Wood Bio-Products Market Analysis & Overview:

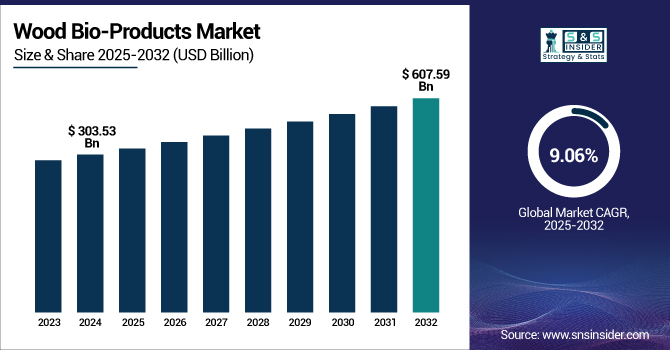

The Wood Bio-Products Market size was valued at USD 303.53 billion in 2024 and is expected to reach USD 607.59 billion by 2032, growing at a CAGR of 9.06% over the forecast period of 2025-2032.

To Get more information on Wood Bio-Products Market - Request Free Sample Report

Rising biofuel demand drives the market growth. It is due to the rising global concerns regarding climate change, there is a greater emphasis on the importance of renewable and sustainable energy sources. Biofuels, especially wood-based types (wood pellets and chips), have recently gained a lot of attention as relatively greener substitutes to fossil fuels. These biofuels have applications in residential heating, industrial power generation, and as a diesel and gasoline substitute in transportation.

For instance, in India, the Ministry of Petroleum and Natural Gas MoPNG targets 20% ethanol blending in petrol by 2025, while 15% in 2024. To achieve this target, about 1,016 crore litres of ethanol would be needed, which means an ethanol production capacity of around 1,700 crore litres will have to be set up by 2025. In this context, an important expansion of the modified Pradhan Mantri JI-VAN Yojana (Ji-VAN), which has been extended up to 2028-29 and expanded to cover not only advanced biofuels generation (through liquefaction) has been noticed.

Moreover, this growing market for biofuels not only supports the development of sustainable energy sources but also enhances the demand for wood bio-products, which play a crucial role in meeting these energy needs.

Wood Bio-Products Market Dynamics:

Drivers:

-

Rising Demand for Sustainable Materials Drives the Market Growth

There is a rising trend of substituting traditional non-renewable materials with sustainable counterparts in both consumer and industrial goods. As environmental concerns continue to be on the rise, so do the sustainable options, and one of them is the wood bio-products, which are renewable and biodegradable. The transition to sustainability is driven by the urgency to lower carbon footprints, protect natural resources, and decrease waste. Wood bio-products, which include biofuels, biochemicals, and engineered wood products, are promising alternatives to fossil fuel-based and petroleum-derived materials to realize the circular economy.

For instance, the U.S. government has set ambitious targets to replace 90% of current plastic use with recyclable-by-design biobased polymers, aiming to reduce environmental impact and promote sustainability. Removal of plastic and a ban on plastic help to reduce the impact, and it may drive the wood bio-products market growth.

Restraints:

-

Competition from Alternative Materials May Hamper Market Expansion

Wood-based products may be renewable and environmentally friendly, but they compete against non-renewable and environmentally debilitating materials, such as concrete, steel, plastics, and composites that seem to be ubiquitous in modern industries. For many businesses, these alternative materials appear to be viable candidates with greater durability, lower production costs, or an established manufacturing process. With wood bio-products, the engineered wood is replacing a lot of timber products due to its sustainability benefit, but concrete and steel are still seen in many construction projects due to their characteristic strength, versatility, and cost benefits. In packaging and consumer goods, too, plastics, while being environmentally harmful, are still a cheaper and more durable solution to many products.

Opportunities:

-

Technological Advancements in Wood Processing are Creating Market Growth Opportunities

Emerging technologies, such as nanotechnology and engineered wood composites or wood-based biorefinery processes, are also increasing the functional efficiency and expanding the diversified potential uses of wood-based products. They help in deriving valuable chemicals and materials out of wood, such as biofuels, bioplastics, and bio-based chemicals, that find applications in several sectors. Furthermore, advancements in wood processing technology, such as precision cutting and eco-friendly harvesting techniques, enable better utilization of raw materials, minimizing waste and boosting sustainability from the onset of production. This not only reduces production costs but also enhances the market position of Wood Bio-Products in competition against traditional materials.

