Prefilled Syringes Market Overview:

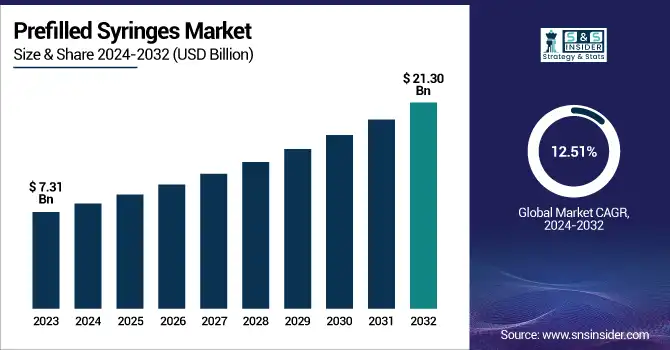

The Prefilled Syringes Market was valued at USD 7.31 billion in 2023 and is projected to reach USD 21.30 billion by 2032, growing at a CAGR of 12.51% from 2024 to 2032.

The Prefilled Syringes Market report provides distinctive insights through an analysis of the prevalence and incidence of injectable drug-dependent diseases, identifying the major therapeutic areas in which prefilled syringes are used to a great extent. It also analyzes prescription trends by region, demonstrating differences in adoption among healthcare systems. The report also provides a thorough evaluation of production and consumption volume, providing a comparative analysis of regional supply and demand. Moreover, it displays healthcare expenditure on injectable treatments, dividing investments into government, commercial, private, and out-of-pocket spending. Such information enables stakeholders to comprehend market usage trends, regional demand changes, and the fiscal environment driving the market.

To Get more information on Prefilled Syringes Market - Request Free Sample Report

Prefilled Syringes Market Dynamics

Prefilled Syringes Market Drivers

-

The increasing demand for biologics and biosimilars is significantly driving the growth of the prefilled syringes market.

The growing need for biologics and biosimilars is strongly fueling the growth of the prefilled syringes market. Biologic medications, necessitating accurate and contamination-free administration, are the choice of treatment for long-term disorders such as rheumatoid arthritis, diabetes, and cancer. Prefilled syringes provide increased convenience to the patient, less dosing error risk, and improved drug stability over conventional vials. More than 60% of biologics are currently delivered through prefilled syringes, according to industry reports. Recent innovations, including BD's introduction of the Neopak XtraFlow Glass Prefillable Syringe in September 2024 to accommodate high-viscosity biologic formulations, indicate the increasing market demand. Regulatory approvals for new biosimilars in 2023 have also driven demand for delivery systems based on prefilled syringes, further driving market growth.

-

The shift toward self-administration and home-based healthcare is another key driver boosting the prefilled syringes market.

The transition to self-administration and home healthcare is another prime force driving the prefilled syringes market. Chronic disease patients are increasingly opting for self-injectable devices that minimize the need for healthcare centers. Prefilled syringes are easy to use, have a lower risk of contamination, and enhance dose accuracy, making them the best option for home treatments. In 2023, about 70% of injectable medications for autoimmune diseases and diabetes were given through prefilled syringes. Firms are working proactively to make safety and usability better, as exemplified by Gerresheimer's introduction of silicone oil-free prefilled syringes for ophthalmic use at CPHI Worldwide 2024. In addition, the growing aging population and increasing telehealth services further underpin the widespread use of prefilled syringes, affirming their position in contemporary drug delivery solutions.

Restraint

-

High Manufacturing and Regulatory Compliance Costs are preventing the market from growing.

Prefilled syringes need sophisticated production units, accurate filling systems, and stringent quality checks to provide sterility, dose precision, and biocompatibility of materials. The raw material cost, especially for medical-grade glass and more sophisticated polymer equivalents, has skyrocketed, thus raising the cost of production even more. Moreover, stringent regulatory clearances from bodies like the FDA, EMA, and PMDA require strict standards of testing drug stability, extractables, and leachables, extending product development cycles. In 2023, multiple manufacturers experienced delays owing to changing compliance requirements, especially for the compatibility of biologic drugs. These prohibitive costs and regulatory hurdles present market entry obstacles for smaller firms and restrict affordability in price-conscious areas, slowing total market growth even as demand increases.

Opportunities in the Prefilled Syringes Market

-

Advancements in prefilled syringe materials and technologies are creating opportunities for the market.

