Medical Device Security Market Report Scope & Overview:

Get more information on Medical Device Security Market - Request Sample Report

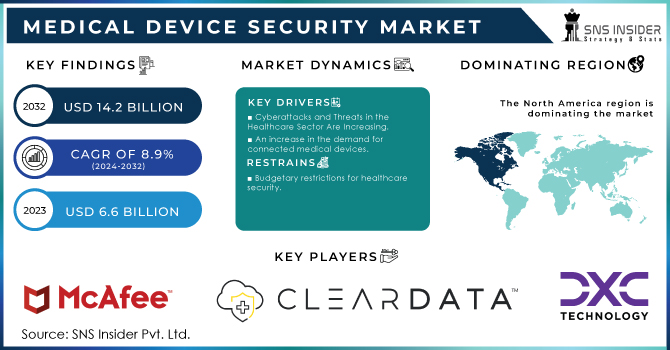

The Medical Device Security Market Size was valued at USD 6.6 billion in 2023 and is expected to reach USD 14.2 billion by 2032 and grow at a CAGR of 8.9% over the forecast period 2024-2032.

The Medical Device Security market has strong growth prospects due to increased growth of connected medical devices and awareness of cybersecurity risks in health care. Internet of Medical Things (IoMT) devices have made their way into hospitals and other healthcare organizations; more importantly, they necessitate adequately robust security measures. The proliferation of life-sustaining medical appliances such as infusion pumps, patient monitors, and imaging systems creates increased attack surfaces for cybercriminals, who would find healthcare facilities an attractive target for cyber-attacks. It thus requires effective medical device security solutions to ensure sensitive patient information is protected for uninterrupted care.

The rising reported cases of cyber incidents that damage healthcare organizations further fuel market demand. A Ponemon study indicates that 50% of the attacked organizations reported attacks in their supply chains, leading to care disruptions and worse health outcomes. Healthcare organizations, therefore, are committing to security in the area of cybersecurity to enhance their chances of countering cyber threats as demand for security products and services advances.

Supply-side factors have also come to the forefront in shaping the Medical Device Security market. Technological change is coming into the limelight in health care through cloud-based solutions and enhanced data analytics capabilities. Such advancements allow healthcare providers to implement strong security controls, such as real-time monitoring and assessment of vulnerabilities in connecting medical devices to avoid hacking. In addition, because of regulatory guidelines such as the FDA's guidelines and HIPAA, manufacturers and healthcare organizations are forced to invest highly in the cybersecurity of their operations. Due to this, there is increased demand for security solutions based on regulatory compliance.

The increase in cybersecurity threats, regulatory pressure, and growth in the adoption of connected medical devices are creating a very robust demand-supply dynamic in the Medical Device Security market. As an organization recognizes the critical importance of protecting medical devices from cyber risks, the market is likely to expand rapidly. It will then open doors for innovative security solutions as and when the healthcare sector develops future needs.

TABLE: Products and Players in Medical Device Security

| Product Category | Example Products | Key Players & Offerings |

|---|---|---|

| Network Security Solutions | Firewalls, Intrusion Detection Systems (IDS) | Palo Alto Networks, Fortinet, Cisco Systems (Comprehensive Network Security Solutions) |

| Endpoint Security Solutions | Antivirus Software, Device Management Systems | Symantec, Sophos, McAfee (Endpoint Protection for Medical Devices) |

| Application Security Tools | Web Application Firewalls (WAF), Secure SDLC Tools | Check Point Software Technologies, Imperva (Advanced Application Protection Tools) |

| Data Encryption Solutions | AES Encryption Tools, Secure Messaging Applications | IBM, CA Technologies, Cisco Systems (Data Protection and Encryption Solutions) |

| Security Assessment Tools | Vulnerability Scanners, Risk Assessment Software | ClearDATA, DXC Technology, Qualys (Risk Management & Security Assessments) |

| Cloud Security Solutions | Cloud Security Monitoring, Encryption, and Firewalls | ClearDATA, CloudPassage, FireEye (Cloud Protection Services for Medical Devices) |

| Incident Response Services | Managed Security Services, Incident Management Software | FireEye, IBM, Sophos (Comprehensive Incident Response Tools and Services) |

