Potash Market Report Scope & Overview:

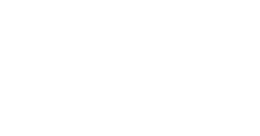

The Potash Market was valued at USD 63.23 billion in 2025E and is expected to reach USD 91.73 billion by 2033, growing at a CAGR of 4.76% from 2026-2033.

Factors such as increasing agricultural applications and technological development are driving the Potash market. Our report delves into the supply chain and logistics, examining surely what seems to complicate establishment, transport and distribution. It describes how supply and demand affect prices and how pricing reacts to demand fluctuations and geopolitical events. Aspects of sustainability and environmental considerations are discussed, noting the trend toward greener mining. Analyzing investment trends and financing mechanisms, the role of capital flows in market growth is presented. It also discusses quality control and certification standards, relating how this practice in compliance with regulations affects product quality and acceptance in the market.

Market Size and Forecast

-

Market Size in 2025E: USD 63.23 Billion

-

Market Size by 2033: USD 91.73 Billion

-

CAGR: 4.76% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Potash Market - Request Free Sample Report

The U.S. Potash market size was valued at an estimated USD 24.10 billion in 2024 and is projected to reach USD 35.20 billion by 2032, growing at a CAGR of 4.06% over the forecast period 2025–2032. Market growth is driven by strong demand from the agricultural sector, as potash remains a critical nutrient for enhancing crop yield, soil fertility, and food security. Increasing adoption of modern farming practices, rising consumption of fertilizers to support large-scale crop production, and growing focus on sustainable agriculture are supporting market expansion. Additionally, stable domestic production, favorable trade dynamics, and continuous investments in mining and processing infrastructure further strengthen the growth outlook of the U.S. potash market during the forecast period.

Potash Market Trends

-

Rising global demand for fertilizers to support food production is driving potash market growth.

-

Increasing adoption in crop nutrition, particularly for cereals, fruits, and vegetables, is boosting market expansion.

-

Growth of sustainable and precision agriculture practices is shaping potash usage trends.

-

Fluctuating raw material prices and supply chain dynamics are influencing market stability.

-

Expansion of agricultural land and modernization in emerging economies is fueling demand.

-

Development of specialty potash products for specific soil and crop needs is enhancing adoption.

-

Collaborations between fertilizer manufacturers, distributors, and agritech companies are accelerating market innovation.

Potash Market Growth Drivers:

-

Increasing Demand for Potash Fertilizers to Boost Agricultural Productivity and Food Security Worldwide

The need for improved agricultural productivity is being driven by the growing global population coupled with increasing food demand. Potash is the main fertilizer that potatoes need to grow to their maximum potential, as it contains potassium, one of the three primary nutrients that promote the flowering and maturation of a wide variety of crops. These sustainable farming practices are driving the demand for Potash fertilizers even more, along with improved practices like precision agriculture, which helps optimize the application of Potash. Usage of Potash is expected to increase as it is an essential component when farmers aim to fulfil the requirements of a growing population and a diversifying diet. This driver is especially important in developing economies, where agricultural productivity is being raised to meet local and international demand. Moreover, regions with a high agricultural output like Asia-Pacific and North America will probably keep driving Potash consumption, a factor that will keep ensuring Potash's critical role in modern agriculture.

Potash Market Restraints:

-

Volatility in Potash Prices Due to Geopolitical Instability and Trade Barriers

Potash prices are market driven and very sensitive to global events or the geopolitical situation that can disrupt the stability of the market. Trade restrictions, tariffs, and sanctions imposed by nations or economic blocks can disrupt Potash's cross-border flow, resulting in supply shortages and price volatility. Political tensions and trade conflicts will have almost immediately negative repercussions on huge Potash-exporting nations including Canada and Russia. Additionally, external shock events, particularly heavy-handed supply chain disruptions (e.g., the COVID-19 pandemic), cause prices to move unpredictably, meaning consumers and producers cannot blindly trust the existing economic situation. This volatility poses problems for companies and farmers who depend on stable pricing to manage budgets and plan for the future.

