives significantly reduce the upfront costs associated with these technologies, making them more accessible for businesses and consumers alike. This policy-driven demand is set to accelerate the market growth, as businesses seek to comply with regulations while also meeting their energy efficiency goals.

Restraint:

-

Competition from Alternative Energy Storage Solutions Limits Growth Potential of Advanced Lead-Acid Batteries

Opportunity:

-

Growing Need for Sustainable Battery Recycling Opens New Market Prospects for Advanced Lead-Acid Batteries

The increasing emphasis on sustainability and the circular economy presents a significant opportunity for advanced lead-acid batteries, especially in the context of battery recycling. Lead-acid batteries are highly recyclable, with a large percentage of their components—such as lead and sulfuric acid—being recoverable and reusable. As regulations around battery recycling tighten and the demand for sustainable solutions rises, the advanced lead-acid battery market is poised to benefit from the growing emphasis on recycling infrastructure and practices. Companies and organizations can capitalize on the opportunity by establishing robust recycling processes and by offering environmentally friendly lead-acid batteries that appeal to eco-conscious consumers and businesses. The recycling market is set to grow significantly, providing a sustainable solution to the disposal and reuse of lead-acid batteries, further enhancing their appeal in various industries.

-

Integration of Advanced Lead-Acid Batteries in Hybrid Vehicles Presents Untapped Market Potential

-

Utilization of Advanced Lead-Acid Batteries in Smart Grid Applications Opens New Business Avenues

The growing demand for smart grid technologies presents a lucrative opportunity for advanced lead-acid batteries, as they are well-suited for energy storage in grid applications. Smart grids require reliable and efficient storage systems to manage the intermittent nature of renewable energy sources like wind and solar power. Advanced lead-acid batteries offer a cost-effective, scalable solution for storing energy generated during periods of low demand, which can then be released during peak demand times. With governments and utilities investing heavily in smart grid infrastructure, the advanced lead-acid battery market stands to benefit from this shift toward modernizing energy networks. This growing market for smart grids provides manufacturers with a new avenue for growth, as lead-acid batteries become an integral part of energy distribution and management systems.

Advanced Lead Acid Battery Market Segments

By Type

The Stationary segment dominated the Advanced Lead-Acid Battery Market in 2023, holding a market share of 65%. Stationary lead-acid batteries are primarily used for energy storage in grid applications, backup power systems, and renewable energy solutions. Their ability to efficiently store and discharge energy makes them an ideal choice for maintaining a stable power supply in both residential and commercial sectors. Additionally, the growing integration of renewable energy sources such as solar and wind is fueling the demand for stationary batteries. For example, utilities and large-scale energy storage systems rely heavily on stationary lead-acid batteries to stabilize energy distribution and ensure a continuous power supply.

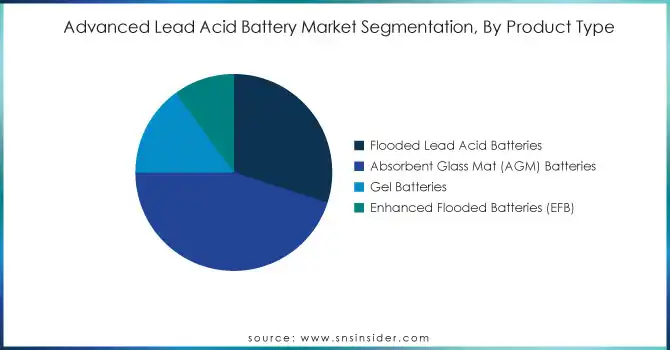

By Product Type

Absorbent Glass Mat (AGM) Batteries dominated the product type segment in the Advanced Lead-Acid Battery Market in 2023, with a market share of 45%. AGM batteries offer significant advantages over traditional flooded batteries, including higher performance, improved charge acceptance, and a longer lifespan. These batteries are widely used in automotive applications, particularly in vehicles equipped with start-stop systems, as well as in renewable energy storage solutions. Their ability to operate in harsh conditions with minimal maintenance has driven their dominance, with applications ranging from automotive to industrial energy storage.

By Construction Method

The Valve Regulated Lead Acid (VRLA) Battery segment dominated the construction method category in 2023, holding a market share of around 48%. VRLA batteries are sealed, maintenance-free, and highly reliable, making them ideal for both stationary and motive applications. These batteries are widely used in backup power systems, electric vehicles, and renewable energy storage, where reliability and minimal maintenance are crucial. The VRLA design eliminates the need for water refilling, making it more convenient for consumers and businesses, especially in remote or industrial settings where regular maintenance might not be feasible.

By End-Use Industry

The Automotive and Transportation segment dominated the end-use industry in the Advanced Lead-Acid Battery Market in 2023, with a market share of 40%. Lead-acid batteries are extensively used in the automotive sector, especially for starting, lighting, and ignition (SLI) applications in conventional vehicles, hybrid vehicles, and electric vehicles. The growing demand for hybrid vehicles and energy-efficient automotive solutions has contributed significantly to the widespread adoption of advanced lead-acid batteries. Furthermore, these batteries’ cost-effectiveness, reliability, and ability to handle extreme temperatures make them an attractive option for transportation-related applications.

