Air Compressor Market Report Scope & Overview:

To get more information on Air Compressor Market - Request Free Sample Report

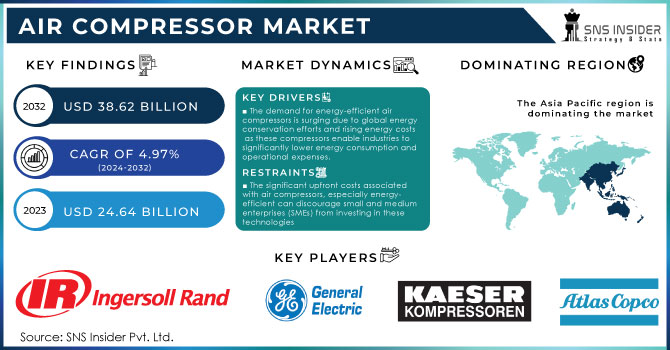

The Air Compressor Market Size was valued at USD 24.64 Billion in 2023 and is expected to reach USD 38.62 Billion by 2032 and grow at a CAGR of 4.97% over the forecast period 2024-2032.

The global shift toward automation and industrialization significantly drives the demand for air compressors. As industries focus on efficiency and productivity, the need for reliable and efficient compressed air systems becomes critical. The growth of the automotive industry is particularly noteworthy, where air compressors are essential for various operations, including painting, assembly, and maintenance tasks. The energy efficiency of air compressors has also garnered attention, with manufacturers increasingly focusing on producing models that minimize energy consumption. For instance, oil-free compressors have gained popularity due to their ability to reduce energy costs and environmental impact. In terms of efficiency, oil-lubricated rotary screw compressors generally operate at a lower cost per unit of compressed air compared to other types. On average, these compressors can achieve efficiencies ranging from 60% to 90%, which can result in significant energy savings over time.

Moreover, technological advancements, such as variable speed drives (VSD) and smart compressors with IoT connectivity, are transforming the market, allowing for better monitoring and optimization of compressor performance. The importance of energy efficiency is further highlighted by the fact that compressed air systems can account for approximately 10% to 30% of a facility's total energy consumption. It is estimated that up to 30% of this energy can be wasted due to leaks in the system. This has led to a growing emphasis on maintaining and optimizing these systems to reduce energy waste and costs.

Air Compressor Market Dynamics

DRIVERS

- The demand for energy-efficient air compressors is surging due to global energy conservation efforts and rising energy costs, as these compressors enable industries to significantly lower energy consumption and operational expenses.

The increasing demand for energy-efficient air compressors is primarily driven by the global emphasis on energy conservation and the escalating costs of energy resources. As industries face rising energy prices, there is a growing need to minimize operational expenses, making energy-efficient compressors an attractive solution. These compressors utilize advanced technologies to optimize energy usage, often resulting in significant savings on electricity bills and reduced carbon footprints.

It is crucial for various reasons to maintain air compressor efficiency. Manufacturers have made great progress in cutting costs, improving system lifespan, and reducing emissions. Giving attention to improving compressor efficiency is one aspect of an extensive sustainability plan. An effective air compressor can save more than USD 30,000 in energy costs and decrease CO2 emissions by about 269 metric tons when using a 200-hp air compressor.

Improvements in compressor technology have enabled the development of much more energy-efficient systems. Variable-speed drive compressors exemplify the latest energy-efficient technology. These units are created to adjust motor speed according to the needs of compressed air, leading to significant energy conservation. Manufacturers are designing air compressors for various industries with a focus on efficiency. Certain models have the capability to lower energy usage by as much as 50%, making them a great choice for companies aiming to cut expenses and achieve sustainability goals.

Moreover, government incentives and subsidies for energy-efficient equipment further encourage industries to adopt these compressors, reinforcing the trend. This demand is particularly strong in energy-intensive sectors like manufacturing, automotive, and construction, where the operational efficiency of air compressors directly impacts productivity and profitability. As a result, businesses are increasingly recognizing that investing in energy-efficient air compressors not only leads to lower operational costs but also enhances their competitive edge in a market that is progressively prioritizing sustainability and cost-effectiveness.

- Technological advancements, such as oil-free and variable-speed compressors, attract environmentally conscious industries that prioritize air purity and efficiency.

Technological advancements in the air compressor market have significantly transformed how industries operate, particularly with the introduction of oil-free compressors and variable-speed compressors. Oil-free compressors are designed to eliminate the need for lubricating oil, which not only enhances air purity but also reduces the risk of contamination. This feature is especially vital in sectors like food and beverage, pharmaceuticals, and electronics, where even minute oil particles can compromise product quality and safety. The growing awareness of environmental sustainability has further fueled the demand for oil-free options, as they minimize the environmental impact associated with traditional oil-lubricated compressors, including oil spills and disposal issues.

