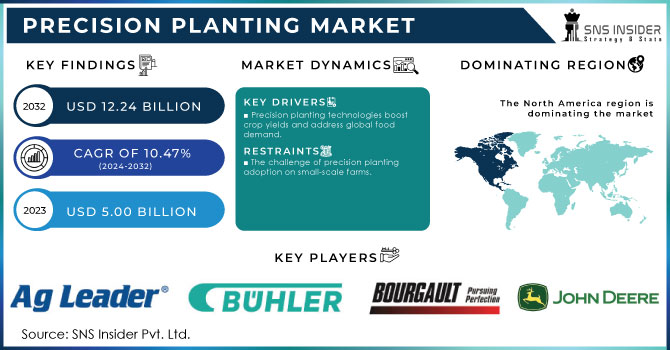

Precision Planting Market Size & Overview:

Get more information on Precision Planting Market - Request Sample Report

The Precision Planting Market Size was valued at USD 5.00 Billion in 2023. It is estimated to reach USD 12.24 Billion by 2032, growing at a CAGR of 10.47% during 2024-2032.

The precision planting market is gaining importance in the agricultural technology sector, providing innovative solutions to improve farming practices for increased productivity and resource conservation. The rising need for food production worldwide is a key factor driving the growth of the precision planting market. The USDA's Economic Research Service predicts that the total value of food production will hit around USD 510 billion. This indicates a rise in growth caused by improvements in technology, greater use of sustainable methods, and a growing emphasis on food security. Major crops such as corn and soybeans remain prevalent, with an expected production of around 15 billion bushels of corn and approximately 4.5 billion bushels of soybeans in the U.S. Precision planting technology allows farmers to plant seeds with accuracy in terms of depth, spacing, and timing, which leads to ideal growing conditions and less wastage. With the utilization of up-to-the-minute data, precision planting systems can adjust to varying conditions, providing resistance to environmental obstacles.

Advances in data analytics and automation have also contributed to the increased adoption of precision planting technologies. Advanced precision planting machinery is combined with advanced software that gathers and examines field information, providing farmers with an in-depth understanding of their soil makeup, moisture content, and other environmental elements. For example, John Deere, a top player in agricultural machinery, has incorporated advanced farming technologies into its range of products, advancing the use of data-driven solutions to assist farmers in improving their planting techniques. The John Deere Operations Center permits farmers to gather and assess data from their equipment and fields, giving them information on planting habits, ground quality, and crop productivity, leading to better decision-making. This approach based on data enables better decision-making by minimizing the uncertainty commonly found in traditional planting techniques. Farmers can change the planting density according to soil fertility, guaranteeing optimal conditions for each seed to grow successfully. Furthermore, precision planting systems frequently include functions such as variable rate planting, allowing for the automatic adjustment of seed distribution according to current data, enhancing crop performance even more.

Precision Planting Market Dynamics

Drivers

-

Precision planting technologies boost crop yields and address global food demand.

The rise in population is leading to a greater need for food, which is motivating farmers and agricultural sectors to utilize more efficient farming techniques. Precision planting focuses on improving crop yields by ensuring seeds are placed optimally for improved growth and increased productivity. Precision planting technologies allow farmers to control seeding depth, spacing, and rate with exceptional accuracy, minimizing waste and optimizing plant growth capacity. Farmers can customize planting techniques based on various types of crops and soil conditions, resulting in higher crop yields. This is important as the amount of arable land decreases. The demand to increase food production on limited land drives the precision planting market, which addresses this by utilizing data-driven choices. Furthermore, precision planting diminishes the reliance on manual labor through the utilization of automated machinery that carries out planting tasks more accurately. This effectiveness results in improved use of resources such as water, fertilizers, and pesticides, which are utilized more efficiently through precise seed positioning. The increasing recognition of sustainable farming is also driving the need for precision planting technologies, which aid in decreasing environmental impact while fulfilling worldwide food requirements.

-

Revolutionizing agriculture through precision planting technologies and advanced analytics.

The growth of technology, such as satellite imagery, GPS guidance, drones, and IoT-based sensors, has transformed the agricultural sector. Precision planting systems use these technologies to track soil conditions, weather patterns, and crop health. One example is that sensors can monitor levels of moisture, pH, and temperature in the soil, allowing for immediate modifications to planting plans. Variable rate technology (VRT) is a progression that has become popular in the precise planting industry. Farmers can modify seeding rates depending on soil properties and crop needs. Drones and satellite images can also give information on variations within fields, allowing for accurate seeding to promote ideal plant development. These technologies diminish human mistakes and enable more effective agricultural activities. Furthermore, combining machine learning and AI in precision agriculture enables predictive analytics, granting farmers the capability to predict crop yields, disease outbreaks, and nutrient deficiencies. These advancements assist in enhancing decision-making regarding the timing and location of planting, leading to higher chances of attaining optimal crop yields and promoting the use of precision planting technologies.

