Polyolefin Market Report Scope & Overview:

The Polyolefin Market was valued at USD 298.90 billion in 2025E and is expected to reach USD 428.33 billion by 2033, growing at a CAGR of 4.6% from 2026-2033.

Get more information on Polyolefin Market - Request Sample Report

Growing demand for polyolefins, particularly in the packaging market, is a key factor driving the growth of the global polyolefins market. Lightweight, and high barrier properties make Polyethylene (PE) and Polypropylene (PP) the major players in flexible and rigid packaging. These are crucial for maintaining product integrity, extending shelf life, and facilitating safe transportation of goods. Polyolefins are essential for efficient and economic packaging as they are needed to meet the massive volume growth in e-commerce and online retailing.

Polyolefin Market Size and Forecast

-

Market Size in 2025E: USD 298.90 Billion

-

Market Size by 2033: USD 428.33 Billion

-

CAGR: 4.6% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–204

Polyolefin Market Trends

-

The polyolefin market is expanding due to its wide usage in packaging, automotive, construction, textiles, and consumer goods.

-

High demand for polyethylene (PE) and polypropylene (PP) in flexible and rigid packaging is a major growth factor.

-

Rising construction activities are fueling applications in pipes, insulation materials, and geomembranes.

-

Automotive industry adoption for lightweight components is enhancing fuel efficiency and sustainability.

-

Advances in catalyst technologies and polymer modification are improving performance and application scope.

-

Growing emphasis on recyclable and bio-based polyolefins is shaping the market toward sustainability.

-

Expansion of e-commerce and food & beverage sectors is significantly driving demand for flexible packaging solutions.

-

Asia-Pacific holds a strong position in production and consumption, supported by industrial growth and rising disposable incomes.

Polyolefin Market Growth Drivers:

-

Increasing demand for plastics across the globe drives market growth.

One of the major factors driving the market growth is the growing consumption of plastics worldwide owing to their versatility, low cost, and wide applications in various end-use industries, including packaging, automotive, construction, health care, and electronics. Plastics are indispensable in manufacturing and consumer goods due to the durability, lightweight nature, and processability of polyolefins (e.g., polyethylene (PE), and polypropylene (PP)). On the one hand, the e-commerce sector flourished which in turn increased the demand for plastic packaging solutions; on the other hand, increasing innovations in healthcare and technology end-use industries increased the consumption of plastics in medical devices, personal protective equipment (PPE), and electronic components. In addition, the establishment of better infrastructure and rapid urbanization in emerging economies have driven the demand for plastics in construction and piping applications. The new sustainable development milestones of recycled plastic and bio-based plastic have been thundering back to the market, which has stimulated the rapid growth of this market segment in the context of stricter environmental control and global response to reduce plastic waste issues. The increasing dependence on plastics forms the backbone of a high-growth industry globally.

Polyolefin Market Restraints:

-

Fluctuation in the raw material prices may hamper the market growth.

The factor hindering the growth of the polyolefin market is the significant fluctuations in the prices of raw materials, which directly affect the cost of production of plastics and the profitability of plastic producers. Plastics, mainly polyolefins (e.g. polyethylene (PE) and polypropylene (PP)) originate from petrochemical feedstocks, including crude oil and natural gas. The fluctuations in crude oil prices due to geopolitical tensions, imbalance in the global energy supply, and changes in regulations add to uncertainty in the cost of raw materials. Moreover, the instability in the price is due to the disruption of the supply chain eg natural disasters, labor strikes, transportation problems, etc. It is often tough for manufacturers to pass on higher sequential costs to end-users, and this can adversely affect profitability and market size. A wider emphasis on alternate materials and recycled plastics provides a greater challenge as it requires investment in new technologies and processes. Managing these real fluctuations will require strategic sourcing, even multi-year contracts with suppliers, and innovation in sustainable raw material substitutes to balance risks and continue growth.

