Dyes and Pigments Market Size & Overview:

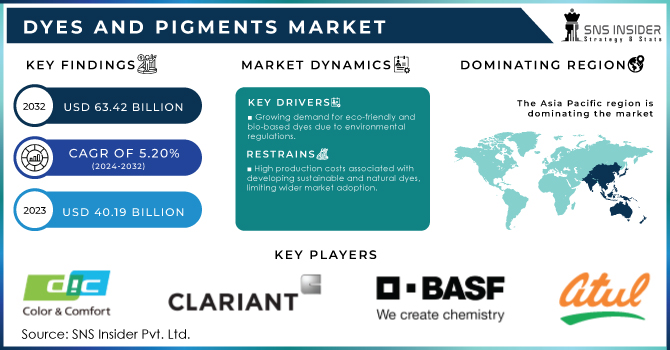

The Dyes and Pigments Market Size was valued at USD 40.19 billion in 2023 and is expected to reach USD 63.42 billion by 2032, and grow at a CAGR of 5.20% over the forecast period 2024-2032.

Get E-PDF Sample Report on Dyes And Pigments Market - Request Sample Report

The dyes and pigments market continues to evolve around rapidly changing dynamics of sustainability, technology, and innovation. In recent times, the placing of green alternatives has been among the major reformation factors in the area of dyes and pigments. More companies, it is noted, have grown to include sustainable operations as part of their business operations in line with expanded environmental objectives. For example, the endorsement Leonardo DiCaprio made of a bio-pigment innovator upstaged this industry's movement toward green chemistry. The endorsement provided acts to stress the change of the development towards natural and bio-based pigments presented today as a variant of the conventional synthetic dyes, which are probably hazardous to the environment.

Innovation is further demonstrated through the partnership between Octarine and Ginkgo Bioworks on natural dyes. All the collaboration simply points to in the industry is the determination to integrate biotechnology into dye production. Using synthetic biology, therefore, companies like these try to make dyes from renewable feedstocks, hence radically reducing reliance on petroleum-based feedstocks. Such processes, in this way, introduce a new level of sustainability and come to respond to growing consumer and manufacturer demands for greener products.

A recent development, in pigment technology, is also worth mentioning. Along with the development of photonic materials, edible pigments have been introduced direction that will combine aesthetic appeal with safety and functionality. This constitutes a crossing from the food industry towards the textile industry, thus opening new product application possibilities. The development of such pigments reflects a trend of growth in integrating advanced materials science into traditional sectors, therefore expanding applications of dyes and pigments.

Along with the rearing of bio-pigs and natural dyes, there is further reinforcement from the whole industry about the trend toward general environmental improvement of dyeing processes. The trend is shifting toward biodegradable and less toxic dyes due to the demands of regulators and consumer society alike. All these changes not only go toward the goal of global sustainability but are also accomplished through ongoing R&D activities regarding optimization on the part of dyeing technologies to minimize waste and energy consumption.

Dyes and Pigments is one of the most fast-evolving industries, marked by escalating usage of sustainable practices, technology innovations, and strategic partnerships. This is a drive toward natural and bio-based products, with the growth of material science shaping the future of this industry. These changes are indicative of a wider movement toward minimizing environmental impact and enhancing functionality in dyes and pigments across a wide array of applications.

Dyes and Pigments Market Dynamics:

Drivers:

-

Growing demand for eco-friendly and bio-based dyes due to environmental regulations.

Strong demand for the Dyes and Pigments market is evident in eco-friendly and bio-based dyes, owing to the presence of strict regulations related to environmental safety and individual awareness about sustainability. Many governments and regulatory mechanisms worldwide have set high standards for industries in terms of minimizing environmental hazards, specifically within the textile and chemical industries. Conventional synthetic dyes, heavy metals, and toxic chemicals are ranked first in water pollution and other ecological hazards. In that sense, the demand for the replacement of such products offers a wide area of opportunity for producers to embark upon more friendly environmental alternatives such as natural dyes extracted from plants, algae, and other renewable resources. Biodegradable, bio-based dye treatments with less harm to aquatic life are also increasingly used by big apparel companies. Besides this, microbial fermentation techniques being applied to the development of bio-dye have drawn attention now, as consumption is at a minimum regarding environmental footprint. All these alternatives achieve compliance with environmental regulations, besides meeting the increasing demand for sustainable fashion. Major fashion brands collaborate with dye manufacturers to introduce natural dye products into their manufacturing line as part of their effort to minimize environmental impacts throughout supply chains. This is a trend that has begun to show significant steam in the European Union and parts of Asia, where companies must meet high wastewater discharge standards. In addition, consumer preference is only now beginning to shift toward environmentally friendly products, and therefore requires manufacturers to go bio-based in response to market demand.