Restraints

-

The challenge of precision planting adoption on small-scale farms.

Small-scale farms often still predominate agricultural land use in large parts of the world. This also fits precision planting technologies, which are typically built for larger farm operations that can afford them due to economies of scale. Small farms may not have the money or proper land availability to merit spending on a planter. Small farms also often struggle to secure the funds to purchase expensive precision planting technologies. But this leads to a split between very large, industrial-scale farms that can justify moving towards the sort of precision agriculture offered here whilst smallholders cannot. This differentiation restricts the universal implementation of precision planting systems in some areas.

Precision Planting Market Segmentation Analysis

by Offering

The hardware sector led the market in 2023 with a 45% market share, as physical tools and equipment play a crucial part in precision agriculture. Included in this list are sensors, GPS receivers, planters, and variable-rate technology, which enable farmers to enhance seed placement, depth, and spacing. This results in higher crop production and better use of resources. Hardware solutions play a crucial role in updating old-fashioned farming techniques, making them vital in the agricultural sector. For instance, John Deere provides cutting-edge planting solutions such as ExactEmerge, which improves seed placement precision and velocity.

The software sector is growing at a rapid CAGR during 2024-2032, due to the rise in data-driven agriculture practices. Precision planting technology enables farmers to assess field data, supervise planting activities instantly, and make educated choices for the best planting outcomes. These programs combine information from various sources to improve the accuracy of planting tasks. For instance, The Climate Corporation's Climate FieldView provides a complete set of tools for managing data, allowing for more informed real-time decision-making using data collected from fields. The movement towards intelligent agriculture is driving this increase.

by Drive Type

Electric Drive systems dominated the market in 2023 with over 56% market share because of their efficiency, precision, and compatibility with cutting-edge technology. Electric drives allow farmers to enhance yields and decrease waste by giving them precise control over planting depth, spacing, and seed rate. Electric drives that incorporate GPS and variable-rate technology (VRT) are in high demand for use in smart farming solutions. Deere & Company's ExactEmerge planters utilize electric drives for precise seed placement at fast speeds, resulting in better control and higher productivity.

Hydraulic drive systems are very dependable and expected to grow very fast during 2024-2032, they are not as quickly adopted as electric drives. They provide strong power transfer and are appropriate for larger machinery. Hydraulic drives are preferred in situations where precise speed regulation is not crucial, but high torque and power are necessary. These systems are frequently found in bigger farming operations, where the emphasis is on durability and heavy-duty performance. Case IH includes hydraulic drive systems in their planters, ensuring dependable performance in challenging terrains where continuous power supply is crucial.

by Farm Size

The "Below 400 ha" category held a major market share above 55% in 2023, which is prevalent in various regions like Europe and Asia. Farmers in this group usually aim to maximize yield while dealing with limited resources, leading to a demand for precision planting technologies that improve efficiency. Businesses such as Trimble Agriculture provide precision planting technology such as Field-IQ, enabling farmers to manage seed populations and planting depth on small agricultural properties.

The "Above 400 ha" category is accounted to experience a rapid growth rate during 2024-2032 and refers to extensive farming activities, commonly found in areas such as North America, South America, and certain parts of Australia. This sector is quickly expanding because of the growth of big farms and their ability to make substantial investments in technology. AGCO Corporation offers advanced planting solutions like the White Planters Series, which come with intelligent sensors and data analysis tools tailored for larger agricultural operations.

Precision Planting Market Regional Outlook

North America held a market share of 37% in 2023 and dominated the market, driven by advanced agricultural practices, high adoption of technology, and significant investments in research and development. The region benefits from a robust agricultural infrastructure and a large number of established agricultural equipment manufacturers. Companies like John Deere and AG Leader Technology are at the forefront, offering innovative precision planting solutions that enhance productivity and efficiency. Additionally, the increasing focus on sustainable farming practices and precision agriculture techniques has further propelled market growth.

The Asia-Pacific region is witnessing a rapid growth rate during 2024-2032 in the precision planting market, fueled by rising population demands, urbanization, and the need for increased agricultural productivity. Countries like China and India are adopting advanced farming techniques to enhance yield and efficiency, driven by government initiatives and subsidies for precision agriculture technologies. Companies such as Trimble and Raven Industries are actively expanding their operations in the region, providing innovative solutions tailored to local farming conditions.

