Pregnancy Pillow Market Size & Overview:

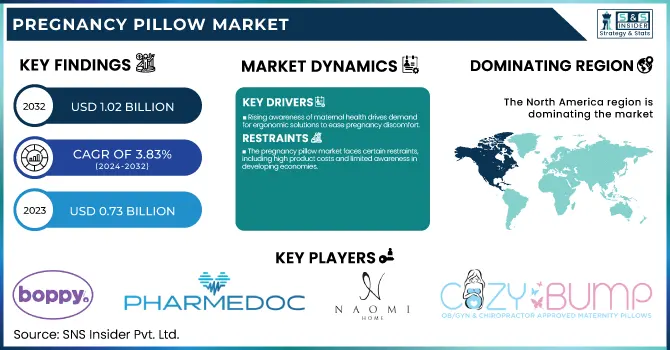

The Pregnancy Pillow Market was estimated at USD 0.73 billion and is poised to reach at USD 1.02 billion by 2032 anticipated to expand at a CAGR of 3.83% for the forecast period of 2024-2032.

To Get More Information on Pregnancy Pillow Market - Request Sample Report

This report identifies price trends and consumer spending patterns, presenting how affordability and high-end product desires drive purchases. The research analyzes healthcare and insurance expenditures on pregnancy-related products, illustrating the contribution of subsidy provision to market growth. It also investigates consumer demographics and purchase behavior, highlighting first-time mothers' rising demand as well as lifestyle choices driving product choice. Sustainability and environmentally friendly trends are becoming more prominent, with an increasing demand for organic products and ethically sourced pregnancy pillows that continue to define the industry's growth.

Pregnancy Pillow Market Dynamics

Drivers

- The increasing awareness of maternal health and prenatal care, with expecting mothers seeking comfortable and ergonomic solutions to alleviate pregnancy-related discomfort.

The increasing prevalence of pregnancy-associated sleep disorders, such as insomnia and lower back pain, has driven the demand for specialized pregnancy pillows offering full-body support. Based on research, an estimated 78% of pregnant women suffer from sleep disturbances, which makes pregnancy pillows an indispensable product. The increasing awareness of self-care and wellness among pregnant women, accompanied by social media influence and medical endorsements, is also a strong driver of product adoption. Also, the growth of online shopping platforms has increased the availability of pregnancy pillows, with sales through the internet accounting for close to 60% of overall sales. Technological advancements in the form of memory foam filling, temperature-controlling materials, and organic hypoallergenic materials have also drawn buyers interested in high-end maternity products. Also, higher disposable incomes and shifting lifestyle choices have increased expenditure on maternity care products. The endorsement from gynecologists and maternity specialists, coupled with favorable consumer opinions, continues to support the growth of the market. With an increase in demand for high-quality, multi-purpose pregnancy pillows, the market is likely to experience ongoing product development and category expansion.

Restraints

- The pregnancy pillow market faces certain restraints, including high product costs and limited awareness in developing economies.

Pregnancy pillows are seen by many low-income consumers as a luxury they do not need, and they use the standard pillow. Premium pregnancy pillows with memory foam and natural content are expensive, ranging over USD 80, which reduces their availability for price-sensitive buyers. Additionally, limited information about the advantages of pregnancy pillows in less literate regions with fewer healthcare facilities limits market penetration. Product durability issues are another significant restraint since some of these pregnancy pillows shift their shape or lose firmness, which makes users dissatisfied. Another competitor is substituting products such as normal body pillows or homemade alternatives, which decrease the intensity to buy a specialized maternity pillow. Also hindering is slow take-up in some cultural environments, whose traditional ways of maternity care disapprove of using specialized products.

Opportunities

- The pregnancy pillow market presents numerous growth opportunities, particularly through technological innovations and product diversification.