Potash Market Opportunities:

-

Growing Demand for Potash in Emerging Economies to Improve Agricultural Productivity

Growing potash markets in emerging economies, especially in Asia-Pacific, Latin America, and Africa These regions are witnessing rapid population growth, urbanization, and transitions to more industrialised agricultural methods. These countries are now looking to Potash and other sophisticated fertilizers to improve their agricultural yields as they attempt to feed the larger populations. As the need for agricultural productivity grows, so too will demand for Potash in these regions. Moreover, the continued evolution of these economies will support the adoption of modern farming techniques and environmentally sustainable farming practices, which will contribute to the growth of demand for Potash fertilizers. The increasing middle class in these areas is also sparking dietary shifts, high agricultural output in such regions therefore continues to encourage high demand for potash.

Potash Market Challenge:

-

High Capital Investment Required for Potash Extraction and Processing Facilities

The mining and processing of potash requires large capital investment, especially in new extraction facilities and upgrading existing ones. Mining operations and refining technologies require significant initial investment, creating a barrier for new entrants in the market. Furthermore, maintaining production rates requires maintenance and investment in infrastructure, among other large-scale operations. This capital-intensive nature of the industry may hinder most small players from competing with the big names in the market, reducing the speed of diversification and innovation. The most challenging challenge for the Potash market is still the high capital costs.

Potash Market Segment Analysis

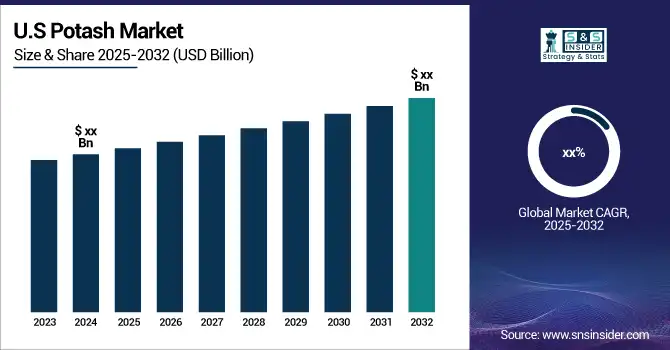

By Product, Potassium Chloride dominates the Potash market

By 2025, Potassium Chloride segment dominated and is anticipated to hold a market share of approximately 60.2% in the Potash market. Among the nutrients, potassium is mostly used in the forms of potassium chloride, which is the most common and effective source of potassium for agricultural applications like fertilizers. It has dominated due to its efficiency in increasing yields and soil health, establishing itself in the hearts of the farmers and agricultural producers. The widespread application of Potassium Chloride fertilizer has been corroborated by organizations like the Food and Agriculture Organization of the United Nations, which emphasize role of Potassium in crop nutrition. Moreover, the global growing demand for sustainable farming practices has increased Potassium Chloride demand, as it improves production of healthy crops with minimum environmental impact.

By Application, Fertilizers segment dominates the Potash market

In 2025, the Fertilizers segment dominated the potash market with a market share of 70.5%. This is because fertilisers are essential for crop production and food security. The most crucial ingredient in fertilizers, especially Potash, boosts crop productivity, hence supplements plants' nutritional requirements. The World Bank and multiple agricultural associations have promoted the use of more fertilizer in developing areas to expand agricultural yield. Moreover, government initiatives to encourage sustainable agriculture and enhance food production have driven the demand for Potash-based fertilizers. Hence this indicates that the Fertilizers segment would remain the foremost application of Potash, highlighting its quintessential role in contemporary farming.

