Business Management Consulting Service Market Report Scope & Overview:

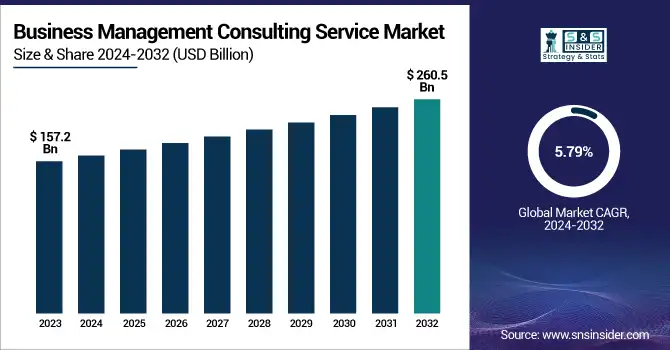

The Business Management Consulting Service Market was valued at USD 157.2 billion in 2023 and is expected to reach USD 260.5 billion by 2032, growing at a CAGR of 5.79% from 2024-2032.

To Get more information on Business Management Consulting Service Market - Request Free Sample Report

The Business Management Consulting Service Market report highlights rising adoption rates of consulting services across sectors like IT, healthcare, BFSI, and manufacturing, with IT and financial services leading in 2023. Strategy and operations consulting hold the largest revenue share, while IT consulting is witnessing the fastest growth. North America dominates the regional market share, but Asia Pacific is rapidly expanding. Additionally, the report notes improving client retention and satisfaction rates, particularly among mid-sized firms, and a growing demand for AI-driven and sustainability-focused consulting services reshaping market strategies.

The U.S. Business Management Consulting Service Market was valued at USD 44.2 billion in 2023 and is projected to reach USD 71.6 billion by 2032, growing at a CAGR of 5.53%. Growth is driven by rising digital transformation initiatives, increased demand for strategic advisory in AI and cybersecurity, and the expanding startup ecosystem. The future outlook indicates strong growth in cloud consulting, ESG advisory, and operational optimization services as enterprises prioritize resilience, digital agility, and sustainability-driven business models.

Business Management Consulting Service Market Dynamics

Driver

-

Rising digital transformation and AI adoption across industries is fueling demand for expert consulting services.

The increasing integration of digital transformation strategies, cloud infrastructure, AI, and advanced analytics across industries is a primary growth driver for the business management consulting market. Companies seek expert advisory services to manage complex technological shifts, cybersecurity frameworks, and business model innovation. This growing demand for consultancy in digital strategy, operational automation, and data-driven decision-making is expanding market opportunities. Moreover, sectors like healthcare, BFSI, retail, and manufacturing are particularly reliant on digital consulting services to stay competitive, creating a steady pipeline for specialized consulting firms. This trend is expected to accelerate further, reshaping the consulting services landscape through 2032.

Restraint

-

Growing in-house strategy and technology teams in enterprises are reducing reliance on external consultants.

A key restraint for the business management consulting services market is the increasing investment by enterprises in building robust internal strategy, technology, and financial advisory teams. Many large and mid-sized corporations are adopting cost-optimization strategies by reducing dependency on external consultants and nurturing in-house digital transformation, HR management, and operations strategy expertise. This shift limits opportunities for traditional consulting firms, particularly in areas where standardized tools and AI-powered decision platforms reduce the need for continuous external guidance. Consequently, consulting firms are pressured to pivot towards offering highly specialized, value-added, and technology-driven services to maintain market relevance.

Opportunity

-

Increasing ESG regulations and corporate sustainability goals are creating strong demand for ESG-focused advisory services.

The rising focus on Environmental, Social, and Governance (ESG) compliance and sustainability-led business strategies presents a significant opportunity for consulting firms. Governments and global regulatory bodies are tightening mandates around carbon neutrality, responsible investing, and corporate social responsibility reporting. This is prompting enterprises to seek expert advisory services to redefine their business models, operational frameworks, and investment strategies in line with sustainability goals. As ESG becomes a boardroom priority, consulting firms offering specialized services in green finance, sustainable supply chain management, and ESG compliance audits are expected to see accelerated demand, especially across the U.S., Europe, and APAC.

