Furfural Market Report Scope & Overview:

Get More Information on Furfural Market - Request Sample Report

The Furfural Market Size was valued at USD 595.7 million in 2023, and is expected to reach USD 1095.2 million by 2032, and grow at a CAGR of 7.0% over the forecast period 2024-2032.

The furfural market is seeing dynamic growth mainly because of the surging demand for bio-based chemicals, which are produced from renewable sources. Furfural is one of the principal intermediates used to make various chemical products and is primarily made from agricultural residues like corn cobs, sugarcane bagasse, and wood chips. Sustainability and eco-friendliness are gaining ground with growing awareness, and so industries are looking at alternatives that can replace petroleum-based products. This direction toward green chemistry not only extends the appeal of furfural as a renewable resource, but it also stimulates innovation in its production processes. The new developments in the market for furfural signify improved conversion techniques and applications giving a further boost to its growing significance in the chemical field.

Among the most impressive recent developments in the area of furfural production is that achieved by a research group, tasked with improving conversion efficiency as well as increasing the sustainability of lignocellulosic biomass. A new strategy for the enhancement of hydrogen bond interactions during the conversion process has been reported by researchers from February 2023 that had greatly improved the yield of furfural. This innovation unlocks the cost-effective production route making it especially appealing to more and more manufacturers interested in efficient ways to incorporate renewable chemicals into their portfolios. The ability to enhance conversion processes resonates with the general market trend of the enhancement of sustainability and, therefore, furfural plays an essential role in the successful transition to bio-based products.

In addition to technological development, the market is witnessing increased utilization of furfural derivatives, mainly in furfuryl alcohol production. It has drawn attention because of its excellent properties and importance as a resin used in foundries and construction, and major companies are investing in increased production capacities to fulfill increasing demand. For instance, bagasse-a sugar manufacturing by-product-is being strategically researched as a possible avenue for sustainable furfural and furfural-related derivatives production. A report issued on 15 October 2024 hints at highly valuable biochemicals from bagasse transformation while displaying the integration of sustainability and profitability in furfural production.

The global pursuit of alternative and more environmentally friendly products, therefore, also calls for more intense cooperation between producers and research institutes in further studying the new applications of furfural. The pressure to develop biochemicals that can outperform petrochemicals is creating a surge in research and investments in the industry. Companies are joining partnerships to collaborate and innovate for novel products and processes with more efficient production of furfural while being less harmful to the environment. It is such partnerships that critically combat challenges against traditional chemical manufacturing methods and will meet emerging global sustainability goals.

In addition, with better processing technologies, the overall market scenario for furfural is being enhanced. Innovations that help in the easy extraction and purification of furfural from biomass are gaining importance. Companies focusing on these innovations will likely firm up their positions in the market and respond well to the growing demand for sustainable chemical solutions. The market is expected to surge with the support of renewable resources and efficient processing technologies, making furfural a very important component in the transition to more sustainable chemical industry industries.

Furfural Market Dynamics:

Drivers:

-

Increasing demand for bio-based chemicals driving market growth

The major driving force behind the furfural market remains the global transition towards sustainable development and an ecologically friendly product. In recent years, concern for the environment has brought the spotlight to renewable alternatives for petrochemical products, and there have been tighter regulations placed on carbon emissions that industries have had to face. Furfural, being derived from agricultural residues such as corn cobs, sugarcane bagasse, or wood chips, provides a sustainable solution in line with the green initiatives. It is seen to have gained preference in various sectors such as plastics, textiles, and food packaging, showing trends of manufacture using furfural and its derivatives toward meeting sustainability requirements and demand from consumers and the marketplace for environmentally friendly products. Societies across the world are also facilitating this shift through policy measures promoting renewable resources, thereby making furfural even more attractive. This would increase the demand in two directions: not only would it expand growth in the market, but innovation in production technologies would also be encouraged, thus making extraction methods greener and more efficient. The increased demand for bio-based chemicals during this period would be a crucial stimulus for the expansion of the furfural market.

-

Advancements in production technologies fueling market expansion

Technological advancement in furfural production and conversion techniques propels market growth. Inventions enhancing the extraction of furfural from biomass by increasing efficiency are gaining increased prevalence, and under such optimal innovation, manufacturers can optimize their processes. For example, recent studies focus on enhancing the catalytic processing and reaction conditions necessary for the efficient conversion of lignocellulosic biomass into furfural. One notable research in February 2023 published the upgrade of hydrogen bond interactions in the conversion of materials with significantly improved furfural yields. Advances are being worked concerning fermentation technologies for the production of furfural in a more sustainable and economic mode. Improvements in production methods not only reduce these operational costs but also waste and energy consumption, aligned with the global emphasis on sustainability. Improved competitiveness and responsiveness of manufacturers in terms of adoption of new technologies will result from this. Therefore, the increase in the production of furfural technologies will spur significant market expansion - fully capable of meeting the ever-growing demands of renewable chemical solutions.