-

Rising applications in textiles, automotive, and packaging industries, driven by evolving consumer preferences for vibrant, sustainable products.

A significant evolution in consumer preference for more colored and sustainable products, however, drove such development in applications of dyes and pigments quite effectively in textile, automotive, and packaging industries. In this respect, it is the consumers' desire that has become a driving force pushing up the demand for textiles of more vivid and long-lasting colors. On the other hand, there is an increase in interest in ecologically clean ways of producing goods of this type. This interest has translated into increased usage of environmentally friendly pigments that have excellent colorfastness and durability without compromising on sustainability. The automotive industry has seen increasing demand for brighter, more colorful car coatings and interiors, forcing manufacturers to improve their processes using high-performance pigments that offer excellent aesthetic and environmental performance. High-performance pigments are now being used vastly in a wide range of auto paints for better durability and UV resistance, also complying with much stricter environmental regulations. Similarly, even in packaging, the shift is towards sustainable biodegradable material combined with dyes that are pleasing to the eyes, hence ensuring that a product appeals on any retail shelves. For example, more and more companies producing foods and beverages are shifting to using nontoxic and biodegradable pigments since consumers are becoming health-conscious. The move into vibrant, sustainable dyes within these industries is based on the demand for products that are not only eye-catching but will also meet the increasingly important consumer concerns relating to eco-friendliness, recyclability, and overall environmental impact reduction.

Restraint:

-

High production costs associated with developing sustainable and natural dyes, limiting wider market adoption.

High production costs may be a big restraining factor to the wider diffusion of more sustainable and natural dyes within the market for Dyes and Pigments. Extraction, processing, and manufacturing from plants, algae, or other organic raw materials involve costly technologies with resource-intensive processing steps. In addition to scalability and consistency, environmental advantages also contribute to the added cost of such bio-based dyes. For example, natural dyes, which are manufactured on a minimal scale compared to mass-produced synthetic dyes at cheaper prices, require more land, water, and labor, and are therefore unaffordable for many manufacturers. This cost difference limits their large-scale use, particularly in price-sensitive markets such as textiles, where low-priced alternatives tend to dominate.

Opportunity:

-

Increasing R&D in biotechnology for natural dyes opens avenues for innovative, sustainable solutions across industries.

Biotechnology investments in research and development are growing, hence promising opportunities that call for innovative, creative, and sustainable solution services in many industries. Advances in biotechnology allow the production of bioengineered dyes from microbes, fungi, and other renewable feedstock that is an environmentally friendly alternative to the traditional synthetic dyes. The present work opens perspectives for the development of non-toxic, non-toxic-to-environment pigments, which can also be designed for special applications such as textiles, cosmetics, and food packaging. For example, scientists are working on vibrantly creating colors using microorganisms through fermentation because conventional agriculture requires massive areas of land. Such developments would lead industries towards meeting the growing demand of customers for sustainable products with lower toxicity while reducing the environmental impact related to dye production. This increase in R&D will widen the potential of natural dyes, enhance their viability, and make them scalable for commercial purposes.

Challenge:

-

Achieving colorfastness and performance parity with synthetic dyes while maintaining eco-friendly attributes poses technical challenges.

The major technical challenge facing the Dyes and Pigments market is to attain colorfastness and performance parity with synthetic dyes while retaining eco-friendly attributes. It is a fact that synthetic dyes are extremely durable, come in a wide array of bright colors, and are generally resistant to fading, and as such, have set the standard within industries such as textiles and automotive. In contrast, eco-friendly alternatives like natural and bio-based dyes often fall behind in trying to match these levels of performance. As a result, natural dyes may fade sooner, possibly not cling as well to materials, and may require additional chemicals or energy-intensive processes to improve their durability-a factor that works against their very environmentally friendly objective. One of the main drawbacks of using bio-based dyes, for instance, is ensuring bright color consistency in a garment after many washes, or upon sunlight exposure, without having to use harmful fixatives. This performance gap currently is the limiting factor to the wide applications of sustainable dyes in high-demanding sectors where long-lasting durability is involved.

