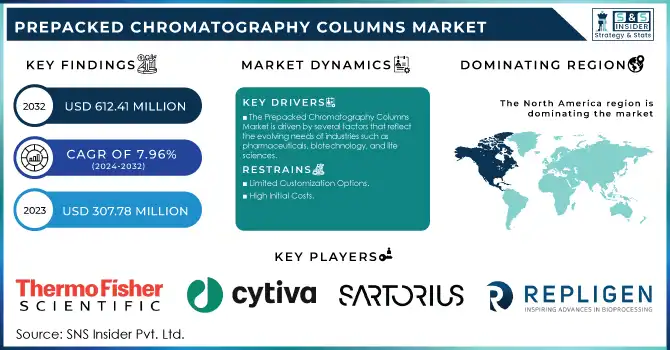

Prepacked Chromatography Columns Market Size & Overview:

The Prepacked Chromatography Columns Market Size was valued at USD 307.78 million in 2023 and is expected to reach USD 612.41 million by 2032 and grow at a CAGR of 7.96% over the forecast period 2024-2032.

The Prepacked Chromatography Columns Market is rapidly growing due to increasing demand for efficient separation and purification methods in industries like pharmaceuticals, biotechnology, and life sciences. These prefilled columns, which are ready for immediate use, help streamline laboratory processes by saving time on column packing and ensuring consistent results. The demand is particularly driven by the expansion of the biopharmaceutical sector, where precise and scalable purification of proteins, monoclonal antibodies, and other biologics is critical. For example, prepacked columns have become a vital part of the biomanufacturing process, enabling faster production timelines and reduced costs in protein purification.

Get more information on Prepacked Chromatography Columns Market - Request Sample Report

One of the key growth drivers is the biopharmaceutical industry, which has seen a dramatic rise in the production of biologics. According to studies, biologics account for nearly 30% of the global pharmaceutical market, and the need for reliable purification technologies is increasing in parallel. In this context, prepacked columns are widely used for the efficient separation of complex biomolecules. For instance, Bio-Rad Laboratories offers a variety of prepacked columns that support the large-scale purification of proteins and antibodies, enhancing both productivity and cost efficiency. Technological advancements are also a significant contributor to market expansion. Prepacked columns now use specialized resins and stationary phases that improve separation efficiency, enabling better resolution of target molecules. For example, Repligen's Opus Prepacked Columns provide superior performance in chromatographic separations and are used in large-scale pharmaceutical manufacturing, contributing to increased throughput and higher yields.

The adoption of automated chromatography systems is another key factor. Automation enhances precision and reduces errors, which is critical in the high-stakes environments of pharmaceutical and biotech labs. The shift to continuous manufacturing has further accelerated the adoption of prepacked columns, as they are designed for scalable processes that meet the demands of regulatory bodies while maintaining high standards of product quality. Moreover, regulatory compliance remains a strong driver. With increasing pressure for stringent quality controls, prepacked columns provide consistent, reproducible results, which are essential for meeting regulatory standards in drug manufacturing. Astraea Bioseparations emphasizes that prepacked chromatography columns are key in meeting FDA and EMA guidelines, particularly in the development and production of biologic drugs.

In conclusion, the growing reliance on biopharmaceuticals, technological innovation, and the need for regulatory compliance will continue to propel the prepacked chromatography columns market. These columns are essential for improving process efficiency and scalability in drug development and manufacturing.

Prepacked Chromatography Columns Market Dynamics

Drivers

-

The Prepacked Chromatography Columns Market is driven by several factors that reflect the evolving needs of industries such as pharmaceuticals, biotechnology, and life sciences.

A major driver is the increasing focus on personalized medicine and biologics, which require precise, scalable separation techniques for proteins, antibodies, and other therapeutic compounds. Prepacked columns provide the high-quality purification necessary for these complex molecules, meeting the growing demand in the pharmaceutical industry.