Restraint:

-

High production costs hindering market growth

Despite the bright prospects, one of the most important restraints of the furfural market is its high production cost. High costs are associated with the extraction and processing of furfural as the customary processes tend to be complex in nature and require expensive equipment and latest technologies. These operational costs make it a little bit more rigorous, especially for smaller firms or new entrants into the market; it is relatively more challenging to compete with cheaper petrochemical alternatives. Variations in raw material prices like agricultural residues would trickle down into knock-on effects on the cost of production and, thus, result in lowered profitability. This high cost structure would provide entry barriers for new players. Limited entry of new players is considered to be the largest factor limiting overall market growth. To aid in curbing the cost of production so that a road to profitability may be attained, businesses within this furfural market require constant exploration into innovative solutions and efficiencies, both individually and through collaborations. The way around this restraint will be critical to the market to realize its full potential and capitalize on the opportunities that are presented by the increasing demand for sustainable chemical products.

Opportunity:

-

Diverse applications presenting growth present significant growth opportunities for the furfural market.

The widening scope of applications in various fields does provide much scope for further market development. Furfural, which has been hitherto used as a solvent and in the preparation of resins, is now quickly discovering opportunities in pharmaceuticals, agrochemicals, and food additives. Furfuryl alcohol and other furfural derivatives are versatile chemicals which can be incorporated in a variety of products making them valuable in several fields of coatings, adhesives, and construction materials. The renewed interest toward sustainable and biodegradable products has further boosted demand for furfural-based solutions. With the ever-growing multitude of innovative solutions, newer and greener alternatives tempt industries to look out to this bio-based building block in new chemical formulations. This appreciation and adaptation of furfural across applications open up not only new market avenues but also further boost research and development efforts. Companies that can exploit these options through new products lines and new markets position themselves well in the furfural market and open the door to expansive market growth.

Challenge:

-

Competition from petrochemical products poses a significant challenge for the furfural market.

The market for furfural is highly under intense competition from well-established petrochemical alternatives. Most fossil-based traditional chemical products have better supply lines and are cheaper to produce, which gives the product little hope to acquire any significant market share within some niches. It's a challenge to the business, especially within price-sensitive markets that already have some established suppliers of petrochemical-based products. The long-term existence of these other options has resulted in a perception among manufacturers and consumers alike that petrochemical alternatives are a superior option or more workable than their bio-based counterparts. Sufficient marketing, education, and demonstration of the benefits and performance of furfural-derived products would be required to overcome this perceived and established preference. Other market challenges that the furfural market might face involve regulatory issues as well as calls for certification of bio-based products. The firm would need strategic collaborations and new product developments for untainted furfural to dominate the market to secure competitive positioning.

Furfural Market Segments

By Process

In 2023, the Chinese Batch Process segment dominated and accounted for nearly 65% of the total market share in the furfural market. Chinese Batch Process is in heavy usage due to its economic feasibility and higher yield on converting agricultural residues like corn cobs and sugarcane bagasse to furfural. These manufacturers, particularly the Chinese companies, who are among the forerunners in the manufacturing industry of furfural prefer the Chinese Batch Process. For instance, Shandong Fuyuan Chemical Co., Ltd. amongst others has utilized the said process to enhance its efficiency of production and output generation that has, over the years contributed substantially to the aggregate market share of this segment. The established infrastructure coupled with the raw materials available in China further fortifies the Chinese Batch Process's position as a globally essential pillar of furfural production.

By Raw Material

Corn cob raw material dominated the furfural market and accounted for a market share of around 45% in 2023. This market share is attributed to corn cob in terms of availability as a byproduct in agriculture, especially in regions such as the United States and China, which are countries with large-scale corn cultivation. Due to its relatively higher cellulose component that can be used to facilitate low-cost, yield-rich manufacture, corn cobs can be considered a good feedstock source for furfural. Companies such as Penn A Kem LLC exploited the use of corn cobs to optimize production processes and continue to push furfural's position in the market. Hence, the corn cob continues to be an important input for the furfural industry that propels efficiency and sustainability in its production chain.

By Application

In 2023, Furfuryl alcohol application dominated the furfural market with approximately 55% market share. Furfuryl alcohol is the primary derivative that makes up the use of furfural in producing resins, adhesives, and coatings. An integral ingredient in various applications in the industrial sector, it derives its increase in demand from the demand for sustainable, nontoxic, and environmentally friendly materials or goods that can also be found in construction and automotive. Kraton Corporation, among many others, has developed bio-based products that meet the fast-growing market demand for sustainable solutions. This sets the trend of higher demand for furfuryl alcohol in the furfural market, and it is one of the significant application segments standing alone on the top.

By End-use Industry

In 2023, the agriculture end-use industry segment dominated the furfural market with an estimated market share of about 40%. Furfural and its derivatives are increasingly used as bio-based solvents and intermediates in pesticide and herbicide synthesis. Increasing demand for furfural-based products arises with changing agricultural practice that follows more environmentally friendly agriculture than others. Companies such as Segetis Inc. have made successful inventions with furfural-based innovative formulations, thus bridging the developing need for a sustainable agricultural solution. Attention to sustainability and eco-friendliness through agricultural production has led to this segment as the leading end-use industry in the furfural market, along with the trend towards green chemistry.

