Scrap Metal Recycling Market Report Scope & Overview:

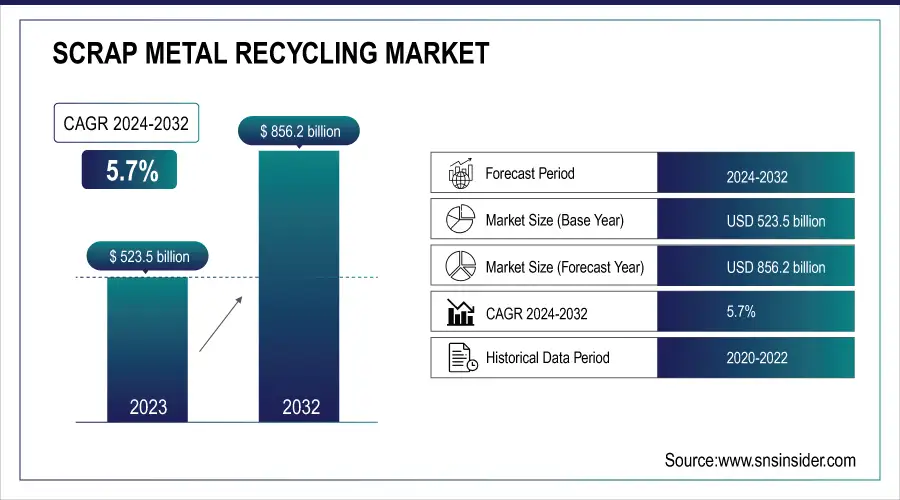

The Scrap Metal Recycling Market Size was valued at USD 523.5 Billion in 2023 and is expected to reach USD 856.2 Billion by 2032, growing at a CAGR of 5.7% over the forecast period 2024-2032.

Urbanization and industrialization have been driving the scrap metal recycling market as they generate a significant amount of scrap metal. Innovations in the field of scrap metal processing such as the use of automation and robotics have made the process of recycling more efficient and of higher quality, reducing manual labor and errors. Recent trends have included the use of blockchain technology to track scrap metal better, ensure its authenticity, and make transactions more transparent while also reducing chain fraud. In addition, the increasing adoption of electric vehicles is leading to a rapid and continuous supply of scrap batteries and components containing lithium, cobalt, and nickel, among others, which can be recycled for these valuable metals, further driving the scrap metal recycling market’s growth.

Government regulation is also important in estimating the market further; the EU, for example, plans to recycle 75% of aluminum packaging by 2025, and India’s National Steel Policy calls for 30-40% of steel production to be produced through the electric arc furnace route, which is heavily dependent on scrap steel as a raw material. Furthermore, recycling 1 ton of steel saves 1.5 tons of iron ore, 0.5 tons of coal, and 40% of the water used which shows the substantial impact of scrap metal recycling on the environment and the growth of this market.

Get More Information on Scrap Metal Recycling Market - Request Sample Report

The global recycling rate for aluminum has reached approximately 76%, making it one of the most recycled materials worldwide. This high recycling rate is largely attributed to the growing demand for aluminum in lightweight automotive designs and packaging, which encourages manufacturers to incorporate recycled content. Additionally, about 95% of the energy required to produce aluminum from recycled materials is saved compared to producing it from bauxite ore. In terms of economic impact, the scrap metal recycling industry contributes roughly $90 billion to the global economy annually, highlighting its significance not only in waste management but also in fostering a sustainable manufacturing landscape.

|

Metal Type |

Subtypes |

Key Characteristics |

Industry Applications |

Stats |

Environmental Regulations |

|---|---|---|---|---|---|

|

Ferrous |

Carbon Steel, Stainless Steel, Cast Iron |

Contains iron, magnetic, prone to rust, high tensile strength |

Automotive (body parts, engines), Construction (reinforced steel), Manufacturing (machinery, tools) |

Ferrous metals account for over 90% of total recycled metals globally. Recycling steel reduces energy consumption by 60-74% compared to new production. |

The EU's Waste Framework Directive mandates recycling targets for metals, aiming for 70% recycling of construction and demolition waste by 2025. |

|

Non-Ferrous |

Aluminum, Copper, Zinc, Lead, Nickel |

No iron content, non-magnetic, corrosion-resistant, lightweight |

Electrical (wiring, cables), Aerospace (lightweight structures), Packaging (aluminum cans), Construction (roofing, piping) |

Copper recycling saves up to 85% of the energy compared to new production. Aluminum has a recycling rate of around 75%. |

The Resource Conservation and Recovery Act (RCRA) in the U.S. encourages recycling and proper disposal of non-ferrous metal waste to minimize environmental impact. |