Polyolefin Market Segment Analysis

By Type, Polyethylene dominates with 39% share in 2025

Polyethylene (PE) held the largest market share around 39% in 2025. It is owing to its the most widely used polymers in the world, providing a unique synergy of properties including high durability, chemical resistance, flexibility, and low weight. Due to these properties, it is a preferable material to use for packaging, which is the primary end-use industry, especially in food, beverages, and consumer durables. In construction, PE is mainly found in pipes, films and insulation whereas in automotive and healthcare industries, it is widely used as part of devices and single-use disposables. Moreover, polymerization technology has improved such as metallocene-catalyzed PE to produce a higher-quality PE with better performance properties allowing for various applications. In developed and emerging markets, its position is anything but weak given its importance for industry and other consumer needs around the world.

By End-Use Industry, Film & Sheet leads with 27% share

Film & Sheet held the largest market share around 27% in 2025. It is used in multiple end-use sectors including packaging, agriculture, construction, and consumer products. Specifically, films, especially polyolefins, i.e., polyethylene (PE) and polypropylene (PP), are widely used due to their flexibility, lightweight, and barrier properties for protection as packaging material. The expansion of the e-commerce sector has led increase in the demand for packaging films as companies search for economical, lightweight, and strong mediums for shipping products. In agricultural applications, films are also important for greenhouse coverings, mulch, and crop protection, which improve yield and crop efficiency. Films have been used in construction to serve as vapor barriers, insulation, and protective coverings.

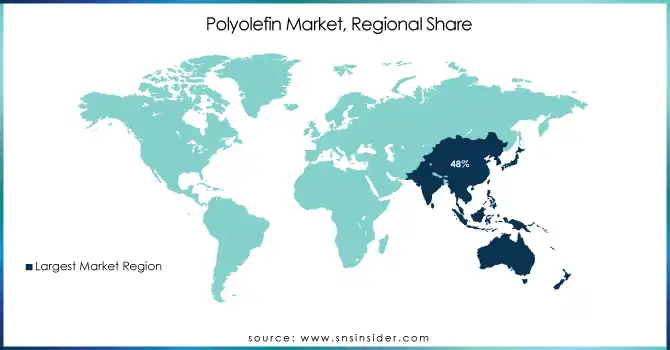

Polyolefin Market Regional Analysis

Asia Pacific Polyolefin Market Insights

Asia Pacific region held the major share of the polyolefin market of more than 48% in 2025. This is owing to fast industrialization, increasing manufacturing base and large consumer population. The expansion primarily stems from countries, China, India, and Japan leading the pack with driving demand from automotive, packaging, electronics, construction, and agriculture sectors. Given China is the leading producer and consumer of plastics globally, the country is a key driver of demand for polyolefins, films and sheets.

North America Polyolefin Market Insights

North America in the polyolefins market driven by high demand from packaging, automotive, and construction sectors. Growing e-commerce, food and beverage consumption, and advanced manufacturing technologies drive polyethylene (PE) and polypropylene (PP) adoption. Emphasis on sustainable, recyclable materials, coupled with innovations like metallocene catalysts and multilayer films, fuels growth. The region benefits from established infrastructure, strong polymer production, and supportive regulations fostering continued polyolefin market expansion.

Europe Polyolefin Market Insights

Europe’s polyolefins market is driven by strong demand from packaging, automotive, and construction sectors. Emphasis on sustainability and recyclable materials is promoting polyethylene (PE) and polypropylene (PP) adoption. Advanced polymerization technologies, multilayer film applications, and bio-based polyolefins are enhancing performance and versatility. Growing e-commerce, food and beverage consumption, and regulatory support for environmentally friendly materials further fuel market expansion, making Europe a significant contributor to the global polyolefins market.

Middle East & Africa and Latin America Polyolefin Market Insights

The Middle East & Africa and Latin America polyolefins market is driven by growing packaging, construction, and automotive demand. Abundant feedstock availability, particularly in the Middle East, supports competitive production. Increasing adoption of polyethylene (PE) and polypropylene (PP) for flexible and rigid packaging, along with infrastructure development and rising industrialization in Latin America, is boosting market growth. Focus on sustainability and recyclable materials is shaping regional polyolefin trends.