The ongoing technology advancements in drug delivery and syringe materials are a major opportunity for the prefilled syringes market. Although conventional glass syringes are common, they have drawbacks like fragility and incompatibility with sensitive biologics. The move towards superior polymer-based syringes, including cyclic olefin polymers (COP), has advantages such as enhanced ruggedness, lower contamination risk, and improved biologic drug compatibility. Further, advancements in safety mechanisms for needles, autoinjectors, and dual-chamber syringes are boosting patient convenience and safety. The Adoption of smart technologies like connected prefilled syringes with digital trackability is also on the rise. Such trends are a testament to the pharma sector's requirement of increased drug stability, extended shelf life, and increased patient compliance, which are stimulating the usage of next-generation prefilled syringe solutions for several therapeutic areas.

Challenges

-

One of the key challenges in the prefilled syringes market is the risk of glass breakage and material compatibility issues, particularly for biologic drugs.

Conventional glass syringes, though commonplace, are easily breakable with high pressure, which can interfere with drug safety and handling. Moreover, biologics and high-viscosity drugs can adhere to siliconized glass surfaces, causing stability problems. In response, producers are moving to more advanced polymer syringes, including cyclic olefin polymer (COP) and cyclic olefin copolymer (COC), that provide improved durability and less interaction risk. But the change to new materials involves extensive regulatory approval and clinical testing, further increasing development expenses and approval periods. Maintaining compatibility between prefilled syringes and many sensitive drugs continues to be a major technical and regulatory hurdle for producers.

Prefilled Syringes Market Segmentation Analysis

By Type

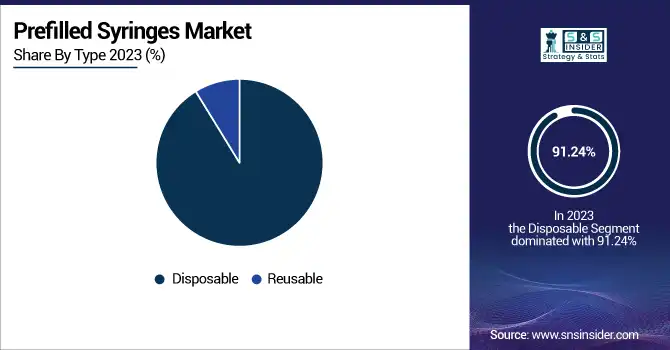

The disposable segment dominated the prefilled syringes market with a 91.24% market share in 2023 because it is very commonly used in hospitals, clinics, and home health due to safety, convenience, and infection control factors. The disposable prefilled syringes remove the possibility of cross-contamination and needle-stick injuries and are, therefore, the most suitable for single-use purposes like vaccination, biologic drug therapy, and emergency care. Besides, the increasing burden of chronic illnesses such as rheumatoid arthritis and diabetes has driven the usage of self-administered injectable medications, further enhancing disposable prefilled syringe adoption. Regulatory agencies like the U.S. FDA and European Medicines Agency (EMA) emphasize robust safety and sterility requirements, encouraging the usage of single-dose syringes. With expanding immunization programs and rising biologics uptake, the leadership of the disposable segment is likely to continue.

By Design

The single-chamber prefilled syringes segment dominated the prefilled syringes market with a 42.12% market share in 2023, owing to their simplicity, extensive clinical application, and affordability. They consist of a single-chamber syringe with a fixed dose of medicine that is enclosed in a single compartment. They are best suited for mass immunization programs, emergency drug use, and day-to-day chronic disease treatments like insulin and anticoagulants. Their simple design reduces dosing mistakes, minimizes the risk of contamination, and promotes patient safety—key considerations for both hospital and home health care. Pharmaceutical companies also prefer single-chamber designs because they are simpler to manufacture in large volumes, involve fewer sophisticated manufacturing processes, and are usable with a wide array of drug formulations. While healthcare systems prioritize efficiency, patient adherence, and decreased healthcare-associated infections, single-chamber syringes continue to be the system of choice worldwide.

By Material

The glass segment dominated the prefilled syringes market with a 51.06% market share in 2023 because of its better compatibility with a broad spectrum of injectable drugs, such as biologics, vaccines, and anticoagulants. Glass syringes have perfect chemical resistance, providing drug stability and discouraging interactions that might undermine the efficacy of delicate drugs. Furthermore, glass syringes have less permeability than plastic syringes, which minimizes oxygen and moisture contamination risks. Major pharmaceutical corporations still prefer prefilled glass syringes because of their long history of regulatory approval and tested record in keeping drugs pure. The great demand for high-quality biologic drugs, which demand accurate and stable storage conditions, has further boosted the use of glass prefilled syringes, making them the undisputed market leaders.

