Protein Purification and Isolation Market Report Scope & Overview:

To Get More Information on Protein Purification and Isolation Market - Request Sample Report

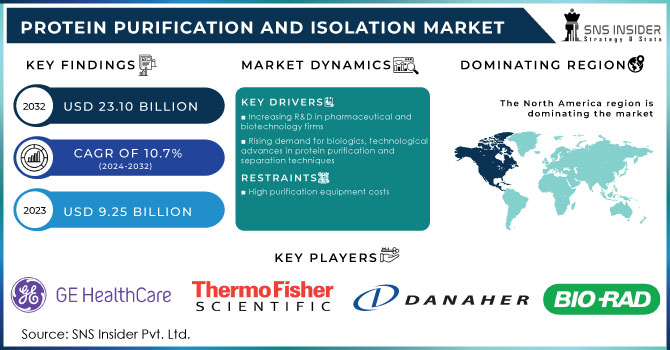

The Protein Purification and Isolation Market size was estimated at USD 9.25 billion in 2023 and is expected to reach USD 23.10 billion by 2032 with a growing CAGR of 10.7% during the forecast period of 2024-2032.

Protein purification is the separation of one or more proteins from a complex mixture of cells or tissues. Protein purification is an important step in any protein study, and it is performed after determining the enzyme activity of a given sample using assay methods to confirm the presence of a protein.

The unanticipated COVID-19 pandemic forced the global deployment of lockdown measures, causing delays in protein purification and isolation import and export. The pandemic also reduced the amount of money available from individual investors and governments around the world. Protein purification and isolation refer to a set of processes for isolating a specific protein from a complex mixture of cells, organisms, or tissues.

MARKET DYNAMICS

DRIVERS

-

Increasing R&D in pharmaceutical and biotechnology firms

-

Rising demand for biologics, technological advances in protein purification and separation techniques

The major factors driving the growth of this market are increased research and development in pharmaceutical and biotechnology companies, rising biologics demand, technological breakthroughs in protein purification and isolation techniques, and the rising popularity of contract research organizations (CROs). Purified proteins are in high demand as biotechnology and pharmaceutical companies focus on the research and development of biologics and other protein-based treatments. Protein separation and purification is an important stage in medication development because it allows researchers to explore the structure and function of proteins. As a result, with the increasing frequency of chronic diseases and the increasing demand for novel treatment alternatives, the demand for protein purification and separation is predicted to rise.

RESTRAIN

-

High purification equipment costs

High purification equipment costs and a scarcity of experienced technicians are projected to limit the growth of the worldwide protein purification and isolation market. The high initial cost of the most advanced purification devices, such as high-performance chromatography systems, centrifuges, and automated workstations, might be a barrier for smaller academic institutions or startups with limited funding. Protein purification and separation procedures necessitate a thorough understanding of both theoretical concepts and practical application.

OPPORTUNITY

-

Technological progress

Technical advances are pushing protein purification and isolation technologies even further. Magnetic and protein beads, as well as ligand tagging systems, are replacing traditional technologies such as agarose beads and other resins. In addition, the increasing use of automated analyzers is expected to enhance demand for protein purification and separation.

-

The greater emphasis on miniaturization should benefit the market.

CHALLENGE

-

A lack of trained technicians can result in poorer yield, insufficient process, and an increased risk of error.

IMPACT OF RUSSIA-UKRAINE WAR

Healthcare systems will be impacted due to the infrastructural breakdown of hospitals and clinics triggering hospital staff to flee and leaving hospitals to cope with growing patient care. Furthermore, hospitals may have stocks of drugs and other consumables, but not beyond a few days of inventory. This is mainly due to storage-space limitations and the costs of preserving large stockpiles. Unfortunately, war can cause rapid consumption of particular supplies needed to treat injuries such as wound dressings, needles, and antibiotics. This is also the case for Chernihiv children’s hospital, where patients battle cancer but are surrounded by Russian forces and it's running out of food and painkillers. Beyond hospitals, the disruption of primary care, screening, and immunization has occurred. Meanwhile, the risk of spreading infectious diseases increases if the clean water supply and sanitation systems are compromised.

KEY MARKET SEGMENTATION

By Product

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

Columns

-

Magnetic Beads

-

Resins

-

Others

-

In 2022, Consumables segment is expected to held the highest market share of 61.2% during the forecast period.