Get Customized Report as per your Business Requirement - Request For Customized Report

Polyolefin Market Competitive Landscape:

China Petroleum & Chemical Corporation (Sinopec)

Sinopec, founded in 2000 and headquartered in Beijing, is one of the world’s largest integrated energy and chemical companies. The company operates across oil, gas, refining, and petrochemicals, with a strong presence in polymers such as polyethylene and polypropylene. Sinopec focuses on technological innovation, sustainability, and meeting growing domestic and global demand for plastics and advanced materials. Its strategic investments strengthen China’s industrial base while addressing packaging, construction, and industrial application needs.

-

2024: Sinopec announced a major investment in expanding its polyethylene production capacity with the construction of a new facility in China to meet rising demand for packaging applications.

LyondellBasell Industries Holdings B.V.

LyondellBasell, founded in 2007 and headquartered in Houston, Texas, and Rotterdam, Netherlands, is a global leader in chemicals, polymers, and refining. The company specializes in polyethylene, polypropylene, and advanced polymers, serving packaging, automotive, and infrastructure markets. With a strong emphasis on sustainability, LyondellBasell invests in circular economy initiatives, renewable feedstocks, and advanced recycling technologies. Its innovation-driven approach strengthens its global position while supporting carbon reduction goals and providing sustainable materials for modern applications.

-

2023: LyondellBasell launched a new polyethylene product made from 100% renewable feedstock, in line with its sustainability goals to reduce its carbon footprint.

PetroChina Company Limited

PetroChina, established in 1999 and headquartered in Beijing, is one of China’s largest oil and gas producers and distributors. The company is a major player in petrochemicals, producing polyolefins such as polyethylene and polypropylene. PetroChina invests heavily in expanding production capacities and modernizing facilities to meet China’s growing demand for plastics in packaging, automotive, and infrastructure. Its strategy emphasizes scaling up domestic supply while balancing sustainability and energy efficiency in its operations.

-

2023: PetroChina increased its polyolefin production capacity by 1 million tons per year through a new facility in Xinjiang, China, to meet growing regional demand.

Key Players

-

Sinopec Corp. (Polyethylene, Polypropylene)

-

LyondellBasell Industries Holdings B.V. (Polyethylene, Polypropylene)

-

PetroChina Company Limited (Polyethylene, Polypropylene)

-

Total Energies (Polystyrene, Polyethylene)

-

Chevron Corporation (Polyethylene, Polypropylene)

-

Repsol (Polypropylene, Polystyrene)

-

Dow (Polyethylene, Polypropylene)

-

Exxon Mobil Corporation (Polyethylene, Polypropylene)

-

Braskem (Polypropylene, Polyethylene)

-

Borealis AG (Polyethylene, Polypropylene)

-

Formosa Plastics Group (Polyethylene, Polypropylene)

-

INEOS (Polyethylene, Polystyrene)

-

DSM (Polyamide, Polyester)

-

LG Chem (Polyethylene, Polypropylene)

-

Sabic (Polyethylene, Polypropylene)

-

Reliance Industries (Polyethylene, Polypropylene)

-

Hanwa Chemical (Polyethylene, Polypropylene)

-

Mitsui Chemicals (Polypropylene, Polystyrene)

-

Kraton Polymers (Styrenic Block Copolymers, Polypropylene)

-

LG Chem (Polyethylene, ABS)

| Report Attributes | Details |

| Market Size in 2025E | US$ 258.6 Bn |

| Market Size by 2033 | US$ 388.6 Bn |

| CAGR | CAGR of 4.6% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Polyethylene (PE), Polypropylene (PP), Ethylene Vinyl Acetate (EVA), Thermoplastic Polyolefins (TPO), Polyoxymethylene (POM), Polycarbonate (PC), Polymethyl Methacrylate (PMMA),Others ) • By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, Fibers & fabrics, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sinopec Corp.; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; Total Energies; Chevron Corporation; Repsol; Dow; Exxon Mobil Corporation; Braskem; Borealis AG |