The variable-speed compressors are engineered to adjust their speed according to the air demand, providing a more efficient and flexible solution for various applications. This technology optimizes energy consumption, significantly reducing operational costs and contributing to a decrease in greenhouse gas emissions. Industries that prioritize energy efficiency and sustainability, such as automotive and manufacturing, are increasingly adopting variable-speed compressors as part of their commitment to reducing their carbon footprints. Overall, these technological innovations not only meet the stringent demands for air purity but also align with the broader goals of environmental responsibility. As industries continue to embrace these advanced compressor technologies, they can enhance operational efficiency while also fulfilling their sustainability commitments, making them appealing choices in an increasingly eco-conscious market landscape.

RESTRAIN

- The significant upfront costs associated with air compressors, especially energy-efficient can discourage small and medium enterprises (SMEs) from investing in these technologies.

The air compressor market is significantly influenced by high initial costs, particularly regarding energy-efficient models, which can pose a considerable barrier for small and medium enterprises (SMEs). These advanced compressors, designed to optimize energy consumption and reduce operational expenses over time, often come with a hefty price tag. For many SMEs, which typically operate with limited budgets and tighter cash flows, the capital required for purchasing these energy-efficient systems can be prohibitive. This financial burden becomes particularly daunting when SMEs must balance the costs of equipment with other essential expenditures such as payroll, raw materials, and overheads. Compressed air systems are critical for process and manufacturing facilities, ensuring a reliable source of air for production equipment. Key measurements such as Cubic Feet per Minute (CFM), pressure, and dew point determine air quality, impacting efficiency and operational continuity. As equipment ages, servicing and repair costs rise significantly, prompting many businesses to explore Compressed Air Utility Services. These services provide compressors, filters, dryers, and controls on a fee-for-service basis, often proving more economical than ownership.

Owning a compressed air system involves substantial upfront costs, including equipment purchases, which can range from tens of thousands to millions of dollars, depending on system size. Moreover, the ongoing energy costs can consume up to 85% of total operating expenses, particularly for larger systems. Regular maintenance is crucial for operational reliability, yet personnel shortages can complicate these needs. Hidden costs, such as system design, component selection, and installation, can escalate overall expenses. Issues like system integration and backup solutions also require careful consideration, as downtime can lead to significant operational disruptions.

Compressed Air Utility Services eliminate many of these financial burdens, offering customized solutions tailored to specific requirements. By outsourcing compressed air needs, facilities can avoid capital investments and maintenance concerns, ensuring efficient, monitored operations while enhancing reliability and reducing overall costs. This approach allows manufacturers to focus on core activities rather than managing complex air systems.

Air Compressor Market Segmentation Analysis

By Type

In 2023, the stationary segment dominated the market share over 61%. Stationary air compressors are perfect for application in manufacturing facilities, industrial settings, and automotive repair shops. Additionally, stationary air compressors are generally larger and have more power compared to portable ones, making them ideal for heavy-duty tasks.

By Product

The rotary/screw segment dominated the market share over 48% in 2023. The attractive qualities of rotary/screw air compressors, including quiet operation, energy efficiency, reliable performance, easy upkeep, and continuous operation, are expected to draw in a growing number of customers in the future, leading to a rising demand for these compressors.

By Operating Mode

The electric segment dominated the market share over 58% in 2023. Electric air compressors are known for their energy efficiency, making them highly adaptable for use in different industries. Electric compressors are generally more efficient in terms of energy consumption when compared to their gasoline or diesel counterparts, leading to long-term cost savings.

Air Compressor Market Regional Outlook

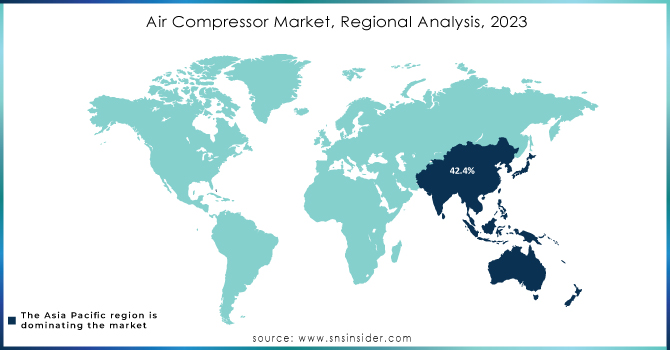

Asia Pacific region dominated the market share by over 42.4% in 2023. The region's strong industrial base, particularly in China, drives this dominance due to its highly diversified industrial sector. The nation serves as a major manufacturing center worldwide, specializing in the production of electronics, including semiconductors, microchips, and other electronic parts. The market's growth in China has been greatly fueled by the reliable air compressor solutions needed for precision-driven manufacturing processes in these industries due to high demand.

