Big Data in Healthcare Market Size & Trends:

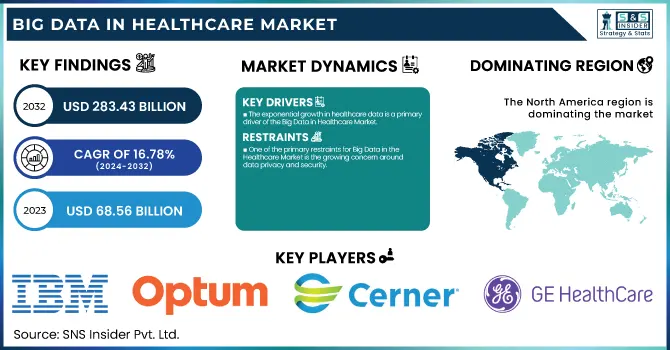

The Big Data in Healthcare Market size was valued at USD 68.56 billion in 2023, projected to reach USD 283.43 billion by 2032, growing at a CAGR of 16.78% from 2024-2032.

To Get more information on Big Data in Healthcare Market - Request Free Sample Report

The Big Data in Healthcare market is witnessing swift expansion as healthcare institutions progressively embrace data-driven technologies to better patient care, optimize operations, and improve decision-making. The incorporation of big data analytics enables healthcare professionals to extract meaningful insights from large volumes of both structured and unstructured data, such as electronic health records (EHRs), medical imaging, genomic information, and patient wearables. These technologies facilitate predictive analytics, tailored medicine, and enhanced patient results, which are essential in the current healthcare landscape.

A major factor propelling this market is the increasing amount of healthcare data. In 2023, the Orient software report indicated that the volume of global healthcare data was growing exponentially, with projections suggesting it would hit 2,314 exabytes by 2025, highlighting the necessity for efficient data management strategies. Consequently, healthcare organizations are making substantial investments in big data analytics platforms, cloud computing, and artificial intelligence to manage and analyze this data efficiently.

Recent trends emphasize the market’s dynamics. For example, in March 2023, Google Cloud launched its Healthcare Data Engine, allowing organizations to effortlessly integrate and analyze data from EHRs, wearables, and various devices, enhancing interoperability. Likewise, Optum Labs examined EHRs from 30 million patients in August 2024, establishing a predictive analytics database that is now available to other healthcare organizations to enhance care delivery and patient management.

Moreover, the predictive analytics features incorporated into Cerner’s EHR systems in April 2023 are assisting healthcare providers in forecasting patient requirements and enhancing care delivery. These developments highlight the increasing shift toward preventive care and the significance of big data analysis in influencing the future of healthcare. The general movement towards digital transformation and the adoption of big data is anticipated to propel the ongoing growth of this market, with considerable investments in infrastructure, artificial intelligence, and cloud technologies.

Big Data in Healthcare Market Dynamics

Drivers

-

The exponential growth in healthcare data is a primary driver of the Big Data in Healthcare Market.

The rapid increase in healthcare data is a key factor driving the Big Data in Healthcare Market. With the growing utilization of electronic health records (EHRs), wearable technology, medical imaging, and genomics, healthcare institutions are producing enormous amounts of data. This increase in data requires the utilization of sophisticated big data analytics tools to manage, store, and extract insights from these extensive datasets. Utilizing big data analytics, healthcare providers can enhance patient outcomes via predictive insights, tailor treatment plans, maximize resource use, and improve operational efficiency. The rising amount of healthcare data will persist in boosting investments in big data technologies and propelling market expansion.

-

The growing demand for personalized medicine and predictive analytics is another significant driver for the big data market in healthcare.

The increasing need for personalized medicine and predictive analytics represents another major factor propelling the big data market within healthcare. In 2023, healthcare spending in the U.S. was at around USD 4.8 trillion, which is expected to be at USD 7.7 trillion by the end of 2032. Due to progress in genomics, wearables, and clinical information, healthcare providers are shifting towards customized treatments designed for a person's genetic makeup, lifestyle, and medical background. Big data analytics facilitates the examination and processing of intricate patient information to uncover trends and forecast future health results, leading to more proactive and preventive healthcare. Predictive analytics can assist in identifying early indicators of diseases like cancer, heart problems, and diabetes, allowing for prompt actions that enhance patient results. As healthcare professionals prioritize enhancing care quality and cutting costs, the need for predictive analytics solutions driven by big data will keep growing, thus speeding up market expansion.

Restraint

-

One of the primary restraints for Big Data in the Healthcare Market is the growing concern around data privacy and security.

A significant limitation of Big Data in the Healthcare Market is the increasing apprehension regarding data privacy and security. Healthcare information is extremely sensitive, including personal health details, medical records, and genetic information, which makes it a prime target for cyber threats. As big data analytics becomes more widely adopted, healthcare organizations encounter the challenge of safeguarding patient data from breaches and unauthorized access. Tight regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. set rigorous standards for data security; however, as the amount of data expands and the adoption of cloud computing and AI rises, ensuring data protection becomes increasingly complex. This issue may hinder the uptake of big data technologies in healthcare, as organizations could be reluctant to implement these solutions without strong security protocols established. Guaranteeing data privacy and adhering to compliance standards continues to be a major obstacle to market expansion since any violation can lead to serious financial, legal, and reputational repercussions.