The companies follow the wood bio-products market trends and the advantages, and launched the new product to increase its share in the market. For instance, in February 2025, AkzoNobel launched a waterborne wood coating with 20% bio-based content, subject to our definition of performance, thus increasing the amount of renewable raw materials without negatively impacting performance.

Moreover, the University of Maine's Tech Hub Investment UMaine is continuing its forest bioproducts technology maturation program, part of Maine's forest bioproducts advanced manufacturing tech hub. An additional USD 22 million investment in this initiative toward helping UMaine become a global leader in the production and manufacturing of forest-based biomaterials.

Wood Bio-Products Market Segmentation Analysis:

By Type

Finished wood products held the largest market share, around 47%, in 2024. It is widely used for general functions, value added quality, and significant demand from various potential end-use industries. These products, which include furniture, cabinetry, flooring, panels, and decorative products are not limited to the building of residences or commercial structures but are also regularly involved in design and architectural type situations due to their beauty and durability.

Manufactured wood material held a significant market share and is expected to be the fastest-growing segment during the forecast period. The segment’s growth is driven by the widespread use of manufactured wood materials in residential, commercial, and industrial applications owing to their cost-effective and versatile nature. Engineered wood products, including plywood, particleboard, medium-density fiberboard (MDF), and oriented strand board (OSB), are composed of wood fibers or particles, which are bound together with adhesives, providing uniform strength and stability that can exceed solid wood.

By Distribution Channel

The offline segment held the largest market share of approximately 68% in 2024 as these outlets offer services, such as expert consultations, cutting on the spot, delivery, and installation services, which builds a sense of confidence and provides a very personalized experience for the customers. Furthermore, large-scale procurement contracts in construction, infrastructure, and furniture manufacturing still heavily depend on traditional supplier relationships and face-to-face negotiations. The combination of which has kept the offline segment at the top in terms of market share across the wood bio-products market.

Online segment held a significant market share and is projected to be the fastest-growing segment during the forecast period due to the rising initiatives undertaken by e-businesses along with the growing convenience offered to consumers and businesses. In the current scenario, many consumers can easily find options for wood products from engineered panels and flooring to decking and furniture without the need to step into a physical store, due to the proliferation of online marketplaces, including Amazon, Alibaba, and niche B2B portals.

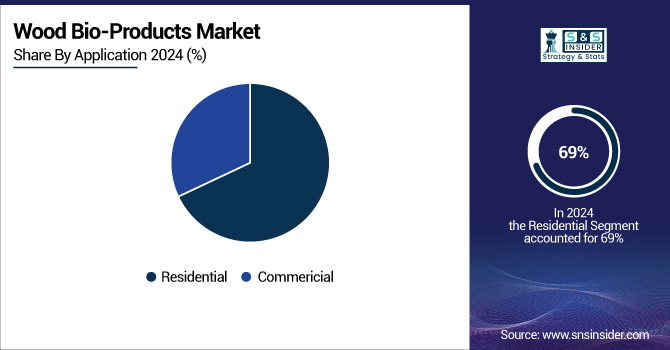

By Application

The residential segment held the largest market share, approximately 69%, in 2024. The segment’s growth is driven by the increasing demand for eco-friendly, visually attractive, and durable materials for home construction, renovation, and design. Wood bio-products are common in housing for flooring, cabinetry, furniture, wall panels, and doors, which offer aesthetic natural looks and insulation, adapting to a variety of architectural contexts. The shift toward living sustainably and promoting green building practices has also driven more people toward using wood-based products, especially products certified FSC (Forest Stewardship Council).

The commercial segment held a significant market share due to the growing need for sustainably sourced and visually appealing materials for their use in offices, hotels, retail spaces, educational institutions, and healthcare facilities. Visible and invisible wood bio-products, which include veneered panels, engineered wood flooring, acoustic ceiling systems, furniture, and decorative cladding, are appreciated for their natural aesthetic, performance, and warmth.