Medical Device Security Market Dynamics

Drivers

-

Demand For Connected Medical Devices with Increased Awareness of Cybersecurity Vulnerabilities

The demand for connected medical devices in the healthcare industry is one of the leading factors. The rationale behind the surge in demand for such devices is that immediate monitoring and collection of data regarding patients can be ensured via them. So, the total security solutions that not only protect sensitive information but also ensure the integrity of the devices increase with healthcare providers' dependence on such IoT-oriented devices. An increased awareness of cybersecurity vulnerabilities through cyberattacks on telemedicine platforms has also reflected increased investment in healthcare organizations. High-profile cases have underlined the consequences of poor security measures regarding unauthorized access to an individual's health information and disruption of patient care services. Regulatory pressures also emphasize the need for having tight security mechanisms in place. Policies from companies like the FDA push manufacturers and healthcare providers to deploy proactive security measures, which drives the expansion of the market. The above factors together lead to positive demand for connectivity devices, cyber threats, and regulatory compliance, creating a dynamic environment that encourages innovation and expansion within the medical device security market. With the rapidly changing healthcare environment, addressing cyber risk challenges will form the primary basis for ensuring patient safety and the reliability of medical technologies.

Restraints

-

High Implementation Costs

-

Complexity of Integration

Medical Device Security Market - Key Segmentation

| Segment | Dominant Segment (2023) | Fastest Growing Segment (CAGR) | Key Players & Offerings |

|---|---|---|---|

| by Component | Solutions | Services | Cisco Systems (Firewalls, IDS), IBM (Data Encryption, Security Assessments), Palo Alto Networks (Network Security) |

| by Type | Application Security | Cloud Security | Check Point Software Technologies (Web Application Firewalls), Imperva (Application Security), Fortinet (Network Security Solutions) |

| by Device Type | Hospital Medical Devices | Wearable and External Medical Devices | GE Healthcare (Medical Device Solutions), Philips Healthcare (Hospital Devices Security), Medtronic (Device Security Integration) |

| by End User | Healthcare Providers | Medical Device Manufacturers | Siemens Healthineers (Device Security Solutions), Abbott Laboratories (IoT Device Security), Johnson & Johnson (Medical Device Protection) |

by Component

In 2023, solutions emerged as the dominant segment with a 54.2% share in the medical device security market, capturing a significant market share due to their essential role in protecting connected medical devices. This segment encompasses a wide array of security solutions, including antivirus software, intrusion detection systems, and encryption technologies. The increasing reliance of healthcare providers on IoT-oriented devices has underscored the necessity for robust security measures to safeguard sensitive patient data. As high-profile cyberattacks on healthcare institutions continue to make headlines, organizations are prioritizing investments in comprehensive security solutions. The robust demand for these solutions is expected to persist as healthcare facilities seek to enhance their cybersecurity frameworks and comply with stringent regulations.

The services segment is the fastest-growing area within the medical device security market, driven by the increasing complexity of healthcare environments and the need for specialized expertise. This segment includes consulting, managed security services, and incident response solutions tailored to meet the unique security needs of healthcare organizations.

by Type

In 2023, application security was the dominant segment with a 38.6% share of the medical device security market, reflecting the increasing reliance on software applications within healthcare settings. With the growing use of telemedicine and health management applications, the need for robust application security measures has become paramount. Healthcare providers are investing significantly in ensuring that the applications used in medical devices are secure, protecting them from vulnerabilities that could be exploited by cybercriminals. Regulatory requirements and the need for secure handling of patient data are driving this demand. As the healthcare landscape continues to evolve, the importance of application security will remain a priority, solidifying its position as a market leader.

Endpoint security is rapidly emerging as the fastest-growing segment within the medical device security market, driven by the proliferation of connected devices in healthcare environments. As healthcare organizations increasingly adopt remote patient monitoring and telehealth services, the number of endpoints has surged, highlighting the urgent need for comprehensive security solutions to protect these devices.

by Device Type

Hospital medical devices represented the largest segment with a 41.6% share in the medical device security market in 2023, driven by their critical role in patient care and the increasing connectivity of these devices. Devices such as imaging systems, surgical instruments, and patient monitoring equipment are essential to hospital operations and are increasingly integrated with hospital networks. The growing focus on patient safety, coupled with regulatory pressures to secure these devices, has prompted healthcare facilities to prioritize their cybersecurity measures. As hospitals continue to adopt advanced technologies, the demand for tailored security solutions to protect these medical devices is expected to sustain this segment's dominance.

