Power Tools Market Report Scope & Overview:

To get more information on Power Tools Market - Request Free Sample Report

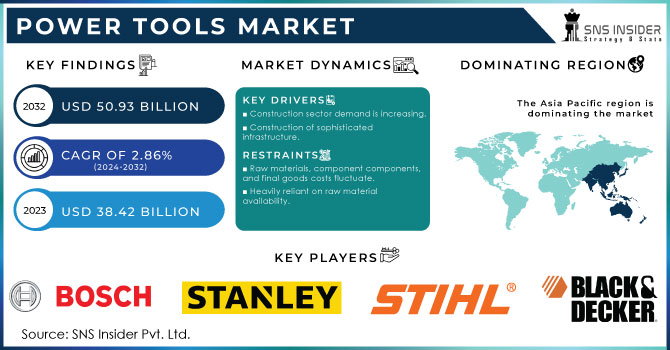

The Power Tools Market size was valued at USD 38.42 Billion in 2023 and is expected to reach USD 50.93 Billion by 2032 and grow at a CAGR of 2.86 % over the forecast period 2024-2032.

Apparatuses that are actuated utilizing a power source separated from physical work are named power tools. They are utilized in various applications, for example, creation and mechanical production systems, upkeep and fix, bundling, and DIY occupations. Straightforwardness and proficiency of activity, diminished time and work prerequisites, and simply convey ability are a portion of the noticeable elements driving the interest for power apparatuses across different ventures.

The worldwide power tools market is supposed to develop at a significant rate attributable to a flood in the prevalence of DIY strategies, interest in infrastructural advancements, and an ascent in extra cash for individuals. During a couple of years, India spent almost one-10th portion of its GDP on developmental exercises, which is expected to mount in the forthcoming years. Power tools have changed various enterprises, for example, auto, development, and others by saving the work and time important for basic assignments, for example, screw heading to convoluted errands including breaking and cutting.

MARKET DYNAMICS:

KEY DRIVERS:

-

Construction sector demand is increasing.

-

Construction of sophisticated infrastructure.

RESTRAINTS:

-

Raw materials, component components, and final goods costs fluctuate.

-

Heavily reliant on raw material availability.

CHALLENGES:

-

COVID-19 has had a significant influence on automotive firms and production centers.

OPPORTUNITY:

-

Leading tool companies are concentrating on developing smart and linked power tools.

-

Smart linked systems adoption in assembly line operations.

IMPACT OF COVID-19:

Coronavirus has caused a few interruptions in the worldwide business sectors. The component of the market is developing quickly. Globally business fields are learning because of the financial emergency. Likewise, the worldwide market is confronting a lot of difficulties. The auto business is experiencing weighty mischance in the pandemic.

The car area is the key end-clients of the power instruments market. The declining request rate in the car market is seriously influencing the market. From North America to the Asia Pacific locales are seeing an ensuing decrease popular. The dialing back of vehicle creation is dialing back the development of the market. Be that as it may, these unfavorable impacts are impermanent. The worldwide Market Trends will change emphatically post Coronavirus.

MARKET ESTIMATION:

The worldwide power tools market is fragmented based on method of activity, apparatus type, application, and district. By method of activity, it is separated into electric (corded and cordless electric power apparatuses), pneumatic, and others. The electric power tools fragment rules the market all through the review period. Based on apparatus type, the worldwide market is classified into drills, torques, material evacuation devices, saws, and others. The drills portion is supposed to rule the market during the estimated time frame. By application, the worldwide market is bifurcated into modern (development, car, aviation, and others) and DIY (Do it yourself).

KEY MARKET SEGMENTATION

By Tool Type

-

Drilling and Fastening Tools

-

Drills

-

Impact Drivers

-

Impact Wrenches

-

Screwdrivers and Nutrunners

-

-

Demolition Tools

-

Demolition Hammers

-

-

Sawing and Cutting Tools

-

Jigsaw

-

Reciprocating Saws

-

Circular Saws

-

Band Saws

-

Shears and Nibblers

-

-

Material Removal Tools

-

Sanders/Polishers/Buffers

-

Air Scalers

-

Grinders

-

Angle Grinders

-

Die and Straight Grinders

-

-

-

Routing Tools

-

Routers/Planers/Joiners

-

-

Others

By Mode of Operations

-

Electric

-

Corded Tools

-

Cordless Tools

-

-

Pneumatic

-

Hydraulic

By Application

-

Industrial/Professional

-

Construction

-

Automotive

-

Aerospace

-

Energy

-

Shipbuilding

-

Others

-

-

Residential/DIY

REGIONAL ANALYSIS:

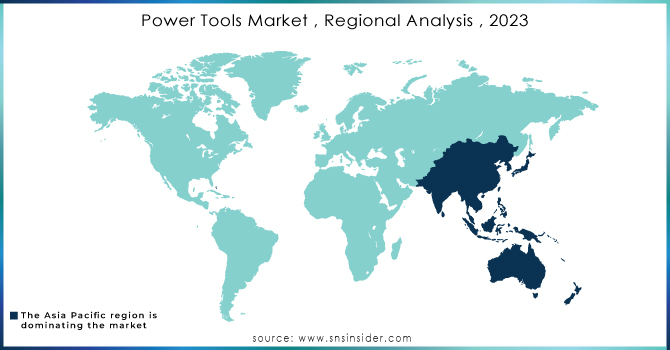

The power tools market is broadened into Asia Pacific, Europe, the middles east, and North America. Further, the Asia Pacific holds the biggest Market Share. This district will grow out of other provincial players in the gauge time frame. The interest in power tools is enormous because of industrialization, development, and improvement factors. The Chinese market is seeing high income. It is one of the best business sectors on the planet.

Further, India is seeing a wide scope of valuable learning experiences. The Middle East market is the following biggest market. The interest in power tools will arrive at a pinnacle sum in the estimated time frame. The necessity for power tools in the oil and gas area is huge. It is persistent fueling the interest around here. Europe and North America get a huge interest in power tools. The power tools are appropriate for complex undertakings in power enterprises. Besides, these two areas are expanding their portfolios in the estimated time frame.

Need any customization research on Power Tools Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

US

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

-

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

-

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Asia Pacific

-

-

China

-

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

-

KEY PLAYERS

The key players in the market are Robert borsch Gmbh, ANDREAS STIHL AG &co, Stanley, Black & Decker. Inc, Hilti Corporation, Enerpac Tool Group, Atlas Copco ltd, Snap-on Incorporated., Apex Tool Group, LLC, Ingersoll Rand, Makita Corporation, and Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 38.42 Billion |

| Market Size by 2032 | US$ 50.93 Billion |

| CAGR | CAGR of 2.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Tool Type (Drilling and Fastening Tools, Demolition Tools, Sawing and Cutting Tools, Material Removal Tools, Routing Tools, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert borsch Gmbh, ANDREAS STIHL AG &co, Stanley, Black & Decker. Inc, Hilti Corporation, Enerpac Tool Group, Atlas Copco ltd, Snap-on Incorporated., Apex Tool Group, LLC, Ingersoll Rand, Makita Corporation, |

| Key Drivers | •Construction sector demand is increasing. •Construction of sophisticated infrastructure. |

| RESTRAINTS | •Raw materials, component components, and final goods costs fluctuate. •Heavily reliant on raw material availability. |