Advanced Lead Acid Battery Market Regional Analysis

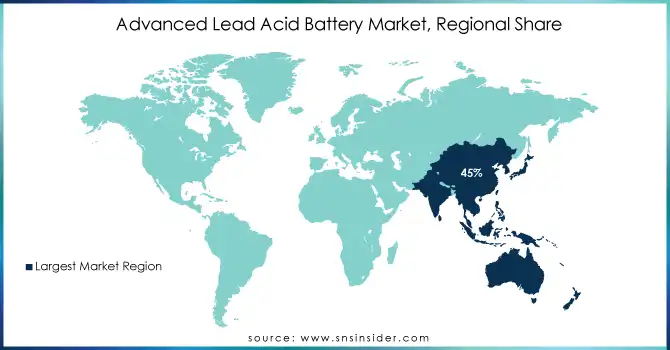

In 2023, the Asia-Pacific (APAC) region dominated the Advanced Lead-Acid Battery Market, holding a market share of 45%. The region’s dominance can be attributed to the growing demand for energy storage solutions and the extensive use of lead-acid batteries in industries such as automotive, energy, and power. APAC is home to several major manufacturing hubs, including China and India, which are significant consumers and producers of lead-acid batteries. China, in particular, plays a key role due to its large automotive market, where lead-acid batteries are widely used in both conventional and electric vehicles. Additionally, the region has seen a rise in renewable energy projects and grid modernization, further driving the demand for stationary lead-acid batteries. In India, the growing electrification of vehicles and the expansion of the renewable energy sector are further accelerating market growth. As the region continues to industrialize and urbanize, demand for advanced lead-acid batteries in sectors like backup power systems and telecommunications is also growing. Examples include China’s push for clean energy projects and India’s development of solar power, both of which rely heavily on lead-acid batteries for energy storage.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Americhem Inc (AMERGY Antimicrobial Additives, Polymer Masterbatches)

-

BASF SE (Ultramid C37LC, Ultradur B1520)

-

BioCote Limited (Antimicrobial Coatings, Polymer Additives)

-

Clariant AG (AddWorks AGC 970, AddWorks PKG 902)

-

Dupont (Delrin Antimicrobial Resins, Zytel Antimicrobial Resins)

-

Ensinger (TECAFORM AH, TECANYL MT)

-

King Plastic Corporation (King StarBoard, King MicroShield)

-

Lifespan Technologies (Guardian Antimicrobial Polymers, Lifespan Resins)

-

Lonza (Lonzabac Antimicrobial Additives, Densil Antimicrobial Solutions)

-

Microban International Ltd. (Microban Antimicrobial Additives, Microban Embedded Polymers)

-

Milliken Chemical (AlphaSan Silver Antimicrobial, Millad NX)

-

Parx Materials N.V (Saniconcentrate, PlasticShield)

-

Polyone Corporation (OnColor Antimicrobial Solutions, OnCap Antimicrobial Masterbatch)

-

RTP Company (Antimicrobial Masterbatches, Thermoplastic Compounds)

-

Sanitized AG (Sanitized PL 14-32, Sanitized BC 02-16)

-

Teknor Apex Company (Apex Flexible Vinyl, Monprene Thermoplastic Elastomers)

-

The Dow Chemical Company (INFUSE Olefin Block Copolymers, SURLYN Ionomers)

-

Toray Industries, Inc. (Torayca Resin, Amilan Nylon Resins)

-

Toyobo Co., Ltd. (Nerbrid Antimicrobial Resin, VYLON Polymer Additives)

-

Tosaf Compounds Ltd. (Antibacterial Masterbatches, Flame Retardant Compounds)

Recent Developments

-

July 2024: Exide launched its advanced SLI AGM battery for automotive use, designed for better performance, durability, and efficiency in start-stop and electric vehicles

-

January 2024: Clarios, a renowned global leader in advanced low-voltage battery solutions, and Altris, a trailblazer in sustainable sodium-ion battery technology, unveiled an exciting partnership. The collaboration is focused on the development of advanced low-voltage sodium-ion batteries specifically designed for the automotive industry.

-

September 2023: Amara Batteries Ltd, a leading manufacturer of industrial and automotive batteries, officially rebranded as Amara Raja Energy & Mobility Ltd (ARE&M). This strategic decision is intended to better represent the company's evolution beyond batteries into the wider energy and mobility sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 23.8 Billion |

| Market Size by 2032 | US$ 41.9 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Stationary, Motive) •By Product Type (Flooded Lead Acid Batteries, Absorbent Glass Mat (AGM) Batteries, Gel Batteries, Enhanced Flooded Batteries (EFB)) •By Construction Method (Flooded, Valve Regulated Lead Acid Battery (VRLA), Others) •By End-Use Industry (Automotive and Transportation, Energy and Power, Industrial, Residential, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Exide Technologies, Banner Batteries, Fiamm Energy Technology S.P.A., Clarios, Amara Raja Batteries Ltd, Hoppecke Batterien gmbh & Co. K, Camel Group Co., Ltd., Leoch International Technology Limited Inc., Midac Batteries S.P.A., First National Battery, Chaowei Power Holdings Limited, Narada Power, Gs Yuasa International Ltd., Gridtential Energy, Inc and other key players |

| Key Drivers | •Rise in Renewable Energy Projects Drives Demand for Advanced Lead-Acid Batteries in Energy Storage Applications •Government Regulations and Policies Supporting Adoption of Advanced Lead-Acid Batteries Fuel Market Growth |

| Restraints | •Competition from Alternative Energy Storage Solutions Limits Growth Potential of Advanced Lead-Acid Batteries |