Building and Construction Tapes Market Key Insights:

The Building and Construction Tapes Market size was valued at USD 4.8 billion in 2023 and is expected to Reach USD 7.36 billion by 2031 and grow at a CAGR of 5.5 % over the forecast period of 2024-2031.

Building and construction tapes are used in residential, commercial, and industrial structures to bond and mount parts on doors and windows, decorative trims or wall coverings, panels to frames, and protective bumper rails to furniture and walls.

Get Sample Copy of Building and Construction Tapes Market - Request Sample Report

Because the market for home renovations is expected to expand, tape demand is anticipated to rise during the forecast period. Additionally, the increased use of such products for bonding and protection is likely to boost demand for lightweight materials. Additionally, manufacturers' introduction of cutting-edge products is anticipated to drive the market.

Growth is anticipated to be driven by the Asia Pacific construction sector's rapid expansion as well as the use of adhesive tapes for window attachments and trim bonding.

Growing public awareness of the need for environmentally friendly products will probably lead to an increase in the production of paper and bioplastic-based adhesive tape backing, which is thought to be stable, safe, and environmentally friendly. In the upcoming years, the use of cutting-edge products like silicone-based resins in coating formulation is also anticipated to boost market growth.

Building and construction tapes are primarily made from plastics, paper, acrylic, polypropylene, and other raw materials. Crude oil price volatility directly affects the costs of the raw materials, which in turn causes price fluctuations in the finished product, limiting market expansion.

MARKET DYNAMICS

KEY DRIVERS:

-

Urbanization and Infrastructure Development in Developing nations

The growth of infrastructure, such as homes, businesses, and factories, along with urbanization trends are what fuel demand for building and construction tapes. Tapes are used for many different purposes, including joining materials, waterproofing, and electrical insulation, during the construction of new buildings, renovation projects, and infrastructure development.

-

The overall growth and expansion of the construction industry.

-

The need for repair and maintenance of existing infrastructure.

RESTRAIN:

-

Fluctuations in the prices of these raw materials can significantly impact the manufacturing

Raw materials like adhesives, backing materials, and release liners are used to make a variety of building and construction tapes. The costs involved in producing tapes can be significantly impacted by changes in the price of these raw materials. Price volatility can make it difficult for manufacturers to keep their margins and pricing stable, which could have an impact on the market.

- Alternative goods and services frequently compete with building and construction tapes.

OPPORTUNITY:

-

Continuous improvements in adhesive technology present possibilities for the creation of high-performance tapes.

Stronger bonding abilities, better adhesion to difficult surfaces, and increased durability in adhesive formulations can meet specific construction needs and spur market expansion.

-

Emerging markets, in Asia, Latin America, and Africa, are experiencing rapid urbanization and infrastructure development.

CHALLENGES:

-

In the market for building and construction tape, consistency in product quality and performance is difficult to maintain.

Variations in the strength of the adhesive, the resilience of the backing, or the weather resistance can cause a product to fail and lose customers. To meet customer expectations and ensure long-term success, it is crucial to implement strong quality control measures, carry out thorough testing, and provide accurate product specifications.

IMPACT OF RUSSIA-UKRAINE WAR

A global shortage of building materials has been brought on by the impact of the Russia-Ukraine conflict. The fundamental components of this industry are raw materials. Being that Russia and Ukraine are their main exporters, this would result in a global shortage of raw materials.

Russian energy and gas are essential to all of Europe. Building materials and energy costs, particularly coal, have increased dramatically since the start of the war. Together, they had a devastating impact on the entire build material industry.

Russia and Ukraine are the world's top producers of metals like nickel, copper, and iron. Steel manufacturing across the globe has been halted by the war. Consequently, this has an effect on industrial sectors like electrical goods, hardware, sanitary fittings, and construction tapes. The war has increased the cost of wood products like pulp because Russia provides 25% of the world's softwood.

Overall, supply chain disruption a less development in domestic region has affected the overall building and construction tapes market.

IMPACT OF ONGOING RECESSION

The construction sector is a vital part of the global economy because it supports infrastructure and jobs for people all over the world. However, the economic downturn that started early in 2022 and the ongoing political unrest and conflicts around the world have severely hurt it, just like they have many other industries. Additionally, the recent conflict in Ukraine has had a big effect on the sector, upsetting supply chains and driving up the price of building supplies.

Due to a decline in demand and funding issues, the recession that started in 2022 has had a significant impact on the construction industry. As a result, many projects have been postponed or cancelled. The construction industry faces increased competition from emerging markets and a shift towards more sustainable building practices as the world economy struggles to recover. Since the pandemic, the industry has begun to show signs of recovery, but it still faces difficulties like rising material costs and a lack of skilled labor.