Big Data in Healthcare Market Segmentation Analysis

By Component

The software segment dominated the big data in the healthcare market with around 70% market share in 2023, as software helps to manage, analyze, and interpret large volumes of healthcare data. Healthcare analytics software provides powerful technology solutions for data integration and analytics, as well as data visualization. For example, SAS Health Analytics and IBM Watson Health are some advanced platforms that enable organizations to analyze patient data, predict health trends, and assist in clinical decision-making. This prevalence reflects how people are increasingly reliant on advanced software solutions to tackle complex healthcare data sets efficiently.

By Spender

The healthcare payer segment dominated the Big Data Analytics in the Healthcare Market in 2023 with 64% of the market share, owing to the increasing need for cost efficiency and improved patient outcomes. Insurance uses analytics to identify risks, streamline claims management, and improve fraud detection. In addition, the growing emphasis on value-based care and payment models is driving demand for data analytics solutions among payers to assess the effectiveness of treatment. To make transitions to these new systems, payers can increasingly be scrambling toward incentive-based compensations tied to patient outcomes further fuelling the demand for big data analytics to enable these transitions.

The Provider segment is the fastest-growing segment in the big data healthcare market with 18.50% throughout the forecast period. Asia Pacific region is experiencing expansion at the fastest rate in Big Data Analytics in the Healthcare Market from 2024 to 2032 is anticipated in the healthcare provider segment, as hospitals and clinics adopt analytics tools at a rapid pace to improve clinician decision-making and manage patients effectively. This widespread expansion of data is being driven by an increased focus on personalized medicine and patient-centered care, where analytics permit treatments that are tailored to individual patient characteristics. Moreover, the incorporation of artificial intelligence and machine learning into analytics, enabling providers to predict patient needs, also drives growth by enhancing delivery and outcomes of care.

By Tool

In 2023, the predictive analytics segment dominated the market and occupied a substantial portion of the Big Data Analytics in the Healthcare Market, as it facilitates the forecasting of future occurrences through the examination of historical data and statistical information. This instrument enables healthcare professionals to enhance their readiness for upcoming patient requirements. The movement towards value-based payment and managing population health has led to a need for risk score assessments, as organizations must pinpoint high-risk individuals and implement proactive strategies. Moreover, incorporating machine learning and artificial intelligence boosts predictive analytics, enhancing the effectiveness of healthcare approaches.

The visual analytics segment is projected to experience the fastest compound annual growth rate (CAGR) in the market throughout the forecast period. Its capability to accurately depict raw data makes it essential for decision-making, particularly since healthcare organizations produce vast amounts of data. The emergence of health information technologies, including electronic health records (EHRs) and various digital health solutions, bolsters the segment’s expansion. Moreover, heightened investment in visual analytics systems aimed at improving patient care and organizational effectiveness boosts the demand for AI-enabled tools in this area.

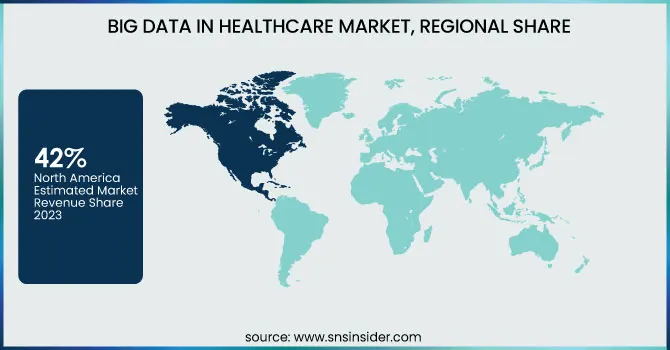

Big Data in Healthcare Market Regional Insights

In 2023, North America, dominated the market with 42% of the market share, especially the United States, leading the Big Data in Healthcare Market owing to its sophisticated healthcare system, extensive use of advanced technologies, and substantial government backing. The area features a well-developed healthcare system with substantial data production, allowing for the incorporation of big data solutions to improve patient care and operational effectiveness. Major healthcare entities in North America, including IBM, Google, and Cerner, foster innovation and the implementation of big data technologies. Government programs, such as the Affordable Care Act, advocate for electronic health records and health information exchanges, fostering the application of data analytics. Moreover, increasing healthcare expenses compel organizations to find more effective, data-informed approaches. These factors together position North America as the leading player in the big data healthcare market.

