POLYETHER ETHER KETONE (PEEK) MARKET REPORT SCOPE & OVERVIEW:

Get More Information on Polyether Ether Ketone Market - Request Sample Report

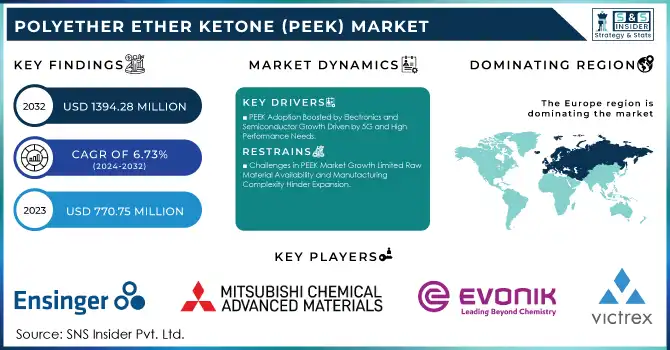

The Polyether Ether Ketone (PEEK) Market was valued at USD 770.75 million in 2023 and is expected to reach USD 1394.28 million by 2032, growing at a CAGR of 6.73% over the forecast period 2024-2032.

The expansion of the Polyether ether ketone (PEEK) market is mainly attributed to the unique properties of the material and growing demand from the prominent end-use industries. PEEK, or polyether ether ketone, is an excellent thermoplastic with special properties such as enhanced mechanical performance, excellent chemical resistance, extremely high thermal stability, and lightweight. This makes it an attractive alternative to metals and other conventional materials in industries such as automotive, aerospace, and medical devices. Increasing demand for lightweight, fuel-efficient vehicles and EVs is driving the sales and growth of PEEK components in the automotive industry. This weight reduction while maintaining structural integrity is one of the main motivators for the adoption of PEEK as a vehicle weight saver and fuel economy improvement. In addition, regulatory pressures on automakers to reduce carbon emissions are fuelling the demand for lightweight high-strength materials like PEEK. the high-performance polymer PEEK is being used in electric vehicles (EVs) for areas such as battery housings, connectors, and insulation, and Ford is seeing a 20% weight reduction in individual components with it. With PEEK replacing Critical components like Transmission systems and Engine components, automakers have carried increases in fuel efficiency of up to 8%.

PEEK market growth is also attributable to the aerospace and medical sectors. Aerospace has also been the stringent requirement for lightweight, high-strength materials for aircraft components thus, PEEK is increasingly being adopted to minimize weight and improve the fuel economy of aircraft. PEEK is useful in medicine due to its bio-compatibility property which allows it to be used in many implants like Permanent magnets in permanent magnet implants for surgery and prosthetic implants and surgical instruments sterilization property which is suitable in the medical field. The increasing trend of minimally invasive surgeries in addition to increasing global healthcare spending are expected to contribute to the high adoption of PEEK in the medical device market. Combining these factors is making the PEEK market stably increasing worldwide. In aerospace, PEEK adoption has gone up by 12% and is being used in various applications such as the landing gear (seals, for instance) by Airbus to improve endurance. Airlines targeting an 11% reduction in weights of aircraft components (commercial & military) using PEEK. The popularity of PEEK in spinal implants keeps on rising, as in 2023 Curiteva presented the world’s first 3D-printed PEEK spinal implants utilized in U.S. surgeries. Medical implants made up of PEEK are poised to grow by 20% each year, in areas such as spinal, orthopedics, and cranial implants.

