Purpose-built Backup Appliance (PBBA) Market Size Analysis:

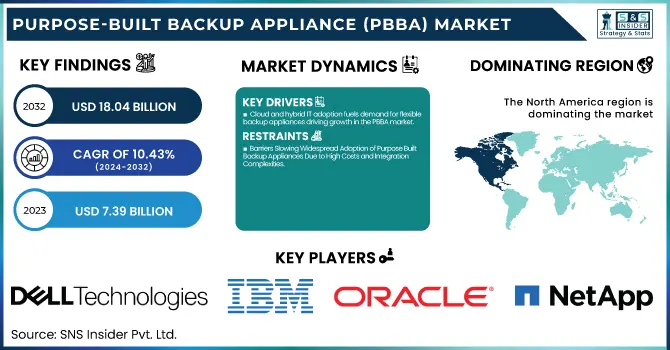

The Purpose-built Backup Appliance (PBBA) Market was valued at 7.39 Billion in 2023 and is projected to reach USD 18.04 Billion by 2032, growing at a CAGR of 10.43% from 2024 to 2032.

To Get more information on Purpose-built Backup Appliance (PBBA) Market - Request Free Sample Report

This growth is being propelled by several key adoption trends, including the rising demand for scalable, secure, and automated backup infrastructure across enterprises. In particular, advanced data deduplication capabilities are playing a critical role in reducing storage footprints and optimizing backup performance, with deduplication ratios increasingly exceeding 20:1 across various industries. Cloud tiering utilization is also on the rise, as businesses seek to balance performance with long-term cost savings by offloading older or less-accessed data to low-cost cloud storage tiers.

In the United States, the PBBA market alone was valued at USD 1.92 billion in 2023 and is projected to nearly double, reaching USD 3.89 billion by 2032 with CAGR 8.16%. This reflects the growing reliance on PBBA solutions to meet stringent compliance, cybersecurity, and disaster recovery demands in increasingly data-driven and hybrid IT environments.

Purpose-built Backup Appliance Market Dynamics:

Drivers:

-

Cloud and hybrid IT adoption fuels demand for flexible backup appliances driving growth in the PBBA market.

The adoption of cloud and hybrid IT environments is a significant driver in the Purpose-built Backup Appliance (PBBA) market, as enterprises increasingly embrace flexible, scalable, and resilient infrastructure strategies. With the rising reliance on cloud-first approaches and hybrid models that combine on premise and cloud systems, organizations are seeking backup solutions that can seamlessly integrate across these environments. PBBAs designed for hybrid compatibility offer enhanced data mobility, centralized management, and support for multi-cloud strategies, enabling efficient data protection regardless of where the data resides. Moreover, these appliances provide secure and optimized backup, ensuring data is readily accessible for recovery while reducing operational complexities. This trend is especially prominent among businesses undergoing digital transformation, where data is distributed across various platforms, driving demand for cloud-integrated backup appliances that offer scalability, compliance support, and reduced total cost of ownership.

Restraints:

-

Barriers Slowing Widespread Adoption of Purpose Built Backup Appliances Due to High Costs and Integration Complexities

The Purpose-built Backup Appliance (PBBA) market faces key restraints including high initial investment costs, complex deployment processes, and limited scalability for small enterprises. Additionally, rapid advancements in cloud-native backup solutions and increasing preference for software-defined storage over traditional hardware-based appliances challenge PBBA adoption. Concerns over vendor lock-in, integration issues with existing IT infrastructure, and evolving cybersecurity threats also pose barriers. In developing regions, lack of technical expertise and insufficient awareness about data backup compliance further hinder market penetration. Moreover, as organizations prioritize flexible, subscription-based models, the rigidity of some PBBA solutions limits appeal, especially among mid-level firms.

Opportunities:

-

Rising Digital Infrastructure in Emerging Markets Accelerates Growth Potential for PBBA Solutions

The Purpose-built Backup Appliance (PBBA) market is witnessing substantial growth opportunities in emerging markets, fueled by accelerated investments in digital infrastructure and growing awareness of data protection needs. Countries across Asia-Pacific, Latin America, and the Middle East are increasingly digitizing sectors like banking, healthcare, and government services, leading to surging data volumes that demand efficient and secure backup solutions. As enterprises in these regions modernize IT systems and shift toward hybrid cloud environments, the demand for reliable, scalable PBBA solutions is rising. Moreover, initiatives promoting smart cities, 5G deployment, and industrial digitization create fertile ground for PBBA adoption. Vendors have a significant opportunity to establish a strong presence in these high-growth areas by offering tailored, cost-effective solutions with localized support. This expansion not only broadens the market reach but also strengthens global data resilience strategies.

