Piezoelectric Devices Market Report Scope & Overview:

Get E-PDF Sample Report on Piezoelectric Devices Market - Request Sample Report

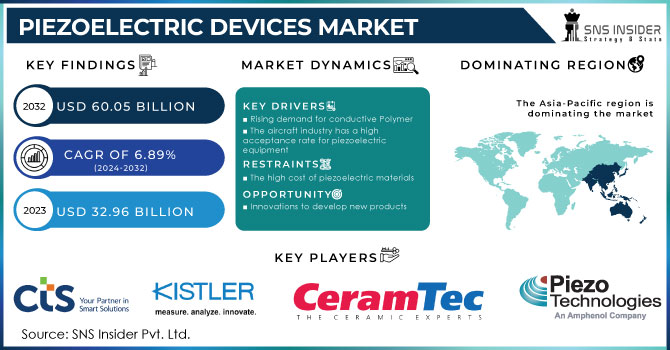

The Piezoelectric devices market size was valued at USD 32.96 billion in 2023 and is expected to grow to USD 60.05 billion by 2032 and grow at a CAGR Of 6.89 % over the forecast period of 2024-2032.

The increasing piezoelectric device market is being driven by the combination of geopolitical tensions, rising defense budgets, and the growing space exploration sector. Countries such as India, China, the United States, Israel, and Japan are making significant investments in upgrading their military capabilities, specifically in advanced technologies like missile guidance, drones, and radars. At the same time, the space industry is experiencing a rise in activity, driven by government and private efforts. The advancement of satellites, rockets, and space journeys requires the use of advanced sensors, sound equipment, and SONARs powered by piezoelectric materials. These materials are essential for detecting slight changes, withstanding tough conditions, and providing accurate information. With governments and private companies focusing on defense and space exploration, there will be a growing demand for Piezoelectric Devices to meet the technological needs of these important areas.

Knock sensors are among the most notable uses of piezoelectric sensors in the automotive sector. Engine knock, also known as detonation, happens when fuel ignites too soon in the cylinder, causing harmful vibrations that may harm engine parts. Piezoelectric knock sensors are specially created to pick up on these high-frequency vibrations. They are made up of piezoelectric crystals that produce an electric charge when the engine knock creates mechanical stress. The ECU receives the electrical signal and modifies the ignition timing to avoid additional knock, ultimately safeguarding the engine. Piezoelectric knock sensors play a crucial role in today's engines, particularly in turbocharged or high compression ratio engines that are more prone to knock. These sensors improve engine performance, fuel efficiency, and emissions by optimizing ignition timing. The need for knock sensors is strongly linked to the global automotive industry's emphasis on cutting emissions and improving fuel efficiency due to strict environmental regulations. The automotive industry heavily relies on Piezoelectric Devices, specifically sensors. With an increasing focus on safety, efficiency, and performance in advanced vehicles, the need for high-precision sensors, such as piezoelectric-based sensors, is projected to increase.

Market Dynamics

Drivers

Emission regulations are driving growth in the piezoelectric device market.

Strict emission standards enforced by areas like Europe and North America are greatly influencing the demand for Piezoelectric Devices. In order to meet regulations reducing harmful emissions such as NOx, CO, and PM, car manufacturers are more and more incorporating piezoelectric sensors in their vehicles' emission control systems. These sensors provide unmatched accuracy and dependability, allowing vehicles to function effectively while meeting strict emission regulations. Therefore, the need for Piezoelectric Devices has increased significantly, making them essential parts of current automotive technology.

Increasing need for conductive polymers in the piezoelectric device industry.

There is an increasing interest in incorporating conductive polymers in the piezoelectric device industry. These materials combine electrical conductivity and mechanical flexibility, making them suitable for Material s needing both characteristics. With the increasing need for wearable electronics, energy harvesting devices, and flexible sensors, conductive polymers are becoming a crucial element. Their light weight, affordability, and ease of processing add to their attractiveness even more. In wearable technology, conductive polymers can be included in piezoelectric fibers to produce energy from body motions, which can then be used to operate smart watches or fitness trackers. Furthermore, incorporating them into flexible sensors allows for the development of adaptable devices that can track a variety of physiological indicators. Although ceramics are high-performing, they typically have drawbacks like rigidity and brittleness. Conductive polymers offer another option with flexibility, biocompatibility, and the potential for mass production. With the advancement of research and development in this area, we anticipate seeing an increasing prevalence of conductive polymers in the piezoelectric device market.

