Dose Calibrator Market Report Scope & Overview:

The Dose Calibrator Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 2.1 Billion by 2032 and grow at a CAGR of 3.9% over the forecast period 2024-2032. Dose calibrators experience a significantly high demand as healthcare infrastructure develops. One of the drivers for the growing significance of dose calibrators is the growing incorporation of the latest equipment and technologies at healthcare facilities across the world. As many regions experienced substantial investments in healthcare infrastructure, including the construction of new hospitals and the enhancement of diagnostic facilities.

Get More Information on Dose Calibrator Market - Request Sample Report

For instance, in 2023, the World Health Organization (WHO) reported substantial investments in healthcare infrastructure across various regions, including new hospital construction and the enhancement of diagnostic facilities. This growth is driven by the rising prevalence of chronic diseases and the need for advanced diagnostic and therapeutic solutions.

Moreover, the U.S. Centers for Medicare & Medicaid Services state that the country’s healthcare spending has increased, with particular investments in the diagnostic imaging and radiology departments of the newly erected and remodeled hospitals. These trends are consistent with global tendencies, as many countries are modernizing the existing healthcare facilities to meet the growing demand for advanced medical technologies, including the use of dose calibrator applications.

Another driver of in the dose calibrator market is technological innovations which have improved the precision of measurements and operational adjustments in recent years. It is stated that the advent of more accurate and user-friendly equipment has allowed the industry to change during these last years. As an example, in 2023, Varian Medical Systems released its next-generation automatic dose calibrator, which comes with advanced digital technology, allowing to accommodate the adjustments in measurements in real-time, providing increased frequencies of calibration, and improved accuracy to meet the growing complexity of nuclear medicine and demand in dose.

These technological advancements are contributing to the dose calibrator market's growth by enhancing device performance and ease of use. As healthcare facilities increasingly adopt these advanced technologies, the demand for advanced dose calibrators continues to rise, driving further innovation and market expansion.

Moreover, The U.S. Food and Drug Administration (FDA) has approved several new dose calibrators and related technologies in recent years. In 2024, the FDA issued new guidelines for dose calibrator accuracy and performance, reflecting the emphasis on enhancing precision and safety in medical procedures. These guidelines encourage the adoption of advanced, automated, and digital dose calibration systems.

Drivers

- Advancements in medical imaging and nuclear medicine drive the market growth.

The dose calibrator market is experiencing significant growth due to advances in medical imaging, as well as in nuclear medicine. First and foremost, the increased complexity and sophistication of medical imaging technologies, such as positron emission tomography and single-photon emission computed tomography, require more precise and accurate measurement of radiation doses. This is an essential application of dose calibrators, as these devices allow ensuring that the correct dose of radiopharmaceuticals is administered, which is necessary to achieve accurate diagnostics and treatment.

In 2023, IBA launched the latest edition of its Smartscan system, integrating advanced dose calibrator technology for both imaging and therapeutic applications. This innovation enables healthcare providers to achieve more reliable radiation dose measurements, enhancing safety and efficiency in diagnostic imaging procedures.

Moreover, advances in nuclear medicine have also expanded the need for advanced dose calibrators as they relate to an increased variety and complexity of new radiopharmaceuticals that are being developed. On top of that, as medical treatment becomes more personalized and targeted, the need for very precise and accurate measurements has also increased, fueling the expansion of the market. Finally, regulatory changes and increased emphasis on measures designed to ensure patient safety are driving healthcare facilities to invest in state-of-the-art dial calibration equipment.

In the U.S., medical imaging services, including nuclear medicine procedures, accounted for more than USD 15 billion in healthcare spending, underlining the growing demand for advanced diagnostic technologies. This growth aligns with the increased use of dose calibrators to ensure accurate dosing in radiopharmaceutical therapies.

Restrain

- High equipment cost hampers market growth.

Dose calibrator devices are highly advanced precision instruments designed to measure radioactivity in nuclear medicine applications, ensuring the accurate dosing of radiopharmaceuticals. Even though the dose calibrator is popular in many developed countries, not all healthcare facilities, especially in the developing world, can afford to invest in such a piece of equipment due to a lack of financial resources. Limited budgets make it difficult for many to enter the market, which may be linked to the slower rates of nuclear diagnostic and treatment implementation.

Key Market Segmentation

By Type

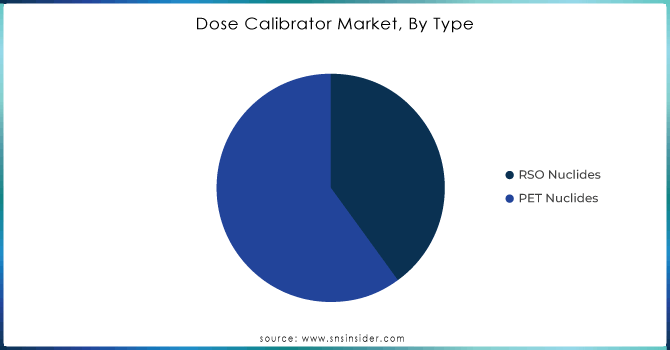

PET Nuclides held the largest market share around 66.95% in 2023. This is primarily due to the widespread use of Positron Emission Tomography (PET) in nuclear medicine, particularly for oncology, cardiology, and neurology applications. PET imaging offers higher resolution and more precise diagnostic capabilities compared to other imaging techniques, driving its demand in hospitals and diagnostic centers globally. Additionally, advancements in PET technology, such as hybrid PET/CT and PET/MRI systems, have enhanced its utility in medical diagnostics. These innovations have increased the reliance on PET nuclides, thus propelling this segment to lead the market.