Challenge

-

Intense market competition and rising price sensitivity are pressuring consulting firms to deliver faster, tech-enabled, and cost-efficient solutions.

The business management consulting market faces intense competition, with established firms, niche consultancies, and new-age digital advisory startups all vying for market share. Additionally, clients are increasingly price-sensitive, demanding quicker, scalable, and measurable consulting outcomes, often at lower costs. This competitive landscape makes client retention difficult and affects profit margins for traditional consulting firms. The emergence of AI-driven consulting platforms and self-service analytics tools further threatens conventional consulting models. To stay competitive, firms must continuously invest in digital capabilities, domain-specific expertise, and flexible pricing strategies while innovating service delivery frameworks tailored to evolving client expectations.

Business Management Consulting Service Market Segmentation Analysis

By Services

The strategy consulting segment led the market in 2023 and accounted for 25% of revenue share, driven by increasing demand for expert guidance in corporate restructuring, digital business model adaptation, and competitive positioning. U.S. enterprises, particularly in healthcare, BFSI, and manufacturing, sought strategic support for navigating economic volatility and regulatory changes. The growing adoption of AI, cloud, and data-driven operations further boosted the need for high-level strategic advisory services. This segment will continue leading as firms prioritize future-ready strategies, mergers, and portfolio realignment initiatives to maintain market resilience and profitability.

Technology consulting is expected to register the fastest CAGR through 2032, fueled by accelerated enterprise digital transformation, AI integration, and cybersecurity concerns. U.S. businesses are increasingly investing in cloud infrastructure, data analytics, IoT, and automation, driving demand for expert technology advisory services. Additionally, rapid advancements in generative AI, blockchain, and edge computing are prompting firms to seek specialized guidance to navigate implementation challenges and secure digital ecosystems. The rising trend of remote work, IT modernization, and smart operations in various sectors will continue propelling this segment’s rapid growth over the forecast period.

By Enterprise Size

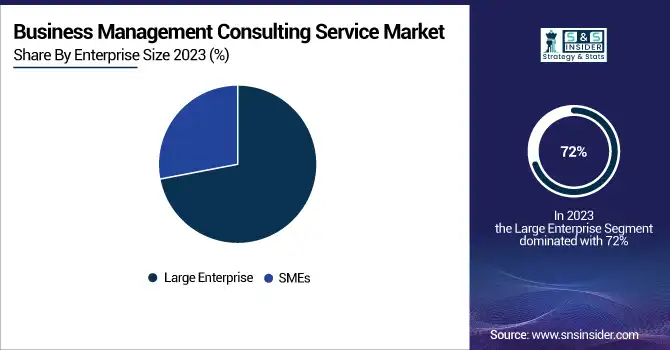

The large enterprise segment dominated the market in 2023 and accounted for 72% of revenue share, driven by complex operational frameworks, global business expansions, and increased focus on digital transformation and ESG compliance. Major corporations across industries, such as healthcare, BFSI, energy, and technology, consistently rely on management consulting services for strategic decision-making, M&A advisory, and supply chain optimization. As large enterprises continue to prioritize business resilience, technology modernization, and corporate governance, demand for end-to-end consulting solutions will remain strong, ensuring this segment retains a dominant share through the forecast period.

The SMEs segment is expected to register the fastest CAGR through 2032, fueled by growing awareness of the strategic value of consulting services in improving operational efficiency, digital integration, and market competitiveness. Increasingly, small and mid-sized enterprises are adopting consulting services for business process optimization, financial advisory, and technology upgrades to scale sustainably. The rise of affordable, modular, and remote consulting models tailored for SMEs has further accelerated adoption.

By End-Use

The BFSI segment dominated the business management consulting services market in 2023 and accounted for a significant revenue share, driven by rising regulatory compliance demands, digital banking transitions, and cybersecurity challenges. Financial institutions and insurance firms are increasingly seeking expert advisory for digital transformation, risk management, and strategic growth planning amid market volatility. As the sector faces ongoing disruption from fintech, AI-powered financial tools, and open banking frameworks, demand for consulting services in areas like M&A advisory, customer experience optimization, and data security strategy is projected to remain strong, solidifying BFSI’s market leadership through the forecast period.