The wearable and external medical devices segment is experiencing rapid growth over the forecast period, fueled by the increasing trend toward personalized healthcare and health monitoring. Devices such as fitness trackers, smartwatches, and portable monitoring devices are becoming more prevalent as consumers seek to manage their health proactively.

by End User

Healthcare providers dominated the medical device security market in 2023 with a 39.5% share, as they are the primary users of connected medical devices. Hospitals and clinics are increasingly prioritizing cybersecurity to safeguard patient data and ensure compliance with evolving regulations. The rise in cyberattacks targeting healthcare institutions has heightened awareness of security vulnerabilities, leading to significant investments in comprehensive security solutions. As healthcare providers recognize the critical importance of securing their connected devices, the demand for tailored security measures will remain strong, sustaining their dominance in the market.

Healthcare payers, including insurance companies and government health programs, are rapidly emerging as the fastest-growing segment in the medical device security market over the forecast period. As these organizations increasingly engage with connected healthcare technologies and face rising concerns regarding data security and compliance, they are prioritizing investments in security solutions to protect sensitive patient information.

Medical Device Security Market Regional Analysis

The medical device security market for North America had the highest share with 45.5% because of massive cyberattacks against medical devices, high adoption of connected medical technologies, and increasing awareness of cybersecurity amongst healthcare professionals. It is further supported by the government initiatives put in place in this region to introduce far-reaching security solutions into the health sector. The presence of these factors together provides North America with the most prominent position in the sector of medical device security.

Asia Pacific is likely to witness the highest compound annual growth rate (CAGR) during the forecast period. Several key factors such as increasing adoption of connected medical devices, growth in healthcare infrastructure, and rising awareness about PHI preservation would fuel this high growth rate. Increasing concern and incidents about cyberattacks on medical devices have increased the demand for effective solutions associated with medical device security. Consequently, the growing demand for security-related solutions for medical device security has, in turn, boosted the market for medical device security in the Asia Pacific region.

Need any customization research on Medical Device Security Market - Enquiry Now

Key Players

-

Check Point Software Technologies

-

Palo Alto Networks

-

IBM

-

GE Healthcare

-

Fortinet

-

Symantec

-

CA Technologies

-

Philips

-

DXC Technology

-

CloudPassage

-

FireEye

-

Sophos, and others.

Recent Developments

In December 2023, Cisco, a leader in enterprise networking and security, announced the Cisco AI Assistant for Security. This is an important step toward embedding AI much more broadly throughout Cisco's Security Cloud: a unified, AI-infused, cross-domain security platform. This AI assistant is to support customers in decision-making, improve their tools, and automate complex security tasks.

In July 2023, Cynerio and Check Point Software Technologies announced that they have formed a strategic partnership to bring comprehensive security solutions for the medical IoT devices of healthcare organizations. The 360 platform of Cynerio provides necessary features for securing IoT healthcare devices, such as device discovery, patch guidance, micro-segmentation, and attack detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.6 Billion |

| Market Size by 2032 | USD 14.2 Billion |

| CAGR | CAGR of 8.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Type (Application Security, Endpoint Security, Network Security, Cloud Security) • By Device Type (Hospital Medical Devices, Internally Embedded Medical Devices, Wearable and External Medical Devices) • By End User (Healthcare Providers, Medical Device Manufacturers, Healthcare Payers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Check Point Software Technologies, Palo Alto Networks, ClearDATA, Cisco Systems, IBM, GE Healthcare, Imperva, Fortinet, Symantec, CA Technologies, Philips, DXC Technology, CloudPassage, FireEye, Sophos, and Others |

| Key Drivers | • Demand For Connected Medical Devices with Increased Awareness of Cybersecurity Vulnerabilities |

| Restraints | • High Implementation Costs • Complexity of Integration |