By End-Use, Agriculture segment dominates the Potash market

Agriculture segment dominated the Potash market in 2025 with a 68% market share. Its dominance is mainly due to the agricultural sector's heavy reliance on Potash in fertilization processes that improve crop productivity and soil fertility. Potash is essential for plant health, water holding and resistance to diseases, which is crucial for farmers who work to fulfil the world's increasing food needs. Various government initiatives and agricultural policies, like those advocated by the United States Department of Agriculture, have increasingly recognized the importance of nutrient management in agriculture, further expanding Potash adoption in farming practices. The major contribution by the agriculture segment shows that Potash is a primary ingredient to food security and sustainable agricultural practices around the globe.

Potash Market Regional Analysis

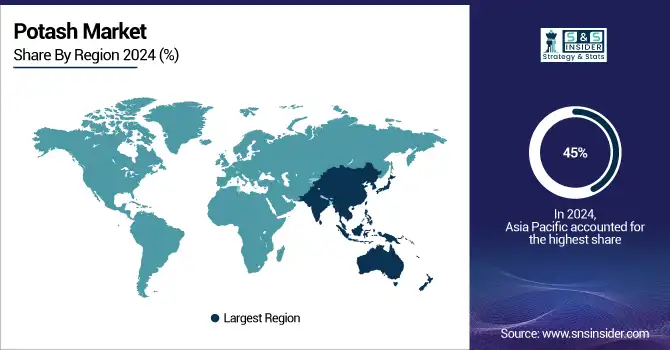

Asia Pacific Potash Market Insights

In 2025, the Asia Pacific region dominated the potash market and accounted for a market share of about 45% of the total revenue share. This dominance is primarily supported by the region's strong agricultural industry, which represents a notable share of Potash usage worldwide. Potash fertilizers are demanded primarily from countries like China and India, where agricultural output is important for feeding their massive populations. Potash is consumed primarily within the agriculture industry and China is both the largest producer and consumer of Potash, accounting for more than 20% of total Global Potash Demand as the country continues to prioritize crop yield improvement and food security. India being an agroeconomic, has a sizeable share of its fertilizer imports attributable to Potash. In addition, efforts taken by governments in these countries as well as increasing awareness regarding sustainable farming has accelerated the demand for Potash fertilizers. Moreover, urbanization trends in Southeast Asia also drive the demand for Potash to improve agricultural productivity. The Asia-Pacific market continues to dominate the Potash session due to the prevalence and importance of agriculture, a key component of the area that is continuing to industrialize.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Potash Market Insights

Moreover, the North America region is projected to be the most lucrative during the forecast period, with a significant CAGR due to increasing imports of potash and growing demand from the agricultural sector. The growth is mainly due to the rising demand of Potash-based fertilizers in the US and Canada, owing to increasing focus on sustainable agriculture and improve crop productivity. As one of the largest agricultural producing countries in the world, the increase in Potash used most notably on corn and wheat has played a role in the increased demand in the U.S. The Canadian market still has a vital role at the local market. Increased investment in agricultural and innovation technologies in North America, which would propel the demand for Potash. As such, such government initiatives, specifically the US Farm Bill, are stimulating adoption of better and eco-friendly farming practices through subsidies, contributing to the Potash market growth in the region.

Europe Potash Market Insights

Europe holds a significant position in the Potash Market, driven by high agricultural demand, modern farming practices, and strong fertilizer consumption. Countries like Germany, France, and Russia are key contributors, supported by government initiatives to enhance crop yields and soil fertility. Rising adoption of balanced nutrient management and precision agriculture further boosts potash usage, making Europe a vital region for potash suppliers and industry growth.

Middle East & Africa and Latin America Potash Market Insights

The Middle East & Africa and Latin America Potash Markets are growing steadily, driven by expanding agricultural activities and rising food demand. Limited local potash production has led to reliance on imports from major suppliers. Investments in modern farming techniques, government support for crop yield improvement, and increasing awareness of balanced fertilization are fueling potash adoption, creating significant opportunities for market expansion in these regions.

Potash Market Competitive Landscape:

BHP Billiton Ltd.

BHP Billiton Ltd. is a leading player in the Potash Market, producing high-quality potash products such as Muriate of Potash and Sulphate of Potash. The company focuses on sustainable mining practices, operational efficiency, and meeting global agricultural demand. BHP’s investments in advanced mining technologies and expansion projects enhance production capacity, supply reliability, and market competitiveness, strengthening its position as a key contributor to the global potash industry.