The Asia Pacific region is the fastest-growing region in Big Data in Healthcare with a CAGR Of 19.71% throughout the forecast period, fueled by swift population increase, urban development, and an aging demographic, resulting in heightened healthcare needs. Nations such as China, India, and Japan are making significant investments in healthcare infrastructure to address these demands, driving the use of big data analytics. Technological progress like the extensive adoption of electronic health records, telemedicine, and wearable technology produces enormous volumes of data, leading to a significant need for big data solutions. Furthermore, government actions and funding for healthcare reforms promote the digital transformation of healthcare services, which also speeds up the market's expansion. The integration of AI, machine learning, and predictive analytics in healthcare administration is improving patient care and operational efficiency, driving the swift market growth in the Asia Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Big Data in Healthcare Market

-

IBM Corporation (IBM Watson Health, IBM Clinical Development)

-

Optum (UnitedHealth Group) (OptumIQ, Optum Analytics)

-

Cerner Corporation (HealtheIntent, PowerChart)

-

Philips Healthcare (HealthSuite, IntelliSpace Precision Medicine)

-

McKesson Corporation (McKesson Decision Support Analytics, McKesson Health Mart Atlas)

-

Allscripts Healthcare Solutions (Allscripts Analytics, Sunrise EHR)

-

Epic Systems Corporation (Epic Cosmos, MyChart)

-

GE Healthcare (Edison Health Services, Centricity Analytics)

-

Oracle Corporation (Oracle Health Management, Oracle Healthcare Foundation)

-

SAS Institute Inc. (SAS Health Analytics, SAS Visual Analytics)

-

Microsoft Corporation (Microsoft Azure Healthcare API, Microsoft Cloud for Healthcare)

-

Amazon Web Services (AWS) (AWS HealthLake, AWS Comprehend Medical)

-

Google (Google Cloud) (Google Cloud Healthcare API, BigQuery for Healthcare)

-

Siemens Healthineers (teamplay Digital Health Platform, AI-Rad Companion)

-

Cognizant Technology Solutions (Cognizant Healthcare Data Analytics, Trizetto)

-

Medtronic plc (CareLink Network, Medtronic Analytics Solutions)

-

IQVIA (IQVIA CORE, Orchestrated Patient Engagement)

-

Dell Technologies (Dell EMC Elastic Cloud Storage, Dell EMC Isilon)

-

Hewlett Packard Enterprise (HPE) (HPE Ezmeral, HPE GreenLake for Healthcare)

-

Tableau (a Salesforce Company) (Tableau for Healthcare, Tableau Prep)

Key suppliers

These suppliers play critical roles in enabling the infrastructure, data processing, and analytics capabilities needed for the Big Data in the Healthcare market.

-

Intel Corporation

-

NVIDIA Corporation

-

SAP SE

-

Cisco Systems

-

Dell EMC (Dell Technologies)

-

Red Hat (IBM)

-

Broadcom Inc.

-

VMware (a Dell Technologies Company)

-

Cloudera

Recent Developments

-

Optum Labs (August 2024) has successfully analyzed electronic health records (EHRs) from 30 million patients, creating a robust predictive analytics database. Optum is now offering these advanced analytics solutions to other healthcare organizations, enabling them to leverage the insights for enhanced patient care and operational efficiency.

-

In March 2023, Google Cloud launched its Healthcare Data Engine, a platform designed to seamlessly integrate and analyze data from a wide range of sources. This solution enhances data-driven decision-making by supporting interoperability and allowing healthcare providers to consolidate data from electronic health records, wearable devices, and other healthcare technologies.

-

Cerner (April 2023) introduced new advanced predictive analytics capabilities within its electronic health record (EHR) systems. These enhancements help healthcare providers anticipate patient needs and optimize care delivery by analyzing historical data to predict future patient outcomes, ultimately facilitating more proactive and personalized care management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 68.56 Billion |

| Market Size by 2032 | US$ 283.43 Billion |

| CAGR | CAGR of 16.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Spender (Healthcare Provider, Healthcare Payer) • By Tool (Financial Analytics, Data Warehouse Analytics, CRM Analytics, Production Reporting, Visual Analytics, Predictive Analytics, Supply Chain Analytics, Risk Management Analytics, Test Analytics, Others) • By Application (Access Clinical Information, Access Transactional Data, Access Operational Information, Others) • By Deployment (On-premises, Cloud-based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Optum (UnitedHealth Group), Cerner Corporation, Philips Healthcare, McKesson Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, GE Healthcare, Oracle Corporation, SAS Institute Inc., Microsoft Corporation, Amazon Web Services (AWS), Google (Google Cloud), Siemens Healthineers, Cognizant Technology Solutions, Medtronic plc, IQVIA, Dell Technologies, Hewlett Packard Enterprise (HPE), Tableau (a Salesforce Company). |

| Key Drivers | •The exponential growth in healthcare data is a primary driver of the Big Data in Healthcare Market. •The growing demand for personalized medicine and predictive analytics is another significant driver for the big data market in healthcare. |

| Restraints | •One of the primary restraints for Big Data in the Healthcare Market is the growing concern around data privacy and security. |