Increased interest in multi-use maternity pillows, which convert into postpartum and nursing pillows, provides manufacturers with new opportunities. In addition, more interest in green and organic products represents a valuable potential, with 20–30% additional pay being willingly invested in sustainable, hypoallergenic, and non-toxic materials. The growth of e-commerce and direct-to-consumer (DTC) brands has provided a platform for global access, with online channels contributing to more than 60% of pregnancy pillow sales. Partnerships with healthcare providers, maternity hospitals, and influencers can further enhance market positioning. Another significant opportunity is the customization of pregnancy pillows, with brands creating adjustable, temperature-controlled, and smart pillows that monitor sleep patterns. Additionally, the rising trend of gift buying among pregnant women has made pregnancy pillows a sought-after maternity and baby shower gift product, driving seasonally higher sales. Expansion of health insurance and reimbursement policies in some areas might also drive more adoption. Those businesses that commit to focused marketing, educational initiatives, and price-friendly solutions will most likely profit from the growth in the maternity wellness market, capturing long-term growth.

Challenges

- One of the biggest challenges in the pregnancy pillow market is intense competition from unbranded and counterfeit products, which are often sold at lower prices but compromise on quality and durability.

The presence of inexpensive, poor-quality counterfeits on online stores impacts consumer confidence and results in brand dilution. Supply chain interruptions and increased raw material prices, especially for memory foam, organic cotton, and hypoallergenic materials, are also major challenges for manufacturers. Another key challenge is product differentiation, as the majority of pregnancy pillows have identical U-shape, C-shape, and wedge designs, which makes it challenging for brands to differentiate themselves in a competitive market. The bulkiness of pregnancy pillows also poses storage and logistics issues for distribution, particularly for retailers with limited warehouse capacity. In addition, the absence of standardization in product quality and certifications renders it challenging for consumers to select the best alternatives, hence evoking skepticism. The limited usage period of pregnancy pillows, usually 6-9 months, translates to low repeat business, and customer retention becomes a challenge. Resolution of these challenges through effective branding, innovation, and quality assurance will be key to long-term market sustainability and competitiveness.

Pregnancy Pillow Market Segmentation Insight

By Shape

The U-shaped pregnancy pillow dominated the market in 2023 with a market share of 45.0%. This was largely due to its better full-body support, which is especially suitable for pregnant women suffering from back pain, hip pain, and sleep disturbances. In contrast to regular pillows, U-shaped pillows support the head, belly, back, and legs at the same time, making them the go-to pillow for pregnant women who want ultimate comfort and alignment. The growing rate of pregnancy-associated sleep disorders and increasing consumer sensitivity to ergonomic alternatives helped drive this shape into popular usage. The fact that U-shaped pregnancy pillows are highly suggested by healthcare workers and maternity care specialists also promoted their popularity. The wedge pregnancy pillow was the fastest-growing segment over the forecast period, driven by its space-saving, lightweight design and reasonable price. In contrast to larger pregnancy pillows, the wedge provides focused support for particular areas like the belly, back, or knees and is thus a flexible and compact option for expectant women. Its growing use is largely because it is an affordable option, which makes it a favorite choice for price-conscious buyers. Its increased demand also comes as a result of the increasing demand for multi-purpose maternity items since wedge pillows can be utilized after pregnancy to support the lumbar area or used as nursing tools.

By Price

The USD 40 to USD 80 price segment was the most popular in the pregnancy pillow market in 2023, with a share of 54.3% of overall market revenue. The popularity of this segment is due to the equilibrium between price and quality, which makes it the most appealing choice for middle-class consumers and first-time mothers. Pregnancy pillows within this category provide excellent material, such as memory foam, organic cotton, and ventilated fabric covers, to provide comfort while keeping costs affordable for a wide customer base. Most consumers like to invest in this category since it delivers durability and ergonomic value without costing too much. The Above USD 80 category was the most rapidly growing category during the forecast period, showing the increased need for high-end pregnancy pillows. This price segment encompasses premium materials, ergonomic designs with specialized features, and luxury elements, making it the most sought-after among consumers who are willing to spend on maximum comfort and long-term usage. High-end pregnancy pillows usually have organic, hypoallergenic materials, memory foam fillings, and temperature control technology, which are sought after by health-aware and environmentally aware consumers. The increased awareness of eco-friendly products has also led to more interest in luxury maternity pillows, especially among millennial and Gen Z parents who value ethical production and better quality.