Scrap Metal Recycling Market Dynamics

Drivers:

-

Rising Demand for Recycled Metals in Automotive and Construction Industries

The automotive and construction industries are under increasing pressure to adopt sustainable practices and reduce their carbon footprints. Recycled metals provide an eco-friendly alternative to virgin metals, as they require less energy for processing and produce fewer greenhouse gas emissions. This makes them highly attractive for industries aiming to meet sustainability targets and adhere to environmental regulations. In the automotive sector, it is estimated that approximately 25% of the steel used in car production comes from recycled materials. Moreover, recycling aluminum can save up to 92% of energy compared to new aluminum production, making it a critical material in the shift towards lighter and more fuel-efficient vehicles. The construction industry also heavily relies on recycled metals, with over 40% of global steel production now derived from recycled scrap, contributing to sustainable infrastructure development.

Restraints:

-

Lack of Recycling Infrastructure in Developing Regions

-

Volatility in Raw Material Prices

The scrap metal recycling industry is highly sensitive to fluctuations in raw material prices. When the prices of primary metals drop due to factors such as decreased demand or oversupply, it becomes less economically viable for manufacturers to use recycled metals. This leads to lower demand for scrap, affecting profitability for recyclers. Additionally, volatile prices can disrupt the supply chain, as collectors and recyclers may hoard scrap metal during periods of low prices, waiting for the market to improve, which further exacerbates supply instability. For instance, in 2020, steel prices dropped by nearly 20% during the pandemic, leading to a sharp decline in scrap metal demand. This price volatility directly impacts recycling margins and deters investment in recycling infrastructure.

Scrap Metal Recycling Market Segmentation Overview

By Metal Type

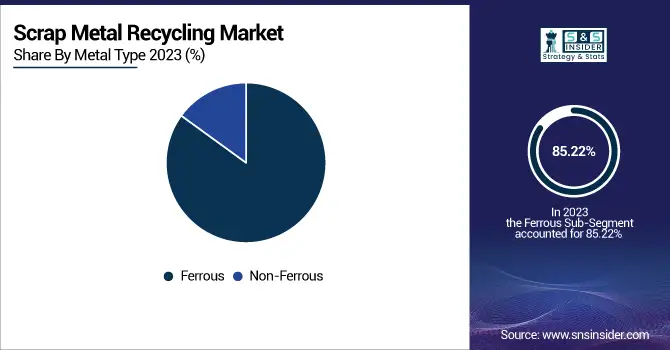

The ferrous segment led the scrap metal recycling market with the highest revenue share of more than 85.22% in 2023. This dominance is attributed to the high recycling rate of steel, which exceeds 85% globally. The recycling of ferrous metals, particularly steel, is significantly more cost-effective than producing new steel from iron ore. For instance, according to the U.S. Environmental Protection Agency, “recycling steel can reduce energy consumption by approximately 60-74% compared to producing new steel, depending on the production method used”. This energy savings translates into lower production costs and improved profitability for recyclers. In 2022, a total of around 1.9 billion metric tons of crude steel were produced worldwide, with a substantial portion derived from recycled sources. The widespread use of recycled steel in various industries, especially construction, where about 40% of the steel utilized is recycled, highlights the ongoing demand and economic viability of the ferrous segment in the scrap metal recycling market. Recycling steel also provides significant environmental benefits, reducing carbon emissions by about 58% compared to new steel production from primary materials. This alignment with sustainability goals, coupled with economic advantages, ensures that the ferrous segment remains a dominant player in the scrap metal recycling landscape.

By End-use Industry

The construction Industry held the highest revenue share of more than 41.88% in 2023 and is expected to grow significantly during the forecast period. This growth is fueled by global infrastructure investments, expected to reach around $94 trillion by 2040, driven by urbanization and population growth. As the demand for construction materials, particularly steel and aluminum, rises, the recycling of scrap metals becomes increasingly vital. Additionally, green building initiatives are gaining traction, with approximately 40% of materials used in such projects being recycled. Rising costs of primary materials further encourage construction companies to source from recycled supplies, making recycled metals a more attractive option.

Government regulations and incentives also play a crucial role in this trend. Many governments are implementing stringent policies to promote recycling within the construction sector. For example, initiatives like the LEED certification in the U.S. encourage the use of recycled materials in building projects, while the European Union has set ambitious recycling targets, aiming for a 70% recycling rate for construction and demolition waste by 2025. In China, the government is pushing for around 80% of its steel production to come from recycled sources by 2025, emphasizing a strong focus on sustainability within the construction industry. This combination of economic factors and regulatory support solidifies the construction sector's dominance in the scrap metal recycling market, highlighting its reliance on recycled materials to meet growing demand and sustainability objectives.