By Technology

-

Ultrafiltration

-

Precipitation

-

-

Ion Exchange Chromatography

-

Affinity Chromatography

-

Reversed-phase Chromatography

-

Size Exclusion Chromatography

-

Hydrophobic Interaction Chromatography

-

-

Electrophoresis

-

Gel Electrophoresis

-

Isoelectric Focusing

-

Capillary Electrophoresis

-

-

Western Blotting

-

Others

In 2022, Chromatography segment is expected to held the highest market share of 29.0% during the forecast period. When compared to its competitors, chromatography is one of the most accurate and sensitive procedures for protein separation and purification. As a result, a number of companies are working on commercializing new goods based on this technology in order to broaden their product portfolio.

By Application

-

Drug Screening

-

Biomarker Discovery

-

Protein-protein Interaction Studies

-

Diagnostics

In 2022, the Protein-protein Interaction Studies segment is expected to dominate the market growth of 31.9% during the forecast period due to High adoption of these techniques for deriving highly purified proteins and an increasing number of studies based on structural protein is contributing to the segment growth.

By End User

-

Academic And Research Institutes

-

Hospitals

-

Pharmaceutical And Biotechnological Companies

-

CROs

In 2022, Academic and Research Institutes segment is expected to dominate the market growth of 40.1% during the forecast period owing to the growing academic institute research activities for structural and functional proteomics, thorough kinetic analysis, and protein-protein interaction are some of the causes driving the market for protein purification and isolation solutions.

REGIONAL ANALYSES

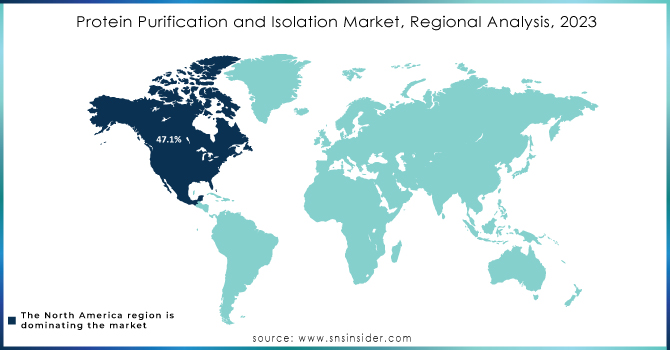

North America held a significant market share growing with a CAGR of 47.1% in 2022 due to Because of significant financing for life science research, established research infrastructure, and the presence of key competitors, North America dominated the industry. Furthermore, the rise in biopharmaceutical drug development is expected to fuel regional market growth throughout the forecast period.

Asia Pacific is witness to expand fastest CAGR rate of 11.7% during the forecast period owing to Initiatives undertaken by developing-country governments such as India and China to enhance healthcare facilities are expected to stimulate demand for protein purification and isolation solutions in this region. Furthermore, these governments are funding the development of novel purification and isolation procedures.

Do You Need any Customization Research on Protein Purification and Isolation Market - Enquire Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Thermo Fisher Scientific, Inc., Merck KGaA, QIAGEN N.V, Bio-Rad Laboratories, Inc., Agilent Technologies, Waters Corporation, GE Healthcare, Promega Corporation, Norgen Biotek Corp., Abcam plc, Danaher and Others.

RECENT DEVELOPMENTS

Waters Corporation introduced its Alliance iS next-generation HPLC system in March 2023, which provides increased error detection and troubleshooting tools to streamline workflows for chromatography applications like as protein purification, among others.

In June 2022, The Merck Research Institute and the Mulliken Center for Theoretical Chemistry collaborated on a machine learning project. The three-year partnership will concentrate on the development of novel computational chemistry modeling tools and molecular representations.

Thermo Fisher Scientific and Symphogen announced in March 2022 that they would continue to collaborate to provide biopharmaceutical R&D laboratories with platform processes for quality monitoring and easier characterization of complicated therapeutic proteins.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 9.25 billion |

|

Market Size by 2032 |

US$ 23.10 billion |

|

CAGR |

CAGR of 10.7% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Product (Instruments, Consumables), By Workflow (Ultrafiltration, Precipitation, Chromatography, Electrophoresis, Western Blotting, Others), By Application (Drug Screening, Biomarker Discovery, Protein-protein Interaction Studies, Diagnostics), By End User (Academic and Research Institutes, Hospitals, Pharmaceutical and Biotechnological Companies, CROs) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Thermo Fisher Scientific, Inc., Merck KGaA, QIAGEN N.V, Bio-Rad Laboratories, Inc., Agilent Technologies, Waters Corporation, GE Healthcare, Promega Corporation, Norgen Biotek Corp., Abcam plc, Danaher |

|

Key Drivers |

•Increasing R&D in pharmaceutical and biotechnology firms • Rising demand for biologics, technological advances in protein purification and separation techniques |

|

Market Opportunities |

•The greater emphasis on miniaturization should benefit the market. •Technological progress |