Challenges:

-

Navigating integration hurdles and cost constraints to unlock growth in the PBBA market

The Purpose-built Backup Appliance (PBBA) market faces several key challenges, including the high initial investment cost, which can be a barrier for small and mid-sized enterprises. Additionally, the rapid evolution of data protection technologies demands continuous updates and integration, placing pressure on vendors to innovate while maintaining system compatibility. Managing the scalability of backup appliances to handle the exponential growth of data, particularly in hybrid and multi-cloud environments, adds complexity. Security concerns, such as ensuring end-to-end encryption and compliance with data privacy regulations like GDPR, further complicate deployment. Moreover, limited awareness about the benefits of PBBA over traditional solutions in some regions restricts market penetration. As enterprises adopt diverse data sources and applications, achieving seamless integration with existing IT infrastructure also becomes a significant hurdle. Lastly, the ongoing shift toward cloud-native backup solutions creates competitive pressure, requiring PBBA vendors to adapt and redefine value propositions for long-term sustainability.

PBBA Industry Segmentation Analysis:

By Component

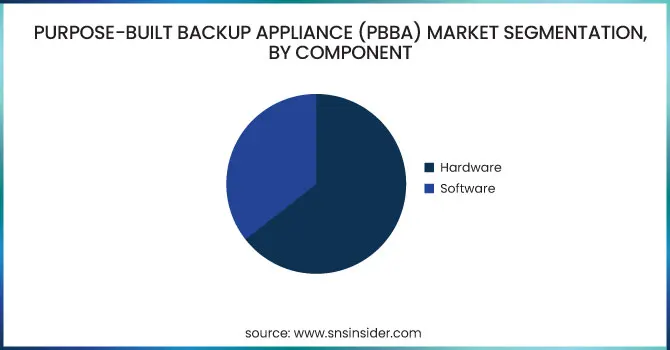

In 2023, the hardware segment dominated the Purpose-built Backup Appliance (PBBA) market, accounting for approximately 65% of the total revenue. This dominance was driven by growing demand for robust physical infrastructure, including disk-based backup systems, storage arrays, and high-performance servers. Enterprises are increasingly prioritizing secure and scalable backup solutions to handle surging data volumes and ensure business continuity. Hardware-based PBBA solutions are preferred for their reliability, high throughput, and integration with on premise IT environments. Moreover, sectors such as BFSI, healthcare, and government continue to rely heavily on in-house data centers, fueling the need for dedicated backup appliances. Advancements in hardware technologies, such as integrated deduplication and encryption features, further enhanced their appeal, making them a critical component of modern enterprise data protection strategies.

The software segment is projected to be the fastest-growing component in the Purpose-built Backup Appliance (PBBA) market from 2024 to 2032, driven by increasing demand for intelligent, automated, and cloud-integrated backup solutions. As enterprises shift toward digital transformation and hybrid IT environments, software capabilities such as AI-powered analytics, automated scheduling, and centralized management have become essential for streamlined backup operations. These solutions offer enhanced flexibility, remote monitoring, and improved data deduplication—crucial for optimizing storage and reducing costs. Additionally, the rise of ransomware threats has fueled demand for software with advanced security and recovery features. Cloud-tiering functionality and seamless integration with virtualized environments make software-driven PBBA systems highly scalable and future-ready. This evolution is transforming traditional backup from a hardware-heavy process into a smarter, software-led approach that delivers greater efficiency and control across distributed IT infrastructures.

By System

The open segment dominated the Purpose-built Backup Appliance (PBBA) market in 2023, capturing approximately 59% of total revenue, primarily due to its flexibility, scalability, and seamless integration with diverse IT environments. Open PBBA systems are increasingly preferred by enterprises seeking vendor-neutral solutions that support hybrid and multi-cloud architectures without being locked into proprietary ecosystems. These systems offer improved interoperability with existing data management tools and provide customizable configurations tailored to specific organizational needs. As businesses continue to prioritize cost-efficiency, rapid deployment, and operational agility, the open segment benefits from widespread adoption in both large enterprises and growing mid-sized firms. Additionally, advancements in open-source software and broader support for third-party applications are enhancing performance and reliability, solidifying the segment's market dominance. With the growing demand for adaptable and future-proof data protection infrastructure, open PBBA solutions are set to maintain their leadership position, especially in digitally transforming industries like BFSI, healthcare, and IT services.