Need any customization research on Dose Calibrator Market - Enquiry Now

By Application

Department of Nuclear Medicine segment held the highest market share around 48.23% in 2023. This dominance is primarily due to the widespread application of dose calibrators in nuclear medicine for diagnostic and therapeutic procedures. In nuclear medicine, accurate dosage measurement of radiopharmaceuticals is critical for ensuring patient safety and the effectiveness of treatments. Dose calibrators are integral in determining the exact radioactivity levels to be administered, particularly in procedures like positron emission tomography (PET) and single-photon emission computed tomography.

By Form

Hospitals are the major area for the end-use industry which holds the largest market share in the dose calibrator market. This is because hospitals play an important role for the administration of advanced diagnostic and therapeutic aspects, especially nuclear medicine. Nuclear medicine departments in hospitals have the required building infrastructure. The dose calibrator is needed in the hospital for accurate measurement and administration of radiopharmaceuticals on a patient to cure diseases. As the use of nuclear medicine is growing in the hospital for diagnosing and treating several diseases such as cardiovascular diseases, cancer, and neurological diseases the demand for the dose calibrator is growing in hospitals.

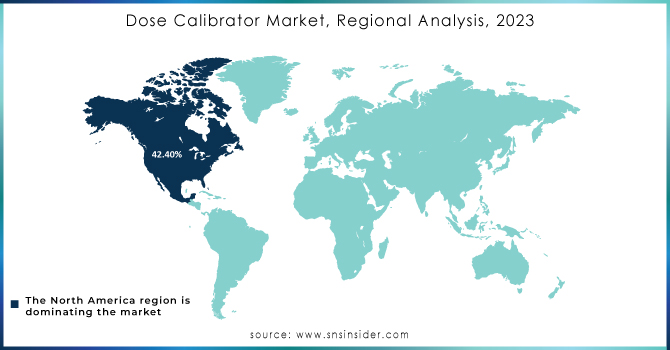

Regional Analysis

North America dominated the dose calibrator market with the highest revenue share of more than 42.40% in 2023. The region’s firmly developed healthcare infrastructure and a high level of investment in all technologies of nuclear medicine require the precise measurement and calibration of radiopharmaceuticals. This position was strengthened by the recent developments. Capintec, one of the leading players in the industry, introduced the Capintec CRC®-15R Dose Calibrator in 2023. The range of advanced technologies used in this calibrator makes it more accurate and efficient in handling radiopharmaceuticals. Besides, in 2022, Biodex Medical Systems released a new version of Atomlab 100 Dose Calibrator, and the improved software used in this device makes it easier to work with and integrate into the applicable medical imaging systems.

Moreover, the region also has a stronger position primarily due to the severe legislative frameworks of the United States and Canada, striving to set the highest standards of radiopharmaceutical practice and sophisticated aid for these medications. The investment in the North American healthcare sector is still significantly larger than in other world regions. Finally, the administration of cancer procedures of treatment and diagnostics is also partially nuclear medicine, which also increases the demand for dose calibrators. Thus, the focus on advanced technology, backed by a perfect environment and the regional med sector’s growth, guarantees North America’s leadership in the field of dose calibrator market.

Key Players

The major players are VacuTec, Esente Healthcare, Radcal, Metrohm, Nuclemed, Pinestar Technology, Siemens Healthineers, Capintec, Thermo Fisher Scientific, Biodex Atomlab, and other players

Recent Development:

-

In 2023, Capintec introduced the Capintec CRC®-15R Dose Calibrator, which features enhanced digital technology for superior accuracy and user-friendly operation.

-

In 2022, Biodex Medical Systems launched the Atomlab 100 Dose Calibrator. This updated model includes advanced software integration that streamlines the calibration process and enhances accuracy.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.5 Billion |

| Market Size by 2032 | US$ 2.1 Billion |

| CAGR | CAGR of 3.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (RSO Nuclides, PET Nuclides) • By Application (Department of Nuclear Medicine, Radiochemistry Center, Others) • By End-User, (Hospitals, Radiology Clinics, Nuclear Medicine centers, and Veterinary Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | VacuTec, Esente Healthcare, Radcal, Metrohm, Nuclemed, Pinestar Technology, Siemens Healthineers, Capintec, Thermo Fisher Scientific, Biodex Atomlab, and other players |

| Key Drivers | •Advancements in medical imaging and nuclear medicine drive the market growth. |

| RESTRAINTS | •High equipment cost hampers market growth. |