Scrap Metal Recycling Market Regional Analysis

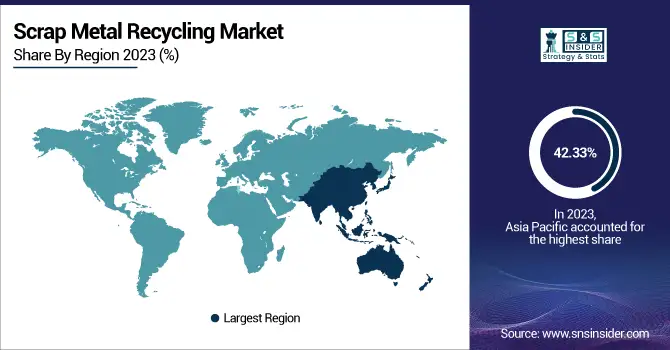

Asia Pacific dominated the scrap metal recycling market in 2023 with a revenue share of more than 42.33% and is expected to continue its dominance over the forecast period. One of the key drivers of this growth is Japan's robust recycling infrastructure and technological advancements in the recycling process. Japan boasts one of the highest recycling rates globally, with about 90% of metals being recycled, due to efficient collection and processing systems. The country's emphasis on sustainability is reflected in initiatives such as the Sound Material-Cycle Society law, which promotes the effective use of resources and mandates recycling across various sectors, further bolstering the market.

Need any customization research on Scrap Metal Recycling Market- Enquiry Now

In addition to Japan, India is also making significant strides in the scrap metal recycling market. The Indian government has introduced policies aimed at increasing recycling rates, such as the Plastic Waste Management Rules, which indirectly promote metal recycling by encouraging the recovery of materials from waste streams. With urbanization on the rise, the demand for construction and manufacturing materials will continue to surge, enhancing the need for recycled metals. Furthermore, there is a growing consumer awareness of sustainability, with more than 65% of Indian consumers expressing a preference for products made from recycled materials. This combination of strong regulatory frameworks, rising urban demand, and increasing consumer awareness positions the Asia-Pacific region as a leader in the scrap metal recycling market.

Recent Development

-

In September 2024, Aurubis AG entered into a development agreement with Australian battery materials and technology company Talga Group Ltd to create a recycled graphite anode product derived from lithium-ion batteries.

-

In March 2023, Sims Metal, a global leader in metal recycling, announced its acquisition of the commercial and operational assets of Northeast Metal Traders (NEMT), a Pennsylvania-based wholesaler and broker of non-ferrous scrap metal.

-

In February 2023, recycling pioneer Kuusakoski announced a €25 million investment in a new production line being constructed at its recycling plant in Heinola, Finland, to meet rising demand.

-

In December 2022, ArcelorMittal revealed that it had signed an agreement to acquire the Polish scrap metal recycling firm, Zakład Przerobu Złomu (“Złomex”).

Key Players

-

COHEN

-

Aurubis AG

-

Kuusakoski Group Oy

-

The David J. Joseph Company

-

European Metal Recycling (EMR)

-

Nucor Corporation

-

Sims Limited

-

OmniSource, LLC

-

Metallon Recycling Pte Ltd.

-

Radius Recycling, Inc.

-

Tata Steel Limited

-

SA Recycling LLC

-

Commercial Metals Company (CMC)

-

TKC Metal Recycling Inc.

-

Dowa Holdings Co., Ltd.

-

Hindalco

-

Upstate Shredding – Weitsman Recycling

-

Harsco

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 523.5 Billion |

| Market Size by 2032 | USD 856.2 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Metal Type (Ferrous, Non-Ferrous) •By End-use Industry (Automotive, Shipbuilding, Construction, Mining, Energy & Power, Railway & Transportation, Aerospace & Defense, Oil & Gas, Heavy Equipment Industry, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, COHEN, Aurubis AG, Kuusakoski Group Oy, The David J. Joseph Company, European Metal Recycling (EMR), Nucor Corporation, AIM Recycling, Sims Limited, OmniSource, LLC, Metallon Recycling Pte Ltd., Radius Recycling, Inc., Tata Steel Limited, SA Recycling LLC, Commercial Metals Company (CMC), TKC Metal Recycling Inc., Dowa Holdings Co., Ltd., Hindalco, Upstate Shredding – Weitsman Recycling, Harsco, and Others. |

| Key Drivers | •Rising Demand for Recycled Metals in Automotive and Construction Industries |

| Restraints | •Lack of Recycling Infrastructure in Developing Regions •Volatility in Raw Material Prices |