By Application

The vaccines and immunizations segment dominated the prefilled syringes market with a 25.29% market share in 2023 because of the growing global vaccination programs and the growing use of prefilled syringes for mass immunization campaigns. The COVID-19 pandemic accelerated the need for effective, ready-to-use vaccine delivery systems, and thus, it was used extensively by healthcare providers and governments. Prefilled syringes provide benefits like decreased dosage errors, better safety, and less chance of contamination, hence the vaccine administrators' choice of administration. Besides, big pharmaceutical firms and healthcare organizations, like the WHO and CDC, have been encouraging prefilled syringes for vaccination efficiency enhancement, further supporting the segment's market leadership. Increased routine immunization programs and booster dose campaigns also helped propel the segment's leadership in 2023.

The oncology segment is experiencing the fastest growth in the prefilled syringes market, owing to the surging incidence of cancer and increased need for biologic and biosimilar treatments. Injectable cancer therapy, including targeted therapies and monoclonal antibodies, frequently entails accurate dosing and safe administration, and as such, is well-suited to prefilled syringes. The trend towards self-administration of oncology drugs, especially in home care environments, is also fueling market growth. Furthermore, the development of syringe technology, such as dual-chamber and safety-featured prefilled syringes, is enhancing drug stability and patient compliance. As pharmaceutical companies are investing considerably in new cancer treatments and personalized medicine, demand for prefilled syringes in oncology is anticipated to increase substantially during the forecast period.

By Distribution Channel

The hospital segment dominated the prefilled syringes market with a 50.26% market share in 2023 because of the large amount of injectable drug administration being undertaken within hospital premises. Hospitals are major healthcare centers for critical treatments such as vaccinations, emergency treatment, and chronic disease care, all of which use prefilled syringes repeatedly for safe and effective drug administration. The increasing incidence of chronic conditions, like diabetes and cancer, has compounded the demand for injectable drugs, further supporting hospital demand for prefilled syringes. Hospitals also place high value on infection control and patient safety, and thus, prefilled syringes are a desirable option with single-use, less risk of contamination, and precise dosing. The inclusion of biologics and biosimilars within hospital treatment protocols has also enabled the segment to dominate, solidifying its leadership within the 2023 market.

Prefilled Syringes Market Regional Insights

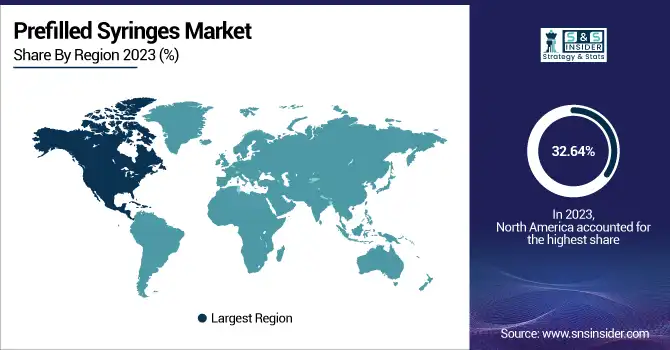

North America dominated the prefilled syringes market with a 32.64% market share in 2023 based on its robust healthcare infrastructure, advanced drug delivery system adoption rate, and high incidence of chronic diseases necessitating injectable therapy. The region also has strong representation from top players like BD (Becton, Dickinson, and Company), Gerresheimer, and West Pharmaceutical Services, which are continually investing in R&D and product development. Moreover, strict regulatory standards established by the U.S. FDA assure high product standards and safety, further propelling market development. Increased demand for biologics and biosimilars, especially for autoimmune diseases, diabetes, and oncology, has necessitated efficient and comfortable drug delivery solutions. Additionally, the increasing practice of home-based healthcare and self-injection, facilitated by beneficial reimbursement trends and healthcare expenditure, underlines North America's market dominance.

Asia Pacific is the fastest-growing region in the prefilled syringes market, with 13.66% CAGR throughout the forecast period as a result of the booming pharmaceutical and biotechnology industries, rising healthcare spending, and escalating chronic disease burden. The demand for biosimilars and biologic drugs is on the rise in countries such as China, India, and Japan, fueling the demand for prefilled syringes as the drug delivery method of choice. Besides, governmental efforts to enhance immunization programs and the availability of sophisticated healthcare solutions are fueling market expansion. The region further has the advantage of inexpensive manufacturing bases, creating an inducement for international players to increase manufacturing units. Rising consciousness regarding the benefits of prefilled syringes, including decreased risk of contamination and accurate dosing, is further driving adoption. With patient-centric healthcare models gaining popularity, the need for novel and convenient drug delivery systems keeps growing in the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Prefilled Syringes Market

