Dimethylformamide (DMF) Market Report Scope & Overview:

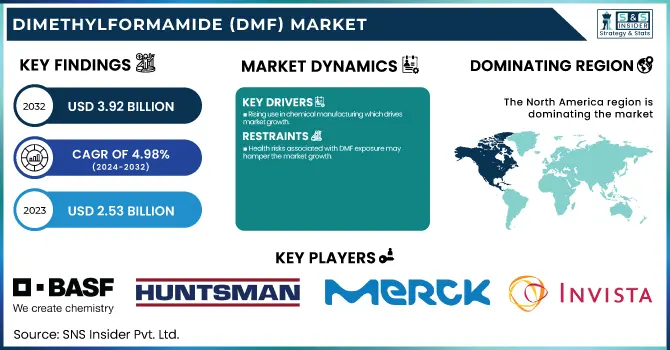

The Dimethylformamide (DMF) Market size was USD 2.53 Billion in 2023 and is expected to reach USD 3.92 Billion by 2032 and grow at a CAGR of 4.98 % over the forecast period of 2024-2032. This report provides comprehensive statistical insights and trends in the dimethylformamide (DMF) market, covering key aspects such as production capacity and utilization by country and grade in 2023, alongside feedstock price trends influencing manufacturing costs. It examines the regulatory impact on DMF production, including environmental restrictions and compliance requirements. Additionally, the report highlights emissions data, waste management, and sustainability initiatives by leading manufacturers. Innovations in high-purity DMF and eco-friendly production methods are explored, along with market demand trends across key applications like pharmaceuticals, textiles, and coatings.

To Get more information on Dimethylformamide (DMF) Market - Request Free Sample Report

Dimethylformamide (DMF) Market Dynamics

Drivers

-

Rising use in chemical manufacturing which drives market growth.

One of the major factors that are driving the growth of the dimethyl formamide market is its increasing use in chemical manufacturing as a solvent for a wide range of industrial process. Due to its solvent properties, DMF is used in high volumes for an array of polymer processes, resins, adhesives, and agrochemicals. Rising requirement for polyurethane-based products, acrylic fibers and specialty chemicals have also helped to support demand for DMF, particularly in regions with high growth industrial sectors. Moreover, DMF is an important solvent in catalysis and organic synthesis and is often integrated into synthetic routes in fine chemicals and pharmaceutical intermediates. Owing to ongoing development in chemical production and with rising focus on high-performance inputs, DMF demand will likely remain robust, further emphasizing its status as a vital solvent in industrial sectors.

Restraint

-

Health risks associated with DMF exposure may hamper the market growth.

Dimethylformamide (DMF), a toxic solvent DMF also has effects on the liver after prolonged exposure, causing a disorder of the respiratory tract and dermatitis. Due to the risk of exposure through inhalation and dermal absorption among workers handling DMF, companies invested heavily in protective systems alongside the installation of costly ventilation systems and personal protective equipment (PPE). When regulators such as OSHA, ECHA, and EPA began to impose restrictions, various sectors-initiated research for better solvent alternatives such as dimethyl sulfoxide (DMSO) and N-methyl-2-pyrrolidone (NMP) with a safer human and environmental profile. Moreover, it identified that although the market for bio-plastics has been expanding rapidly, health concerns have been leading to increased compliance costs and potential phase-outs in regulated regions like Europe and North America that may slow steady market expansion.

Opportunity

-

Expanding textile and synthetic fiber industry creates an opportunity in the market.

The growing textile and synthetic fiber industry poses an opportunity for the Dimethylformamide (DMF) market due to the importance of DMF as a solvent for polyurethane-based coatings, synthetic leather, and acrylic fibers. The growing global consumption of DMF will be fueled by the expanding macroeconomic trends concerning the free and easy processing of manufacturing activities to developing nations to achieve higher efficiency while doing business, who in turn, are expected to meet the growing global demand for long-life, low weight, and high-performance textiles that are typically used in sportswear, automotive upholstery, and industrial fabrics. This has resulted in large investments in textile manufacturing in developing economies such as China, India, and Vietnam, further fuelling the demand for DMF. There is also an increase in the trend of producing synthetic fibers based on polyurethane, which provides higher durability and elasticity, further fuelling the market growth. The growing demand for superior quality solvents such as DMF from fashion, technical textiles, and other industries will fuel long-term growth throughout the DMF market, owing to the continuous expansion of these sectors.

Challenges

-

Fluctuations in raw material prices may create a challenge for the market.

This could act as a restrain on the Dimethylformamide (DMF) market as it is primarily one switch in the feedstock (majorly methanol and dimethylamine). These raw material prices including crude oil price volatility, supply chain disruption, and geopolitical tensions can result in unforeseeable cost fluctuations for manufacturers. Producers generally find it hard to maintain price stability with any raw material cost increase as it directly affects the cost of production and profit margin of DMF. In addition, the growing demand for methanol for non-fuel applications, including biofuels and chemical derivatives, which have the potential to constrain prices. Such uncertainties raise financial risks for manufacturers with possible higher product prices, which may reduce demand in price-sensitive industries such as textiles and coatings.

Dimethylformamide (DMF) Market Segmentation Analysis

By Resin

The reactant segment held the largest market share around 68% in 2023. It is owing to its wide applications in numerous chemical synthesis and manufacturing processes. DMF is an important intermediate in the manufacture of bulk drugs or Active Pharmaceutical Ingredients (APIs), agrochemical products, and various specialty chemicals, used as an important coupling /reactant/solvent agent for chemical reactions. It is indispensable in drug synthesis (especially for active pharmaceutical ingredients (APIs)) due to its great solvation characteristics and the ability of its ammonium ion to participate in amide bond formation. Moreover, the increasing need for high-performance polymers, resins, and adhesives has increased its stake as a reactant. DMF is also used in the electronics, textile, and coating industries to produce high-quality synthetic materials and fibers.