Polyether Ether Ketone (PEEK) Market Dynamics

KEY DRIVERS:

-

PEEK Adoption Boosted by Electronics and Semiconductor Growth Driven by 5G and High-Performance Needs

Increasing adoption of PEEK for electronics and semiconductors is a major factor driving market growth Also Read: Manufacturers Turn to High-Performance Materials like PEEK to Meet Demand for Smaller, Faster, and More Efficient Electronic Devices Due to its good dielectric properties, thermal stability, and resistance to aggressive chemicals, it is widely used in semiconductor manufacturing equipment, connectors, insulators, and wire coating. The high-temperature resistance is back, as PEEK would not deform at nearly high temperatures, so it can be used in a scenario that would find other plastics failing. In addition, with the world moving towards a large-scale rollout of 5G infrastructure, there is a critical demand for the end-users of 5G network equipment, which must endure the high frequencies and thermal loads of the 5G equipment. For instance, PEEK's performance in high temperatures and aggressive chemical environments makes it favorable in printed circuit boards (PCBs) and semiconductor handling tools sectors thereby boosting its demand in extreme conditions reliability area. PEEK demand has been growing at 13% annually in the semiconductor industry owing to usage in connectors and insulators. With the continuous construction of global 5G infrastructure, the demand for PEEK in the 5G sector is increasing at a high rate of 19% per year, and the application fields of PEEK in components of 5G equipment have rapidly grown by 18% over the years.

-

PEEK Market Growth Driven by Oil and Gas Sector Demand for Durable Components in Harsh Conditions

Another sector that is responsible for increasing the growth of the PEEK market is the oil & gas industry. PEEK is widely used in critical systems such as seals, valve seats, insulators, and compressor components due to excellent resistance to extreme temperatures, high pressures, and corrosive chemicals. Unlike traditional materials, such as metal and lower-grade plastics, PEEK does not lose its strength or dimensional stability in aggressive environments (e.g. deep-sea drilling). As exploration and production ramp-up into more difficult offshore and deep-sea locations, durable and long-lasting materials are in increasing demand. Moreover, PEEK components provide a longer life cycle and better wear resistance than many other materials, which allows oil companies to save on maintenance costs and downtime. This need for durable materials under harsh operating conditions is anticipated to drive additional growth in PEEK in the oil & gas segment. The adoption of PEEK in key oil and gas elements such as seals and valve seats has grown by 20% for the years 2023 to 2024. This has resulted in reductions in maintenance costs and downtime of 17% and a service life of up to 28% higher than traditional materials. It is used in deep-sea drilling because of its strength in adverse offshore conditions, and the growth of this usage at 13% per year.

RESTRAIN:

-

Challenges in PEEK Market Growth Limited Raw Material Availability and Manufacturing Complexity Hinder Expansion

The two main restraints are the raw materials availability is limited and it also has a manufacturing complexity. Characterized by its unique polymeric properties, PEEK has to be produced in exceptional environments using specialized equipment that makes scaling much more difficult. That can make it less accessible, especially in parts of the world where the advanced manufacturing infrastructure is less so developed. A homegrown challenge, for some, is the competition from alternative materials. PEEK has many great properties and makes for a very good performing material, but in many applications, the unique properties of PEEK may not be needed and other high-performance thermoplastics, such as polyimide or polyphenylene sulfide, can be used instead. In addition, PEEK, despite its many advantages, has a processing temperature that is too high, which may also hinder the competition where there is less technological capacity to process such advances. As the industries develop, PEEK cannot occupy its market share in some application fields because new materials or better processing technology will come to compete with PEEK.

Polyether Ether Ketone (PEEK) Market Segments

BY TYPE

The Carbon-Filled PEEK accounted for the largest revenue share of 48.6% in 2023 owing to their unique features which are beneficial for high-performance applications. Carbon-loaded PEEK is a unique material characterized by its higher strength, stiffness, and conductivity, making it suitable for high-end applications in the aerospace, automotive, or electronics industries. Here it gains market share by being able to survive in extreme environments and by being a low-friction solution to wear applications. Such dominance is even more prevalent in industries such as aerospace with structural components needing both low weight and high strength.