-

2025 – BHP Jansen potash project hit a major milestone: on February 21, the service and production shafts were successfully connected underground marking critical progress toward eventual potash production.

-

2023 – BHP’s Potash operations in Canada became the first operational-focused workforce to achieve gender balance at the end of FY 2023 43.8% female in operations and 57.4% overall a significant inclusion milestone.

Nutrien

Nutrien is a leading Potash Market player, producing Muriate of Potash and Sulphate of Potash to meet global agricultural demands. The company emphasizes sustainable mining practices, operational efficiency, and technological innovation, including automation and advanced extraction methods. Nutrien’s strategic initiatives enhance production capacity, cost-effectiveness, and safety, reinforcing its position as a key supplier in the global potash industry.

-

2024 – Nutrien Achieved a milestone of 25 million ore tonnes mined via automation across its Saskatchewan potash mines, boosting safety, efficiency, and tele-remote operations advancement. Additionally, Nutrien mined 35% of its potash ore using automation, supporting its highest production levels and reducing controllable cash costs per tonne.

Key Players

-

BHP Billiton Ltd. (Muriate of Potash, Sulphate of Potash)

-

Compass Minerals Intl. Ltd. (Muriate of Potash, Salt)

-

Encanto Potash Corp. (EPC) (Potash Fertilizer)

-

Eurochem (Muriate of Potash, Sulphate of Potash)

-

Intrepid Potash Inc. (Muriate of Potash, Potash Fertilizer)

-

JSC Belaruskali (Muriate of Potash)

-

K+S Aktiengesellschaft (Muriate of Potash, Sulphate of Potash)

-

Mosaic Company (Muriate of Potash, Potash Fertilizer)

-

Nutrien (Muriate of Potash, Sulphate of Potash)

-

OAO Uralkali (Muriate of Potash)

-

Passport Potash (Potash Fertilizer)

-

Qinghai Salt Lake (Muriate of Potash, Potash Fertilizer)

-

Red Metal Ltd. (Potash Fertilizer)

-

Rio Tinto Ltd. (Muriate of Potash)

-

ICL (Muriate of Potash, Sulphate of Potash)

-

Vale (Potash Fertilizer, Muriate of Potash)

-

PotashCorp (now part of Nutrien) (Muriate of Potash, Potash Fertilizer)

-

Sinofert (Muriate of Potash)

-

Jiangxi Ganfeng Potash Co. (Muriate of Potash, Potash Fertilizer)

-

Arab Potash Company (Muriate of Potash, Potash Fertilizer)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 63.23 Billion |

| Market Size by 2033 | USD 91.73 Billion |

| CAGR | CAGR of 4.76% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate, Others) •By Application (Fertilizers, Animal Feed, Industrial Chemicals, Others) •By End-use (Agriculture, Industrial, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nutrien, Mosaic Company, Uralkali, JSC Belaruskali, Compass Minerals Intl. Ltd., Eurochem, BHP Billiton Ltd., K+S Aktiengesellschaft, Intrepid Potash Inc., Rio Tinto Ltd. and other key players |

Frequently Asked Questions

Ans: Asia Pacific dominated the Potash Market in 2025, accounting for approximately 45% market share due to high agricultural demand and fertilizer consumption.

Ans: The Potassium Chloride product segment, Fertilizers application segment, and Agriculture end-use segment dominated the Potash Market throughout the projected period.

Ans: Increasing demand for potash fertilizers to enhance agricultural productivity, support food security, and improve crop yields is the primary growth driver.

Ans: The Potash Market was valued at USD 63.23 billion in 2025, reflecting strong global demand for fertilizers and crop nutrition solutions.

Ans: The Potash Market is expected to grow at a CAGR of 4.76% from 2026 to 2033, driven by rising fertilizer demand globally.