Dyes and Pigments Market Segments

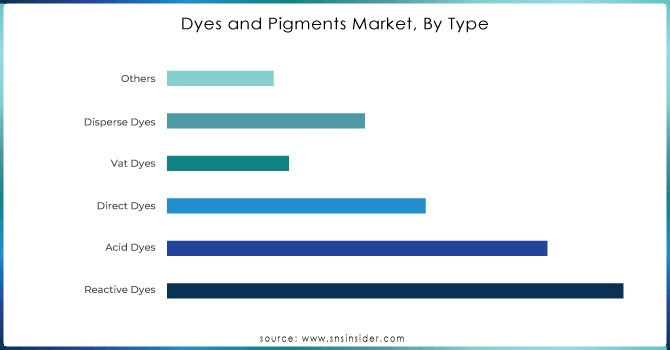

By Type

The Reactive Dyes segment dominated the market in 2023, accounting for about 30% market share. Of these, major applications are reactive dyes, which have a strong bonding with fibers and provide very glowing colors that do not get washed out or faded, hence used as excellent textiles and apparel. The fashion industry is highly dependent on reactive dyes in cotton fabrics because their brightness and colorfastness depend on them. The segment is expected to grow principally, based on the rising demand for quality and durable fabrics in both consumer and industrial sectors, hence making more takers of reactive dyes than acid or disperse dyes.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

In 2023, the Textiles application segment dominated the Dyes segment of the Dyes and Pigments market, having an estimated share of approximately 40%. The segment is dominant mainly because large amounts of dyes are used to color fabrics and garments in the textile industry. Above all, reactive dyes have good colorfastness and brightness compared to other classes of dyes. Thus, they find broad applications in various textile industries, ranging from fashion to home textiles and technical textiles. In the fashion industry, for instance, colored items are manufactured using such dyes, which are assuredly durable upon several washes. The wide applications in textiles underpin its significant market share in dyes, reflecting the vital role they play in the use of consumer preferences for high-quality and long-lasting colored fabrics.

Dyes and Pigments Market Regional Analysis

The Asia Pacific dominated the Dyes and Pigments Market, having a revenue share of around 60% in 2023. This can be attributed to the rise of the middle-class population, leading to a rapid growth in consumer spending globally. This further causes massive growth in the textile and plastic industries, thereby contributing to the growing growth in the market. Notably, the textile industry has accounted for upwards of half the demand in dyes and pigments for the last few years and has thus provided the leading driver for consumption of dyes and pigments. With this, consumption of dyes and pigments would remain concentrated in the Asia Pacific region because it accounts for the majority share of production in textiles and consumer plastic products across the world. While China is going to prevail in the world market, countries such as Bangladesh, India, and Vietnam are enjoying a partial relocation of textile and plastic production within their borders because of lower wages. The shift has facilitated paths for such countries to find their place in the market. Besides, consumers also have an emerging demand for newer and greener shades that do not lead to the loss of color and are thus greener for the environment. This ever-evolving taste of consumers will provide yet another boost to the market demand for dyes and pigments since textile manufacturers will increasingly move towards manufacturing these newer, higher-value products. This trend is an exciting opportunity for the market to grow and develop.

Key Players

The major key players are DIC Corp., Clariant AG, BASF SE, Huntsman Corp, Atul Ltd., Sudarshan Chemical Industries Ltd., Kiri Industries Ltd., Lanxess AG, Kronos Worldwide Inc., Dystar, and other key players mentioned in the final report.

Recent Developments

-

August 2024: Organic Dyes & Pigments further develops its special-effect dyes and pigments portfolio by acquiring Bolger O'Hearn.

-

July 2024: Organic Dyes & Pigments announces the appointment of Jadel Baptista as Technical Director, who will lead innovation in dye technology.

-

April 2024: Koel USA Inc. collaborated with Univar Solutions on the distribution of its specialty pigment and dye portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 40.19 Billion |

| Market Size by 2032 | US$ 63.42 Billion |

| CAGR | CAGR of 5.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Dyes [Reactive Dyes, Acid Dyes, Direct Dyes, Vat Dyes, Disperse Dyes, Others], Pigments [Organic, Inorganic]) •By Application (Dyes [Printing Inks, Paper, Textiles, Leather, Others], Pigments [Paints & Coatings, Printing Inks, Construction, Others]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DIC Corp., Clariant AG, BASF SE, Huntsman Corp, Atul Ltd., Sudarshan Chemical Industries Ltd., Kiri Industries Ltd., Lanxess AG, Kronos Worldwide Inc., Dystar and other key players |

| Key Drivers | •Growing demand for eco-friendly and bio-based dyes due to environmental regulations systems, enhance efficiency and lower costs •Rising applications in textiles, automotive, and packaging industries, driven by evolving consumer preferences for vibrant, sustainable products |

| Restraints | •High production costs associated with developing sustainable and natural dyes, limiting wider market adoption |