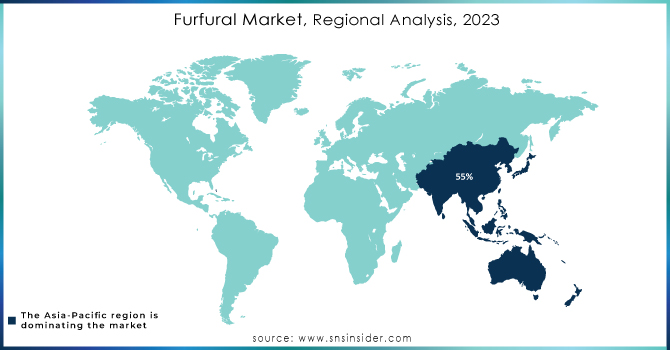

Furfural Market Regional Analysis

The Asia-Pacific region dominated the furfural market in 2023, with an approximate market share of about 55%. This may be mainly due to the large production capacities and high agricultural output of China, more so in corn and sugarcane, which are the major raw materials in the production of furfural. With good government policies for the use of bio-based chemicals, coupled with strong infrastructure, China has been the highest producer in the furfural market. Companies like Shandong Fuyuan Chemical Co., Ltd. have also increased the production of furfural, further capitalizing on the agricultural residues in the region to meet local and international demand. Good awareness about sustainable issues, as well as increasing use of furfural in many industries, drives the Asia-Pacific's market.

Moreover, the North American region emerged as the fastest growing region in the furfural market with an expected CAGR of 6.5% in 2023. This increase in demand for bio-based chemicals, enhanced awareness of sustainability close to the near term, and the awareness of recent liberalization policies all add to this growth. On the other hand, the U.S. and Canada also record a significant amount of investment in applied research and development for newer applications of furfural, especially for applications in agriculture and construction. For example, development programs in pesticides and adhesives using furfural-derived intermediates have picked on manufacturers. The companies are focusing more and more on converting agricultural residues into value-added products, which is fostering the growth of the furfural market in North America. Additionally, consumer preference for sustainable alternatives is quite high, and the North American region is expected to continue this robust growth trajectory over the coming years.

Need any customization research on Furfural Market - Enquiry Now

Key Players

-

Cayman Chemical Company (furfural, furfuryl alcohol)

-

Furfural Company (furfural, furfural derivatives)

-

Hongye Holding Group Corporation (furfural, furfuryl alcohol)

-

Kraton Corporation (furfural, furfuryl alcohol)

-

Mitsubishi Chemical Corporation (furfural, furfuryl alcohol)

-

Penn A Kem LLC (furfural, furfural derivatives)

-

Segetis Inc. (furfural, furfural-based solvents)

-

Shandong Fuyuan Chemical Co., Ltd. (furfural, furfuryl alcohol)

-

Sundow Polymers Co., Ltd. (furfural, furfuryl alcohol)

-

Zhangjiagang Huasheng Chemical Co., Ltd. (furfural, furfuryl alcohol)

-

Anhui Aokai Chemical Co., Ltd. (furfural, furfuryl alcohol)

-

BASF SE (furfural, furfuryl alcohol)

-

Dharmaji Chemicals (furfural, furfuryl alcohol)

-

Gujarat Bikas Industries Ltd. (furfural, furfuryl alcohol)

-

Harshil Chemicals (furfural, furfuryl alcohol)

-

Lenzing AG (furfural, furfuryl alcohol)

-

Lignin and Furfural Company (furfural, furfuryl alcohol)

-

Royal Dutch Shell (furfural, furfuryl alcohol)

-

The DOW Chemical Company (furfural, furfuryl alcohol)

-

Zibo Guangtong Chemical Co., Ltd. (furfural, furfuryl alcohol)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 595.7 Million |

| Market Size by 2032 | US$ 1095.2 Million |

| CAGR | CAGR of 7.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Process (Quaker Batch Process, Chinese Batch Process, Rosenlew Continuous Process, Others) •By Raw Material (Corn cob, Sugarcane bagasse, Sunflower hull, Rice husk, Others) •By Application (Furfuryl alcohol, Solvent, Intermediate, Others) •By End-use Industry (Agriculture, Paints & Coatings, Pharmaceuticals, Food & Beverage, Refineries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Furfural Company, Penn A Kem LLC, Shandong Fuyuan Chemical Co., Ltd., Kraton Corporation, Hongye Holding Group Corporation, Cayman Chemical Company, Mitsubishi Chemical Corporation, Zhangjiagang Huasheng Chemical Co., Ltd., Segetis Inc., Sundow Polymers Co., Ltd.and other key players |

| Key Drivers | • Increasing demand for bio-based chemicals driving market growth • Advancements in production technologies fueling market expansion |

| Restraints | • High production costs hindering market growth |