Regulatory pressures also play a crucial role in driving market growth. As regulatory bodies like the FDA and EMA enforce stringent guidelines on the production of biologics, manufacturers are turning to prepacked chromatography columns for their ability to deliver consistent and reproducible results, ensuring compliance with safety and efficacy standards. Moreover, cost-efficiency and productivity are driving the adoption of prepacked columns. By eliminating the need for manual packing, these columns reduce labor costs and minimize the risk of errors in the chromatography process. This has made them highly attractive to large-scale production environments, where reducing operational costs is a priority.

The advancement of automation technologies is another key factor. The integration of prepacked columns with automated systems enables higher throughput, faster turnaround times, and more precise separations. This trend is particularly important as labs and manufacturing plants increasingly shift toward continuous manufacturing, where prepacked columns support the need for scalable, high-efficiency processes.

Restraints

-

High Initial Costs

The significant upfront investment required for prepacked chromatography columns and their integration into advanced manufacturing systems can be a barrier for small and medium-sized enterprises (SMEs).

-

Limited Customization Options

Prepacked columns may not provide the flexibility required for certain specialized or niche applications, limiting their adoption in unique experimental setups.

Prepacked Chromatography Columns Market - Key Segmentation

By Product Type

The >1 L segment dominated the market in 2023, accounting for approximately 45.0% of the revenue share. This segment's dominance is driven by its widespread use in large-scale manufacturing of biologics and other therapeutic compounds, where high-volume purification is essential. Industries such as pharmaceuticals and biotechnology rely heavily on >1 L prepacked columns to meet stringent production demands while ensuring consistency and efficiency in downstream processing.

The 100-1000 ML segment is expected to be the fastest-growing category during the forecast period. This growth is attributed to its balanced capacity, making it ideal for pilot-scale operations and medium-scale manufacturing. Increasing demand for precision in purification processes for niche applications such as personalized medicine and diagnostics has further accelerated its adoption.

By Technique

Ion exchange chromatography led the market in 2023, capturing nearly 40.0% of the share. This dominance is due to its versatility in separating and purifying charged biomolecules such as proteins, nucleic acids, and peptides. Its effectiveness in both analytical and preparative applications makes it a preferred choice for pharmaceutical and biotech industries, particularly in the production of monoclonal antibodies and vaccines.

Multimodal chromatography is projected to be the fastest-growing technique. Its ability to combine multiple separation principles within a single column enhances efficiency and versatility, catering to the evolving demands of complex biologics purification. The increasing adoption of multimodal chromatography in continuous manufacturing processes and its ability to handle challenging separations have contributed to its rapid growth.

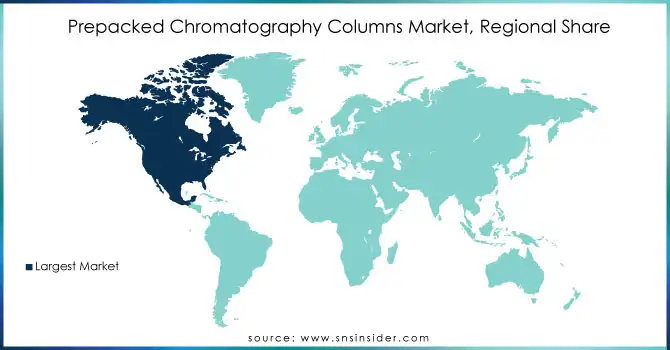

Prepacked Chromatography Columns Market Regional Analysis

The North American region held the largest share of the prepacked chromatography columns market in 2023, driven by the robust presence of pharmaceutical and biotechnology companies, particularly in the United States. High investments in R&D for biologics, coupled with stringent regulatory requirements by bodies like the FDA, have fueled the adoption of prepacked columns. Moreover, the region's advanced healthcare infrastructure and growing focus on personalized medicine contribute significantly to market growth.

Europe emerged as the second-largest market, with countries like Germany, the UK, and Switzerland leading in biopharmaceutical production. Supportive government policies and collaborations between academic and industrial players have enhanced the adoption of advanced chromatographic technologies. The increasing prevalence of chronic diseases in the region further propels the demand for biologics and, consequently, for prepacked columns.

The Asia-Pacific region is expected to witness the fastest growth during the forecast period. Countries such as China, India, and South Korea are rapidly becoming hubs for biopharmaceutical manufacturing due to cost-effective production capabilities and increasing investments in healthcare infrastructure. Growing awareness of advanced purification techniques and the expansion of CROs and CMOs in the region also drive market growth.