The state of the construction sector has also been significantly impacted by the situation in Ukraine. Because of supply chain closures, higher transportation and material costs, and an ongoing conflict, numerous construction projects have been halted. Additionally, the instability in the area has made it more challenging for construction firms to obtain financing and insurance, resulting in further delays and project cancellations.

Construction has always been a risky business, and changes in the economy can have a big impact on revenue. Construction activity decreased significantly in 2020 as a result of the COVID-19 pandemic, with numerous projects being postponed or abandoned. Despite signs of recovery in 2021, the industry has been negatively impacted by ongoing problems with the global supply chain and rising material costs.

KEY MARKET SEGMENTS

By Product

-

Masking Tapes

-

Double Sided Tapes

-

Duct Tapes

-

Others

By Backing Material

-

Paper

-

Foil

-

Polypropylene

-

Polyethylene

-

Foam

-

Polyvinyl Chloride

-

PET

-

Others

By Application

-

Building Envelope

-

Flooring

-

Windows

-

Roofing

-

Doors

-

Walls & Ceiling

-

Electrical

-

Others

By Function

-

Glazing

-

Bonding

-

Sound Proofing

-

Insulation

-

Cable Management

-

Protection

By Distribution

-

Direct

-

Third-Party

By End Use

-

Commercial

-

Industrial

-

Residential

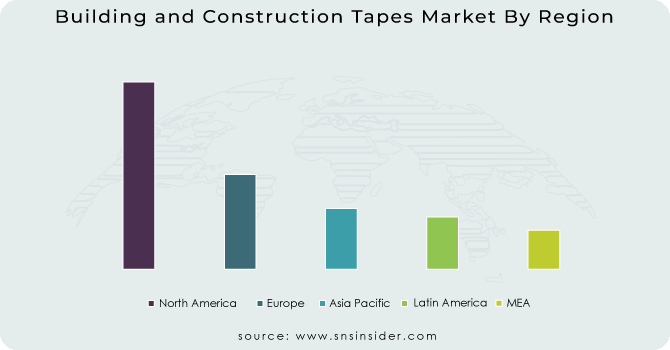

REGIONAL ANALYSIS

In North America, the demand for building and construction tapes is anticipated to increase in terms of sales. The initiatives made by the national governments to accommodate the expanding population with housing can be credited with the growth. The presence of independent organizations is probably going to contribute to the expansion of the local residential construction industry.

Due to the increased use of double-sided products, which are widely used in a variety of building applications, Asia Pacific is predicted to experience an increase in demand for foam backing material. Due to its qualities, including heat resistance and dimensional stability, PVC backing material has seen high volume growth, which also contributes to its increased usage in the expanding construction industry in this region.

The expansion of Brazil's commercial sector is a result of the private sector's involvement in the construction of the nation's infrastructure for economic growth. The expansion of the commercial construction industry is anticipated to contribute to the rise in demand for specialized tapes with high strength for various uses.

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Building and Construction Tapes Market are 3M Company, Bow Tape Co Ltd, American Biltrite Inc, L & L Products Inc, Henkel AG & Co. KGaA, LINTEC Corporation, Berry Global Group Inc, DuPont, Jonson Tapes Ltd, Avery Dennison Corporation and other players.

American Biltrite Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

Bostik, Two new cutting-edge products for the tape and label market have been introduced by Bostik, a leading global adhesive specialist for industrial, construction, and consumer markets. The first is Bostik HM2060, which offers a unified approach to high-speed label conversion in the Fast Moving Consumer Goods (FMCG) industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.8 Bn |

| Market Size by 2031 | US$ 7.36 Bn |

| CAGR | CAGR of 5.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Masking Tapes, Double Sided Tapes, Duct Tapes, Others) • by Backing Material (Paper, Foil, Polypropylene, Polyethylene, Foam, Polyvinyl Chloride, PET, Others) • by Application (Building Envelope, Flooring, Windows, Roofing, Doors, Walls & Ceiling, HVAC, Electrical, Others) • by Function (Glazing, Bonding, Sound Proofing, Insulation, Cable Management, Protection) • by Distribution (Direct, Third-Party) • by End Use (Commercial, Industrial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Bow Tape Co Ltd, American Biltrite Inc, L & L Products Inc, Henkel AG & Co. KGaA, LINTEC Corporation, Berry Global Group Inc, DuPont, Jonson Tapes Ltd, Avery Dennison Corporation and other players |

| Key Drivers | • Urbanization and Infrastructure Development in Developing nations • The overall growth and expansion of the construction industry. • The need for repair and maintenance of existing infrastructure. |

| Market Opportunities | • Continuous improvements in adhesive technology present possibilities for the creation of high-performance tapes. • Emerging markets, in Asia, Latin America, and Africa, are experiencing rapid urbanization and infrastructure development. |