The European market is expected to grow at a strong pace during the forecast period. The growth in Europe is largely driven by the region's emphasis on energy efficiency and sustainability, reflecting strict environmental regulations. European countries are increasingly prioritizing the use of energy-efficient air compressors as part of their efforts to meet climate change goals and adhere to environmental standards. These factors are pushing industries across Europe, including manufacturing, construction, and energy sectors, to adopt more sustainable air compressor technologies.

Do You Need any Customization Research on Air compressor Market - Inquire Now

KEY PLAYERS

Some of the major key players of Air compressor Market

-

Frank Compressors: (Industrial air compressors, screw compressors)

-

Galaxy Auto Stationary Equipment Co. Ltd.: (Portable and stationary air compressors)

-

Gast Manufacturing, Inc.: (Piston air compressors, vacuum pumps)

-

GENERAL ELECTRIC: (Industrial air compressors, gas turbine-driven compressors)

-

Ingersoll Rand Plc: (Reciprocating and rotary screw air compressors)

-

Kaeser Compressors: (Rotary screw air compressors, blowers)

-

MAT Industries, LLC: (Portable air compressors, contractor air compressors)

-

AireTex Compressor: (Oil-free and oil-lubricated compressors)

-

Atlas Copco: (Oil-free air compressors, rotary screw compressors)

-

Bauer Group: (Breathing air compressors, high-pressure compressors)

-

BelAire Compressors: (Reciprocating air compressors, rotary screw compressors)

-

Cook Compression: (Compressor valves, seals, and packing)

-

Compressor Products International: (CPI) (Compressor components, rod packing)

-

ELGi Equipments Ltd.: (Oil-lubricated and oil-free screw compressors)

-

Sullair LLC: (Portable air compressors, rotary screw air compressors)

-

Quincy Compressor: (Reciprocating air compressors, rotary screw compressors)

-

Doosan Portable Power: (Portable air compressors, industrial air solutions)

-

Hitachi Industrial Equipment Systems Co., Ltd.: (Oil-free screw compressors, scroll compressors)

-

Gardner Denver, Inc.: (Rotary screw air compressors, reciprocating compressors)

-

Chicago Pneumatic: (Piston and rotary screw compressors)

RECENT DEVELOPMENTS

-

In August 2023: this 150-horsepower industrial air compressor is part of Doosan Bobcat's transition into the Bobcat portfolio. It features a fixed-speed, oil-flooded rotary screw design and comes with a leading warranty, aiming for performance and reliability in industrial applications.

-

In 2024: The air compressor market showcases top models such as the California Air Tools CAT-60040CAD and the Fortress 26 Gallon Ultra Quiet Compressor, emphasizing features like low noise levels and portability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.64 Billion |

| Market Size by 2032 | USD 38.62 Billion |

| CAGR | CAGR of 4.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stationary,Portable) • By Product (Reciprocating, Rotary/Screw, Centrifugal) • By Application (Healthcare & Medical, Manufacturing, Oil & Gas, Home Appliances, Food & Beverage, Energy, Semiconductor & Electronics, Others) • By Lubrication (Oil Free, Oil Filled) • By Operating Mode (Electric, Internal Combustion Engine) • By Power Range (Up to 20 kW, 21-50kW, 51-250 kW, 251-500 kW, Over 500kW) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Frank Compressors, Galaxy Auto Stationary Equipment Co. Ltd., Gast Manufacturing, Inc., GENERAL ELECTRIC, Ingersoll Rand Plc, Kaeser Compressors, MAT Industries, LLC, AireTex Compressor, Atlas Copco, Bauer Group, BelAire Compressors, Cook Compression, Compressor Products International (CPI), ELGi Equipments Ltd., Sullair LLC, Quincy Compressor, Doosan Portable Power, Hitachi Industrial Equipment Systems Co., Ltd., Gardner Denver, Inc., Chicago Pneumatic. |

| Key Drivers | • The demand for energy-efficient air compressors is surging due to global energy conservation efforts and rising energy costs, as these compressors enable industries to significantly lower energy consumption and operational expenses. • Technological advancements, such as oil-free and variable-speed compressors, attract environmentally conscious industries that prioritize air purity and efficiency. |

| RESTRAINTS | • The significant upfront costs associated with air compressors, especially energy-efficient ones, can discourage small and medium enterprises (SMEs) from investing in these technologies. |