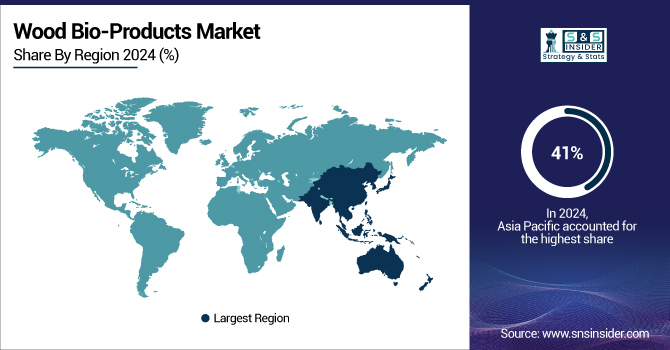

Wood Bio-Products Market Regional Outlook:

Asia Pacific held the largest market share, around 41%, in 2024 It is owing to the availability of massive raw material, the growing construction and furniture industry, along with government support for sustainable development. Nations, such as China, India, Indonesia, and Vietnam, with large forest reserves and well-established timber processing infrastructures, among others, can produce wood based bioproducts including plywood, MDF, particleboard, and finished furniture at a lower cost. The demand for wood-based material has increased specifically in this region due to the rapid urbanization and increasing disposable income across the region, resulting in the development of more residential and commercial buildings.

For instance, Thai furniture and wood factory PJ Chonburi Parawood Ltd. has taken some major expansion steps. The supplier sells products to large retailers including Walmart, Sainsbury, and Amazon. Highlighting the strategic initiatives toward increasing production capabilities and market presence, PJ Chonburi Parawood is reportedly set to finalize an acquisition in Myanmar in 2024 in an effort to develop a manufacturing base for the Eurozone.

Europe held a significant market share and is expected to grow during the forecast period. The region’s growth is driven by the commitment of the European Union to sustainability, mainly through the European Green Deal that invests heavily in renewable energy assets and carbon footprint reduction, bio-based products, such as wood have benefited from this expansion. Additionally, Finland, Sweden, and Austria, which boast large forest resources, have also moved into more advanced phases of wood processing and bio-products technology generation that promote their competitive (score) advantage. Initiatives in support of these developments as the European Forest-based Sector Technology Platform (FTP) with its ambition of enhancing the innovation and market penetration of wood bio-products, can be further expected to fuel the development in the European wood bio-products market.

Europe was the largest producer of this key bio-product, with 70 million tons of wood pellets in 2022, against the increasing demand for renewable energy solutions and efficient heating systems in the region.

North America held a significant market share in 2024. It is owing to a combination of factors, such as the natural forest endowments available in the region, along with higher appetites towards renewable energy solutions as well as government policies that favour the use of forest products. Both the United States and Canada, as leading producers of wood bio-products have ample wood resources used for a variety of products, including wood pellets, lumber, and paper products.

The U.S held the largest market share and is expected to growth with a CAGR of 8.86% during the forecast period of 2025-2032. Demand for wood pellets has significantly increased, especially in the U.S., as the focus on renewable energy continues to grow, and log pelleting processes customers’ shift from fossil fuels to using wood pellets as a sustainable biomass for energy production and heating.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The key wood bio-products manufacturing companies operating in the report are Borregaard, Stora Enso, UPM-Kymmene, Domtar Corporation, Rayonier Advanced Materials, Mercer International, Lenzing AG, West Fraser, Georgia-Pacific Chemicals, and Sappi Limited. These key players help to understand the wood bio-products market share, wood bio-products market analysis, wood bio-products market trends, and wood bio-products industry trends.

Recent Developments:

-

In 2024, Stora Enso secured up to USD 485 million from the European Investment Bank for a planned upgrade of its Oulu plant to make circular and recyclable food and personal care product packaging. This project stems from the company-wide commitment to reduce dependence on plastic and support a circular economy.

-

In March 2024, UPM started offering a sustainable transport solution for wood delivery to its Leuna biorefinery in cooperation with DB Cargo. Such cooperation allows wood to be transported by rail, increasing the overall sustainability and efficiency of the logistics chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 303.53 Billion |

| Market Size by 2032 | USD 607.59 Billion |

| CAGR | CAGR of 9.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Finished Wood Product, Manufactured Wood Material, Wood Processing) •By Distribution Channel (Online, Offline) •By Application (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Borregaard, Stora Enso, UPM-Kymmene, Domtar Corporation, Rayonier Advanced Materials, Mercer International, Lenzing AG, West Fraser, Georgia-Pacific Chemicals, and Sappi Limited. |