The mainframe segment is projected to be the fastest-growing in the Purpose-built Backup Appliance (PBBA) market from 2024 to 2032, driven by increasing reliance on high-performance computing environments in large enterprises and government sectors. As critical applications continue to run on mainframes due to their unmatched processing power, security, and stability, the need for robust, purpose-built backup solutions tailored to these systems is growing rapidly. Modern mainframe-based PBBA solutions are integrating advanced features such as real-time replication, encryption, and AI-driven automation to enhance data protection and minimize downtime. This growth is also fueled by industries like BFSI and telecom, which manage vast volumes of sensitive data and require reliable, scalable backup appliances. Furthermore, as organizations modernize legacy infrastructure with hybrid cloud capabilities, demand for mainframe-compatible PBBA systems is surging, positioning the segment for strong, sustained growth across the forecast period.

By Enterprise

The Small and Mid-level Enterprise (SME) segment dominated the Purpose-built Backup Appliance (PBBA) market in 2023 with around 64% of the total revenue share, driven by the growing need for cost-effective, scalable, and easy-to-deploy data protection solutions. SMEs are increasingly adopting digital technologies, cloud platforms, and hybrid IT environments, which demand robust backup systems to ensure data security, business continuity, and regulatory compliance. Unlike large enterprises with dedicated IT teams, SMEs prefer PBBA solutions that offer automated backups, simplified management, and integrated software features, making them an attractive choice. The rise in cyber threats, data breaches, and ransomware attacks has further heightened the importance of secure, purpose-built appliances among this segment. Additionally, vendors are offering tailored PBBA solutions to meet the unique requirements of SMEs, such as budget constraints and minimal IT support, solidifying the segment’s dominance in the overall market landscape.

The Large Enterprise segment is projected to witness the fastest growth in the Purpose-built Backup Appliance (PBBA) market from 2024 to 2032, to exponentially growing data volumes, stringent compliance requirements, and a need for advanced backup and recovery solutions. As recent as this month, OKI Electric has added a PBBA system with integrated deduplication, disaster recovery, and scalability that drives extreme performance for large organizations that operate complex and mission-critical workloads in multi-cloud and hybrid situations. They need secure and efficient backup appliances that can operate at scale, offer real time monitoring enable integration with their ERP and other IT infrastructures. In addition, the growing need for data protection methods in areas like banking, healthcare, and telecom is driving large companies to pour money into purpose-built backup technologies. These trends, in addition to increased cybersecurity attacks and data governance requirements, are also likely to ultimately sustain growth in this segment over the forecast period.

By Vertical

The Telecom & IT segment dominated the Purpose-built Backup Appliance (PBBA) market in 2023, accounting for the largest revenue share of approximately 28%, driven by the exponential growth of data generated through communication networks, cloud services, and IT infrastructure. With the increasing complexity of data management, this sector requires highly efficient and reliable backup solutions to maintain uptime, ensure disaster recovery, and meet regulatory compliance. The surge in demand for digital services, 5G rollout, and the expansion of cloud computing has further accelerated PBBA adoption. Companies in this segment are investing in backup appliances with features like data deduplication, encryption, and cloud tiering to optimize performance and reduce storage costs. The reliance on real-time data and the need for continuous business operations make PBBA systems essential in safeguarding massive volumes of critical information.

The Healthcare segment is expected to witness the fastest growth in the Purpose-built Backup Appliance (PBBA) market from 2024 to 2032, As healthcare organizations increasingly adopt electronic health records (EHRs), telemedicine, and connected medical devices, we need secure, reliable, and compliant data backup solutions. Stringent data protection laws like HIPAA in the U.S. require indicating strong data management practices, thereby driving demand for sophisticated PBBA systems, capable of supporting encryption, data deduplication, and rapid recovery from disasters. Increasing ransomware attacks on hospitals and clinics add to that urgency for reliable backup appliances. With the acceleration of digital transformation across healthcare, Critical layers of security, PBBA solutions ensure data availability, continuity of care, and adherence to legal standards.