The IT & telecom segment is projected to record the fastest CAGR through 2032, fueled by rapid technological advancements, expanding 5G networks, and rising enterprise cloud and AI adoption. Companies within this sector are heavily investing in digital infrastructure upgrades, cybersecurity frameworks, and IoT integrations, driving strong demand for consulting services. Additionally, telecom operators and tech firms are seeking strategic guidance for operational optimization, service innovation, and competitive positioning in the evolving digital landscape. The growing focus on AI-driven services, data monetization, and enterprise connectivity solutions will further propel this segment’s accelerated growth over the next decade.

Regional Landscape

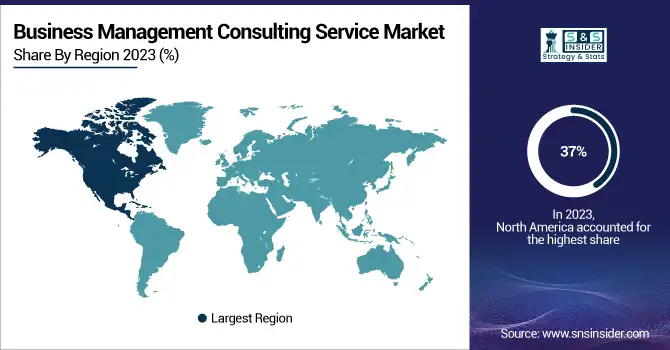

North America dominated the business management consulting services market in 2023 and accounted for 37% of revenue share, driven by the presence of major global consulting firms, a digitally mature corporate landscape, and high demand for strategic advisory in areas like digital transformation, ESG, and operational restructuring. U.S.-based enterprises in sectors like BFSI, healthcare, and technology are leading adopters of consulting services to navigate market volatility, regulatory shifts, and innovation trends.

Asia Pacific is projected to register the fastest CAGR through 2032, fueled by rapid industrialization, economic growth, and enterprise digitalization initiatives across emerging markets like India, China, and Southeast Asia. SMEs and large corporations alike are increasingly seeking consulting support for market entry, digital infrastructure development, and operational optimization. The region’s expanding IT and telecom sectors, coupled with rising demand for ESG advisory and M&A consulting, are further driving market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

McKinsey & Company — McKinsey Digital

-

Boston Consulting Group (BCG) — BCG Gamma

-

Bain & Company — Bain Vector

-

Deloitte Consulting — Deloitte Monitor

-

PwC Advisory — PwC Strategy&

-

EY Advisory — EY-Parthenon

-

KPMG Advisory — KPMG Strategy

-

Accenture — Accenture Strategy

-

Capgemini Invent — Capgemini Perform AI

-

IBM Consulting — IBM Garage

-

Cognizant Consulting — Cognizant Business Consulting

-

BearingPoint — HyperCube

-

LEK Consulting — LEK Growth Strategy

-

Oliver Wyman — Oliver Wyman Digital

-

Roland Berger — Roland Berger Restructuring & Performance

Recent Developments

-

May 2024: BCG partnered with Aptos Labs to offer Web3 and digital asset management solutions to financial institutions, aiming to enhance tokenization and blockchain-enabled solutions in regulated financial markets.

-

May 2024: Launched the 6th edition of the Jeel Tamooh program in Saudi Arabia, empowering over 150 university students with leadership, technology, and sustainability skills aligned with Vision 2030.

-

November 2024: Rebranded its 'Private Equity & Principal Investors' practice to 'Private Capital' and introduced a new 'Social Sector' practice, aiming to enhance focus and service delivery.

-

November 2024: Developed 'Lilli', a generative AI platform designed to enhance productivity by organizing the firm's extensive knowledge base.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 157.2 Billion |

|

Market Size by 2032 |

US$ 260.5 Billion |

|

CAGR |

CAGR of 5.79% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Service (Operations & supply chain consulting, Strategy consulting, Human resource consulting, M&A consulting, Product & portfolio management, ESG consulting, Technology consulting) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting, PwC Advisory, EY Advisory, KPMG Advisory, Accenture, Capgemini Invent, IBM Consulting, Cognizant Consulting, BearingPoint, LEK Consulting, Oliver Wyman, Roland Berger |