Restraints

Challenges in Labor Shortages and Material Competition Hinder Piezoelectric Device Market Growth

The lack of skilled workers and the increased use of various materials are obstacles facing the piezoelectric device sector. A lack of qualified engineers and technicians in materials science and electronics is impeding progress in research, development, and manufacturing. This skill shortage may result in delays in projects and decreased efficiency in production, affecting the overall growth of the market. Furthermore, the emergence of alternative substances such as potassium sodium bismuth Titanate (KSBT) presents a challenge in terms of competition. These substances frequently display better performance qualities, like increased piezoelectric coefficients and enhanced temperature stability. If these alternative choices become cheaper and more accessible, they may attract investment away from conventional piezoelectric materials, potentially disrupting the market. To conquer these obstacles, a strategic plan is required that includes strong workforce training programs and a proactive approach to developing new materials in order to maintain the growth and competitive edge of the piezoelectric device market.

Templated grain growth can be used as a strategy to reduce costs for Piezoelectric Devices.

The market expansion is often prevented by the expensive nature of piezoelectric materials. Templated Grain Growth (TGG) provides a hopeful answer by allowing for the production of single crystals and textured ceramics with improved properties at potentially reduced expenses. This process includes arranging anisotropic single-crystal template particles, which serve as nucleation sites for the oriented growth of the matrix material. By improving this method, the piezoelectric sector has the potential to lower manufacturing expenses and make Piezoelectric Devices more economical, ultimately driving market expansion.

Segment Analysis

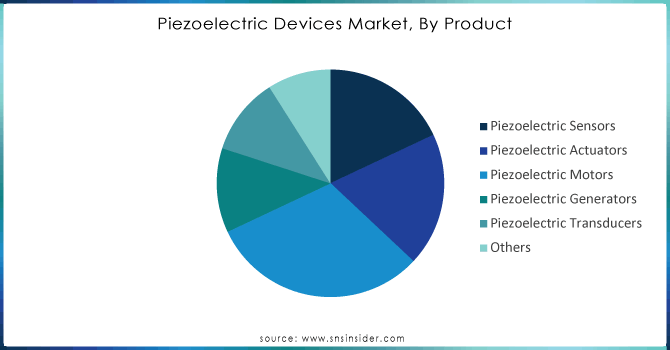

By Product

Based on Product, Piezoelectric Motors dominated the Piezoelectric Device with 31% of share in 2023. These new gadgets utilize piezoelectric materials to transform electrical energy into mechanical movement. A piezoelectric motor contains a ceramic element that, when given an electrical signal, produces force on a ceramic plate in a specific direction. This interaction drives the rotor, creating an uninterrupted movement. Piezoelectric motors provide unmatched precision, quick responsiveness, and high torque-to-weight ratios, unlike conventional electric motors. Their small size, quiet function, and capability to achieve nanometer-level positioning are essential in a range of uses such as robotics, automation, medical devices, and optical systems. Physik Instrumente (PI), Nanomotion, and Novanta are leading the industry in the development of advanced piezoelectric motors, pushing technology boundaries and expanding market potential.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Material

Based on Material, Piezoelectric Composites dominated the piezoelectric device market with 32% of share in 2023. Piezoelectric composites are quickly expanding in popularity because of their excellent characteristics and wide range of uses. By merging the advantages of piezoelectric ceramics and polymers, these materials present high coupling coefficients, low acoustic impedance, and exceptional mechanical durability. This special blend of characteristics makes them essential in industries like healthcare, where they are used by companies like Siemens Healthineers and GE Healthcare for advanced ultrasound imaging. In the aerospace and defense industries, major companies such as Boeing and Lockheed Martin use piezoelectric composites for vibration control and monitoring structural health. The automotive sector, including companies such as Bosch and Continental, is also reaping the rewards of using these materials in parts like knock sensors and fuel injection systems. The increasing need for small, high-performing electronic devices is driving the growth of piezoelectric composites, which are known for their excellent electro-acoustic efficiency and wide bandwidth. Due to their importance in advanced technologies across various sectors, the market leadership of these materials is expected to strengthen in the future.