Need any customization research on Prepacked Chromatography Columns Market - Enquiry Now

Key Players

-

Thermo Fisher Scientific Inc. – ProPac, MAbPac, and Hypercarb prepacked columns

-

Cytiva – HiTrap, HiScreen, and MabSelect columns

-

Sartorius AG – Sartobind and Sartoclear prepacked chromatography columns

-

Repligen Corporation – OPUS (Open Platform User-Specified) columns

-

Merck Millipore – Eshmuno and ProSep prepacked columns

-

VWR International, LLC (Avantor) – Nucleodur and SiliaChrom prepacked columns

-

Phenomenex Inc. – Luna and Gemini prepacked chromatography columns

-

Agilent Technologies, Inc. – AdvanceBio and ZORBAX prepacked columns

-

Knauer Wissenschaftliche Geräte GmbH – Eurospher II and BlueShell columns

-

Hawach Scientific Co., Ltd. – Hawach HPLC prepacked columns

-

Purolite – Praesto prepacked columns

-

BioServUK Ltd. – Recombinant Protein A and Protein G prepacked columns

-

Astrea Bioseparations Ltd. – EvolveD and PuraBead prepacked columns

-

Daisogel USA (Osaka Soda Co., Ltd.) – Daisogel prepacked chromatography columns

-

Shimadzu Corporation – Shim-pack and Nexera prepacked columns

-

Waters Corporation – XBridge and ACQUITY UPLC columns

-

Showa Denko K.K. – Shodex prepacked chromatography columns

-

Harvard Bioscience, Inc. – Chromacol and ELSD prepacked columns

-

Tosoh Corporation – TSKgel prepacked columns

-

Geno Technology Inc., USA – G-Biosciences prepacked columns

-

Santai Science – SepaFlash prepacked columns

-

Biotage – ISOLUTE and SNAP prepacked columns

-

ChromaNik Technologies, Inc. – SunShell prepacked columns

-

Proxcys B.V. – ProXC prepacked columns

-

GALAK Chromatography Technology Co., Ltd. – GLK-Gel prepacked columns

-

Daicel Corporation – ChiralPak and Chiralcel prepacked columns

Recent Developments

In June 2023, a notable development in the market was the intensification of Fab-fragment purification using multicolumn chromatography with prepacked Protein L columns, enhancing efficiency and scalability in biologics manufacturing.

In June 2022, Bio-Rad Laboratories, Inc. introduced CHT-prepacked Foresight Pro Columns, designed to facilitate downstream process-scale chromatography applications at various stages of biological drug development and production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 307.78 million |

| Market Size by 2032 | US$ 612.41 million |

| CAGR | CAGR of 7.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (1-100ML, 100-1000ML, >1 L) •By Technique (Ion Exchange Chromatography, Affinity Chromatography, Hydrophobic Interaction Chromatography, Multimodal Chromatography, Gel Filtration Chromatography, Others) •By Application (Sample Preparation, Resin Screening, Protein Purification, Desalting) •By End User (Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Cytiva, Sartorius AG, Repligen Corporation, Merck Millipore, VWR International, LLC (Avantor), Phenomenex Inc., Agilent Technologies, Inc., Knauer Wissenschaftliche Geräte GmbH, Hawach Scientific Co., Ltd., Purolite, BioServUK Ltd., Astrea Bioseparations Ltd., Daisogel USA (Osaka Soda Co., Ltd.), Shimadzu Corporation, Waters Corporation, Showa Denko K.K., Harvard Bioscience, Inc., Tosoh Corporation, Geno Technology Inc., USA, Santai Science, Biotage, ChromaNik Technologies, Inc., Proxcys B.V., GALAK Chromatography Technology Co., Ltd., and Daicel Corporation. |

| Key Drivers | • The Prepacked Chromatography Columns Market is driven by several factors that reflect the evolving needs of industries such as pharmaceuticals, biotechnology, and life sciences. |

| Restraints | • High Initial Costs • Limited Customization Options |