Glass-filled PEEK is anticipated to achieve the fastest CAGR during the forecast period between 2024 to 2032. Glass-filled PEEK holds an attractive middle ground between performance and price, opening it up to a greater range of industries. It is ideal for providing strength, dimensional stability, and chemical resistance where carbon-filled variants are not required but carbon cost is a concern. The increase in demand for lightweight, durable, and low-cost materials from the electrical, electronics, and automotive industries is the reason behind the glass-filled PEEK demand. Moreover, the increasing transition to electric vehicles (EVs) is projected to grow at a rapid CAGR, creating demand for high-performance materials required for battery housings, insulation, as well as structural components, thereby positively impacting the growth of glass-filled PEEK over subsequent years.

BY END USE

The PEEK market was majorly dominated by Automotive in 2023 with a 34.4% share. The dominance is also due to the high demand for lightweight materials to address fuel efficiency and emission criteria in an automobile. The exceptional parameters of PEEK – their high strength, wear resistance, and stiffness at increased temperature make it a perfect choice for automotive applications like engine components, transmission, and electrical connectors. The transition to electric vehicles (EVs) also accelerates the demand for PEEK in the automotive sector as the material can fulfill the strict criteria for various components including battery housings and wire insulation. Moreover, the lower weight of vehicles using PEEK helps the affected industry in its basic task of improving the competitiveness of fuel efficiency along with manufacturer requirements for decreasing carbon emissions.

The Aerospace sector is poised to be the highest during the CAGR period from 2024 to 2032. The growth of this segment can be attributed to the high demand for lightweight, durable, and high-performance materials in the aerospace industry. PEEK is known for its excellent mechanical performance, thermal stability, and chemical resistance making it suitable for critical applications in aircraft components including mechanical structure, seals, and bearings among others. With the aerospace industry always seeking to reduce aircraft weight to enhance fuel efficiency and lower operational expenses, PEEK is likely to rise in its adoption. Diverse applications in other industries as well as aerospace advancements, such as commercially available aircraft and commercial space exploration, will spur growth in demand for high-performance materials, including PEEK.

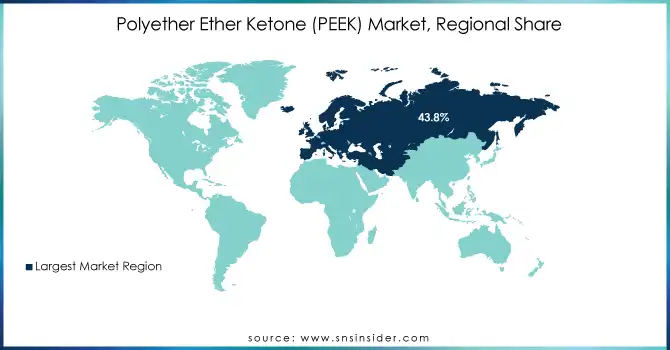

Polyether Ether Ketone (PEEK) Market Regional Analysis

In 2023, Europe held the largest share of the PEEK market by 43.8% owing to the strong industrial base and manufacturing capabilities in the region. A few well important industries in Europe that depend on PEEK are the automotive, aerospace, and medical industries. As an example, PEEK is used in lightweight automotive components for BMW & Volkswagen to comply with fuel efficiency & performance requirements. Aerospace: Airbus is a great example of how PEEK is used for aircraft structural components because the strength-to-weight ratio and thermal stability directly relate to safety and efficiency. Furthermore, PEEK’s biocompatibility and durability make it ideal for implants and surgical instruments, which is a driver for Europe’s robust healthcare industry with companies such as Johnson & Johnson manufacturing medical devices.