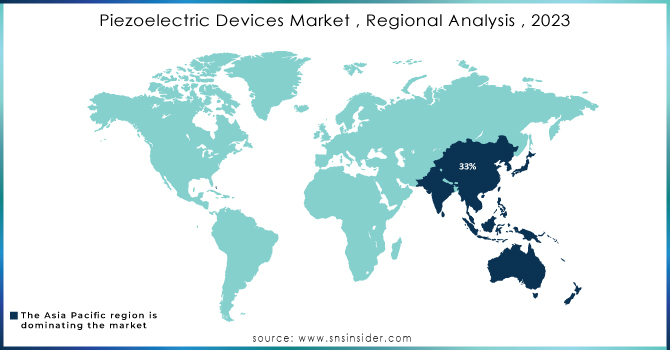

Regional Analysis

Asia Pacific dominated the piezoelectric Device market with 33% of share in 2023. The Asia Pacific region is quickly becoming the main hub for the piezoelectric device market on a global scale. Nations such as China, Taiwan, South Korea, and Japan are leading the way in this expansion, fueled by strong manufacturing industries, advanced technology skills, and a flourishing electronics sector. These countries are making significant investments in piezoelectric sensors and actuators for various uses in consumer electronics, automotive, healthcare, and industrial automation. Additionally, India, Singapore, Malaysia, Indonesia, and Australia are also aiding in the region's growth by incorporating piezoelectric technology across various industries. Asia Pacific's dominance in the global piezoelectric device market is driven by its emphasis on innovation and the growing need for accurate, effective, and dependable components in the region.

North America is the fastest growing in piezoelectric device market with 24% of share in 2023. The piezoelectric device sector in North America is seeing strong growth, driven by progress in important areas. The healthcare sector, spearheaded by companies such as Medtronic and Boston Scientific, plays a crucial role, as piezoelectric sensors improve ultrasound imaging and wearable health tracking. At the same time, major companies in the automotive industry like Magna International and Linamar are adopting piezoelectric actuators to enhance fuel efficiency and control emissions in compliance with stricter environmental laws. Industrial automation, supported by Honeywell and Rockwell Automation, is also playing a major role, utilizing piezoelectric components in precision control systems and robotics. The combination of these elements establishes North America as a top market for piezoelectric technology, with further expansion expected as advancements in these industries continue.

KEY PLAYERS

CeramTec GmbH (Germany), CTS Corporation (US); Kistler Group (Switzerland); Physik Instrumente (PI) GmbH & Co. KG. (Germany); piezosystem jena GmbH (Germany); Piezo Technologies (US). Aerotech Inc. (US); APC International, Ltd., (US); Mad City Labs, Inc. (US), CTS Corporation and other players are listed in a final report.

RECENT DEVELOPMENT

-

April 2023: A research group at KAIST, under the leadership of Professor Keon Jae Lee from the Department of Materials Science and Engineering, in collaboration with the College of Medicine at the Catholic University of Korea, successfully created an exceptionally sensitive wearable blood pressure sensor based on piezoelectric technology.

-

In 2024, significant progress has been made in the commercialization of lead-free Piezoelectric Devices, which are safer for both the environment and human health. Companies like KEMET and APC International

| Report Attributes | Details |

| Market Size in 2023 | US$ 32.96 Bn |

| Market Size by 2032 | US$ 60.05 Bn |

| CAGR | CAGR of 6.89 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Piezoelectric Sensors, Piezoelectric Actuators, Piezoelectric Motors, Piezoelectric Generators, Piezoelectric Transducers, Others) • By Material (Piezoelectric Crystals, Piezoelectric Ceramics, Piezoelectric Polymers, Piezoelectric Composites) • By Element (Piezoelectric Discs, Piezoelectric Rings, Piezoelectric Plates) • By Application (Aerospace and Defence, Industrial and Manufacturing, Automotive, Healthcare, Information and Communication, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CeramTec GmbH (Germany), CTS Corporation (US); Kistler Group (Switzerland); Physik Instrumente (PI) GmbH & Co. KG. (Germany); piezosystem jena GmbH (Germany); Piezo Technologies (US). Aerotech Inc. (US); APC International, Ltd., (US); Mad City Labs, Inc. (US) CTS Corporation |

| Key Drivers | • Rising demand for conductive Polymer. • The aircraft industry has a high acceptance rate for piezoelectric equipment. |

| Market Restraints | • The high cost of piezoelectric materials |