-

Becton, Dickinson and Company (BD) (BD PosiFlush Prefilled Saline Syringe, BD Hypak for Biotech)

-

Gerresheimer AG (Gx RTF Glass Prefillable Syringes, Gx RTF ClearJect Polymer Syringes)

-

SCHOTT AG (SCHOTT TopPac Polymer Syringes, SCHOTT syriQ Glass Syringes)

-

West Pharmaceutical Services, Inc. (West Ready-to-Use Prefilled Syringes, NovaPure Plungers)

-

Terumo Corporation (PLAJEX Prefilled Syringes, K-Pack Surshield)

-

Nipro Corporation (ClearJect Prefilled Syringes, TrueTear Prefilled Syringes)

-

Owen Mumford Ltd. (UniSafe Prefilled Syringe Safety System, Autoject Micro)

-

Stevanato Group (SG EZ-fill Glass Syringes, SG Nexa Polymer Syringes)

-

Vetter Pharma International GmbH (Vetter-Ject Prefilled Syringes, V-LK Prefilled Syringes)

-

Medtronic plc (MiniMed Mio Advance Infusion Set, InPen Prefilled Syringe)

-

Sanofi S.A. (Lantus SoloStar Prefilled Pen, Toujeo Max SoloStar)

-

Pfizer Inc. (Trazimera Prefilled Syringe, Fragmin Prefilled Syringe)

-

Amgen Inc. (Repatha SureClick Autoinjector, Enbrel Prefilled Syringe)

-

Eli Lilly and Company (Trulicity Prefilled Pen, Basaglar KwikPen)

-

Novo Nordisk A/S (NovoLog FlexPen, Ozempic Prefilled Pen)

-

AstraZeneca plc (Bydureon BCise Prefilled Pen, Fluenz Tetra Prefilled Syringe)

-

Boehringer Ingelheim GmbH (Pradaxa Prefilled Syringe, Spiriva Respimat)

-

GlaxoSmithKline plc (Benlysta Prefilled Syringe, Nucala Autoinjector)

-

Merck & Co., Inc. (Keytruda Prefilled Syringe, Recarbrio Prefilled Syringe)

-

Johnson & Johnson (Invega Sustenna Prefilled Syringe, Risperdal Consta Prefilled Syringe)

Suppliers (These suppliers provide critical components such as glass and polymer barrels, elastomeric plungers, coatings, and drug delivery technologies essential for prefilled syringe manufacturing.) in Prefilled Syringes Market.

-

SCHOTT AG

-

Gerresheimer AG

-

Stevanato Group

-

West Pharmaceutical Services, Inc.

-

BD Medical – Pharmaceutical Systems

-

Nipro Corporation

-

Terumo Corporation

-

AptarGroup, Inc.

-

Catalent, Inc.

-

SiO2 Materials Science

Recent Developments in the Prefilled Syringes Industry

-

September 2024 – BD (Becton, Dickinson, and Company), a medical technology leader, has introduced the commercial availability of the BD Neopak XtraFlow Glass Prefillable Syringe. The company has also broadened the BD Neopak Glass Prefillable Syringe platform to address the growing demand for biologic therapies.

-

January 2025 – BD (Becton, Dickinson and Company) will unveil a comprehensive portfolio of cutting-edge drug delivery solutions at Pharmapack, Europe's leading drug delivery event, on January 22–23, 2025, at Paris Expo, Porte de Versailles, Paris.

-

September 2024 – Gerresheimer will unveil its silicone oil-free prefillable syringe systems for ophthalmic use at CPHI Worldwide 2024.

Prefilled Syringes Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 7.31 billion Market Size by 2032 US$ 21.30 billion CAGR CAGR of 12.51% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type (Disposable, Reusable)

• By Design (Single-chamber Prefilled Syringes, Dual-chamber Prefilled Syringes, Customized Prefilled Syringes)

• By Material (Glass, Plastic)

• By Application (Vaccines and Immunizations, Anaphylaxis, Rheumatoid Arthritis, Diabetes, Autoimmune Diseases, Oncology, Others)

• By Distribution Channel (Hospitals, Mail Order Pharmacies, Ambulatory Surgery Centers)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Becton, Dickinson and Company (BD), Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., Terumo Corporation, Nipro Corporation, Owen Mumford Ltd., Stevanato Group, Vetter Pharma International GmbH, Medtronic plc, Sanofi S.A., Pfizer Inc., Amgen Inc., Eli Lilly and Company, Novo Nordisk A/S, AstraZeneca plc, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Merck & Co., Inc., Johnson & Johnson, and other players.