Asia Pacific is anticipated to witness the highest growth rate in terms of CAGR during the period 2024 to 2032, owing to rapid industrial growth, expansion of automotive & electronics production, and the tendency toward electric vehicles (EVs). As China transitions towards electric vehicle (EV) production, the automotive sector is increasingly utilizing PEEK in battery housings, connectors, and insulation materials. Japan is an important regional player, with its electronics sector utilizing PEEK for semiconductor equipment and connectors. Further, the expanding aerospace sector across Asia especially concerning India is likely to enhance the demand for PEEK in aerospace applications due to the regional investments in the development of commercial aviation as well as aerospace industries. This rapid growth in the PEEK market in Asia is due to the combination of automotive, electronics, and aerospace industries in Asia.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major players in the Polyether Ether Ketone (PEEK) Market are:

-

Victrex plc (Victrex PEEK, APTIV™)

-

Evonik Industries AG (VESTAKEEP®, VESTAMID®)

-

Mitsubishi Chemical Advanced Materials (Ketron®, Semitron®)

-

Ensinger (TECAPEEK®, TECATEC)

-

Solvay (KetaSpire®, AvaSpire®)

-

Jilin Joinature Polymer Co., Ltd. (Jilin PEEK, Jilin PEEK-HT)

-

Panjin Zhongrun High-Performance Polymers Co., Ltd. (Zhongrun PEEK, Zhongrun PEEK-HT)

-

Zhongyan PEEK (Zypeek PEEK, Zypeek PEEK-HT)

-

Zeus Industrial Products, Inc. (Zeus PEEK Tubing, Zeus PEEK Rods)

-

New Technology Plastics, Inc. (PEEK Tubing, PEEK Sheets)

-

Coral Labtech Enterprises (PEEK Tubing, PEEK Fittings)

-

Ensinger (TECAPEEK®, TECATEC)

-

Victrex plc (Victrex PEEK, APTIV™)

-

Evonik Industries AG (VESTAKEEP®, VESTAMID®)

-

Mitsubishi Chemical Advanced Materials (Ketron®, Semitron®)

-

Solvay (KetaSpire®, AvaSpire®)

-

Jilin Joinature Polymer Co., Ltd. (Jilin PEEK, Jilin PEEK-HT)

-

Panjin Zhongrun High-Performance Polymers Co., Ltd. (Zhongrun PEEK, Zhongrun PEEK-HT)

-

Zhongyan PEEK (Zypeek PEEK, Zypeek PEEK-HT)

-

Zeus Industrial Products, Inc. (Zeus PEEK Tubing, Zeus PEEK Rods)

Some of the Raw Material Suppliers for Polyether Ether Ketone (PEEK) companies:

-

Victrex plc

-

Evonik Industries AG

-

Solvay

-

Mitsubishi Chemical Advanced Materials

-

Jilin Joinature Polymer Co., Ltd.

-

Panjin Zhongrun High-Performance Polymers Co., Ltd.

-

Zhongyan PEEK

-

Ensinger

-

Zeus Industrial Products, Inc.

-

New Technology Plastics, Inc.

RECENT TRENDS

-

In October 2024, Victrex launched LMPAEK™ Granules and Powders, enhancing performance and efficiency in thermoplastic applications with faster processing and broader industry use.

-

In April 2024, Evonik's VESTAKEEP® i4 3DF PEEK filament was used in the first U.S. surgeries for 3D-printed spinal implants, marking Curiteva’s implants as the world’s first commercially approved 3D-printed spinal implants.

-

In May 2023, Solvay launched KetaSpire® PEEK for monolayer e-motor magnet wire insulation, offering improved efficiency and sustainability in electric motor production.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 770.75 Million |

|

Market Size by 2032 |

USD 1394.28 Million |

|

CAGR |

CAGR of 6.73% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Glass Filled, Carbon Filled, Unfilled, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Victrex plc, Evonik Industries AG, Mitsubishi Chemical Advanced Materials, Ensinger, Solvay, Jilin Joinature Polymer Co., Ltd., Panjin Zhongrun High Performance Polymers Co., Ltd., Zhongyan PEEK, Zeus Industrial Products, Inc., New Technology Plastics, Inc., Coral Labtech Enterprises. |

|

Key Drivers |

• PEEK Adoption Boosted by Electronics and Semiconductor Growth Driven by 5G and High-Performance Needs |

|

Restraints |

• Challenges in PEEK Market Growth Limited Raw Material Availability and Manufacturing Complexity Hinder Expansion |