Purpose-built Backup Appliance (PBBA) Market Regional Outlook:

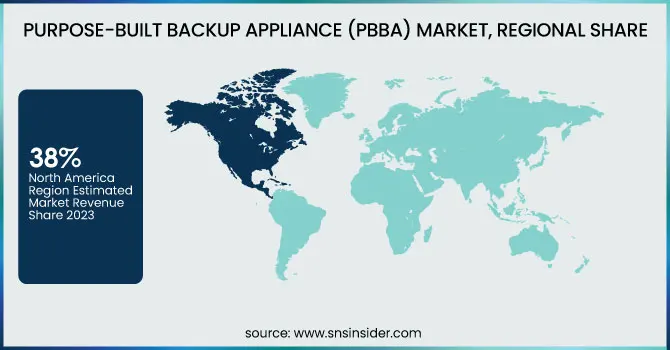

North America dominated the Purpose-built Backup Appliance (PBBA) market with the largest revenue share of approximately 38% in 2023, driven by the strong presence of major PBBA vendors and high technology adoption rates in the U.S. and Canada. The region benefits from advanced IT infrastructure, widespread digital transformation across enterprises, and a mature data management ecosystem. The United States, in particular, leads due to large-scale investments in cloud data centers, cybersecurity, and backup solutions across sectors such as BFSI, healthcare, and telecom. Additionally, regulatory compliance requirements like HIPAA, SOX, and GDPR-equivalent mandates compel organizations to adopt reliable backup appliances. With the rapid growth of hybrid cloud adoption, high data generation, and increasing focus on disaster recovery, North America continues to be the primary contributor to PBBA market expansion through both innovation and early adoption.

The Asia Pacific region is projected to witness the fastest growth in the Purpose-built Backup Appliance (PBBA) market from 2024 to 2032, driven by rapid digital transformation, increasing adoption of cloud computing, and growing cybersecurity awareness across emerging economies. Countries like China, India, Japan, and South Korea are investing heavily in data centers, enterprise IT infrastructure, and regulatory compliance, fueling demand for reliable backup and recovery solutions. The rise of small and mid-sized enterprises (SMEs) and the expansion of multinational companies in the region are accelerating the need for scalable and secure data protection systems. With increased government initiatives to promote digitalization and the surge in data volume from sectors such as BFSI, healthcare, and telecom, the market is expected to grow at a CAGR exceeding 12% during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Purpose-built Backup Appliance (PBBA) Market along with their Products:

-

Dell Technologies (US) – PowerProtect DD Series, PowerProtect Data Manager

-

IBM Corporation (US) – IBM Spectrum Protect, IBM TS Series Tape Storage

-

Oracle Corporation (US) – Oracle ZFS Storage Appliance, Oracle Zero Data Loss Recovery Appliance

-

NetApp Inc. (US) – AltaVault Cloud-Integrated Storage, NetApp ONTAP

-

Fujitsu Limited (Japan) – Eternus CS800, Eternus LT Tape Systems

-

Commvault Systems Inc. (US) – Commvault HyperScale X, Commvault Complete Backup & Recovery

-

Veritas Technologies (US) – NetBackup Appliances, Flex Appliance

-

Hewlett Packard Enterprise (US) – HPE StoreOnce Systems, HPE Backup and Recovery Service

-

Quantum Corporation (US) – DXi Backup Appliances, Scalar Tape Libraries

-

Barracuda Networks Inc. (US) – Barracuda Backup, Cloud-to-Cloud Backup

-

Hitachi (US) – Hitachi Virtual Storage Platform, Hitachi Data Protection Suite

-

Arcserve LLC (US) – Arcserve UDP Appliance, Arcserve Backup

-

Axcient Inc. (US) – x360Recover, x360Cloud, x360Sync

List of companies that supply raw materials and components for the Purpose-built Backup Appliance (PBBA) market:

-

Micron Technology

-

Kioxia

-

Kingston Technology

-

Western Digital

-

Murata Manufacturing

-

Texas Instruments

-

PARPRO

-

Caldera Manufacturing Group

-

Entegris

-

Pall Corporation

-

Panaro Tech

-

Technobind

Recent Development:

-

9 Apr 2025, Dell Technologies unveiled advancements in its server, storage, and data protection portfolios, including the launch of PowerEdge R470 to R770 servers powered by Intel Xeon 6, delivering higher performance, efficiency, and AI scalability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.39 Billion |

| Market Size by 2032 | USD 18.04 Billion |

| CAGR | CAGR of 10.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Hardware, Software) • By System(Mainframe, Open) • By Enterprise(Large Enterprise, Small and Mid-level Enterprise) • By Vertical(Telecom & IT, BFSI, Manufacturing, Retail, Healthcare, Media & Entertainment, Government, Others (Travel & Hospitality, Power & Utility)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dell Technologies (US), IBM Corporation (US), Oracle Corporation (US), NetApp Inc. (US), Fujitsu Limited (Japan), Commvault Systems Inc. (US), Veritas Technologies (US), Hewlett Packard Enterprise (US), Quantum Corporation (US), Barracuda Networks Inc. (US), Hitachi (US), Arcserve LLC (US), Axcient Inc. (US) |