By End-User

The residential segment captured the pregnancy pillow market in 2023 with a market share of 79.9%. This is due to the growing practice of home-based maternity care and rising prenatal wellness and self-care awareness. Pregnant women opt for comfort-boosting solutions that can be accessed at home during pregnancy, and hence, greater adoption of pregnancy pillows is being observed in the residential market. Growth in e-commerce and direct-to-consumer sales has contributed to increased market penetration inasmuch as it enables customers to access a number of choices easily online. The hospitals and maternity homes category experienced the most rapid growth during the forecast period due to greater adoption in healthcare facilities. Hospitals and maternity wards began using ergonomic maternity pillows to support patient comfort, alleviate pregnancy-related pain, and enhance maternal sleep during hospital stay. Medical personnel are now realizing the advantages of pregnancy pillows for relieving back pain, pelvic pressure, and circulation problems and are using them more in prenatal and postpartum care.

Pregnancy Pillow Market Regional Analysis

North America led the pregnancy pillow market in 2023, with a 46.7% global market share. This was propelled by high awareness among consumers, increasing pregnancy-related health issues, and extensive distribution of high-quality maternity products. The growing usage of ergonomic pregnancy pillows by pregnant women, supported by strong word-of-mouth and recommendations from medical professionals, accelerated market growth. Availability of strong maternity product brands and widespread e-commerce penetration also added to the leadership in the region. Moreover, there has been increasing demand for hypoallergenic and organic pregnancy pillows in the U.S. and Canada as part of overall consumer demand for sustainable and healthy products.

The Asia-Pacific region was the highest-growing region with very high growth driven by higher birth rates, higher disposable incomes, and increasing awareness of women's health. Regions such as China, India, and Japan are seeing rising demand for mid-range and value-priced pregnancy pillows, stimulated by the growth of the middle-class population and increased adoption of online retail. Government support for maternal health and upgradation of healthcare infrastructure has also catalyzed market growth. The increase in popularity of online shopping websites in the region also spurred demand for pregnancy pillows, driving more first-time purchases. The area will maintain its high growth pattern and thus will be one of the leading drivers of market growth in the future.

Do You Need any Customization Research on Pregnancy Pillow Market - Enquire Now

List of Key Players in Pregnancy Pillow Market

-

The Boppy Company – Boppy Total Body Pillow, Boppy Side Sleeper Pregnancy Pillow, Boppy Multi-Use Total Body Pillow

-

Leachco – Snoogle Total Body Pillow, Back ‘N Belly Contoured Body Pillow, All Nighter Total Body Pillow

-

Queen Rose – Queen Rose U-Shaped Pregnancy Pillow, Queen Rose C-Shaped Pregnancy Pillow, Queen Rose Full Body Maternity Pillow

-

PharMeDoc – PharMeDoc U-Shaped Pregnancy Pillow, PharMeDoc C-Shaped Pregnancy Pillow, PharMeDoc Full Body Pillow

-

Naomi Home – Naomi Home Cozy Body Pillow, Naomi Home Maternity Pillow, Naomi Home U-Shaped Pregnancy Pillow

-

Cozy Bump Corporation – Cozy Bump Pregnancy Pillow, Cozy Bump Maternity Lounger

-

Medela AG – Medela Pregnancy & Nursing Pillow

-

Easygrow AS – Easygrow Mum&Me Pregnancy Pillow

-

Babymoov – Babymoov Mum & b Pregnancy Pillow, Babymoov Doomoo Buddy Pregnancy Pillow

-

Theraline – Theraline Original Maternity and Nursing Pillow, Theraline Comfort Pregnancy Pillow

Recent Developments

In Oct 2024, Regalo Baby launched two new maternity pillows, the C-Shaped Maternity Pillow and U-Shaped Maternity Pillow, on Amazon. These pillows are designed to provide optimal comfort and support for expectant and new mothers during pregnancy, postpartum, and beyond

| Report Attributes | Details |

| Market Size in 2023 | USD 0.73 billion |

| Market Size by 2032 | USD 1.02 billion |

| CAGR | CAGR of 3.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Shape [Residential, U Shape, Wedge-shaped Pillow] • By Price [Up to USD 40, USD 40 TO USD 80, Above USD 80] • By End-User [Residential, Commercial, Hospitals, Maternity Homes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Boppy Company, Leachco, Queen Rose, PharMeDoc, Naomi Home, Cozy Bump Corporation, Medela AG, Easygrow AS, Babymoov, Theraline. |