By End-Use Industries

Chemical manufacturing held the largest market share around 32% in 2023. It is a common solvent and reactant in the manufacture of numerous chemicals. DMF is critical in the synthesis of pharmaceuticals, agrochemicals, dyes, and specialty chemicals boosting reaction efficiency and solubility This feature makes it useful and integral in polymer production, resins, and adhesives manufacturing, as it can dissolve a wide range of organic and inorganic compounds. Its extensive use in chemical manufacturing is further backed by the high demand for high-performance coatings, synthetic fibers, and industrial chemicals. The strong demand for DMF in the chemical manufacturing process continues to make this the largest application segment in the DMF market, propelled by the growing chemical and pharmaceutical sectors, especially in the Asia-Pacific region, along with rapid industrialization.

Dimethylformamide (DMF) Market Regional Outlook

North America held the largest market share around 42% in 2023. It is owing to the well-established chemical, pharmaceutical, and electronics industries in the region. DMF is a widely used solvent and reactant in performance chemicals, specialty chemicals, agrochemicals, and coatings, thereby creating a huge demand in the chemical manufacturing sector in this region. Moreover, the pharmaceutical sector in the US and Canada is also expected to boost market growth due to increasing R&D spending and growing drug formulation activities in these countries. DMF finds high-purity applications in semiconductor and battery manufacturing in large markets where North America boasts a dominant position, too, in circuit board cleaning and lithium-ion battery production. Additionally, large-scale chemical manufacturers and regulatory systems maintain an uninterrupted supply chain fortifying the regional position of the DMF market in North America as well.

Asia Pacific held a significant market share in 2023. It is owing to rapid growing chemical, pharmaceutical, textile and electronics industries. Driven by sustained industrialization and strong demand from synthetic fibers, resins, and specialty chemicals, DMF is primarily produced and consumed in countries such as China, India, South Korea, and Japan. Increasing drug manufacturing and R&D activities backed by the burgeoning pharmaceutical industry in this region also propels the demand for DMF. Furthermore, Asia Pacific, globally the center of production for Electronics and Semiconductor manufacturing, is suitable for the DMF applications which are used in cleaning circuit boards chemically and also in production of Lithium-Ion batteries. With the low cost of raw materials, cheap labor, and government initiatives supporting the growth of the industrial sector coupled together, the position of the region in the market has become strong. Asia Pacific retains its dominance in the DMF market, with ongoing investments in chemical manufacturing and infrastructure development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (DMF EL, DMF Pharma)

-

Eastman Chemical Company (Eastman DMF, Eastpure DMF)

-

Merck KGaA (EMSURE DMF, EMPLURA DMF)

-

Luxi Chemical Group Co., Ltd. (Luxi DMF Industrial, Luxi DMF Pharma)

-

Mitsubishi Gas Chemical Company, Inc. (MGCC DMF, Tech-Grade DMF)

-

Balaji Amines Limited (BALAMINE DMF, Pharma-Grade DMF)

-

Zhejiang Jiangshan Chemical Co., Ltd. (Jiangshan DMF, High-Purity DMF)

-

Chemanol (Methanol Chemicals Company) (Chemanol DMF, Specialty DMF)

-

Helm AG (Helm DMF 99.9%, Industrial-Grade DMF)

-

Shandong Hualu-Hengsheng Chemical Co., Ltd. (Hualu DMF, Pharma-Grade Hualu DMF)

-

Invista (Invista DMF, Chemical-Grade DMF)

-

Kailash Chemicals (Kailash DMF, Pure-Grade DMF)

-

Shandong Jinmei Riyue Industry Co., Ltd. (Jinmei DMF, Riyue DMF)

-

Samsung Fine Chemicals (Samsung DMF, Electronic-Grade DMF)

-

Taminco (A Subsidiary of Eastman Chemical Company) (Taminco DMF, Ultra-Pure DMF)

-

Anhui Jin'ao Chemical Co., Ltd. (Jin’ao DMF, Industrial-Grade Jin’ao DMF)

-

Inner Mongolia Yuanxing Energy Co., Ltd. (Yuanxing DMF, High-Purity Yuanxing DMF)

-

Jiutian Chemical Group Limited (Jiutian DMF, Electronic-Grade Jiutian DMF)

-

Shaoxing Xingxin New Material Co., Ltd. (Xingxin DMF, High-Performance DMF)

-

Linde plc (Linde DMF, Research-Grade DMF)

Recent Development:

-

In 2024, BASF increased its DMF production capacity to address the rising demand from the pharmaceutical and electronics industries.

-

In 2023, the Mitsubishi Gas Chemical Company, Inc. launched a high-purity DMF variant designed for advanced electronic applications, strengthening its presence in the semiconductor sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.53 Billion |

| Market Size by 2032 | USD 3.92 Billion |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin (Reactant, Feedstock) • By End-User Industry (Pharmaceuticals, Chemical Manufacturing, Paints & Coatings, Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Eastman Chemical Company, Merck KGaA, Luxi Chemical Group Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Balaji Amines Limited, Zhejiang Jiangshan Chemical Co., Ltd., Chemanol (Methanol Chemicals Company), Helm AG, Shandong Hualu-Hengsheng Chemical Co., Ltd., Invista, Kailash Chemicals, Shandong Jinmei Riyue Industry Co., Ltd., Samsung Fine Chemicals, Taminco (A Subsidiary of Eastman Chemical Company), Anhui Jin'ao Chemical Co., Ltd., Inner Mongolia Yuanxing Energy Co., Ltd., Jiutian Chemical Group Limited, Shaoxing Xingxin New Material Co., Ltd., Linde plc |