Need any customization research on Precision Planting Market - Enquiry Now

Key Players

The key players in the Precision Planting market are:

-

AG Leader Technology (InCommand Displays, SureForce™)

-

Bourgault Industries Ltd. (Bourgault Air Seeder, Bourgault Paralink™)

-

Buhler Industries Inc. (Versatile RT490 Combine, Farm King Allied 6610 Snowblower)

-

CNH Industrial N.V. (Case IH 2000 Series Early Riser® Planter, New Holland SP.400F Guardian™ Sprayer)

-

Davimac Group (Davimac Chaser Bins, Davimac MK5 Air Seeder)

-

Deere & Company (John Deere ExactEmerge™ Planter, John Deere S700 Combine)

-

Dendra Systems (Dendra Planting Drone, Dendra Ecosystem Restoration Drone)

-

Dickey-John Corporation (GAC® 2500-UGMA Grain Analysis Computer, Mini GAC® 2500)

-

Droneseed (Droneseed Drone-Based Reforestation, Droneseed Drone Spraying System)

-

Hexagon Agriculture (HxGN AgrOn Seed Monitor, HxGN AgrOn Planter Monitor)

-

Kasco Manufacturing Inc. (Kasco Herd Seeder/Spreaders, Kasco Plotters Choice® Seeders)

-

Kinze Manufacturing Inc. (Kinze 4900 Multi-Hybrid Planter, Kinze Mach Till™ Disc)

-

Kuhn Group (Kuhn Axis® Fertilizer Spreader, Kuhn Vari-Master Plow)

-

Kubota Corporation (Kubota BV4160 Econo Variable Chamber Round Baler, Kubota M7 Tractor)

-

Kverneland Group (Kverneland iXtrack T4 Sprayer, Kverneland Optima HD II Precision Seed Drill)

-

Lemken GmbH & Co. KG (Lemken Solitair Seed Drill, Lemken Rubin Compact Disc Harrow)

-

Mahindra Agribusiness (Mahindra eMax Series Tractor, Mahindra Agribusiness Crop Care Solutions)

-

Salford Group (Salford BBI MagnaSpread2 Fertilizer Spreader, Salford AerWay® 2B Series Aerator)

-

Trimble Inc. (Trimble GFX-750 Display, Trimble Field-IQ™ Crop Input Control System)

-

Valmont Industries (Valmont Irrigation, Valley Precision Planting Equipment)

Recent Development

-

January 2024: Precision Planting Winter Conference 2024: Precision Planting debuted the CornerStone Planting System. The SpeedTube is a factory-built system that works with planter bars, which makes it adaptable to fit the needs of farmers. Mechanical and electrical hardware both improve its performance as well as make it easy to upgrade. After shaving another seven years off, it should go on sale to the public in 2025 after field tests.

-

January 2024: The Panorama system (introduced in 2023, a way to provide farmers with ready access to agronomic data via the Gen3 20|20 platform) available for sale. This allows users to combine data from John Deere Operations Center and Climate FieldView for a more complete view of the farm.

-

November 2023: Precision Planting announced the opening of a new 510,000-square-foot manufacturing facility in Morton, Illinois. The new plant leverages advanced machinery, including the AutoStore robotic parts management system that enhances productivity in production and logistics. The facility will be a major base for manufacturing and shipping Precision Planting products worldwide.

-

January 2024: A new, larger, 16-inch option was added to the popular 20|20 display, providing farmers with improved visualization within the cab. This improvement increases the count of available widget locations x2 and is primarily focused on secondary display configurations that make working with data more approachable.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.00 Billion |

| Market Size by 2032 | USD 12.24 Billion |

| CAGR | CAGR of 10.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By System Type (High-Speed Precision Planting Systems, Precision Air Seeders, Drones) • By Drive Type (Electric Drive, Hydraulic Drive) • By Farm Size (Below 400 ha, Above 400 ha) • By Application (Row Crops, Cereals, Oilseeds & Pulses, Forestry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AG Leader Technology, Bourgault Industries Ltd., Buhler Industries Inc., CNH Industrial N.V., Davimac Group, Deere & Company, Dendra Systems, Dickey-John Corporation, Droneseed, Hexagon Agriculture, Kasco Manufacturing Inc., Kinze Manufacturing Inc., Kuhn Group, Kubota Corporation, Kverneland Group, Lemken GmbH & Co. KG, Mahindra Agribusiness, Salford Group, Trimble Inc., Valmont Industries |

| Key Drivers | • Precision planting technologies boost crop yields and address global food demand. • Revolutionizing agriculture through precision planting technologies and advanced analytics. |

| RESTRAINTS | • The challenge of precision planting adoption on small-scale farms. |